- Australia

- /

- Metals and Mining

- /

- ASX:CHN

ASX Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

The Australian market has experienced a relatively stable day, with the ASX200 closing at 7,760 points and sectors like Health Care leading gains. For investors interested in exploring beyond the well-known stocks, penny stocks offer intriguing opportunities. Although the term may seem outdated, these smaller or newer companies can present a mix of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.55 | A$120.92M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.04 | A$150.57M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$70.76M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.36 | A$363.87M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$121.16M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.25 | A$154.21M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.88 | A$631.99M | ✅ 4 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.735 | A$458.51M | ✅ 4 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.40 | A$1.1B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.385 | A$45.17M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 983 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Aurelia Metals (ASX:AMI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aurelia Metals Limited is an Australian company involved in the exploration and production of mineral properties, with a market cap of A$406.22 million.

Operations: The company's revenue is derived from its operations at the Hera Mine (A$5.98 million), Peak Mine (A$245.13 million), and Dargues Mine (A$73.90 million).

Market Cap: A$406.22M

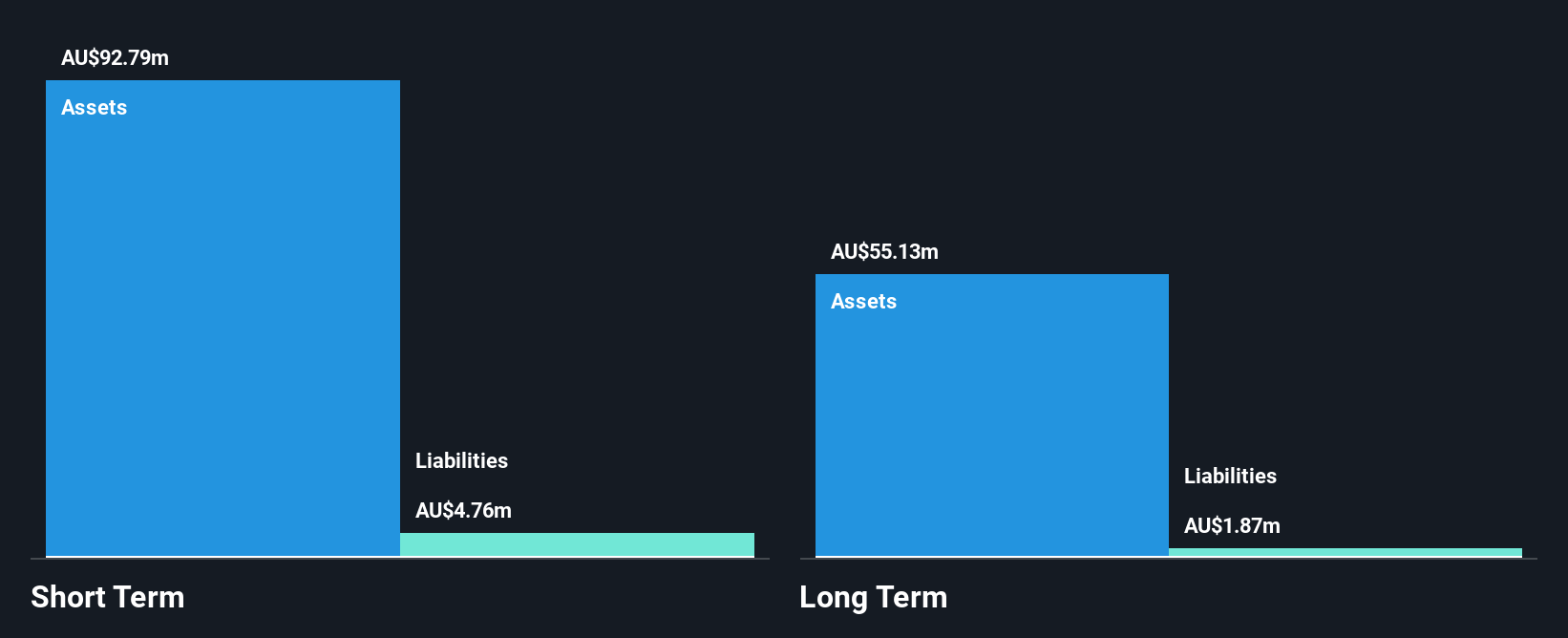

Aurelia Metals has shown a turnaround, becoming profitable recently with net income of A$17.95 million for the half year ending December 2024, compared to a loss previously. The company's operating cash flow significantly covers its debt, indicating strong financial management. However, its Return on Equity remains low at 4.3%, and interest coverage by EBIT is below optimal levels at 2.6 times. While short-term and long-term liabilities are well-covered by assets, the board and management team lack extensive experience, which could impact strategic decisions as the company navigates growth in a competitive industry environment.

- Take a closer look at Aurelia Metals' potential here in our financial health report.

- Assess Aurelia Metals' future earnings estimates with our detailed growth reports.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market capitalization of A$408.48 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration and evaluation company.

Market Cap: A$408.48M

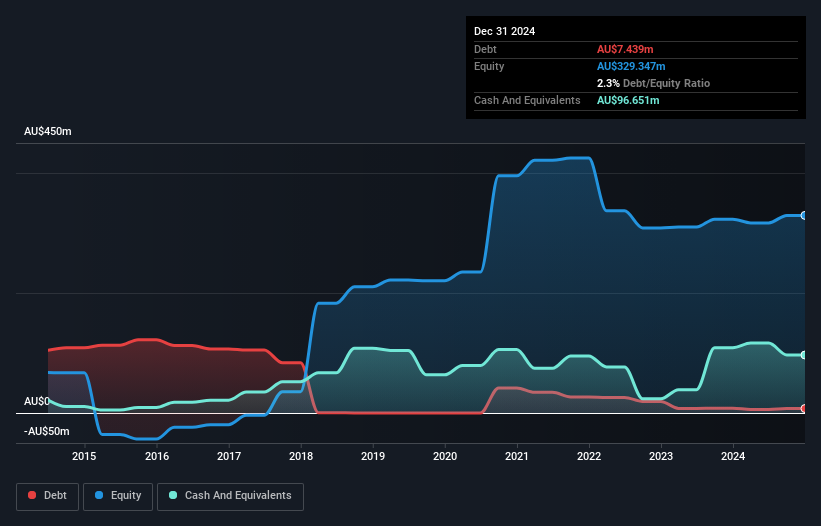

Chalice Mining, with a market cap of A$408.48 million, is pre-revenue with sales under US$1 million. Despite being debt-free and having sufficient cash runway for over three years, the company remains unprofitable and isn't expected to achieve profitability in the near term. Recent management changes include appointing a new COO to advance its Gonneville Project, which may enhance operational focus. However, significant insider selling in recent months could signal caution among stakeholders. While short-term assets exceed liabilities comfortably, earnings are forecasted to decline by 9.3% annually over the next three years amidst high share price volatility.

- Get an in-depth perspective on Chalice Mining's performance by reading our balance sheet health report here.

- Explore Chalice Mining's analyst forecasts in our growth report.

Sunrise Energy Metals (ASX:SRL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sunrise Energy Metals Limited focuses on metal recovery and the exploration of mineral tenements in Australia, with a market cap of A$64.06 million.

Operations: The company generates revenue from its Metals segment, amounting to A$0.24 million.

Market Cap: A$64.06M

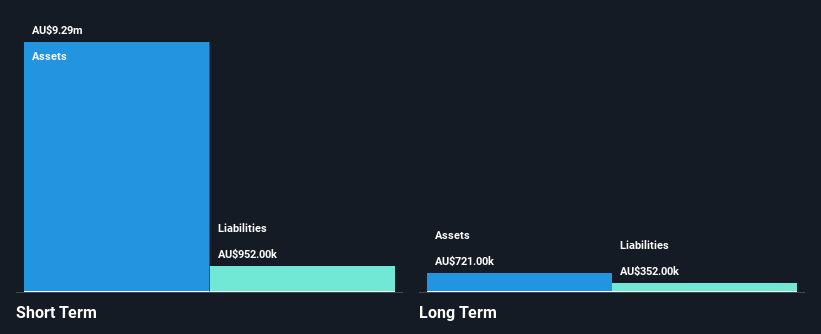

Sunrise Energy Metals, with a market cap of A$64.06 million, is pre-revenue and debt-free, with short-term assets exceeding liabilities. Despite being unprofitable, it has reduced losses by 58.4% annually over five years. Recent announcements highlight positive assay results from the Syerston Scandium Project, indicating potential high-grade scandium mineralisation. An updated Mineral Resource Estimate (MRE) supports plans for a dedicated scandium mine and processing plant in NSW. However, the company faces less than a year of cash runway based on current free cash flow trends and exhibits significant share price volatility recently increasing to 21%.

- Navigate through the intricacies of Sunrise Energy Metals with our comprehensive balance sheet health report here.

- Assess Sunrise Energy Metals' previous results with our detailed historical performance reports.

Summing It All Up

- Embark on your investment journey to our 983 ASX Penny Stocks selection here.

- Interested In Other Possibilities? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CHN

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives