- Australia

- /

- Medical Equipment

- /

- ASX:PNV

ASX Stocks Estimated To Be Trading At Discounts Up To 44.8%

Reviewed by Simply Wall St

As the Australian market demonstrates resilience with a 0.44% gain, defying initial predictions of a downturn, nearly every sector found itself in positive territory, showcasing strong performances from Energy and Real Estate. In such an environment, identifying undervalued stocks becomes crucial for investors seeking opportunities to capitalize on potential discounts within the market.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.33 | A$12.31 | 48.6% |

| Cettire (ASX:CTT) | A$1.565 | A$3.02 | 48.1% |

| Charter Hall Group (ASX:CHC) | A$14.50 | A$28.66 | 49.4% |

| MLG Oz (ASX:MLG) | A$0.58 | A$1.15 | 49.4% |

| Telix Pharmaceuticals (ASX:TLX) | A$23.84 | A$46.49 | 48.7% |

| Aussie Broadband (ASX:ABB) | A$3.54 | A$6.42 | 44.8% |

| Ansell (ASX:ANN) | A$33.76 | A$60.63 | 44.3% |

| Ingenia Communities Group (ASX:INA) | A$4.64 | A$9.18 | 49.4% |

| Genesis Minerals (ASX:GMD) | A$2.48 | A$4.90 | 49.4% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Aussie Broadband (ASX:ABB)

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market cap of A$1.06 billion.

Operations: The company's revenue is derived from various segments including Business (A$96.97 million), Wholesale (A$159.73 million), Residential (A$585.07 million), Symbio Group (A$69.93 million), and Enterprise and Government (A$88.04 million).

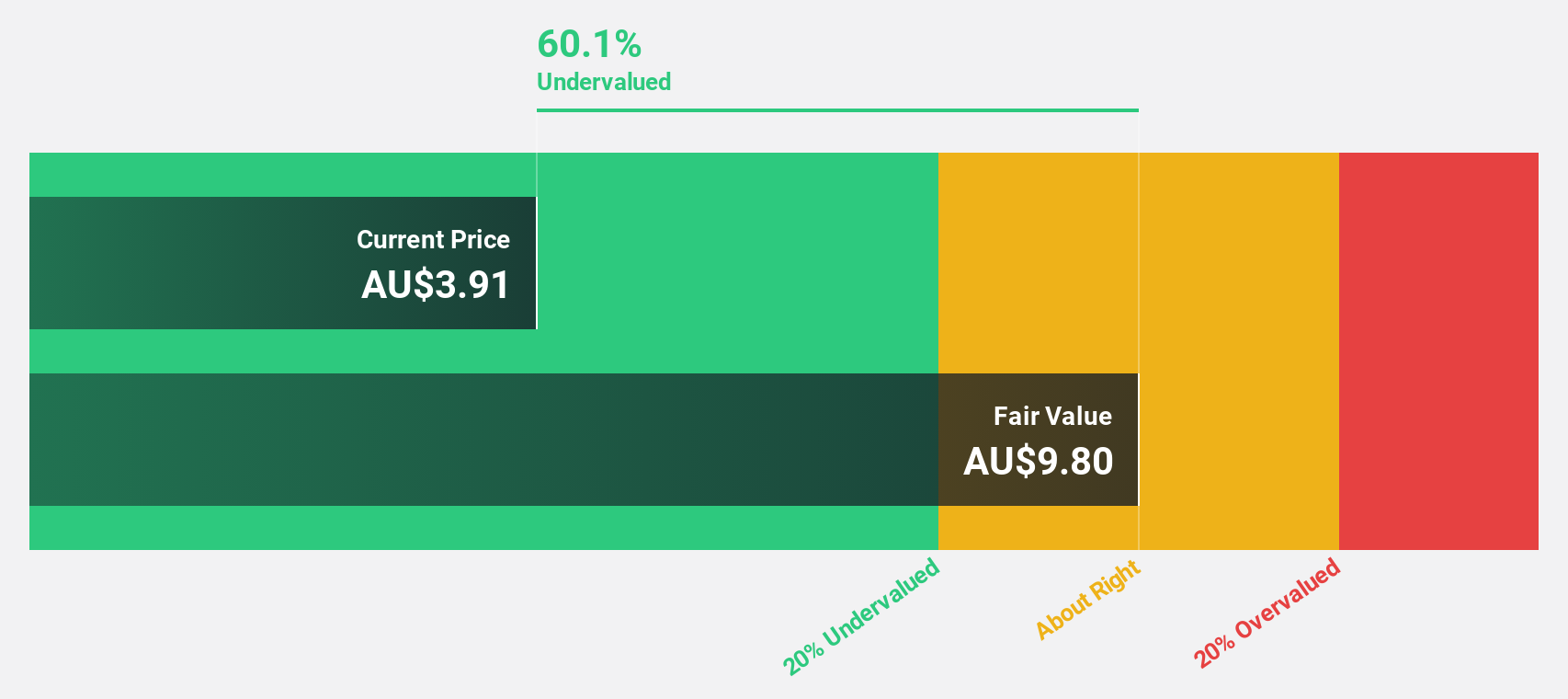

Estimated Discount To Fair Value: 44.8%

Aussie Broadband is trading at A$3.54, significantly below its estimated fair value of A$6.42, suggesting it could be undervalued based on cash flows. The company recently announced a share buyback program to optimize capital and enhance shareholder value, indicating financial flexibility. Despite past shareholder dilution and insider selling, earnings are expected to grow at 23.2% annually—outpacing the Australian market—though revenue growth remains moderate at 8.5% per year.

- Our growth report here indicates Aussie Broadband may be poised for an improving outlook.

- Take a closer look at Aussie Broadband's balance sheet health here in our report.

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally with a market cap of A$1.41 billion.

Operations: The company's revenue is primarily derived from the development, manufacturing, and commercialization of the NovoSorb Technology, amounting to A$103.23 million.

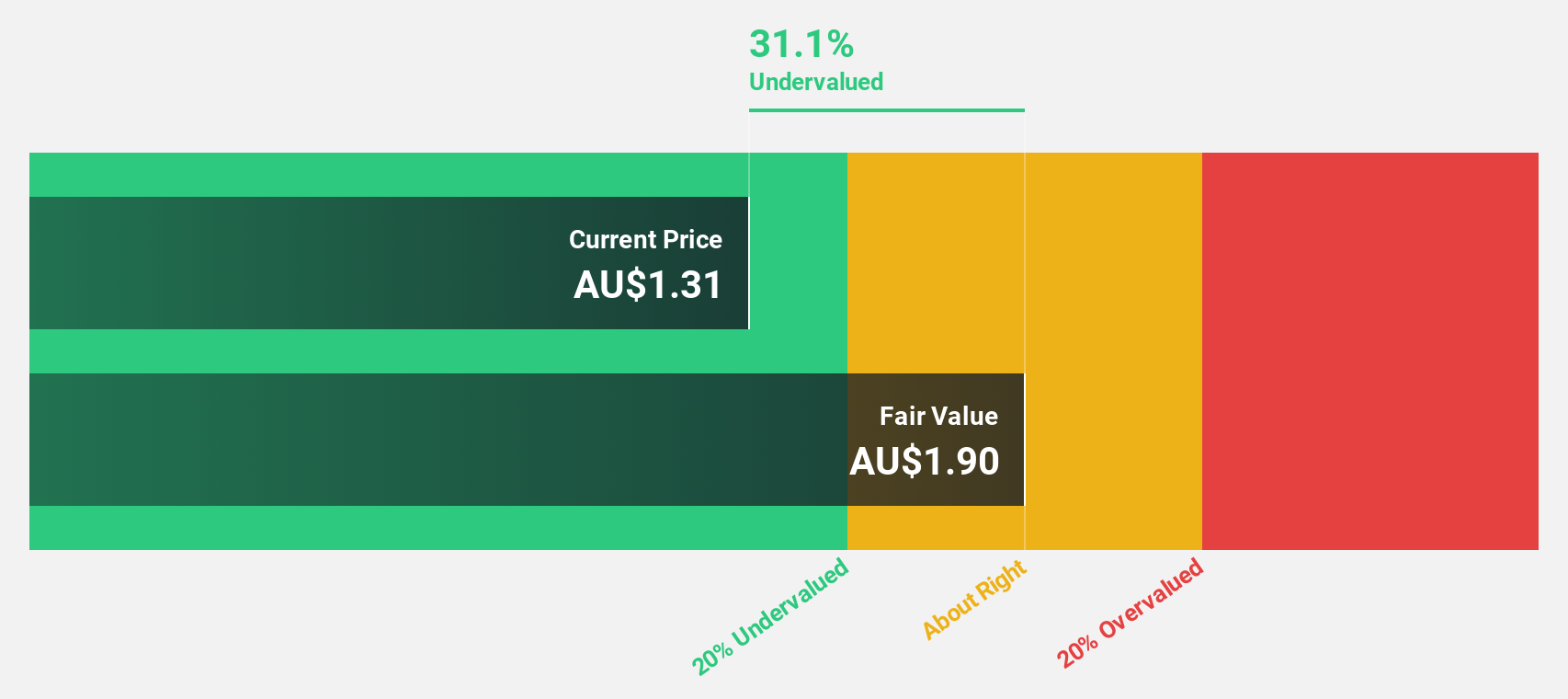

Estimated Discount To Fair Value: 31.2%

PolyNovo is currently trading at A$2.05, which is 31.2% below its estimated fair value of A$2.98, highlighting potential undervaluation based on cash flows. The company recently reported record monthly sales of A$10.1 million for November 2024 and a year-to-date revenue increase of 25.4%. Earnings are forecast to grow significantly at 38.3% annually, surpassing the Australian market's growth rate, while revenue growth is projected at 17.6% per year.

- The analysis detailed in our PolyNovo growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of PolyNovo stock in this financial health report.

Select Harvests (ASX:SHV)

Overview: Select Harvests Limited operates in Australia, focusing on the cultivation, processing, packaging, and sale of almonds and related by-products with a market capitalization of A$603.96 million.

Operations: The company's revenue primarily comes from its almond segment, which generated A$337.29 million.

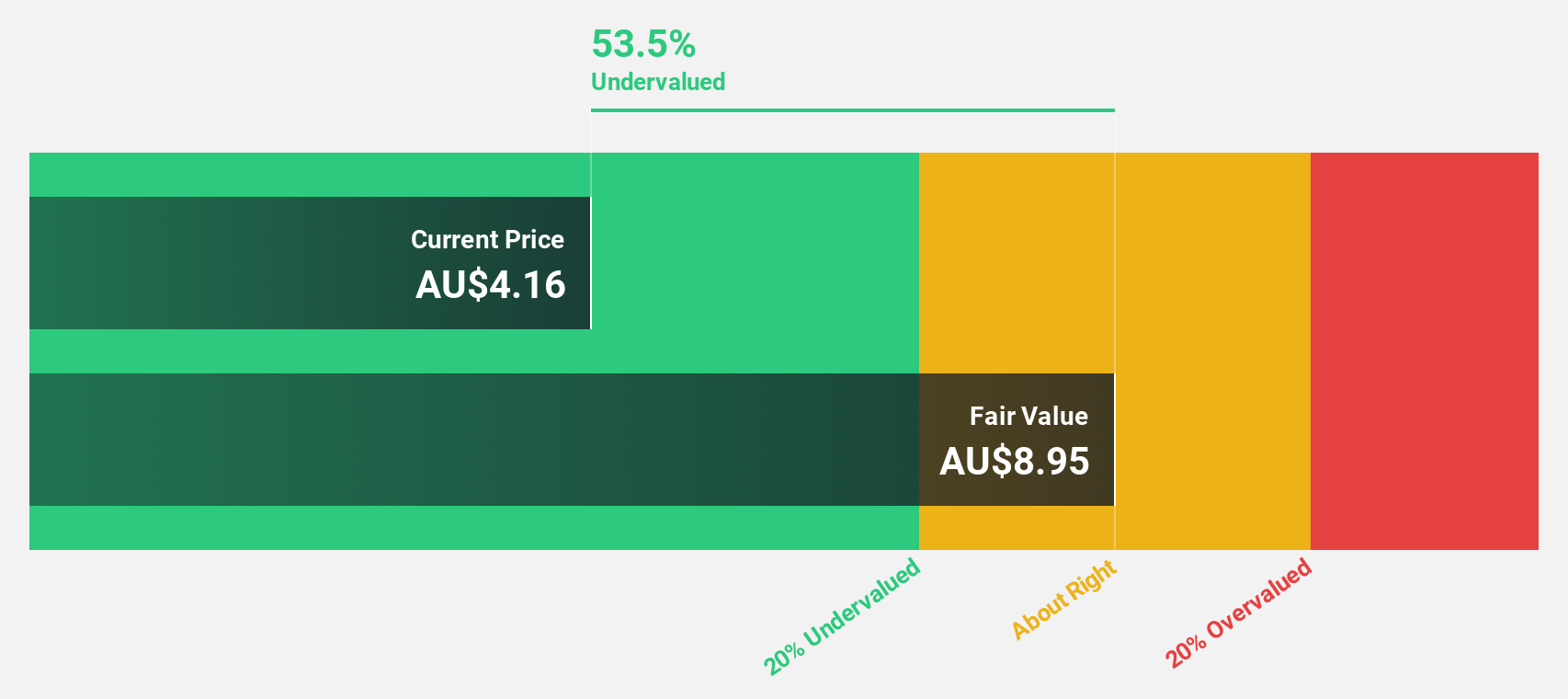

Estimated Discount To Fair Value: 35.6%

Select Harvests is trading at A$4.30, significantly below its estimated fair value of A$6.68, suggesting it may be undervalued based on cash flows. The company reported a return to profitability with sales of A$337.29 million and net income of A$1.5 million for the year ended September 2024. Despite recent shareholder dilution, earnings are projected to grow at 36% annually over the next three years, outpacing the Australian market's growth rate.

- The growth report we've compiled suggests that Select Harvests' future prospects could be on the up.

- Navigate through the intricacies of Select Harvests with our comprehensive financial health report here.

Summing It All Up

- Click this link to deep-dive into the 41 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNV

PolyNovo

Designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives