- United Arab Emirates

- /

- Banks

- /

- ADX:UAB

United Arab Bank P.J.S.C Leads 3 Middle Eastern Penny Stocks To Monitor

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently shown a mixed performance, with Dubai reaching a 17-year high while other indices experienced varied outcomes. Despite the fluctuating market conditions, penny stocks remain an intriguing investment area due to their potential for growth at lower price points. These smaller or newer companies often offer a blend of affordability and growth potential, especially when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.625 | ₪12.06M | ✅ 1 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.10 | SAR1.64B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.612 | ₪323.7M | ✅ 3 ⚠️ 2 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY3.42 | TRY940.5M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.13 | AED2.24B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.86 | TRY2B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.14 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.57 | AED10.89B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.825 | AED501.81M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.524 | ₪187.64M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Arab Bank P.J.S.C. offers commercial banking products and services to institutional and corporate clients in the United Arab Emirates, with a market capitalization of AED2.58 billion.

Operations: The company's revenue is derived from three main segments: Retail Banking generating AED76.82 million, Wholesale Banking contributing AED425.35 million, and Treasury and Capital Markets providing AED193.07 million.

Market Cap: AED2.58B

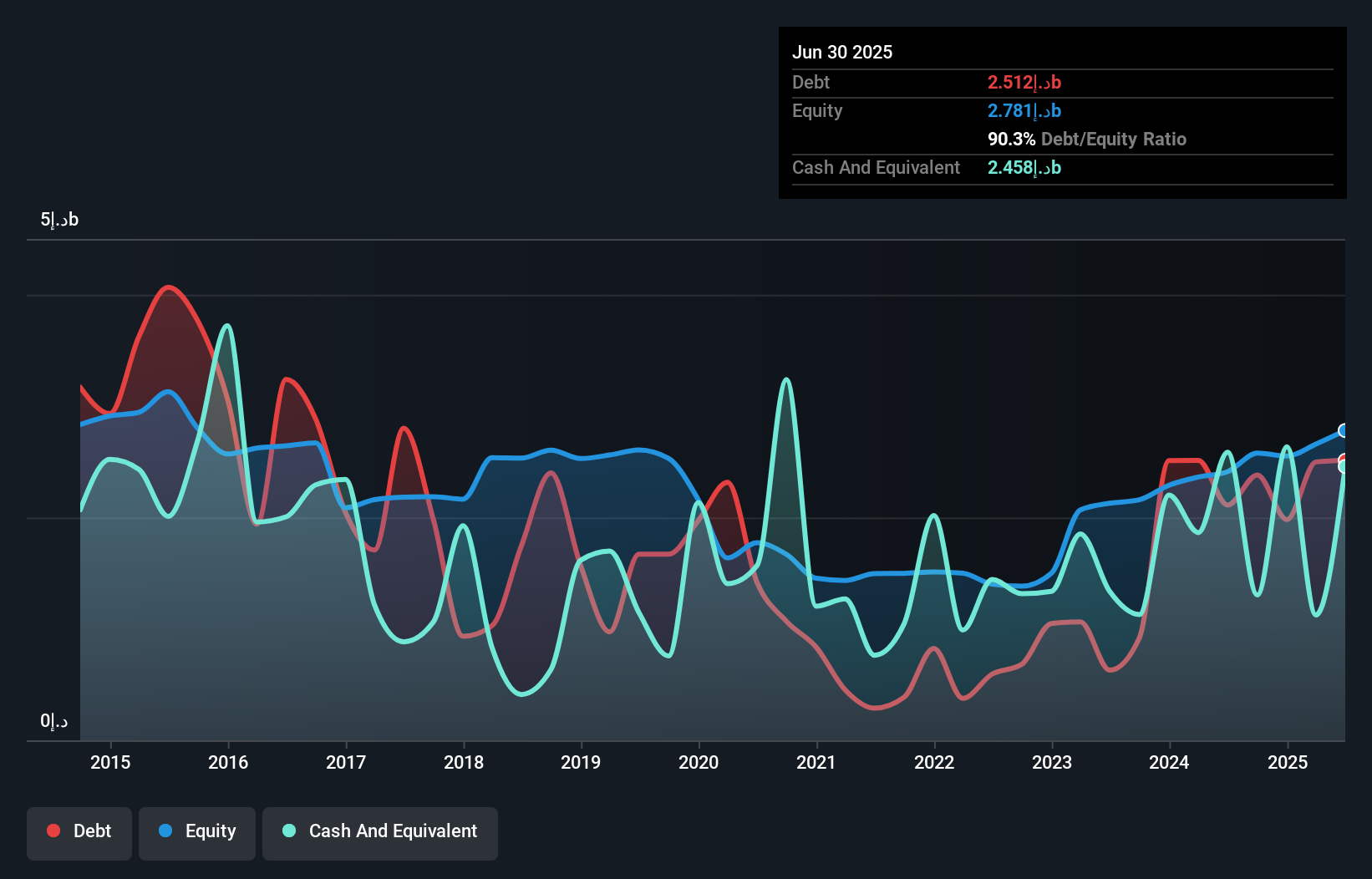

United Arab Bank P.J.S.C. demonstrates a stable financial foundation with 84% of its liabilities funded through low-risk customer deposits, minimizing external borrowing risks. The bank's earnings growth of 24.4% last year surpassed the industry average, and its net profit margin improved to 48.3%. Despite a high bad loans ratio of 3.4%, UAB maintains an adequate allowance for these loans at 118%. The recent follow-on equity offering of AED1.03 billion may impact share dilution but aims to strengthen capital reserves further, supporting future growth prospects in the competitive banking sector within the UAE market.

- Get an in-depth perspective on United Arab Bank P.J.S.C's performance by reading our balance sheet health report here.

- Gain insights into United Arab Bank P.J.S.C's historical outcomes by reviewing our past performance report.

Union Insurance Company P.J.S.C (ADX:UNION)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Union Insurance Company P.J.S.C. provides insurance products in the United Arab Emirates, Gulf Cooperation Council, and internationally with a market capitalization of AED225.04 million.

Operations: The company generates revenue from two main segments: Life Insurance, contributing AED16.83 million, and General Insurance, which brings in AED246.91 million.

Market Cap: AED225.04M

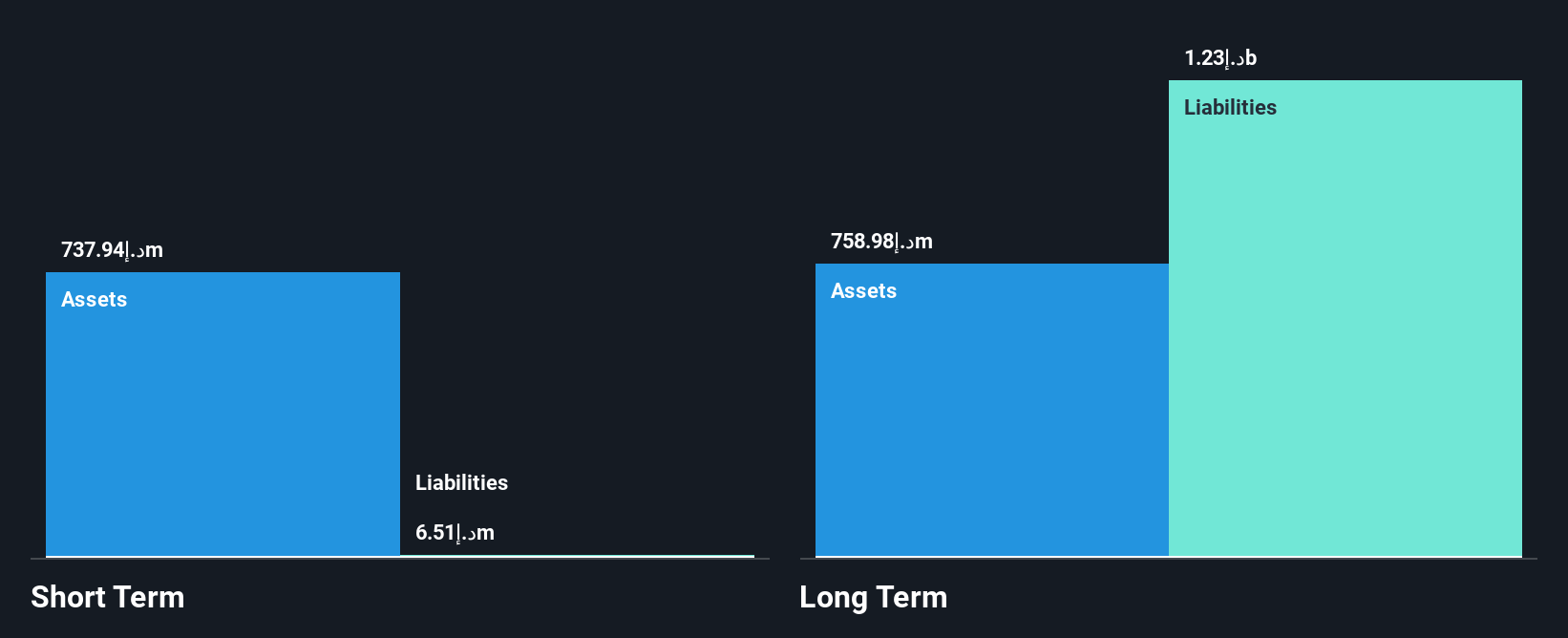

Union Insurance Company P.J.S.C. has shown a shift towards profitability, with recent earnings of AED 13.05 million for Q1 2025, up from AED 11.78 million the previous year. Despite a low return on equity at 15.4%, its price-to-earnings ratio of 8.2x suggests potential undervaluation compared to the AE market average of 13.1x. The company is debt-free and has reduced its debt over time, though its short-term assets do not cover long-term liabilities (AED1.2 billion). Volatility remains high, reflecting market uncertainties, while management's inexperience could pose operational challenges moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Union Insurance Company P.J.S.C.

- Explore historical data to track Union Insurance Company P.J.S.C's performance over time in our past results report.

Thob Al Aseel (SASE:4012)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market capitalization of SAR1.64 billion.

Operations: The company's revenue is primarily derived from Thobs, contributing SAR407.44 million, and Fabrics, accounting for SAR124.63 million.

Market Cap: SAR1.64B

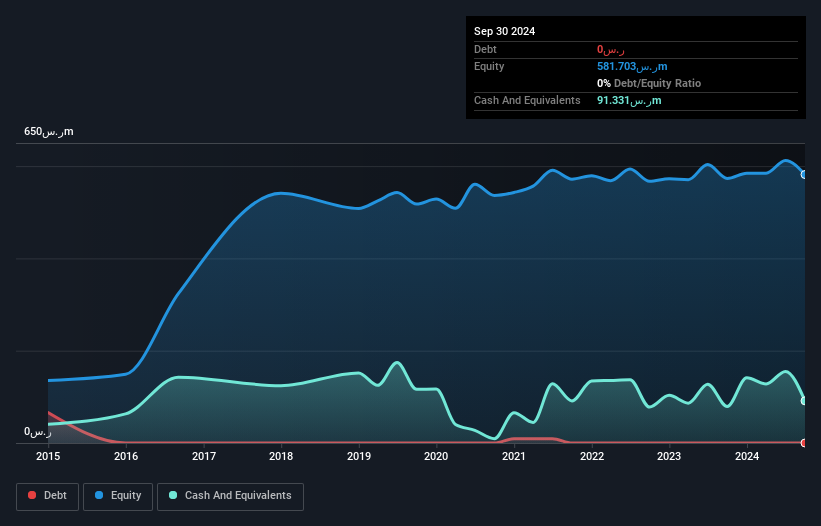

Thob Al Aseel has demonstrated robust earnings growth, with a 19.8% increase over the past year, surpassing its five-year average. The company is debt-free and maintains strong financial health, as evidenced by short-term assets of SAR750.6 million exceeding both short and long-term liabilities. However, the board's inexperience could be a concern due to an average tenure of 2.3 years. Recent developments include appointing Ernst & Young as auditors for upcoming fiscal quarters, potentially enhancing financial oversight. Despite stable weekly volatility at 4%, the company's dividend track record remains unstable, suggesting potential income unpredictability for investors.

- Click here to discover the nuances of Thob Al Aseel with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Thob Al Aseel's track record.

Turning Ideas Into Actions

- Navigate through the entire inventory of 78 Middle Eastern Penny Stocks here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:UAB

United Arab Bank P.J.S.C

Together with its subsidiary, provides commercial banking products and services for institutional and corporate customers in the United Arab Emirates.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives