- United Kingdom

- /

- IT

- /

- LSE:FDM

UK Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. In such times, investors often look beyond blue-chip stocks to explore opportunities in smaller or newer companies. Despite their vintage name, penny stocks remain a relevant investment area, offering potential value when backed by solid financial health and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £511.64M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.12 | £252.06M | ✅ 5 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.282 | £140.14M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.853 | £315.42M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.71 | £278.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.55 | £127.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.17 | £185.96M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.775 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Samuel Heath & Sons (AIM:HSM) | £3.35 | £8.49M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

FDM Group (Holdings) (LSE:FDM)

Simply Wall St Financial Health Rating: ★★★★★★

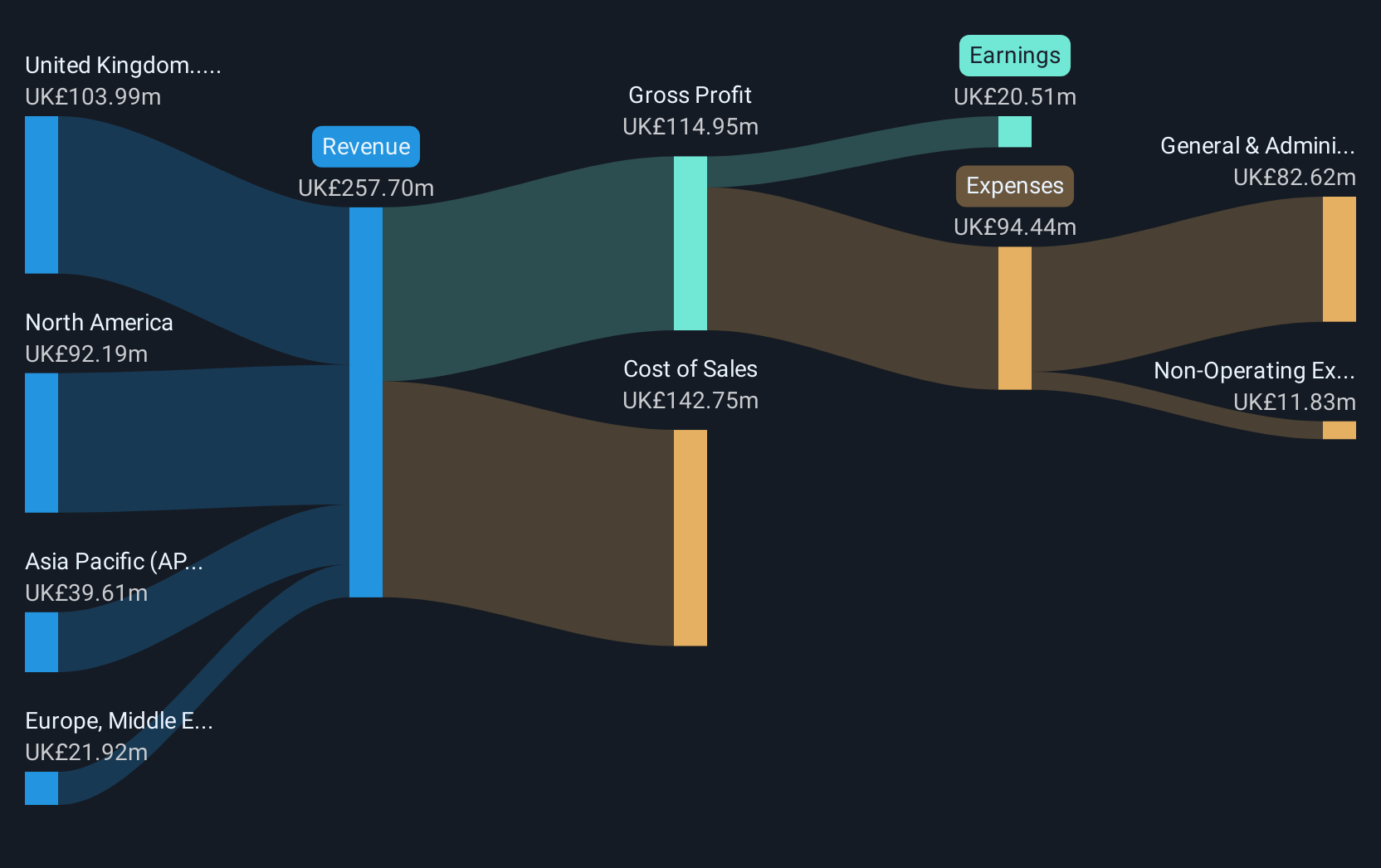

Overview: FDM Group (Holdings) plc delivers IT services across various regions including the UK, North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £140.14 million.

Operations: The company's revenue is primarily derived from the United Kingdom (£96.19 million), North America (£65.09 million), and the Asia Pacific region (£33.01 million).

Market Cap: £140.14M

FDM Group (Holdings) plc, with a market cap of £140.14 million, faces challenges in the penny stock arena as its earnings are forecast to decline by 10.8% annually over the next three years. Recent half-year results show a drop in sales to £97.28 million from £140.19 million year-on-year, and net income fell to £6.23 million from £11.25 million last year, reflecting lower profit margins at 7.2%. Despite trading at good value compared to peers and having no debt, its dividend yield of 14.43% is unsustainable given current earnings coverage issues and high share price volatility further complicates investor sentiment.

- Unlock comprehensive insights into our analysis of FDM Group (Holdings) stock in this financial health report.

- Understand FDM Group (Holdings)'s earnings outlook by examining our growth report.

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company that offers medical diagnostics services to patients, with a market cap of $244.16 million.

Operations: The company's revenue is primarily derived from its Pathology segment, which generated EGP 4.49 billion, while the Radiology segment contributed EGP 224 million.

Market Cap: $244.16M

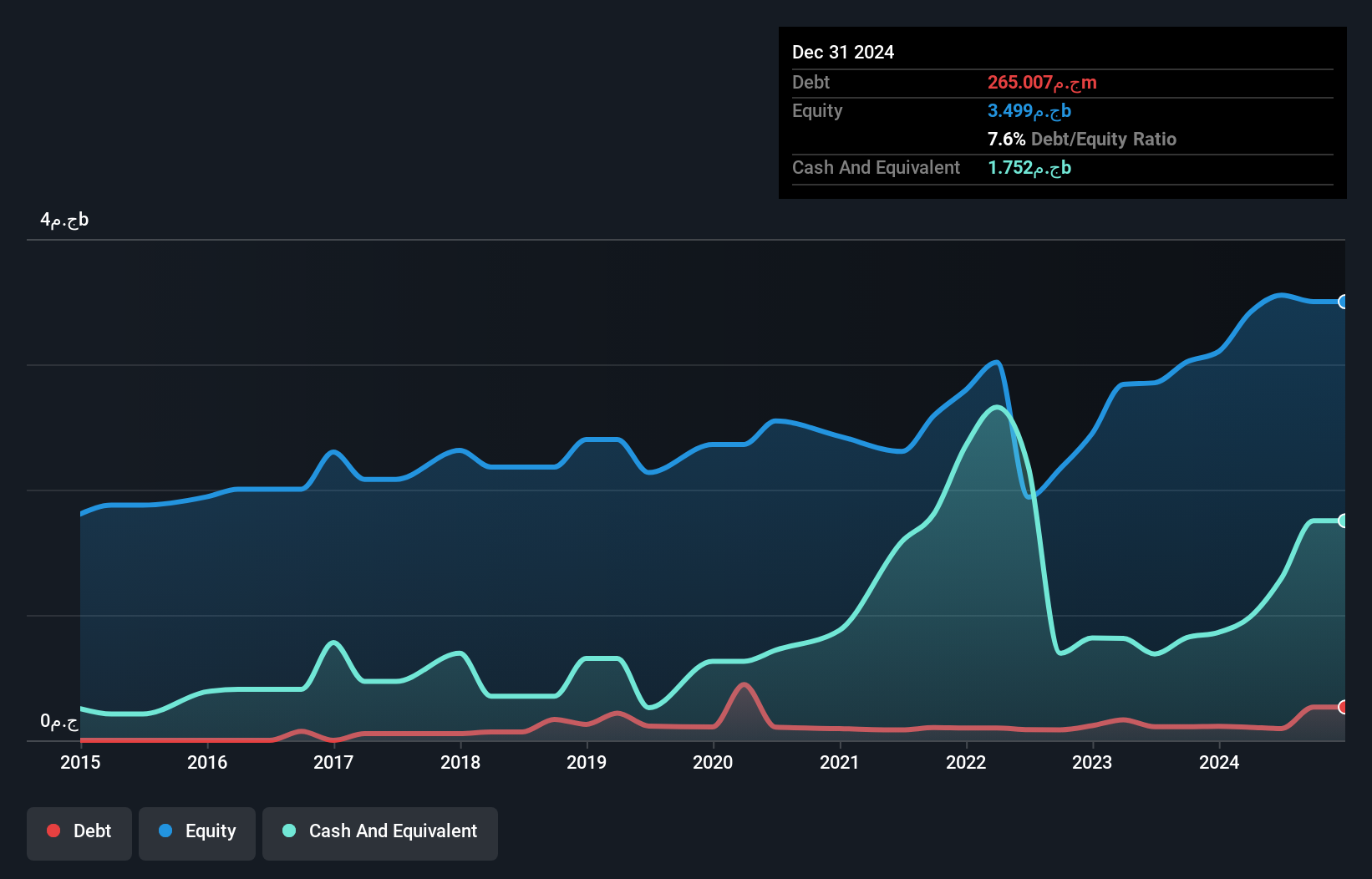

Integrated Diagnostics Holdings, with a market cap of $244.16 million, is making strategic moves in the healthcare sector. The recent acquisition of CAIRO RAY for Radiotherapy enhances its radiology offerings and positions it well in Egypt's growing radiotherapy market. Financially robust, the company has high-quality earnings and a strong balance sheet with short-term assets exceeding liabilities. Earnings grew 111.1% last year, surpassing industry averages, supported by substantial interest coverage (47x EBIT) and operating cash flow covering debt by a very large margin (591.9%). Despite increased debt-to-equity ratios over five years, IDH maintains more cash than total debt.

- Click here and access our complete financial health analysis report to understand the dynamics of Integrated Diagnostics Holdings.

- Gain insights into Integrated Diagnostics Holdings' future direction by reviewing our growth report.

NCC Group (LSE:NCC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market cap of £441.28 million.

Operations: The company generates revenue from two main segments: Cyber Security, which contributes £246.18 million, and Escode, contributing £65.95 million.

Market Cap: £441.28M

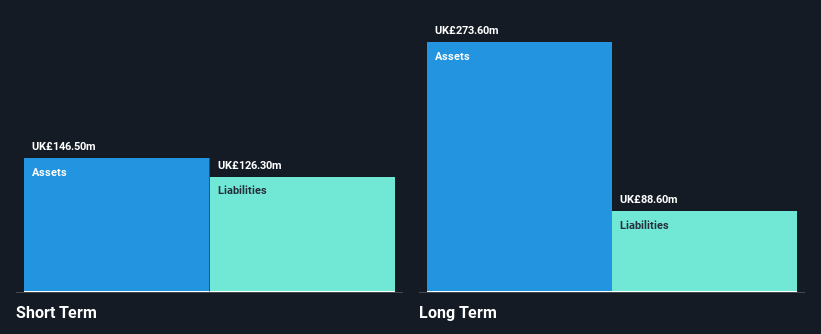

NCC Group plc, with a market cap of £441.28 million, operates in the cyber and software resilience sector. Despite its unprofitability and declining revenue in Cyber Security, NCC has managed to maintain stable dividends and anticipates single-digit growth in Escode. The company's debt is well-managed with more cash than total debt, though interest coverage remains low at 2.1x EBIT. Short-term assets exceed both short-term and long-term liabilities, providing some financial stability. While trading below fair value estimates by 10.3%, analysts expect earnings to grow significantly at 61.55% per year despite historical losses increasing annually by a large margin.

- Click here to discover the nuances of NCC Group with our detailed analytical financial health report.

- Evaluate NCC Group's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 295 UK Penny Stocks now.

- Interested In Other Possibilities? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FDM

FDM Group (Holdings)

Provides information technology (IT) services in the United Kingdom, North America, Europe, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives