The Australian market is showing positive momentum, with ASX 200 futures indicating a 0.44% gain, aligning with the global uptick following recent U.S. market movements and Trump's inauguration. In this context, penny stocks—though an outdated term—remain a niche area that can offer unique growth opportunities, particularly when they are backed by strong financial health. This article will explore several penny stocks that stand out for their balance sheet resilience and potential for long-term success amidst current market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.91 | A$241.27M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.975 | A$321.56M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.95 | A$107.87M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.13 | A$329.91M | ★★★★☆☆ |

| Servcorp (ASX:SRV) | A$5.00 | A$493.36M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$111.85M | ★★★★★★ |

Click here to see the full list of 1,028 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Alcidion Group (ASX:ALC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alcidion Group Limited develops and licenses healthcare software products in Australia, New Zealand, and the United Kingdom, with a market cap of A$88.63 million.

Operations: The company generates revenue primarily through the provision of healthcare software solutions, amounting to A$37.06 million.

Market Cap: A$88.63M

Alcidion Group, with a market cap of A$88.63 million, primarily generates revenue from healthcare software solutions totaling A$37.06 million. Despite trading at 62.6% below its estimated fair value and being debt-free, the company remains unprofitable with increasing losses over the past five years. Its short-term assets do not cover short-term liabilities, though long-term liabilities are covered. Analysts expect earnings to grow significantly by 103.74% annually, and they agree on a potential stock price rise of 26.3%. Recent leadership changes include appointing Michael Sapountzis as Company Secretary for seamless corporate communication continuity.

- Click here and access our complete financial health analysis report to understand the dynamics of Alcidion Group.

- Assess Alcidion Group's future earnings estimates with our detailed growth reports.

Proteomics International Laboratories (ASX:PIQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Proteomics International Laboratories Ltd is a medical technology company specializing in proteomics across Australia, New Zealand, the United States, Europe, India, and South East Asia with a market cap of A$91.05 million.

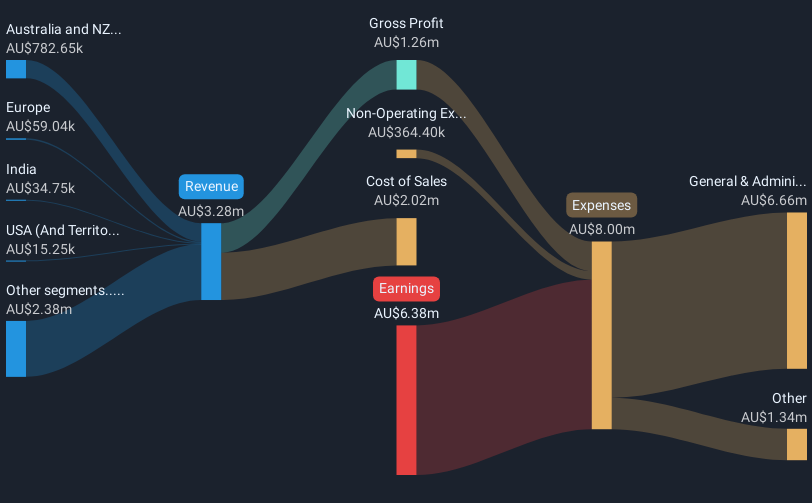

Operations: The company generates revenue primarily from its operational activities, amounting to A$3.28 million.

Market Cap: A$91.05M

Proteomics International Laboratories, with a market cap of A$91.05 million, is currently unprofitable and lacks meaningful revenue at A$3.28 million. Despite this, it maintains a strong financial position with short-term assets of A$9.2 million covering both short-term and long-term liabilities comfortably. The company is debt-free but faces challenges with less than a year of cash runway if cash flow continues to decline at historical rates. Recent board changes include the appointment of Aaron Brinkworth as an independent director, bringing valuable industry experience from his tenure at Gilead Sciences Inc., which could enhance strategic direction and partnerships moving forward.

- Dive into the specifics of Proteomics International Laboratories here with our thorough balance sheet health report.

- Understand Proteomics International Laboratories' earnings outlook by examining our growth report.

Vita Life Sciences (ASX:VLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vita Life Sciences Limited is a healthcare company involved in formulating, packaging, distributing, and selling vitamins and supplements across Australia, Singapore, Malaysia, Thailand, Vietnam, Indonesia, and China with a market cap of A$111.85 million.

Operations: The company's revenue is primarily generated from Australia (A$46.99 million), Malaysia (A$23.63 million), and Singapore (A$6.83 million).

Market Cap: A$111.85M

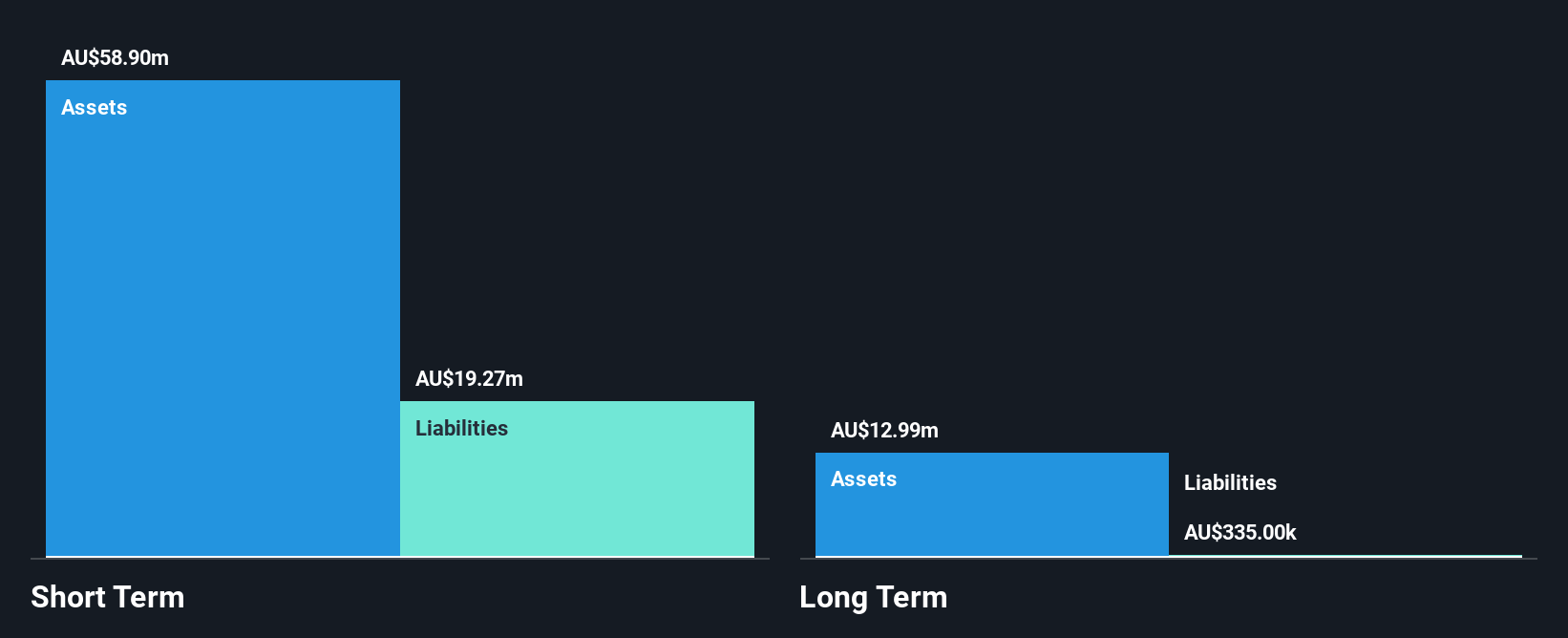

Vita Life Sciences, with a market cap of A$111.85 million, showcases strong financial health and growth potential within the healthcare sector. The company is debt-free and has short-term assets (A$56.3M) exceeding both short-term (A$19.0M) and long-term liabilities (A$236K). Recent earnings guidance indicates expected sales of A$77.5 million to A$78 million for 2024, driven by robust performance in Australia, Malaysia, and Singapore despite challenging global conditions. Earnings growth over the past year was 26.6%, surpassing industry averages, although its return on equity remains relatively low at 19.3%. The management team is experienced with an average tenure of 7.8 years.

- Unlock comprehensive insights into our analysis of Vita Life Sciences stock in this financial health report.

- Learn about Vita Life Sciences' historical performance here.

Turning Ideas Into Actions

- Embark on your investment journey to our 1,028 ASX Penny Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VLS

Vita Life Sciences

A healthcare company, engages in formulating, packaging, distributing, and selling vitamins and supplements in Australia, Singapore, Malaysia, Thailand, Vietnam, Indonesia, and China.

Flawless balance sheet with solid track record and pays a dividend.