- Australia

- /

- Capital Markets

- /

- ASX:MFF

ASX January 2025 Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

The Australian market has demonstrated resilience, closing 34 points higher at 8,189 despite initial predictions of a decline. With nearly every sector in the green and notable gains in Energy and Real Estate, small-cap stocks are drawing attention for their potential amidst these positive market conditions. In this environment, identifying promising small-cap stocks often involves looking at those with strong fundamentals and insider activity that may indicate confidence from within the company.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infomedia | 43.1x | 3.9x | 34.45% | ★★★★★★ |

| Rural Funds Group | 8.2x | 6.1x | 36.28% | ★★★★★★ |

| Collins Foods | 15.5x | 0.6x | 13.24% | ★★★★★☆ |

| Iluka Resources | 8.0x | 1.8x | 7.36% | ★★★★★☆ |

| Abacus Group | NA | 5.3x | 26.25% | ★★★★★☆ |

| SHAPE Australia | 14.8x | 0.3x | 29.55% | ★★★★☆☆ |

| Dicker Data | 19.2x | 0.7x | -60.05% | ★★★★☆☆ |

| Healius | NA | 0.6x | 11.28% | ★★★★☆☆ |

| Coventry Group | 222.7x | 0.4x | -13.88% | ★★★☆☆☆ |

| Corporate Travel Management | 22.3x | 2.7x | 45.45% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

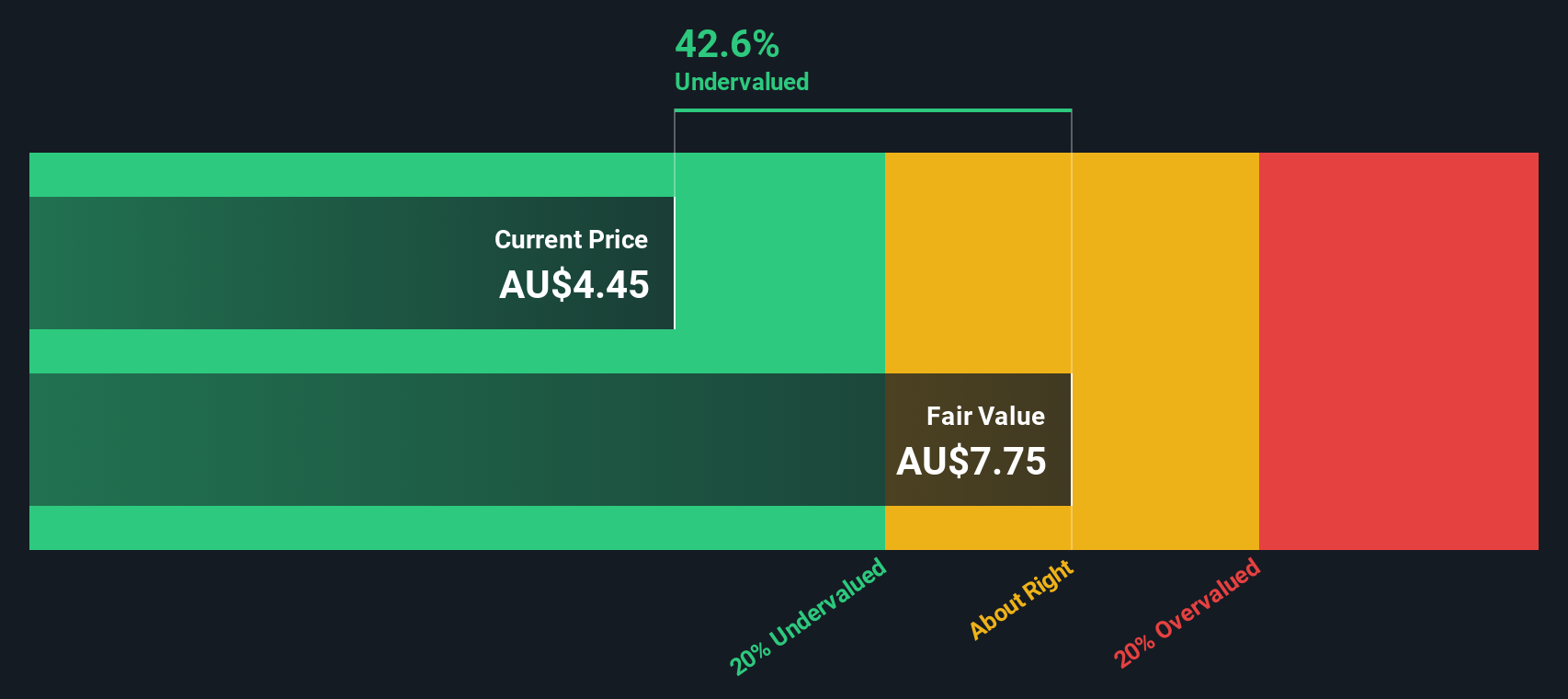

Corporate Travel Management (ASX:CTD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Corporate Travel Management is a company that provides travel services across Asia, Europe, North America, and Australia/New Zealand with a market capitalization of A$2.95 billion.

Operations: Corporate Travel Management generates revenue through its travel services across Asia, Europe, North America, and Australia/New Zealand. The company has seen fluctuations in its gross profit margin over time, with a recent figure of 40.60%. Operating expenses have been a significant part of the cost structure, impacting net income margins.

PE: 22.3x

Corporate Travel Management, a small player in Australia's travel sector, shows potential for growth with earnings projected to rise by 12% annually. Insider confidence is evident with recent share purchases in October 2024. However, the company relies entirely on external borrowing for funding, which poses higher risks compared to customer deposits. Despite these challenges, the anticipated growth and insider activity suggest a positive outlook for investors considering undervalued opportunities in this market segment.

- Navigate through the intricacies of Corporate Travel Management with our comprehensive valuation report here.

Understand Corporate Travel Management's track record by examining our Past report.

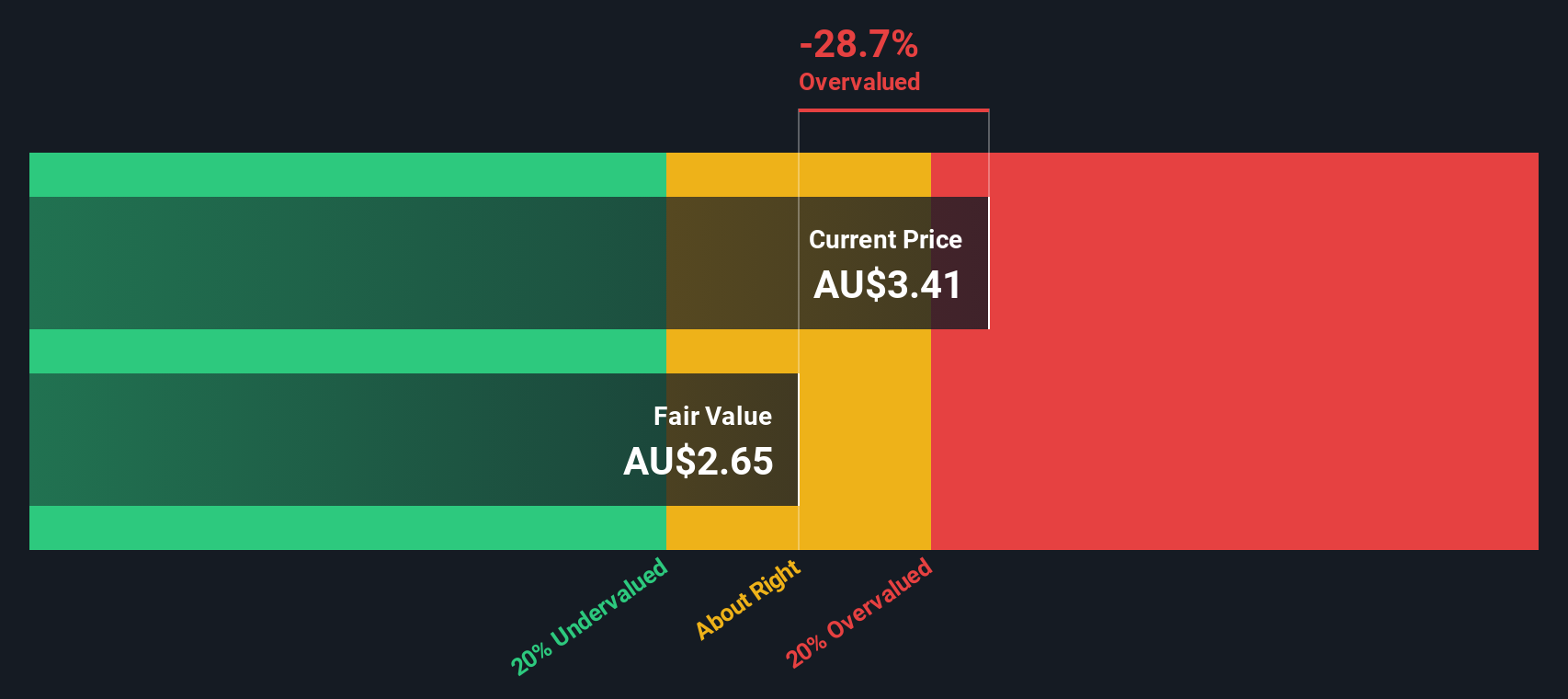

K&S (ASX:KSC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: K&S is a logistics and transportation company involved in fuel distribution and transport services across Australia and New Zealand, with a market cap of A$0.38 billion.

Operations: K&S generates revenue primarily from Australian Transport and Fuel segments, with New Zealand Transport contributing a smaller portion. The company has experienced fluctuations in its gross profit margin, which was 43.18% at the beginning of the period and reached 15.64% by mid-2024. Operating expenses are significant, with general and administrative costs being a major component over time.

PE: 15.7x

K&S, a transport and logistics company, is catching attention in the Australian market for its potential as an undervalued stock. Recent insider confidence is evident with board members purchasing shares over the past year, signaling belief in future growth. Despite relying solely on external borrowing for funding—considered higher risk without customer deposits—the company maintains operational stability. With strategic positioning in a competitive industry, K&S might offer intriguing prospects for investors seeking opportunities in this segment of the market.

- Unlock comprehensive insights into our analysis of K&S stock in this valuation report.

Gain insights into K&S' historical performance by reviewing our past performance report.

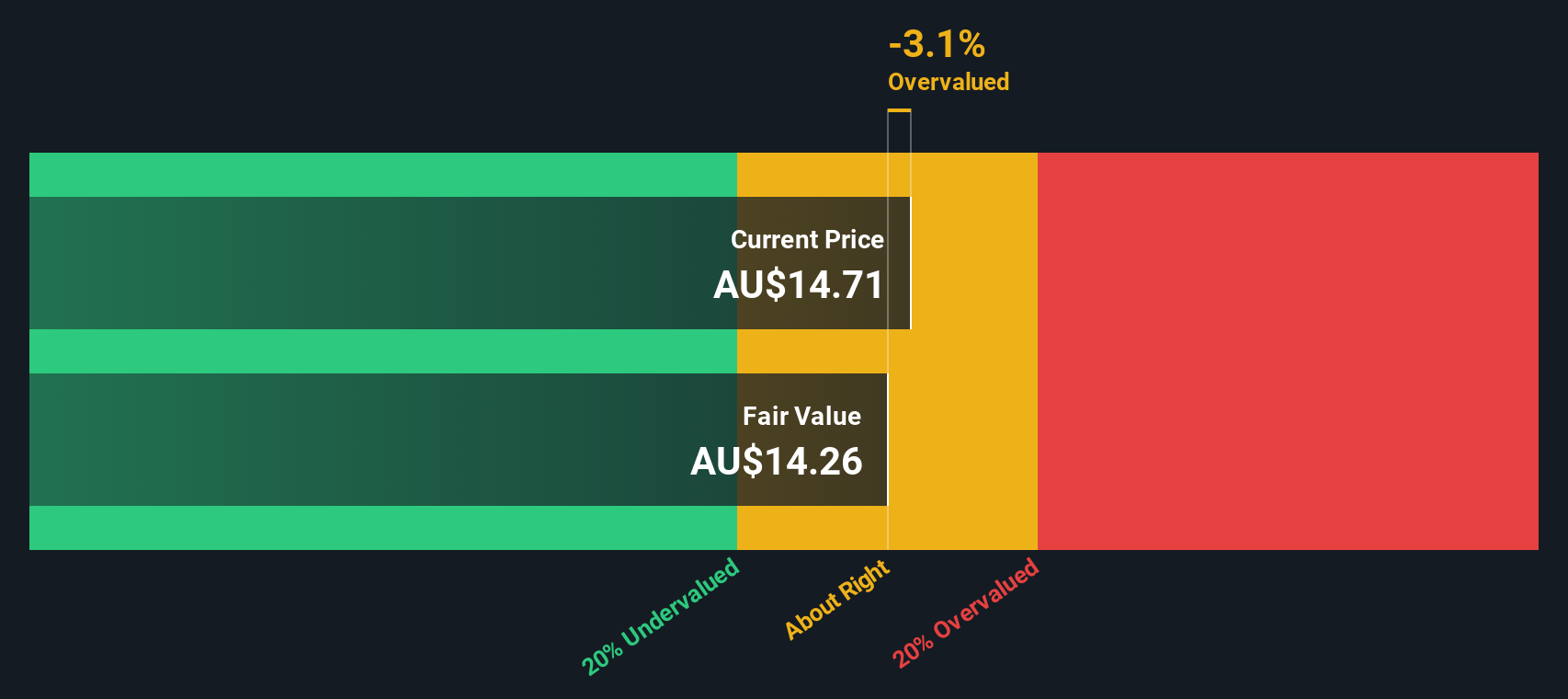

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MFF Capital Investments is an investment company focused on equity investments, with a market capitalization of A$1.78 billion.

Operations: MFF Capital Investments primarily generates revenue from equity investments, with recent figures showing A$659.96 million in revenue. The company consistently achieves a gross profit margin of 100%, indicating no cost of goods sold is reported. Operating expenses are relatively low compared to revenue, with the latest figure at A$3.89 million, contributing to a net income margin of approximately 67.78%.

PE: 6.1x

MFF Capital Investments, a small Australian company, recently saw insider confidence with Christopher MacKay purchasing 1.3 million shares worth A$5.03 million, reflecting a 1.12% increase in their holding. Despite relying solely on external borrowing for funding, which carries higher risk compared to customer deposits, the company's strategic moves signal potential growth opportunities. Recent executive changes include Ms Kathy Molla-Abbasi's interim appointment as Company Secretary following Ms Marcia Venegas's resignation in December 2024.

- Delve into the full analysis valuation report here for a deeper understanding of MFF Capital Investments.

Learn about MFF Capital Investments' historical performance.

Taking Advantage

- Click here to access our complete index of 22 Undervalued ASX Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives