- Australia

- /

- Metals and Mining

- /

- ASX:CYL

Top ASX Growth Companies With Insider Ownership October 2024

Reviewed by Simply Wall St

As the Australian market experiences a downturn with the ASX200 down 1.3% at 8,235 points and all sectors retreating, investors are closely monitoring economic indicators and adjusting their strategies amid shifting rate cut expectations. In such a volatile environment, growth companies with high insider ownership can offer a unique perspective on potential resilience and commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12.3% | 117.7% |

| Catalyst Metals (ASX:CYL) | 14.8% | 45.4% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 68.9% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.2% | 102% |

Let's take a closer look at a couple of our picks from the screened companies.

Catalyst Metals (ASX:CYL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Catalyst Metals Limited is involved in the exploration and evaluation of mineral properties in Australia, with a market cap of A$793.20 million.

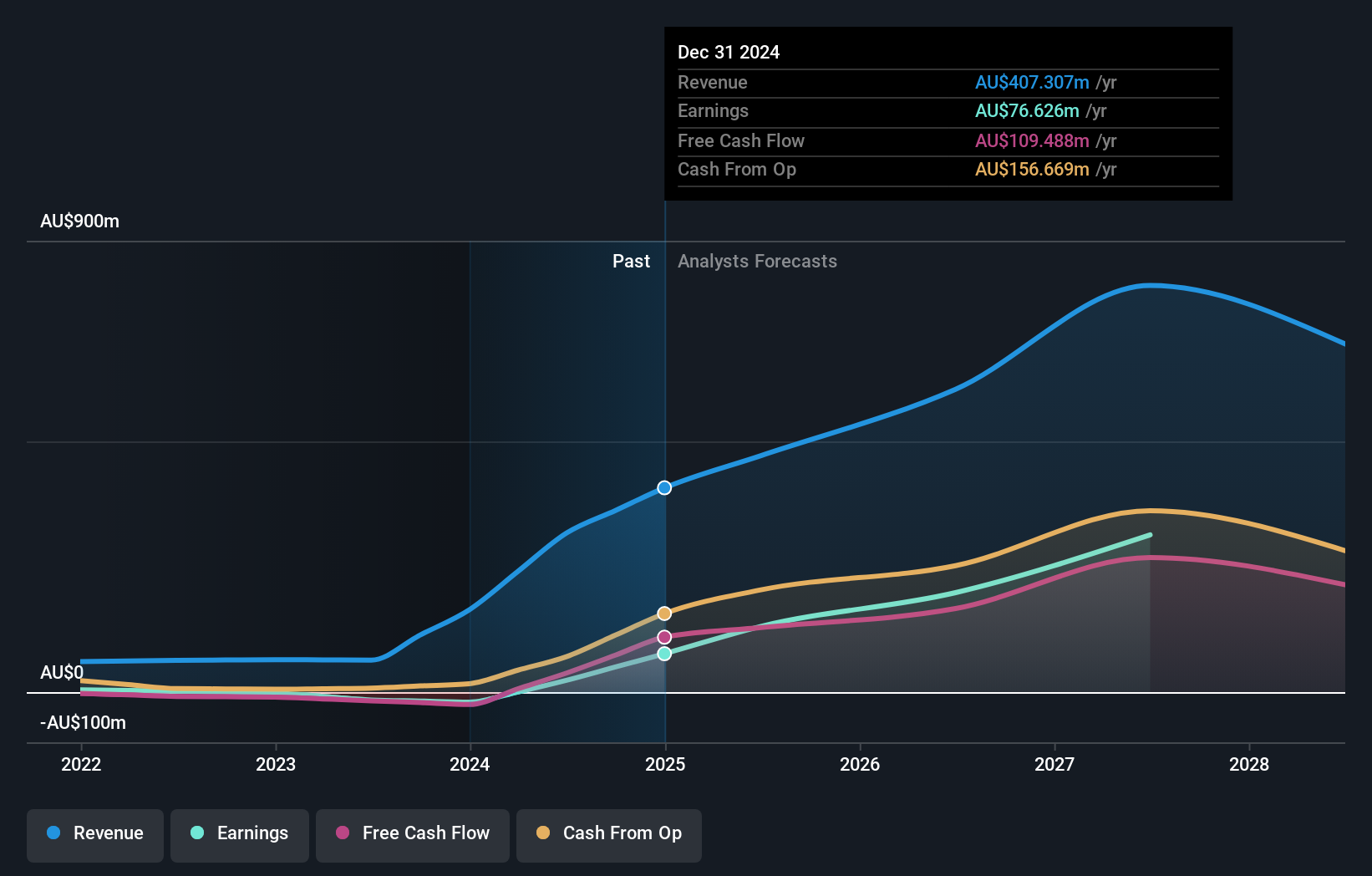

Operations: The company's revenue segments include A$75.08 million from Tasmania and A$243.77 million from Western Australia.

Insider Ownership: 14.8%

Revenue Growth Forecast: 25.5% p.a.

Catalyst Metals, recently added to the S&P/ASX Emerging Companies Index, demonstrates strong growth potential with its revenue forecasted to grow at 25.5% annually, outpacing the market. The company became profitable this year and anticipates earnings growth of 45.4% per year. Despite past shareholder dilution, Catalyst is trading significantly below its estimated fair value and has provided robust production guidance for FY2025, indicating a solid operational outlook amidst substantial insider ownership.

- Dive into the specifics of Catalyst Metals here with our thorough growth forecast report.

- The analysis detailed in our Catalyst Metals valuation report hints at an deflated share price compared to its estimated value.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.90 billion.

Operations: The company's revenue primarily comes from mine operations, amounting to A$366.04 million.

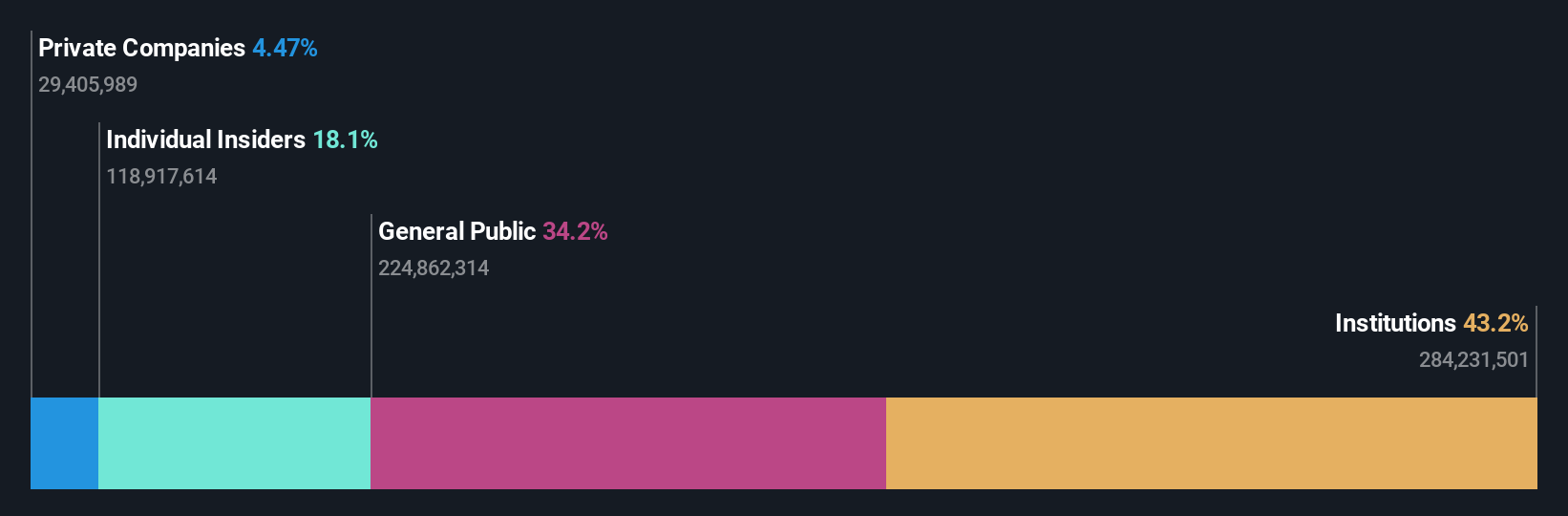

Insider Ownership: 18%

Revenue Growth Forecast: 31.1% p.a.

Emerald Resources is set for significant growth with earnings forecasted to rise by 32.2% annually, surpassing the Australian market's average. Revenue is also expected to grow at 31.1% per year, indicating robust expansion potential. Despite past shareholder dilution, the stock trades well below its estimated fair value. Recent financial results show increased sales and net income compared to last year, while Simon Lee AO's upcoming retirement marks a leadership transition after a decade of impactful contributions.

- Click here and access our complete growth analysis report to understand the dynamics of Emerald Resources.

- According our valuation report, there's an indication that Emerald Resources' share price might be on the expensive side.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited owns, operates, and franchises quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$3.89 billion.

Operations: The company generates revenue of A$364.99 million from its quick service restaurant operations across multiple countries.

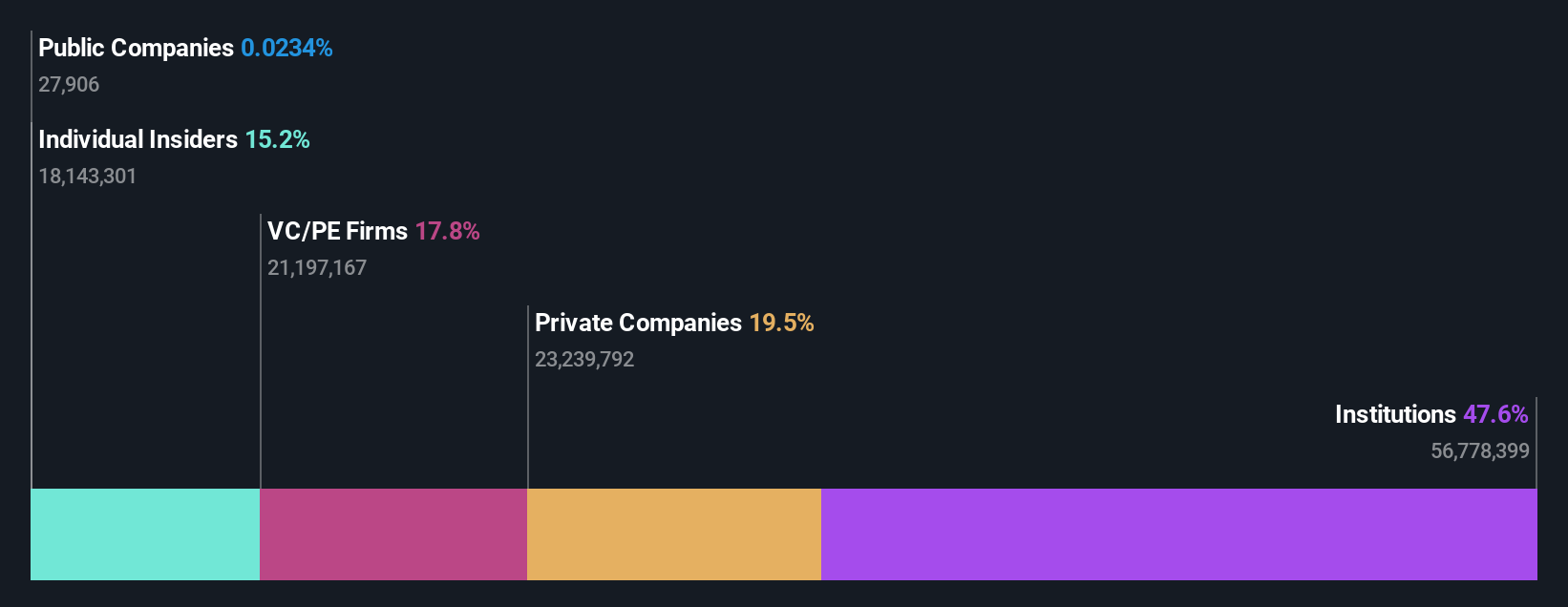

Insider Ownership: 13.1%

Revenue Growth Forecast: 17.8% p.a.

Guzman y Gomez Limited is experiencing robust revenue growth, with a 31.9% increase over the past year and forecasted annual growth of 17.8%, outpacing the Australian market's average. Despite reporting a net loss of A$13.75 million for fiscal 2024, earnings are expected to grow at an impressive rate of 46.69% annually, becoming profitable within three years. The recent inclusion in multiple S&P/ASX indices highlights its rising prominence in the consumer discretionary sector.

- Click to explore a detailed breakdown of our findings in Guzman y Gomez's earnings growth report.

- The analysis detailed in our Guzman y Gomez valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Explore the 97 names from our Fast Growing ASX Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Exceptional growth potential and undervalued.