- Australia

- /

- Metals and Mining

- /

- ASX:TYX

3 ASX Penny Stocks With Market Caps Under A$400M To Consider

Reviewed by Simply Wall St

The Australian stock market recently demonstrated resilience, closing 34 points higher at 8,189 with nearly all sectors showing gains. In such a climate, investors often look for opportunities that combine affordability with growth potential. While the term "penny stocks" may seem outdated, these smaller or newer companies can still offer significant opportunities when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$65.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$238.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$842.94M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.905 | A$103.99M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$205.65M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.995 | A$112.19M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Alkane Resources (ASX:ALK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alkane Resources Ltd is an Australian company focused on gold exploration and production, with a market cap of A$308.58 million.

Operations: The company generates revenue primarily through its Gold Operations segment, which accounts for A$173.58 million.

Market Cap: A$308.58M

Alkane Resources, with a market cap of A$308.58 million, is primarily focused on gold operations generating A$173.58 million in revenue. Despite being debt-free and having stable weekly volatility, the company faces challenges such as negative earnings growth (-58.4%) last year and profit margins declining from 22.3% to 10.2%. Short-term assets exceed short-term liabilities but fall short of covering long-term liabilities (A$103 million). Trading significantly below estimated fair value may present opportunities; however, low return on equity (5.7%) and high non-cash earnings indicate caution for investors considering penny stocks like Alkane Resources.

- Jump into the full analysis health report here for a deeper understanding of Alkane Resources.

- Understand Alkane Resources' earnings outlook by examining our growth report.

Gold Hydrogen (ASX:GHY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gold Hydrogen Limited focuses on the discovery, exploration, and development of hydrogen and helium gas in Australia with a market cap of A$99.84 million.

Operations: The company's revenue segment is derived from the exploration and development of its PEL tenements, amounting to A$0.49 million.

Market Cap: A$99.84M

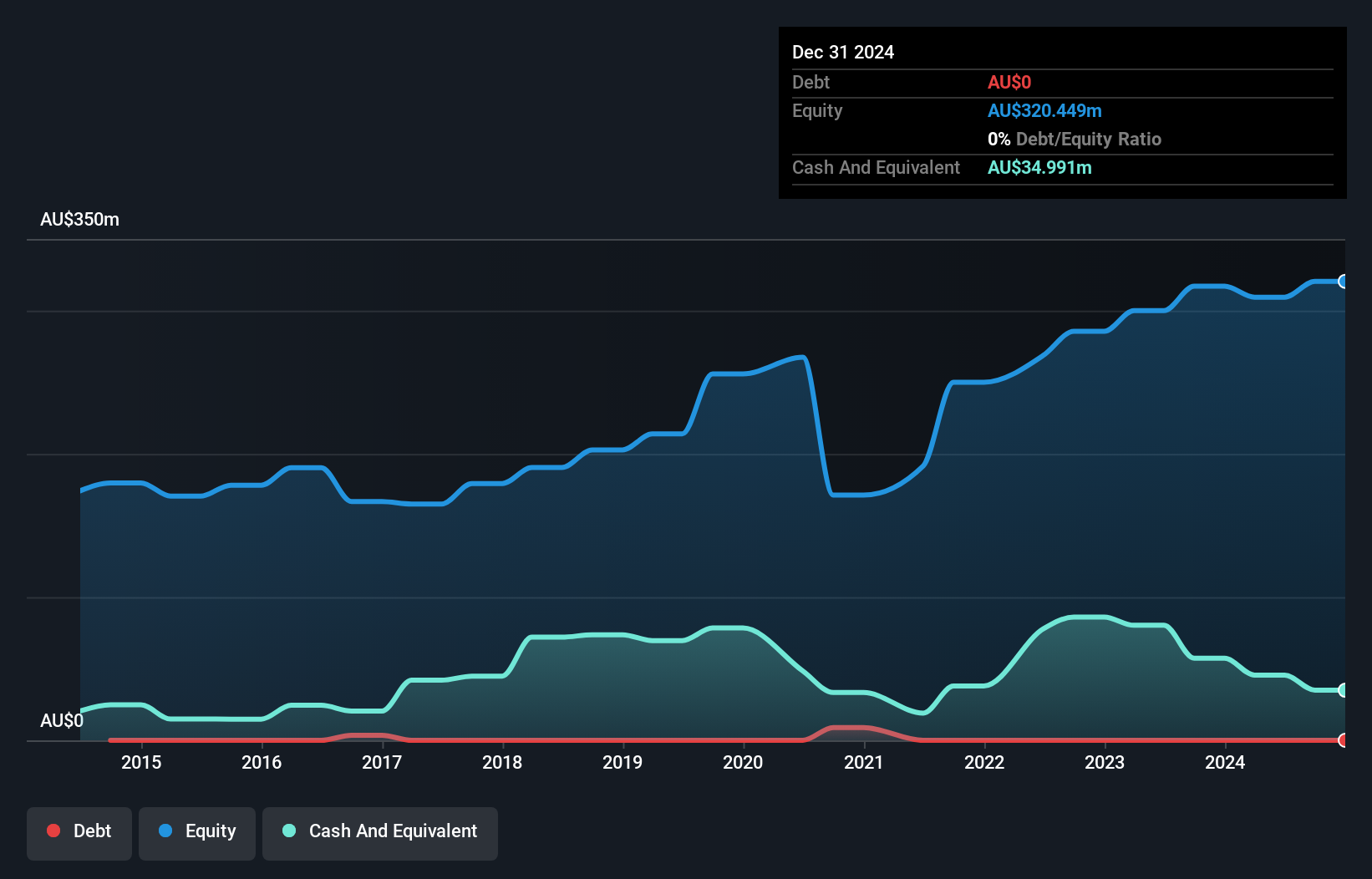

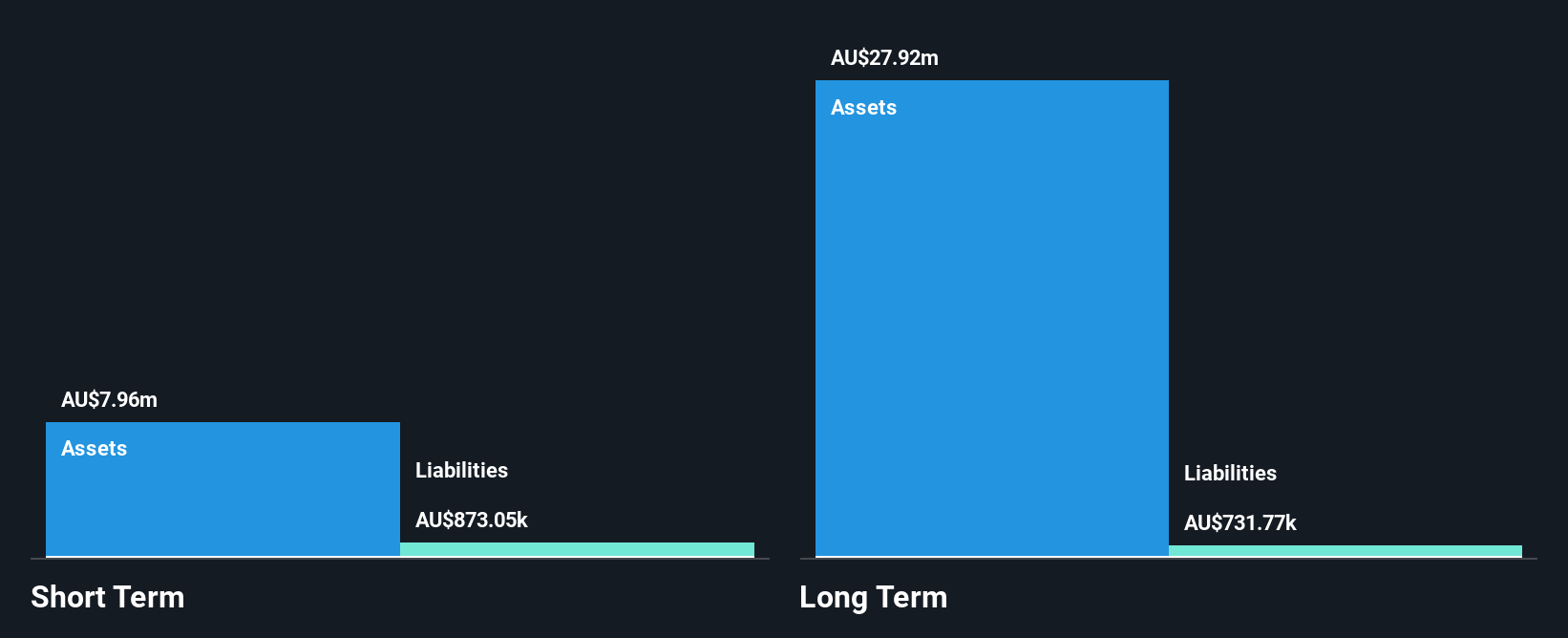

Gold Hydrogen Limited, with a market cap of A$99.84 million, is pre-revenue and focuses on hydrogen and helium exploration in Australia. The company's short-term assets (A$15.2 million) comfortably cover both its short-term (A$1.2 million) and long-term liabilities (A$731.2K), indicating a solid financial position despite being unprofitable with negative return on equity (-5.25%). Management's average tenure of 1.5 years suggests a relatively new team steering the company through its early public trading phase of less than three years, while the absence of debt removes concerns over interest coverage or cash flow constraints for now.

- Dive into the specifics of Gold Hydrogen here with our thorough balance sheet health report.

- Understand Gold Hydrogen's track record by examining our performance history report.

Tyranna Resources (ASX:TYX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyranna Resources Limited is engaged in the exploration and development of mineral properties both in Australia and internationally, with a market cap of A$16.44 million.

Operations: The company's revenue segment includes A$0.06 million from exploration activities in Angola.

Market Cap: A$16.44M

Tyranna Resources Limited, with a market cap of A$16.44 million, is pre-revenue and focuses on mineral exploration. Despite its unprofitability, the company maintains a debt-free status and has sufficient cash runway for over a year based on current free cash flow. Its short-term assets of A$7.6 million significantly exceed short-term liabilities of A$170.7K, providing financial stability in the near term. However, the share price has been highly volatile recently, and losses have increased at 37.6% annually over five years. The management team is experienced with an average tenure of 5.1 years but faces challenges in improving profitability amidst declining earnings growth rates.

- Navigate through the intricacies of Tyranna Resources with our comprehensive balance sheet health report here.

- Explore historical data to track Tyranna Resources' performance over time in our past results report.

Make It Happen

- Embark on your investment journey to our 1,052 ASX Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyranna Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TYX

Tyranna Resources

Explores for and develops mineral properties in Australia and internationally.

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives