- Australia

- /

- Metals and Mining

- /

- ASX:VYS

ASX Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

As optimism for a potential US-China trade deal rises, the Australian market has shown steady growth, with the ASX200 surpassing 9,000 points and achieving a notable one-year return of 10%. Amid these developments, certain sectors like Energy and IT have led gains while others lag behind. Despite its outdated connotation, the term 'penny stock' remains relevant as it highlights opportunities in smaller or emerging companies. These stocks can offer surprising value when built on solid financial foundations. In this article, we explore three penny stocks that demonstrate financial strength and potential for long-term growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.47 | A$134.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.92 | A$57.29M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$432.02M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.87 | A$285.63M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.043 | A$50.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.077 | A$40.56M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$3.08 | A$284.39M | ✅ 3 ⚠️ 2 View Analysis > |

| Perenti (ASX:PRN) | A$2.73 | A$2.57B | ✅ 3 ⚠️ 3 View Analysis > |

| Clover (ASX:CLV) | A$0.63 | A$105.21M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 418 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

DroneShield (ASX:DRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$4.02 billion.

Operations: The company's revenue is derived from its Aerospace & Defense segment, which generated A$107.17 million.

Market Cap: A$4.02B

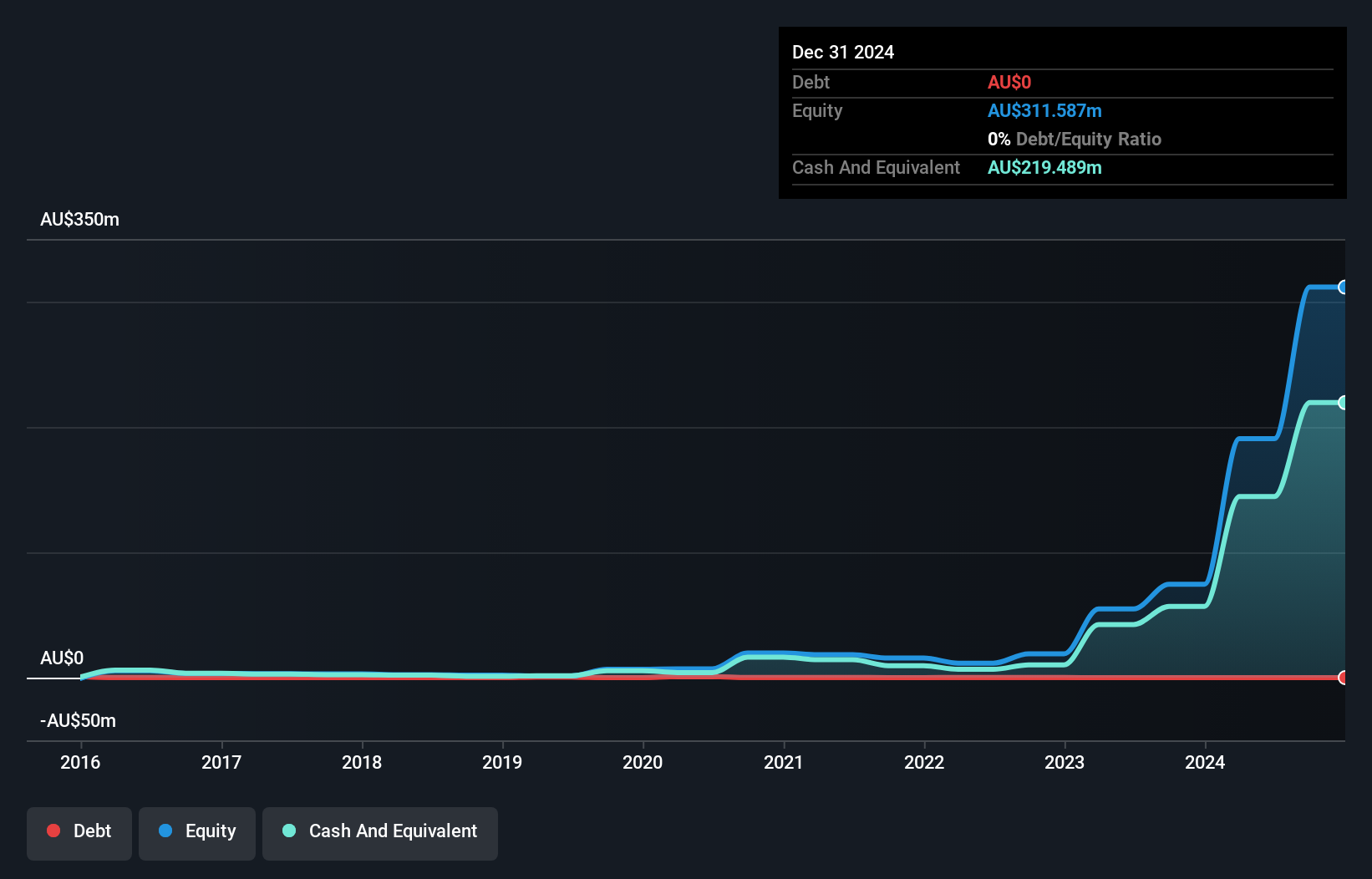

DroneShield Limited, with a market cap of A$4.02 billion, operates in the Aerospace & Defense sector and has shown substantial revenue growth, reporting A$107.17 million from its operations. Despite negative earnings growth of -24.9% over the past year and high share price volatility, DroneShield remains debt-free with strong asset coverage for liabilities. The company's recent inclusion in the S&P/ASX 200 Index highlights its growing prominence. Leadership changes aim to bolster innovation as it collaborates on advanced defense projects like the Nexus 20 platform for Ukraine's Ministry of Defence, enhancing its counter-drone capabilities globally.

- Click to explore a detailed breakdown of our findings in DroneShield's financial health report.

- Review our growth performance report to gain insights into DroneShield's future.

Peet (ASX:PPC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Peet Limited acquires, develops, and markets residential land in Australia with a market cap of A$908.23 million.

Operations: Peet's revenue is primarily derived from Company Owned Projects (A$313.24 million), Funds Management (A$56.39 million), and Joint Arrangements (A$51.88 million).

Market Cap: A$908.23M

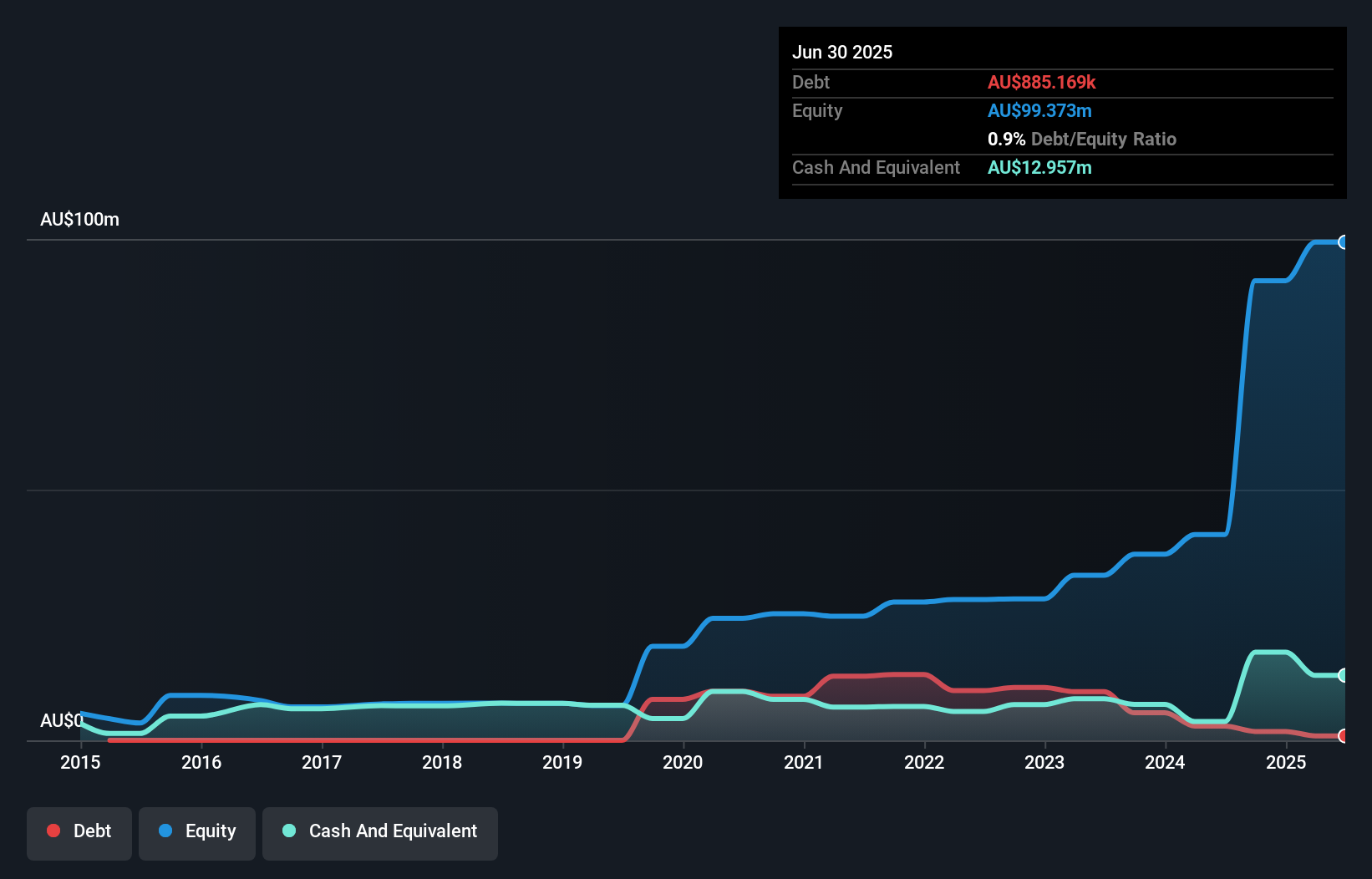

Peet Limited, with a market cap of A$908.23 million, has demonstrated robust financial performance, reporting A$414.79 million in sales for FY25 and net income of A$58.47 million. The company's earnings growth of 60% over the past year surpasses the industry average, although its high net debt to equity ratio (45.8%) suggests a significant leverage position. Peet's strategic review led by Goldman Sachs aims to optimize its asset base amidst favorable market conditions in the Australian residential sector. While dividends have increased recently, their sustainability remains uncertain due to an unstable track record and high debt levels.

- Jump into the full analysis health report here for a deeper understanding of Peet.

- Understand Peet's track record by examining our performance history report.

Vysarn (ASX:VYS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vysarn Limited offers water services to sectors such as resources, urban development, government and utilities in Australia, with a market cap of A$337.56 million.

Operations: The company's revenue is primarily derived from its Industrial segment, which generated A$60.50 million, followed by the Technology segment at A$25.98 million and the Advisory segment at A$20.02 million.

Market Cap: A$337.56M

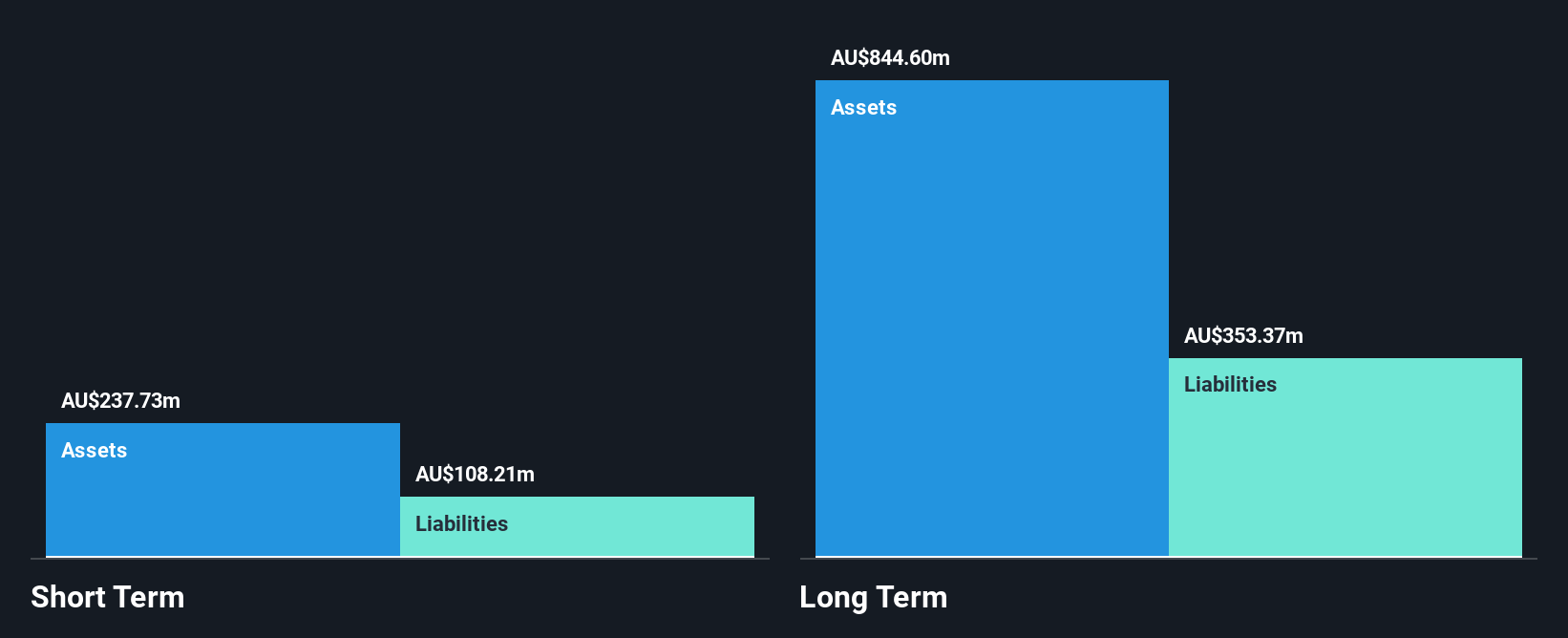

Vysarn Limited, with a market cap of A$337.56 million, reported FY25 sales of A$106.53 million and net income of A$10.69 million, reflecting solid growth from the previous year. The company's debt to equity ratio has significantly decreased over five years, indicating improved financial health, while its short-term assets comfortably cover both short and long-term liabilities. Despite a slight dip in profit margins compared to last year, Vysarn's earnings have consistently grown at an impressive rate over five years. Additionally, the company trades below estimated fair value and maintains strong cash flow coverage for its debt obligations.

- Click here and access our complete financial health analysis report to understand the dynamics of Vysarn.

- Understand Vysarn's earnings outlook by examining our growth report.

Next Steps

- Dive into all 418 of the ASX Penny Stocks we have identified here.

- Curious About Other Options? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VYS

Vysarn

Provides water services to various sectors, including resources, urban development, government and utilities in Australia.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026