- Australia

- /

- Real Estate

- /

- ASX:UOS

3 Promising ASX Penny Stocks With A$300M Market Cap

Reviewed by Simply Wall St

The Australian market is showing signs of optimism, with ASX 200 futures indicating a potential gain, mirroring the positive momentum seen in U.S. and European markets. In this context, penny stocks—though an old term—remain relevant for investors seeking opportunities in smaller or newer companies that might offer substantial value. With solid financial foundations, these stocks can present both stability and growth potential, making them intriguing options for those looking to explore under-the-radar investment opportunities.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.91 | A$241.27M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.975 | A$321.56M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.95 | A$107.87M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.13 | A$329.91M | ★★★★☆☆ |

| Servcorp (ASX:SRV) | A$5.00 | A$493.36M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$111.85M | ★★★★★★ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Arafura Rare Earths (ASX:ARU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arafura Rare Earths Limited is involved in the exploration and development of mineral properties in Australia, with a market cap of A$332.68 million.

Operations: Arafura Rare Earths Limited does not report any revenue segments.

Market Cap: A$332.68M

Arafura Rare Earths, with a market cap of A$332.68 million, is pre-revenue and unprofitable but debt-free, with short-term assets exceeding both its short and long-term liabilities. Recent developments include a significant A$200 million investment commitment from the National Reconstruction Fund Corporation to support the Nolans Project, potentially enhancing its financial runway beyond current estimates. The company has also strengthened its leadership by appointing Tommie van der Walt as Chief Projects Officer, leveraging his extensive experience in mining project development. Despite management's limited tenure, these moves may bolster operational capacity and strategic direction.

- Click here to discover the nuances of Arafura Rare Earths with our detailed analytical financial health report.

- Assess Arafura Rare Earths' future earnings estimates with our detailed growth reports.

Horizon Oil (ASX:HZN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Horizon Oil Limited, along with its subsidiaries, is involved in the exploration, development, and production of oil and gas properties in China, New Zealand, and Australia with a market cap of A$325.36 million.

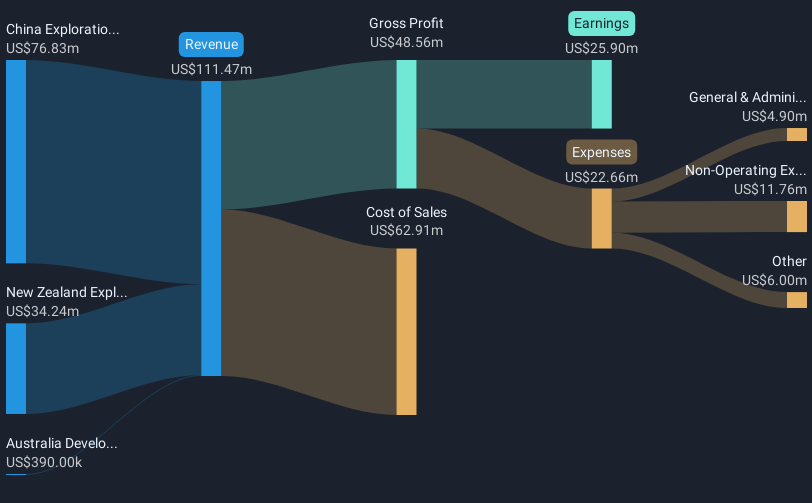

Operations: The company generates revenue from its operations in China ($76.83 million), New Zealand ($34.24 million), and Australia ($0.39 million) through exploration and development activities.

Market Cap: A$325.36M

Horizon Oil, with a market cap of A$325.36 million, generates significant revenue from its operations in China and New Zealand. Despite experiencing negative earnings growth over the past year, it maintains high-quality earnings and a strong return on equity at 31.1%. The company's management and board are considered experienced, contributing to stable weekly volatility. Horizon Oil trades well below its estimated fair value and has reduced its debt-to-equity ratio over five years while maintaining more cash than total debt. However, its dividend is not well covered by earnings or free cash flows, indicating potential sustainability concerns.

- Unlock comprehensive insights into our analysis of Horizon Oil stock in this financial health report.

- Examine Horizon Oil's earnings growth report to understand how analysts expect it to perform.

United Overseas Australia (ASX:UOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, along with its subsidiaries, operates in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia with a market cap of A$908.57 million.

Operations: The company generates revenue from investment activities amounting to A$604.42 million and land development and resale bringing in A$250.14 million.

Market Cap: A$908.57M

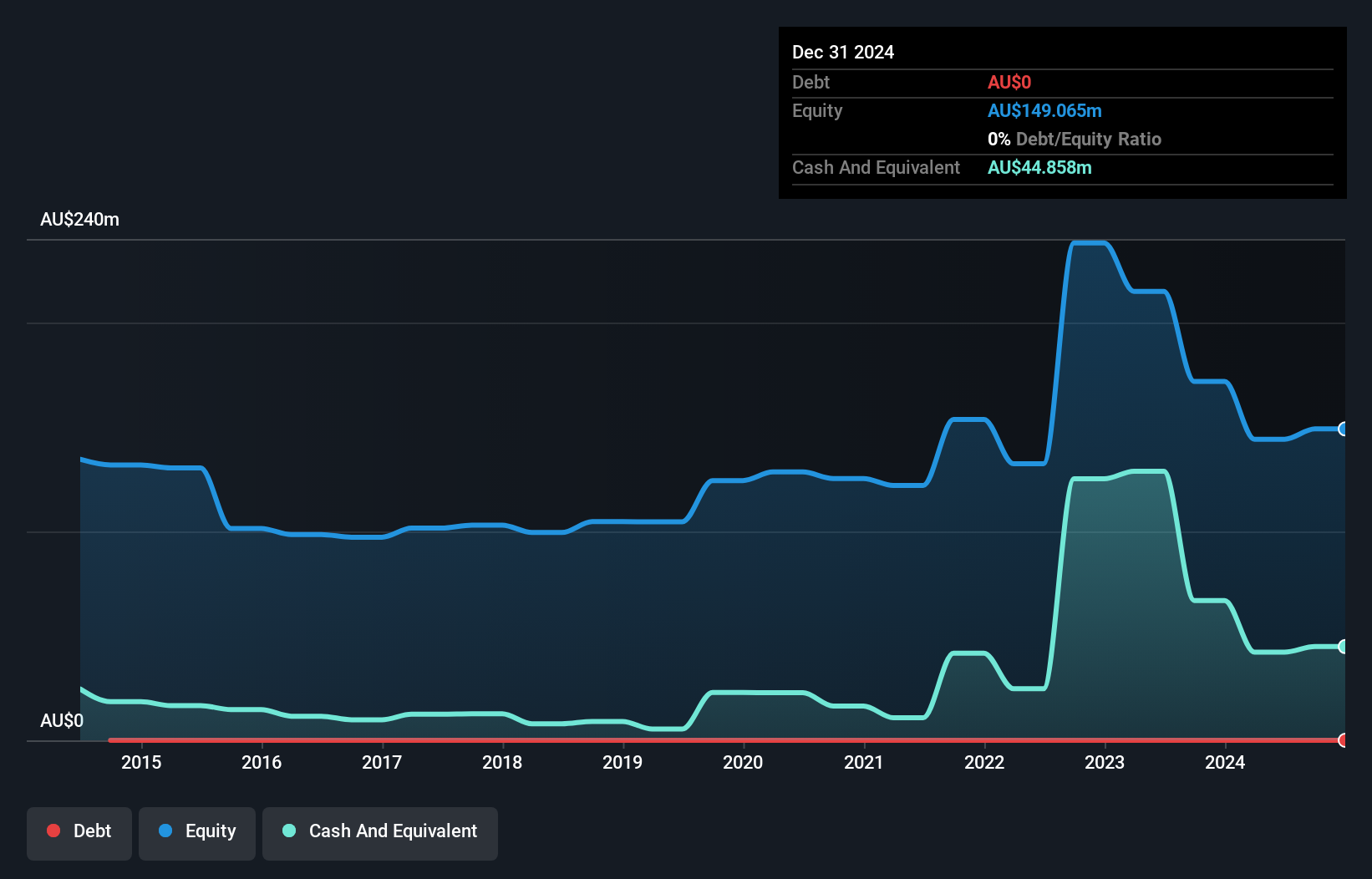

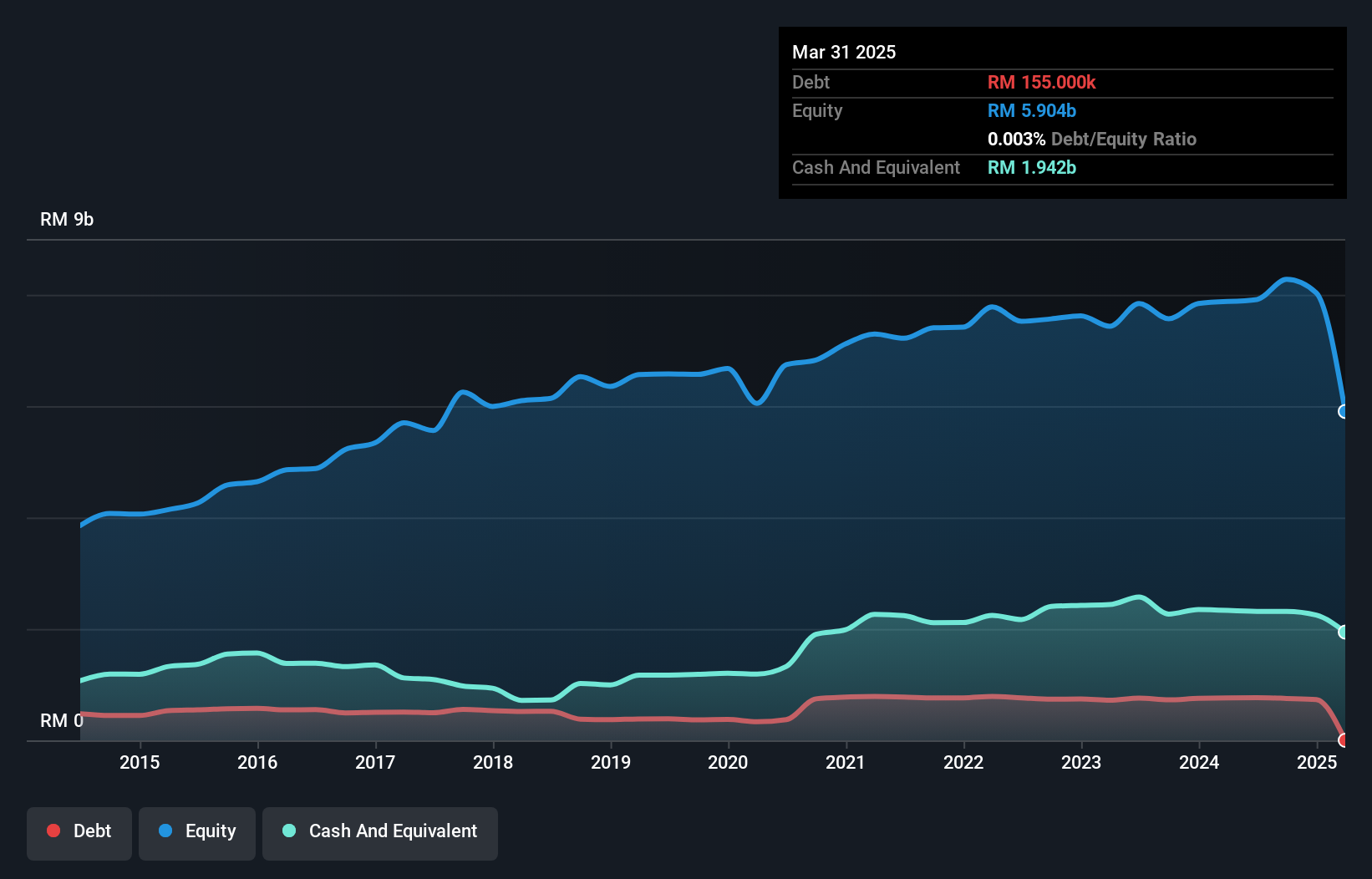

United Overseas Australia Ltd, with a market cap of A$908.57 million, operates in land development and resale across multiple regions. The company has shown modest earnings growth of 1.5% over the past year, surpassing its five-year average decline of 4.4%. Despite low return on equity at 4.8%, UOA is financially stable with cash exceeding total debt and strong coverage of short-term liabilities by assets (A$1.4 billion vs A$406.6 million). With experienced management and board members, UOA maintains stable weekly volatility and trades below its estimated fair value, although recent financial results were impacted by a significant one-off gain.

- Take a closer look at United Overseas Australia's potential here in our financial health report.

- Assess United Overseas Australia's previous results with our detailed historical performance reports.

Summing It All Up

- Discover the full array of 1,027 ASX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:UOS

United Overseas Australia

Engages in the development and resale of land and buildings in Malaysia, Singapore, Vietnam, and Australia.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives