UNIQA Insurance Group AG's (VIE:UQA) top owners are private companies with 53% stake, while 35% is held by individual investors

Key Insights

- The considerable ownership by private companies in UNIQA Insurance Group indicates that they collectively have a greater say in management and business strategy

- 55% of the business is held by the top 2 shareholders

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

A look at the shareholders of UNIQA Insurance Group AG (VIE:UQA) can tell us which group is most powerful. With 53% stake, private companies possess the maximum shares in the company. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And individual investors on the other hand have a 35% ownership in the company.

Let's delve deeper into each type of owner of UNIQA Insurance Group, beginning with the chart below.

See our latest analysis for UNIQA Insurance Group

What Does The Institutional Ownership Tell Us About UNIQA Insurance Group?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

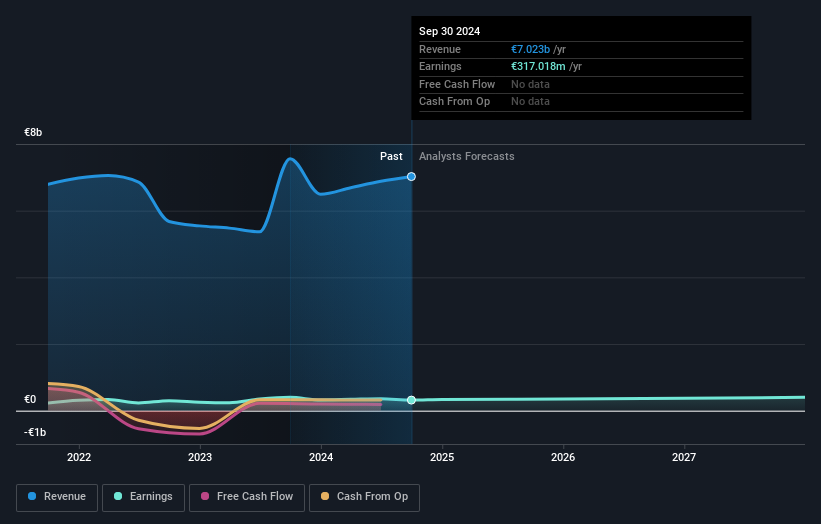

We can see that UNIQA Insurance Group does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of UNIQA Insurance Group, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don't have many shares in UNIQA Insurance Group. UNIQA Versicherungsverein Privatstiftung is currently the largest shareholder, with 49% of shares outstanding. Raiffeisen Bank International AG is the second largest shareholder owning 5.5% of common stock, and Collegialität Versicherung Auf Gegenseitigkeit holds about 3.5% of the company stock.

After doing some more digging, we found that the top 2 shareholders collectively control more than half of the company's shares, implying that they have considerable power to influence the company's decisions.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of UNIQA Insurance Group

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our data cannot confirm that board members are holding shares personally. Not all jurisdictions have the same rules around disclosing insider ownership, and it is possible we have missed something, here. So you can click here learn more about the CEO.

General Public Ownership

The general public-- including retail investors -- own 35% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

We can see that Private Companies own 53%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Public Company Ownership

Public companies currently own 5.5% of UNIQA Insurance Group stock. We can't be certain but it is quite possible this is a strategic stake. The businesses may be similar, or work together.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand UNIQA Insurance Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with UNIQA Insurance Group , and understanding them should be part of your investment process.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:UQA

UNIQA Insurance Group

Operates as an insurance company in Austria and Central and Eastern Europe.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>