- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

ASX September 2024's Top Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

The Australian market has shown mixed performance recently, with the Materials sector gaining 9.0% while the overall market remained flat over the last week, yet rising 16% in the past 12 months. In this context of anticipated annual earnings growth of 12%, identifying undervalued stocks that are trading below their fair value can present significant opportunities for investors seeking to capitalize on potential gains.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| EZZ Life Science Holdings (ASX:EZZ) | A$4.53 | A$8.77 | 48.3% |

| DroneShield (ASX:DRO) | A$1.365 | A$2.68 | 49.1% |

| Genesis Minerals (ASX:GMD) | A$2.06 | A$3.93 | 47.5% |

| MLG Oz (ASX:MLG) | A$0.615 | A$1.15 | 46.3% |

| Ingenia Communities Group (ASX:INA) | A$5.03 | A$9.38 | 46.4% |

| MedAdvisor (ASX:MDR) | A$0.425 | A$0.85 | 49.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Little Green Pharma (ASX:LGP) | A$0.09 | A$0.17 | 46.8% |

| Ai-Media Technologies (ASX:AIM) | A$0.755 | A$1.42 | 46.8% |

| Superloop (ASX:SLC) | A$1.725 | A$3.31 | 47.9% |

Here's a peek at a few of the choices from the screener.

DroneShield (ASX:DRO)

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$1.19 billion.

Operations: The company generates revenue primarily from its Aerospace & Defense segment, which amounted to A$67.52 million.

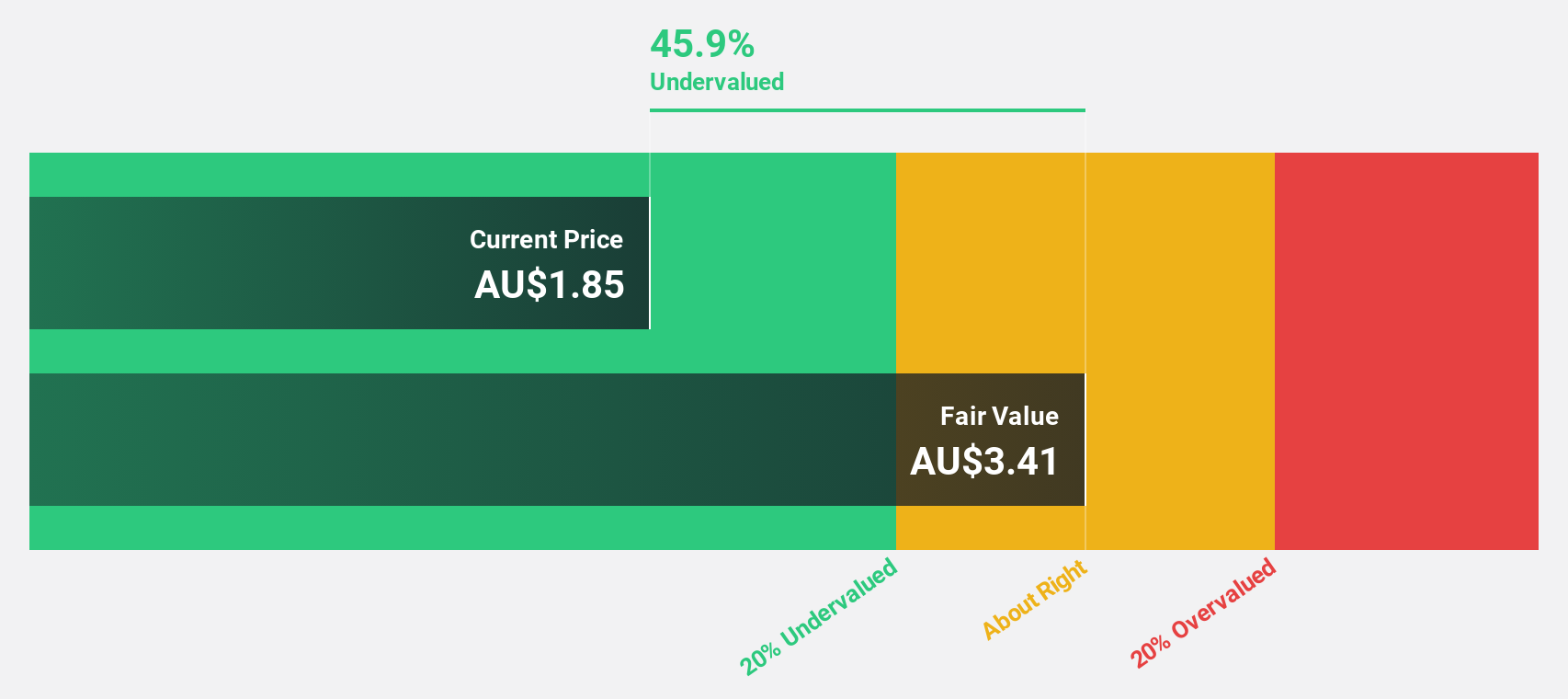

Estimated Discount To Fair Value: 49.1%

DroneShield is trading at A$1.37, significantly below its estimated fair value of A$2.68. Despite a net loss of A$4.8 million for the half year, revenue surged to A$23.99 million from A$11.55 million last year, reflecting strong growth potential. Recent board additions and index inclusions further bolster its strategic positioning. However, shareholders have faced dilution due to a recent equity offering worth A$120 million, impacting short-term returns despite long-term growth prospects.

- Insights from our recent growth report point to a promising forecast for DroneShield's business outlook.

- Delve into the full analysis health report here for a deeper understanding of DroneShield.

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited designs, prototypes, produces, tests, validates, and sells cooling products and solutions globally with a market cap of A$910.10 million.

Operations: The company's revenue segments include PWR C&R at A$41.98 million and PWR Performance Products at A$111.26 million.

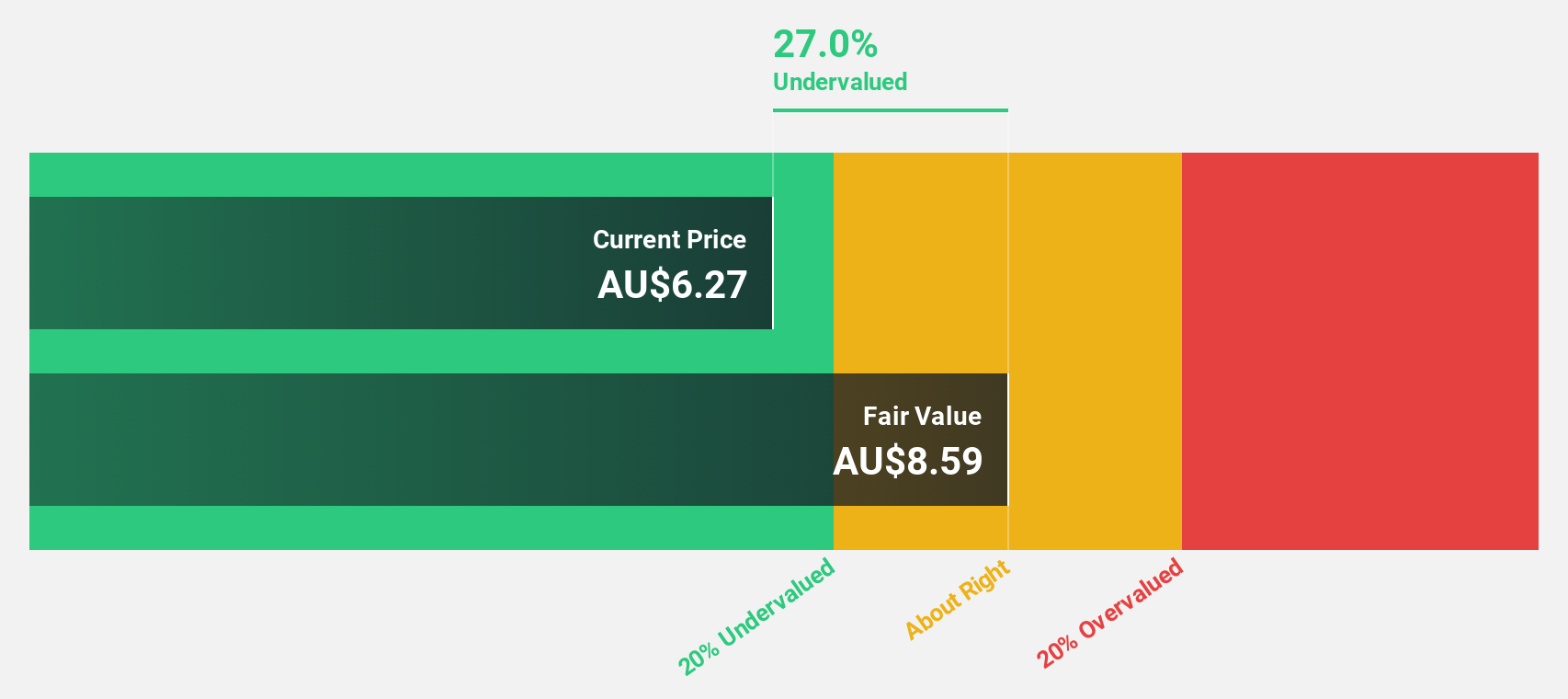

Estimated Discount To Fair Value: 15.4%

PWR Holdings is trading at A$9.05, below its fair value estimate of A$10.7. The company reported annual sales of A$97.53 million and net income of A$20.99 million, showing robust earnings growth over the past five years at 12.9% per year. Forecasts indicate earnings will grow 14.99% annually, outpacing the Australian market's 12.2%. Recent board changes and a dividend increase to AUD 0.092 per share highlight ongoing strategic adjustments and shareholder returns.

- The growth report we've compiled suggests that PWR Holdings' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of PWR Holdings.

Westgold Resources (ASX:WGX)

Overview: Westgold Resources Limited is involved in the exploration, operation, development, mining, and treatment of gold and other assets primarily in Western Australia with a market cap of A$2.52 billion.

Operations: The company's revenue segments are Bryah, contributing A$183.25 million, and Murchison, generating A$533.23 million.

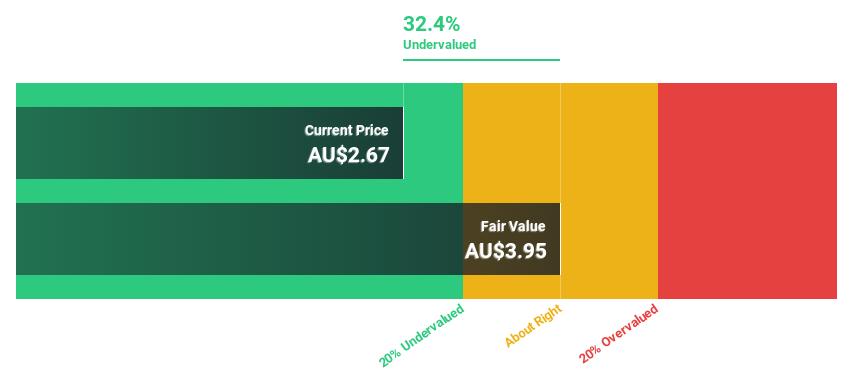

Estimated Discount To Fair Value: 32.4%

Westgold Resources, trading at A$2.67, is significantly undervalued compared to its fair value estimate of A$3.95. Recent inclusion in the S&P/ASX 200 Index and increased production guidance for FY25 highlight operational improvements. Earnings grew substantially over the past year, with net income rising from A$10 million to A$95.23 million. The company's accelerated drilling programs and new discoveries at Beta Hunt and South Junction indicate strong future cash flows, supporting its undervaluation thesis based on cash flows.

- Our comprehensive growth report raises the possibility that Westgold Resources is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Westgold Resources' balance sheet health report.

Taking Advantage

- Navigate through the entire inventory of 46 Undervalued ASX Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives