- Australia

- /

- Specialized REITs

- /

- ASX:NSR

Top 3 ASX Dividend Stocks To Consider

Reviewed by Simply Wall St

As Christmas approaches, the ASX200 has seen a slight decline of 0.35% to 8,267 points, with the anticipated Santa rally yet to take hold amid underwhelming Chinese stimulus measures. While sectors such as Materials and IT have struggled, Utilities and Industrials have shown modest gains, highlighting the importance of strategic sector selection in navigating current market conditions. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an appealing option for those looking to weather market fluctuations while benefiting from regular payouts.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.42% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.64% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.06% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.42% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.04% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.64% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.13% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.78% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 8.51% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.50% | ★★★★☆☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Amotiv (ASX:AOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amotiv Limited, with a market cap of A$1.45 billion, operates through its subsidiaries to manufacture, import, distribute, and sell automotive products in Australia, New Zealand, Thailand, South Korea, France, and the United States.

Operations: Amotiv Limited's revenue is derived from three segments: Powertrain & Undercar (A$313.90 million), Lighting Power & Electrical (A$324.47 million), and 4wd Accessories & Trailering (A$348.81 million).

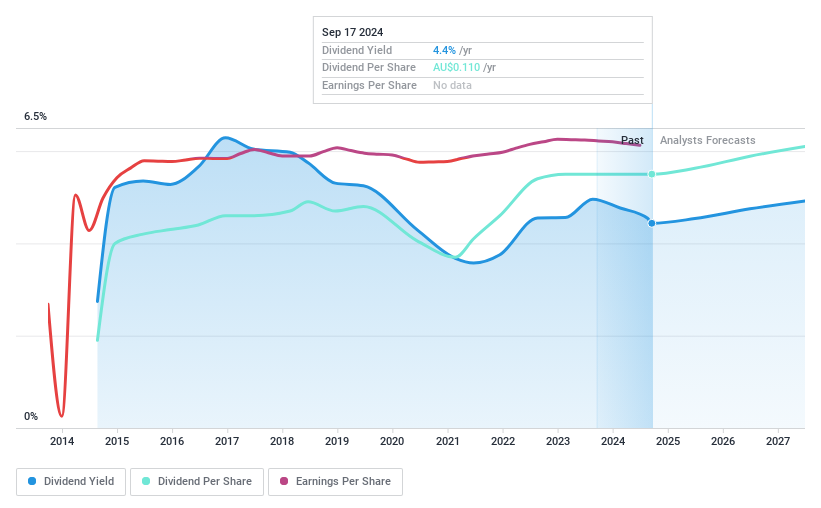

Dividend Yield: 3.9%

Amotiv's dividends have grown over the past decade, supported by a reasonable payout ratio of 57.2% and strong cash flow coverage at 37.6%. However, the dividend track record has been unstable, with volatility in payments. The current yield of 3.92% is below top-tier payers in Australia. Recent announcements include a share buyback program for up to 5% of issued shares and executive changes with Aaron Canning appointed as CFO, enhancing financial leadership stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Amotiv.

- According our valuation report, there's an indication that Amotiv's share price might be on the cheaper side.

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kina Securities Limited operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage with a market cap of A$302.35 million.

Operations: Kina Securities Limited generates revenue through its Banking & Finance segment, which includes corporate services, amounting to PGK 391.80 million, and its Wealth Management segment, contributing PGK 39.65 million.

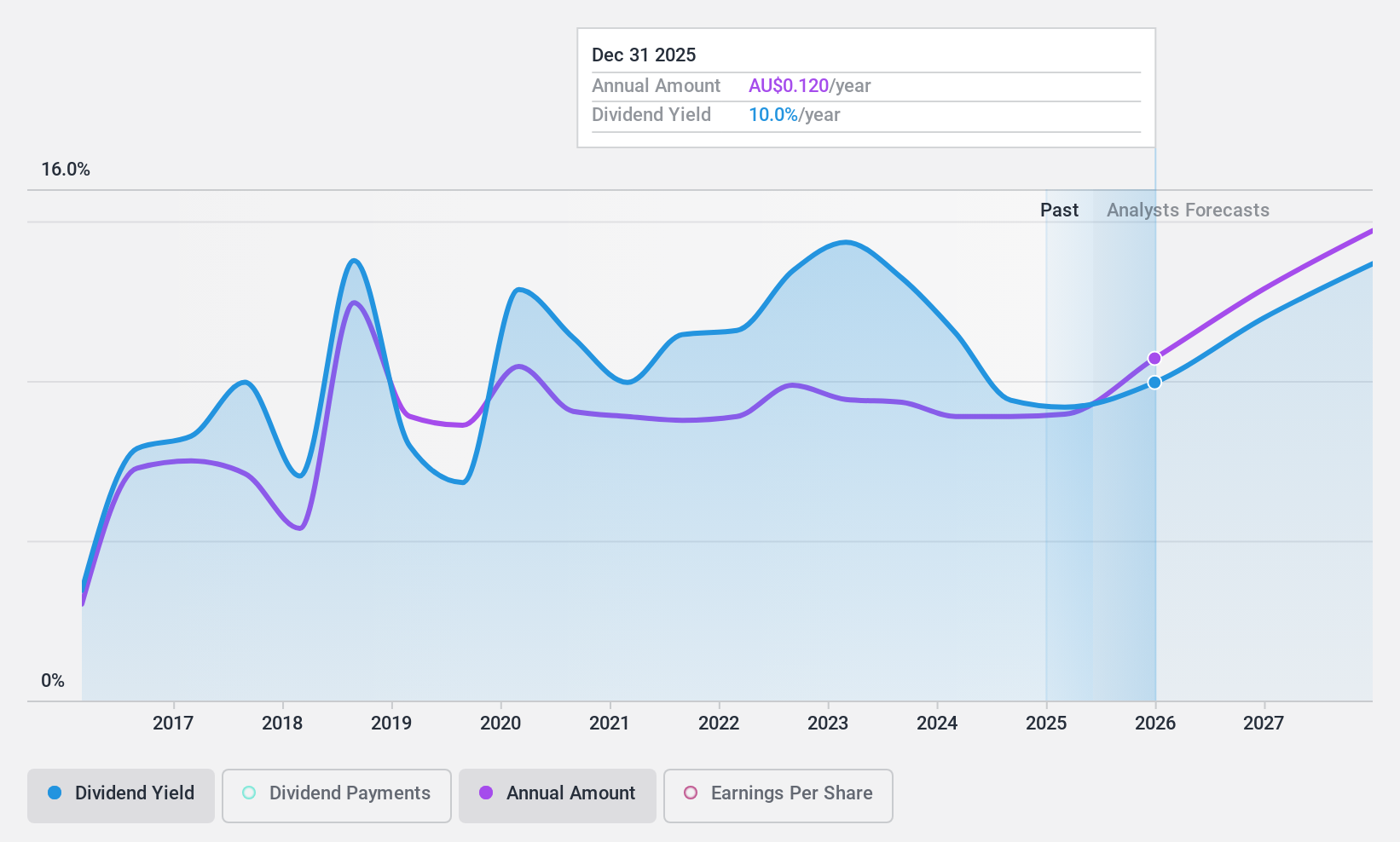

Dividend Yield: 9.6%

Kina Securities offers a high dividend yield of 9.62%, placing it in the top 25% of Australian dividend payers. However, its track record is less stable, with payments being volatile over its nine-year history. The current payout ratio of 75.5% suggests dividends are covered by earnings, and forecasts indicate continued coverage at 67.6%. Despite trading below estimated fair value, concerns include a high level of bad loans at 7.9%.

- Click here to discover the nuances of Kina Securities with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Kina Securities is priced lower than what may be justified by its financials.

National Storage REIT (ASX:NSR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Storage REIT is the largest self-storage provider in Australia and New Zealand, operating over 225 centers to serve more than 90,000 residential and commercial customers, with a market cap of A$3.27 billion.

Operations: National Storage REIT generates revenue of A$354.69 million from the operation and management of its storage centers.

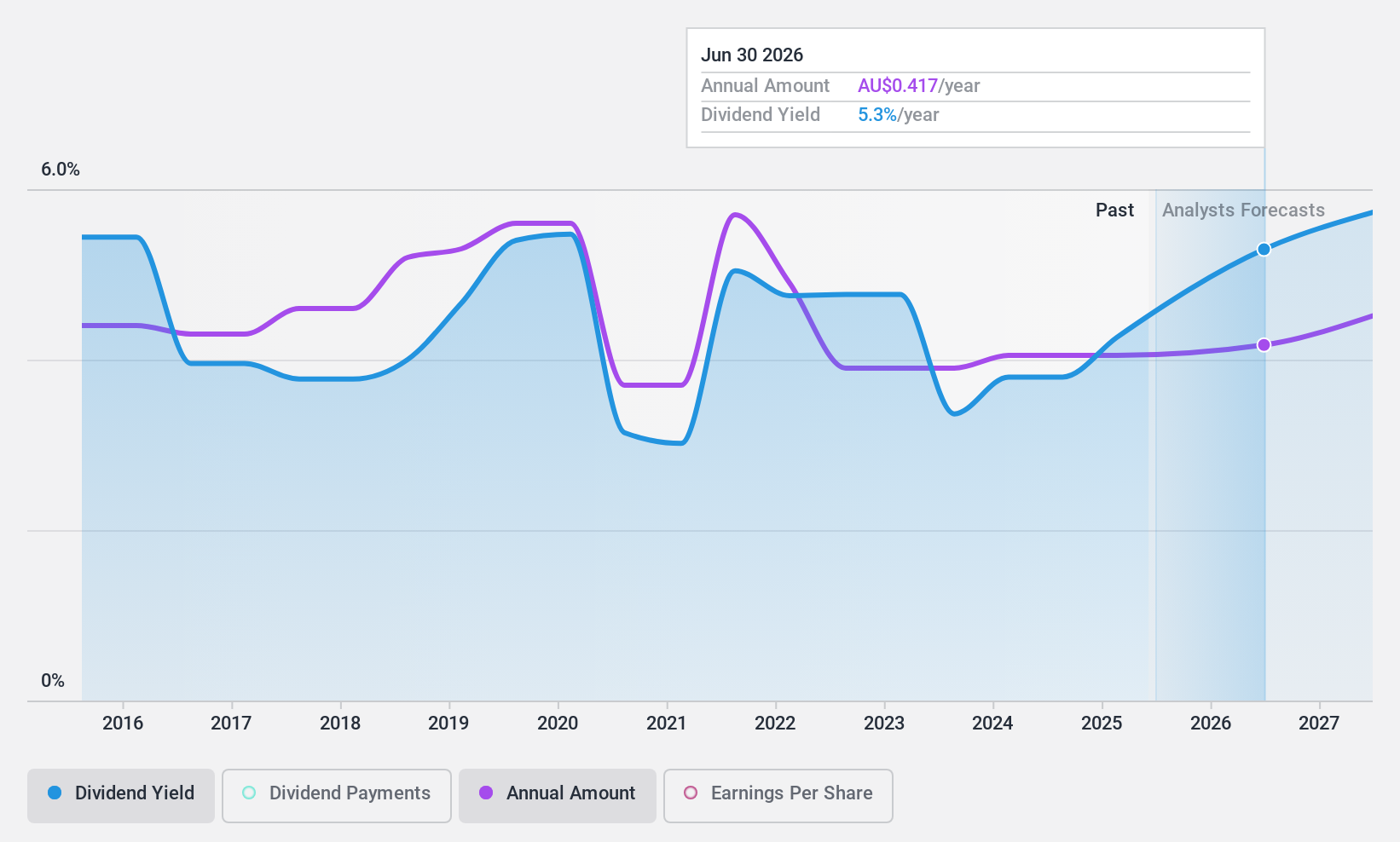

Dividend Yield: 4.6%

National Storage REIT offers a reliable dividend yield of 4.64%, although it is below the top tier in Australia. The dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 55.5% and cash flow coverage at 83%. Recent board changes include appointing Simone Haslinger as a non-executive director, potentially enhancing strategic direction with her extensive investment banking experience. The stock trades at a significant discount to its estimated fair value.

- Click to explore a detailed breakdown of our findings in National Storage REIT's dividend report.

- Our expertly prepared valuation report National Storage REIT implies its share price may be too high.

Taking Advantage

- Dive into all 30 of the Top ASX Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 225 centres providing tailored storage solutions to over 90,000 residential and commercial customers.

Established dividend payer with adequate balance sheet.