- Australia

- /

- Metals and Mining

- /

- ASX:CMM

ASX Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

The Australian market has shown robust performance, climbing 1.7% in the last 7 days and achieving a 12% increase over the past year, with earnings forecasted to grow by 12% annually. In this favorable environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.4% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

We're going to check out a few of the best picks from our screener tool.

Capricorn Metals (ASX:CMM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricorn Metals Ltd is an Australian company involved in the evaluation, exploration, development, and production of gold properties with a market cap of A$2.36 billion.

Operations: Capricorn Metals generates revenue primarily from its Karlawinda gold property, amounting to A$359.73 million.

Insider Ownership: 11.9%

Earnings Growth Forecast: 20.2% p.a.

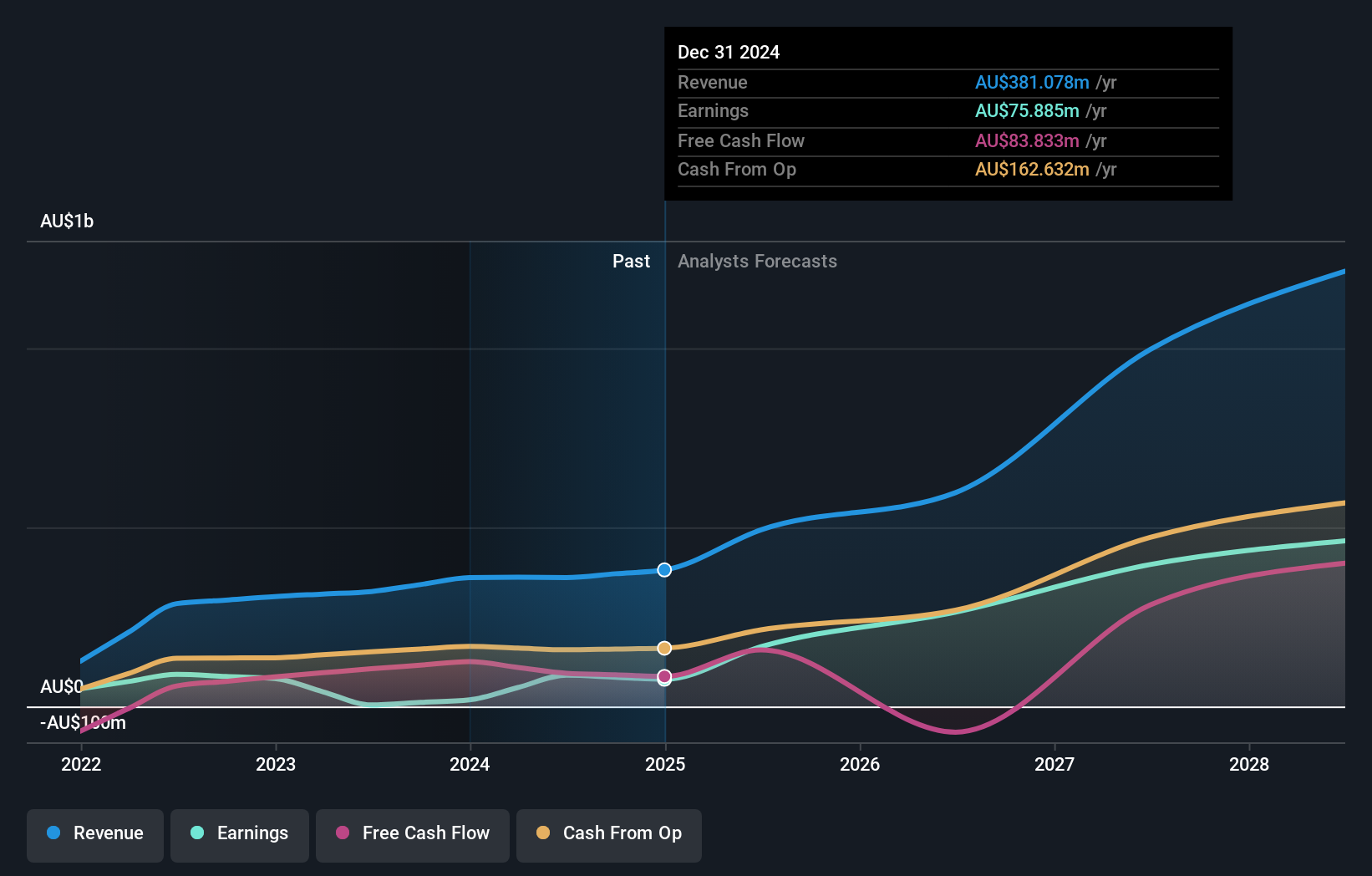

Capricorn Metals has demonstrated significant growth, with recent earnings showing a dramatic rise from A$4.4 million to A$87.14 million year-over-year. The company reported sales of A$359.83 million for the full year ending June 30, 2024, up from A$320.84 million the previous year. Capricorn's Karlawinda Gold Project expansion study indicates potential for increased throughput and extended mine life, supported by substantial insider ownership aligning management interests with shareholders' goals for long-term value creation.

- Dive into the specifics of Capricorn Metals here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Capricorn Metals is priced higher than what may be justified by its financials.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$7.38 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: The company's revenue segments include Energy (A$16 million), Lithium (A$1.41 billion), Iron Ore (A$2.58 billion), Mining Services (A$3.38 billion), and Other Commodities (A$19 million).

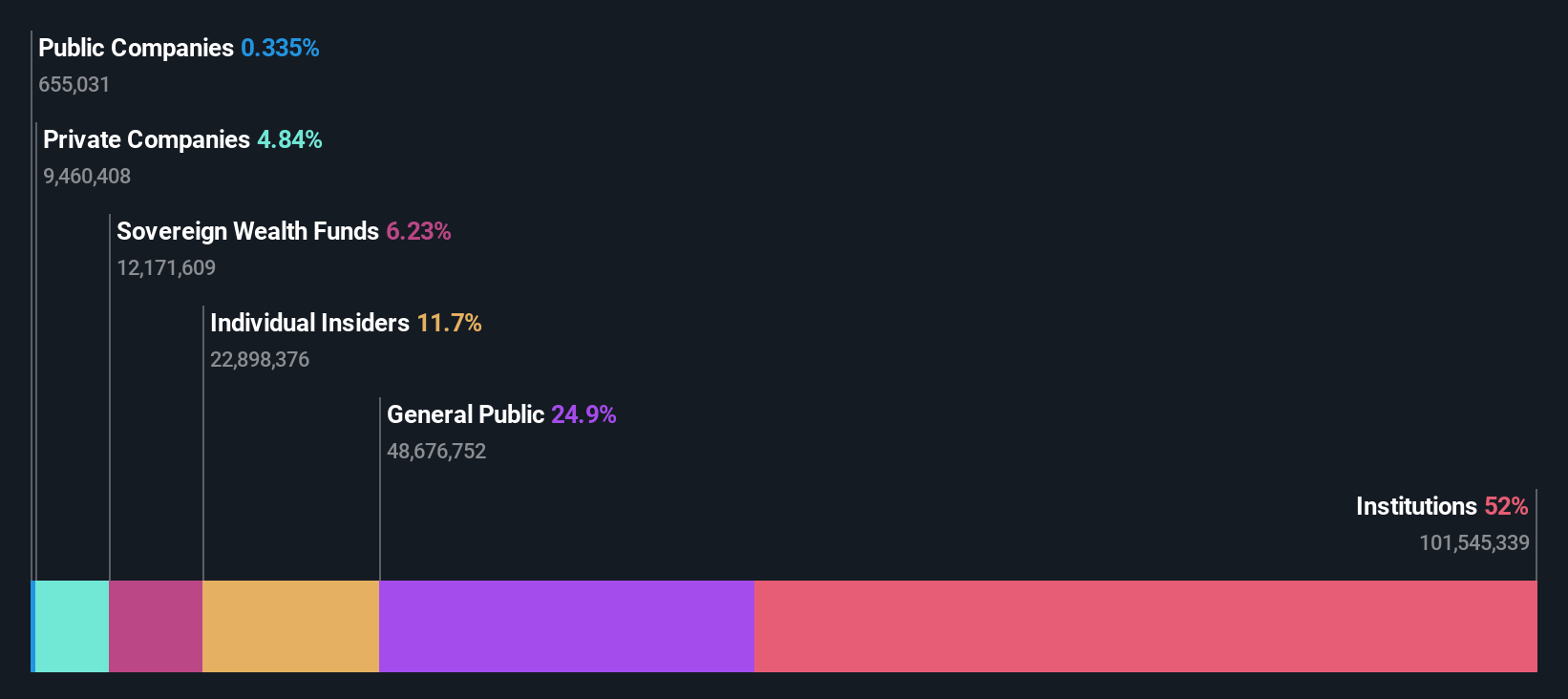

Insider Ownership: 11.7%

Earnings Growth Forecast: 38.7% p.a.

Mineral Resources Limited reported full-year sales of A$5.28 billion, up from A$4.78 billion last year, but net income fell to A$125 million from A$243 million. Earnings per share also declined significantly. Despite this, the company's earnings are forecasted to grow at 38.65% annually, outpacing the Australian market's growth rate of 12.3%. Insiders have been buying more shares recently, indicating confidence in future performance despite current financial challenges and lower profit margins compared to last year.

- Click to explore a detailed breakdown of our findings in Mineral Resources' earnings growth report.

- The valuation report we've compiled suggests that Mineral Resources' current price could be inflated.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$7.73 billion.

Operations: The company's revenue segments include Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

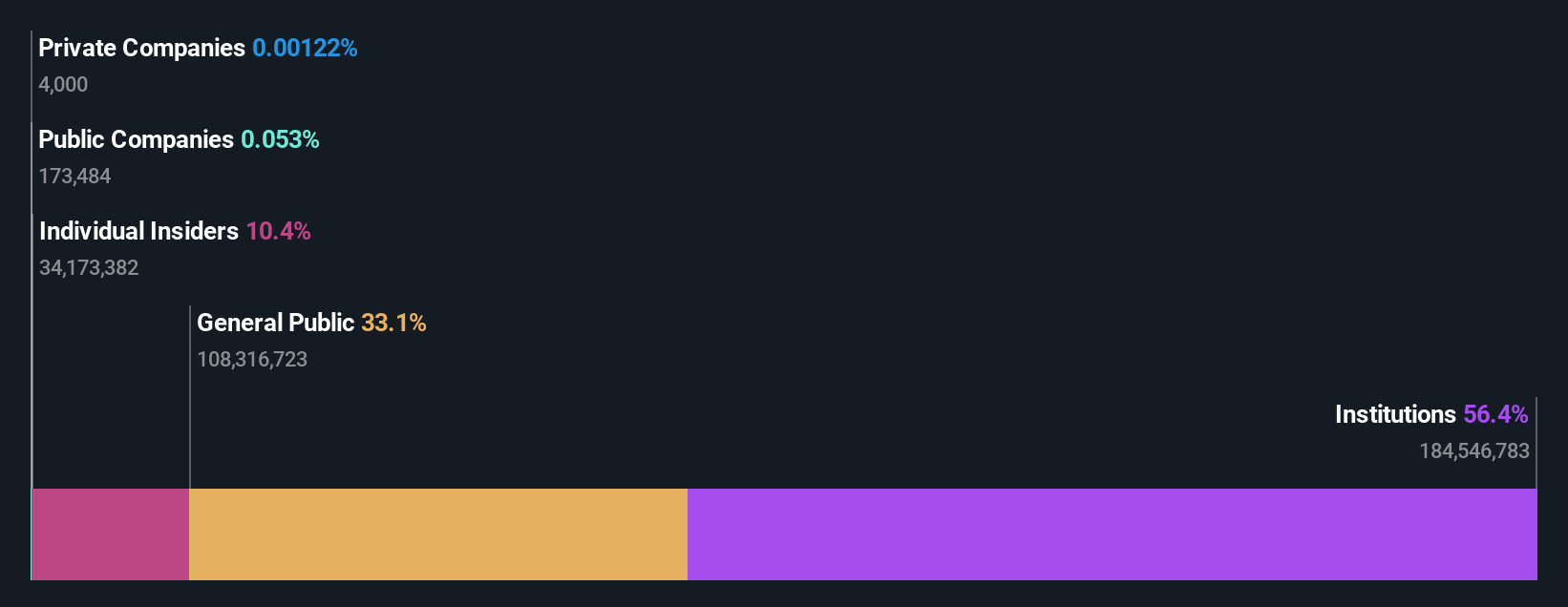

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.8% p.a.

Technology One's revenue is forecast to grow 11.5% annually, outpacing the Australian market's 5.3% growth rate, with earnings expected to rise by 14.8% per year. The company's Return on Equity is projected to reach 32.6% in three years, indicating strong profitability potential. Recent board changes include the appointment of Paul Robson as an independent Non-Executive Director, bringing valuable SaaS expertise and strategic transformation skills essential for global growth and innovation initiatives.

- Navigate through the intricacies of Technology One with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Technology One's shares may be trading at a premium.

Where To Now?

- Gain an insight into the universe of 99 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMM

Capricorn Metals

Engages in the evaluation, exploration, development, and production of gold properties in Australia.

Exceptional growth potential with outstanding track record.