- Australia

- /

- Professional Services

- /

- ASX:C79

ASX Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

The Australian market has shown a modest uptick, with the ASX200 rising 0.5% to 8,445 points, as sectors like IT and Discretionary lead gains despite geopolitical tensions surrounding U.S.-China trade relations. In this environment of sector-specific growth and market fluctuations, identifying companies with strong insider ownership can be crucial for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medallion Metals (ASX:MM8) | 13.8% | 67.5% |

| Acrux (ASX:ACR) | 20.2% | 91.8% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Pointerra (ASX:3DP) | 23.8% | 126.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.8% | 77.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 110.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited develops and supplies mining technology, with a market cap of A$571.48 million.

Operations: The company's revenue segment primarily consists of Mining Services, generating A$45.36 million.

Insider Ownership: 20.1%

Earnings Growth Forecast: 47.7% p.a.

Chrysos Corporation is positioned for significant growth, with revenue expected to increase by 28.4% per year, outpacing the Australian market's 6% growth rate. Analysts anticipate a stock price rise of 28.7%. The company is on track to achieve profitability within three years and has confirmed its fiscal year 2025 earnings guidance, projecting revenue between A$60 million and A$70 million. Despite these positive indicators, insider trading activity over the past three months hasn't been substantial.

- Take a closer look at Chrysos' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Chrysos shares in the market.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited offers travel retailing services for leisure and corporate clients across various regions worldwide, with a market cap of A$3.68 billion.

Operations: The company's revenue is primarily derived from its leisure segment, which generated A$1.35 billion, and its corporate segment, contributing A$1.11 billion.

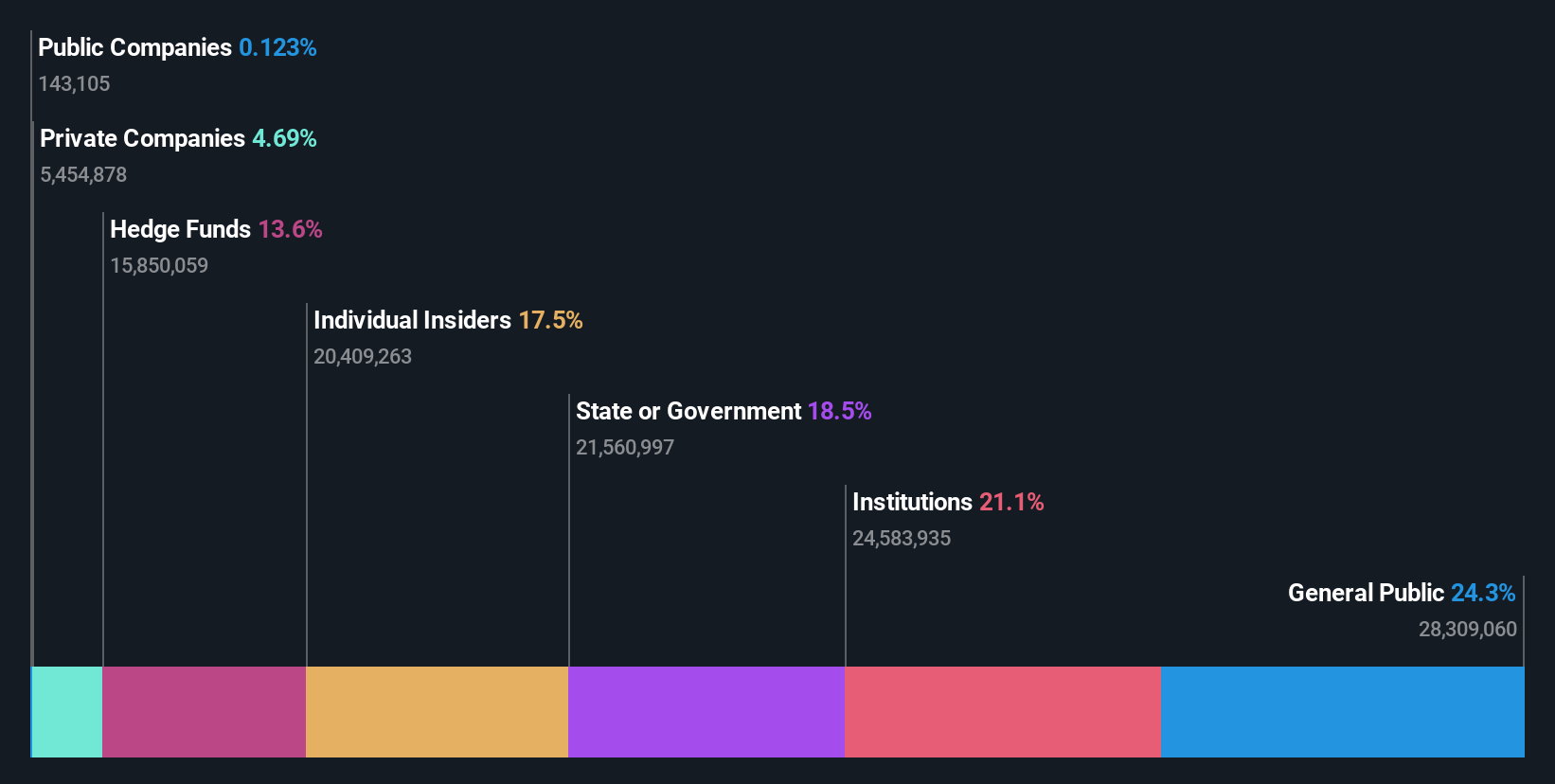

Insider Ownership: 13.5%

Earnings Growth Forecast: 19% p.a.

Flight Centre Travel Group is poised for growth, with earnings forecast to increase by 19% annually, surpassing the Australian market's average. Despite a slower revenue growth rate of 7.2%, it remains above the market average. Recent insider activity shows more buying than selling, suggesting confidence in future prospects. The company trades at a significant discount to its estimated fair value and has issued A$140 million in convertible notes due 2028, reflecting strategic financial maneuvers.

- Click here to discover the nuances of Flight Centre Travel Group with our detailed analytical future growth report.

- According our valuation report, there's an indication that Flight Centre Travel Group's share price might be on the cheaper side.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

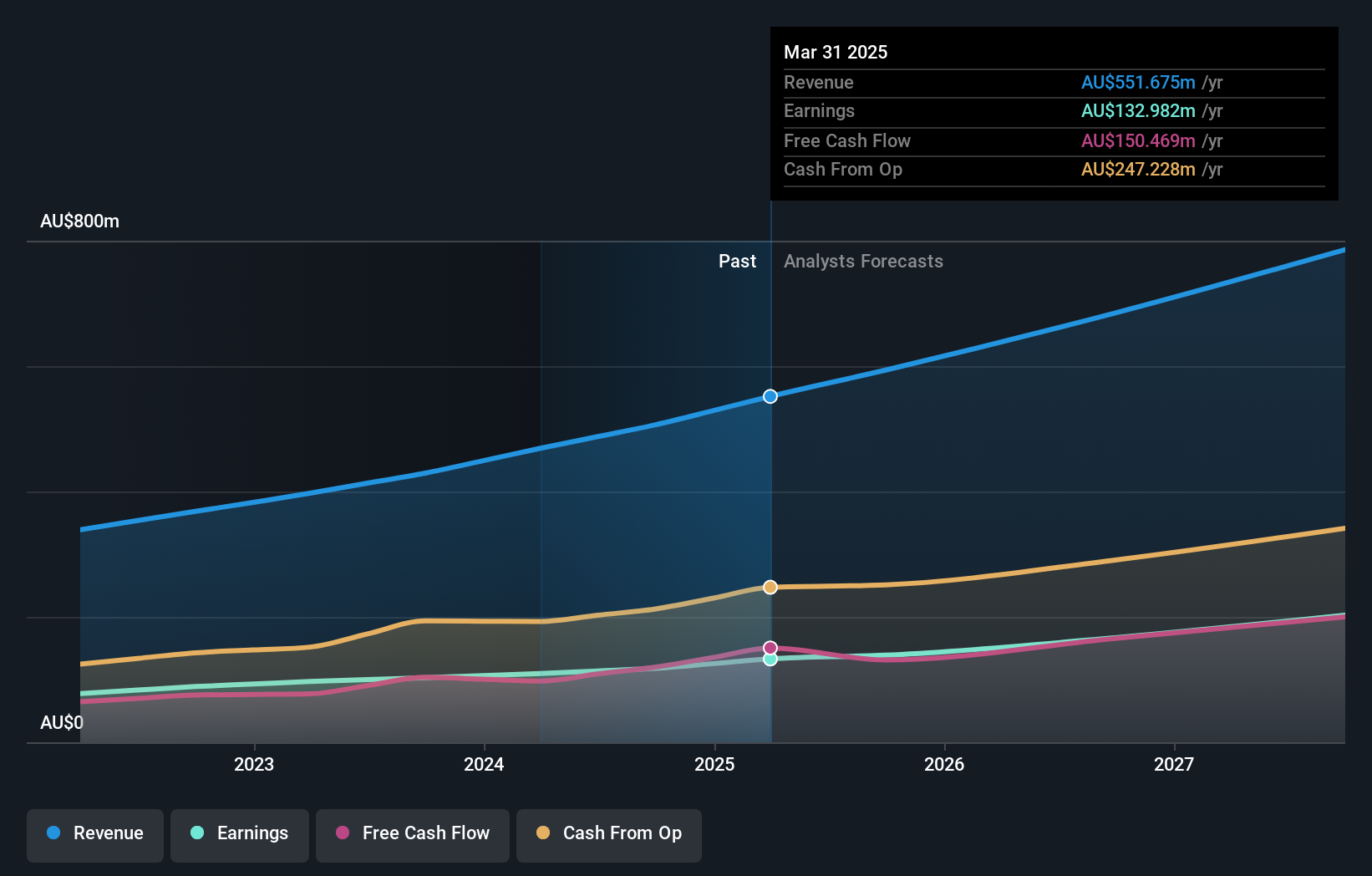

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$9.56 billion.

Operations: The company's revenue segments include A$347.35 million from software, A$87.02 million from corporate services, and A$72.17 million from consulting activities.

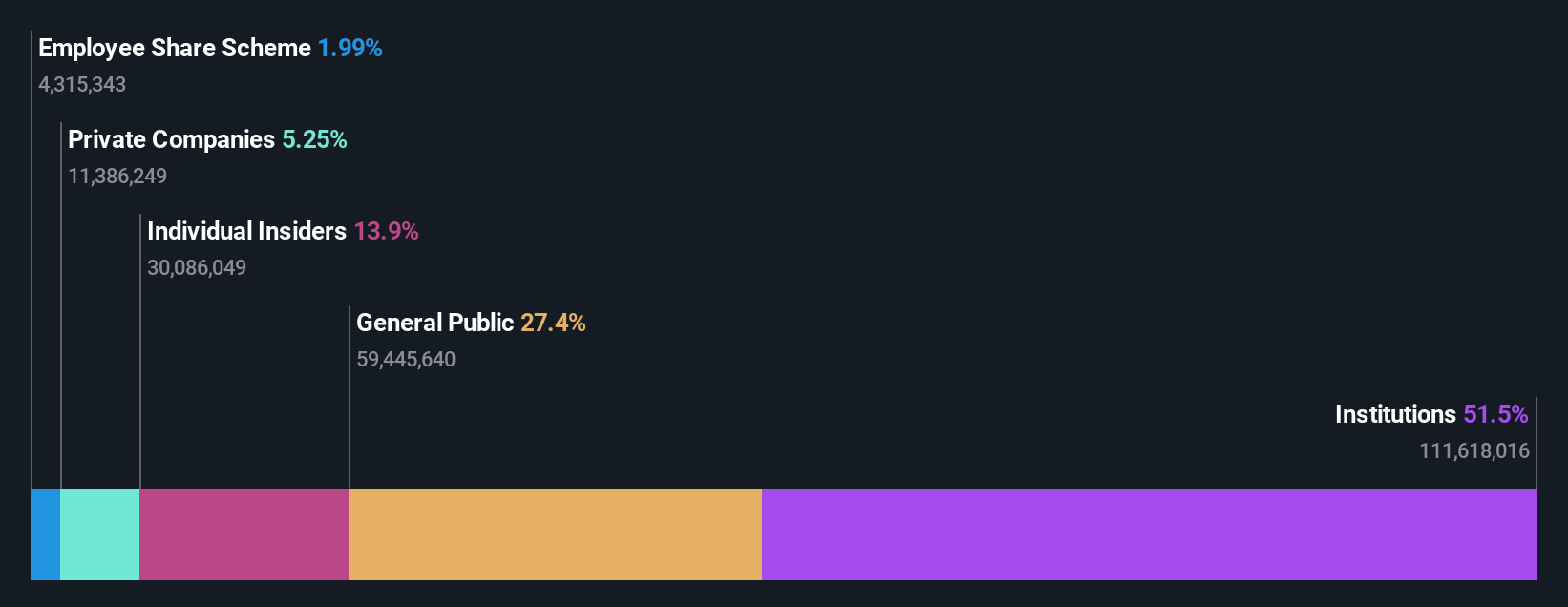

Insider Ownership: 10.4%

Earnings Growth Forecast: 16.1% p.a.

Technology One's earnings are projected to grow at 16.1% annually, outpacing the Australian market average of 12.6%. Revenue is expected to increase by 12.4% per year, also above the market rate. Recent insider activity indicates more buying than selling, reflecting potential confidence in its growth trajectory despite significant selling in the past quarter. The company's net income rose to A$118.01 million from A$102.88 million last year, signaling robust financial performance and growth prospects.

- Dive into the specifics of Technology One here with our thorough growth forecast report.

- The analysis detailed in our Technology One valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Explore the 89 names from our Fast Growing ASX Companies With High Insider Ownership screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:C79

Flawless balance sheet with high growth potential.