- Australia

- /

- Real Estate

- /

- ASX:UOS

Undervalued Small Caps With Insider Action On ASX In January 2025

Reviewed by Simply Wall St

In recent trading, the Australian market has seen fluctuations with the ASX200 closing down by 0.22%, as sectors like IT and Telecommunications faced declines while Discretionary and Real Estate showed modest gains. Amidst this mixed performance, small-cap stocks continue to draw attention due to their potential for growth in a volatile environment, especially when insider actions suggest confidence in their prospects. Identifying promising small-cap opportunities involves looking at those with strong fundamentals and strategic positioning within their industries, particularly in light of current economic indicators and sector performances.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Collins Foods | 16.9x | 0.6x | 14.04% | ★★★★★☆ |

| Iluka Resources | 8.4x | 1.9x | 1.99% | ★★★★★☆ |

| Dicker Data | 18.7x | 0.7x | -56.56% | ★★★★☆☆ |

| Bapcor | NA | 0.8x | 49.60% | ★★★★☆☆ |

| Eureka Group Holdings | 18.8x | 6.0x | 30.77% | ★★★★☆☆ |

| Abacus Storage King | 10.7x | 6.7x | -17.58% | ★★★★☆☆ |

| Abacus Group | NA | 5.3x | 28.29% | ★★★★☆☆ |

| Healius | NA | 0.6x | 9.42% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.6x | 3.12% | ★★★★☆☆ |

| Corporate Travel Management | 22.1x | 2.6x | 45.81% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Bapcor (ASX:BAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bapcor is an automotive aftermarket parts and accessories provider with operations spanning trade, retail, and specialist wholesale sectors, boasting a market capitalization of A$2.58 billion.

Operations: Bapcor generates revenue primarily from its Trade and Specialist Wholesale segments, contributing A$767.32 million and A$792.22 million respectively. The company's gross profit margin has shown a slight decrease to 46% as of June 2024, while net income margin turned negative during the same period at -7.77%. Operating expenses have increased over time, with General & Administrative expenses reaching A$539.61 million by June 2024.

PE: -10.2x

Bapcor, an Australian company in the automotive aftermarket sector, is currently seen as undervalued among small-cap stocks. Recent insider confidence has been demonstrated through share purchases over the past six months. Despite relying solely on external borrowing for funding, which carries higher risk, its earnings are projected to grow by 52.85% annually. This growth potential positions it attractively within its industry context, suggesting possible future value creation as it navigates financial challenges.

- Unlock comprehensive insights into our analysis of Bapcor stock in this valuation report.

Examine Bapcor's past performance report to understand how it has performed in the past.

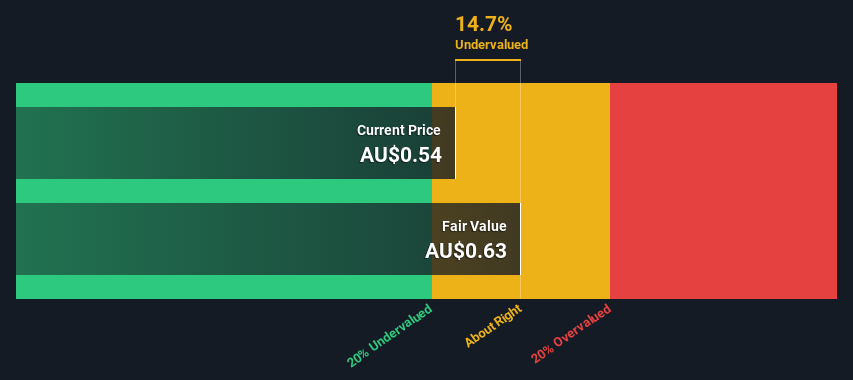

Iluka Resources (ASX:ILU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Iluka Resources is a company engaged in the exploration, project development, operations, and marketing of mineral sands products with a market capitalization of A$5.56 billion.

Operations: C/SW and JA/MW are the primary revenue segments, contributing A$626.30 million and A$549 million respectively. Gross profit margin has shown an upward trend, reaching 64.97% in mid-2022 before slightly declining to 59.76% by mid-2024. Operating expenses have been consistently high, with notable allocations towards D&A and Sales & Marketing expenses over the periods analyzed.

PE: 8.4x

Iluka Resources, operating in the mineral sands and rare earths sector, is drawing attention for its potential value. Despite relying solely on external borrowing, which poses higher risk, the company demonstrates high-quality earnings with a strong non-cash component. Recent insider confidence is evident through share purchases over the past year. The Australian Government's support for Iluka’s Eneabba rare earths refinery further bolsters its growth prospects. Leadership changes see Andrea Sutton as Acting Chair following Rob Cole's retirement due to health reasons.

- Get an in-depth perspective on Iluka Resources' performance by reading our valuation report here.

Assess Iluka Resources' past performance with our detailed historical performance reports.

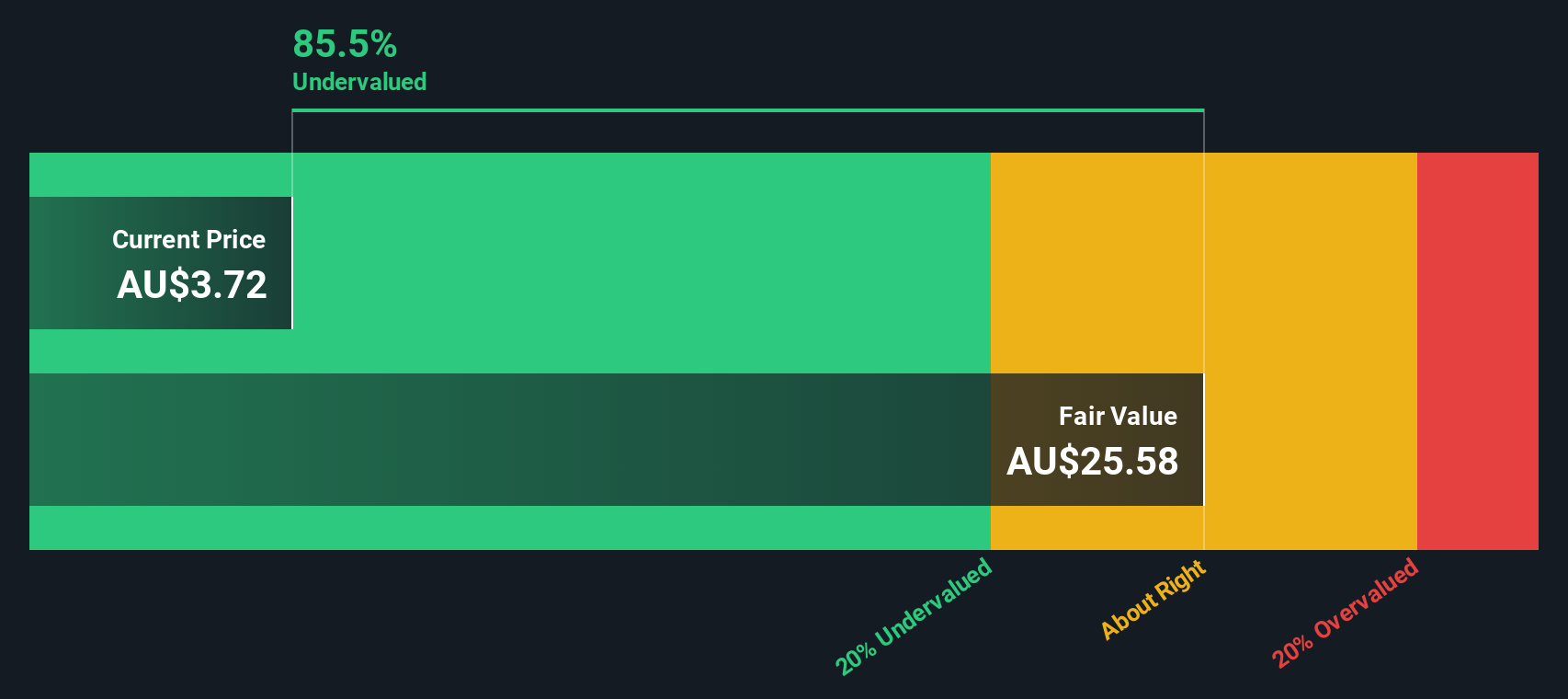

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: United Overseas Australia is a company engaged in land development and resale, along with investment activities, with a market capitalization of A$1.26 billion.

Operations: The company primarily generates revenue from its investment activities and land development and resale, with investment contributing significantly to its total revenue. Over recent periods, the net income margin has shown a notable increase, reaching 60.59% as of June 30, 2024.

PE: 11.2x

United Overseas Australia, a smaller player in the Australian market, has captured attention due to its potential for value. Despite earnings declining by 4% annually over five years, insider confidence is evident with recent share purchases in late 2024. The company’s reliance on external borrowing highlights a riskier financial structure without customer deposits. However, no shareholder dilution occurred recently, suggesting stability. Future prospects hinge on navigating these financial challenges while capitalizing on growth opportunities within its industry context.

- Take a closer look at United Overseas Australia's potential here in our valuation report.

Gain insights into United Overseas Australia's past trends and performance with our Past report.

Make It Happen

- Gain an insight into the universe of 24 Undervalued ASX Small Caps With Insider Buying by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:UOS

United Overseas Australia

Engages in the development and resale of land and buildings in Malaysia, Singapore, Vietnam, and Australia.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives