- United States

- /

- Banks

- /

- NYSE:FCF

Top Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq continue to hit record highs amidst a wave of corporate earnings reports, investors are keenly watching the Federal Reserve's meeting on interest rates for further market direction. In this dynamic environment, dividend stocks can offer a reliable income stream and potential stability, making them an attractive consideration for those navigating today's fluctuating markets.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.62% | ★★★★★☆ |

| Universal (UVV) | 6.07% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.51% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.34% | ★★★★★★ |

| Ennis (EBF) | 5.52% | ★★★★★★ |

| Dillard's (DDS) | 5.07% | ★★★★★★ |

| Credicorp (BAP) | 4.62% | ★★★★★☆ |

| CompX International (CIX) | 4.87% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.86% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.76% | ★★★★★☆ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Bank OZK (OZK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank OZK is a full-service Arkansas state-chartered bank offering retail and commercial banking services in the United States, with a market cap of approximately $5.80 billion.

Operations: Bank OZK generates its revenue primarily from its Community Banking segment, which accounts for $1.51 billion.

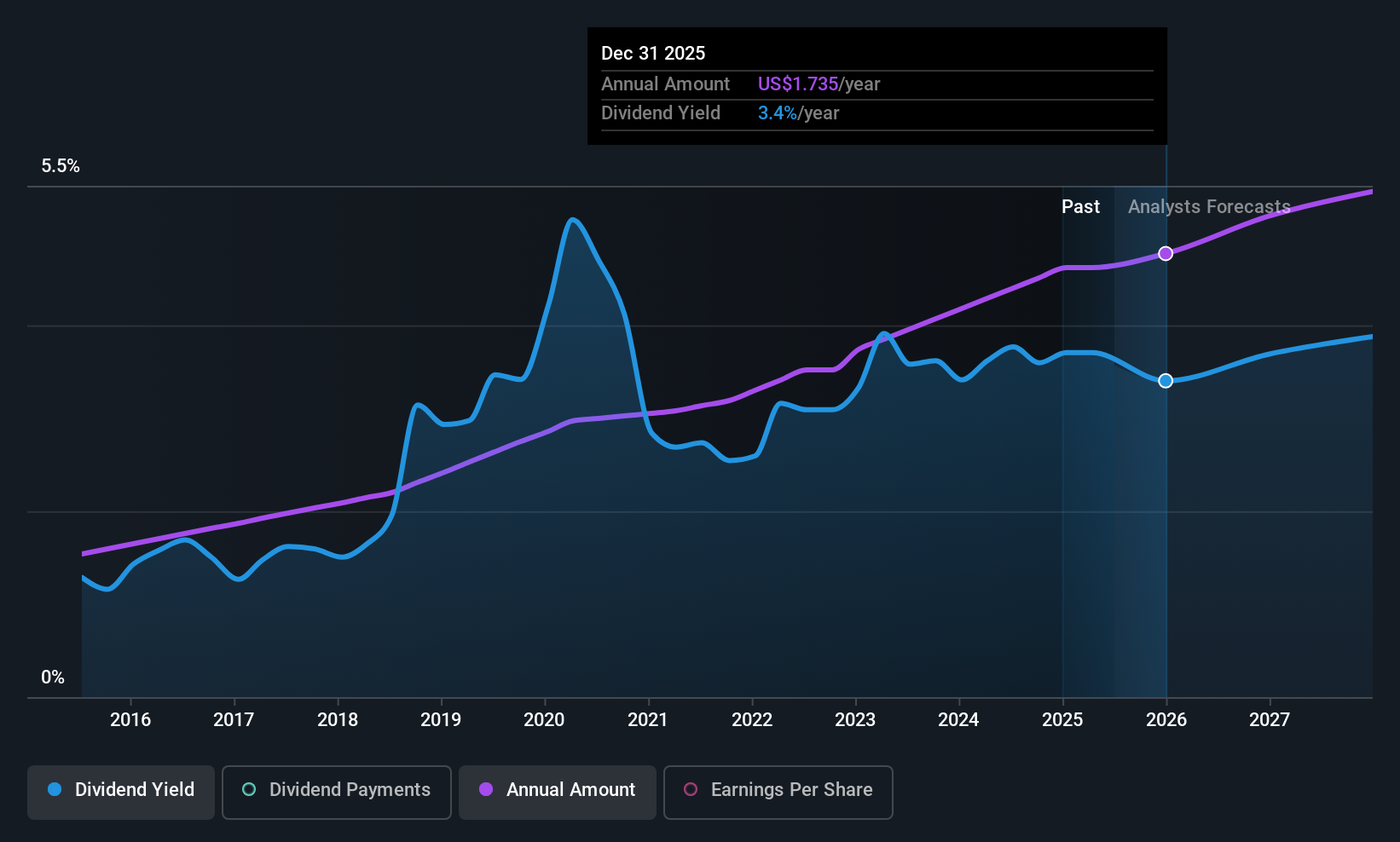

Dividend Yield: 3.4%

Bank OZK offers a stable and growing dividend, with its payout ratio at 26.8%, indicating dividends are well covered by earnings. The company recently increased its quarterly dividend to US$0.44 per share, reflecting a consistent upward trend over the past decade. Despite significant insider selling in recent months, Bank OZK trades at good value compared to peers and maintains reliable earnings growth, supporting sustainable future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank OZK.

- Our valuation report unveils the possibility Bank OZK's shares may be trading at a discount.

First Commonwealth Financial (FCF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Commonwealth Financial Corporation is a financial holding company offering a range of consumer and commercial banking products and services in the United States, with a market cap of approximately $1.70 billion.

Operations: First Commonwealth Financial Corporation generates revenue primarily from its banking segment, which amounts to $448.66 million.

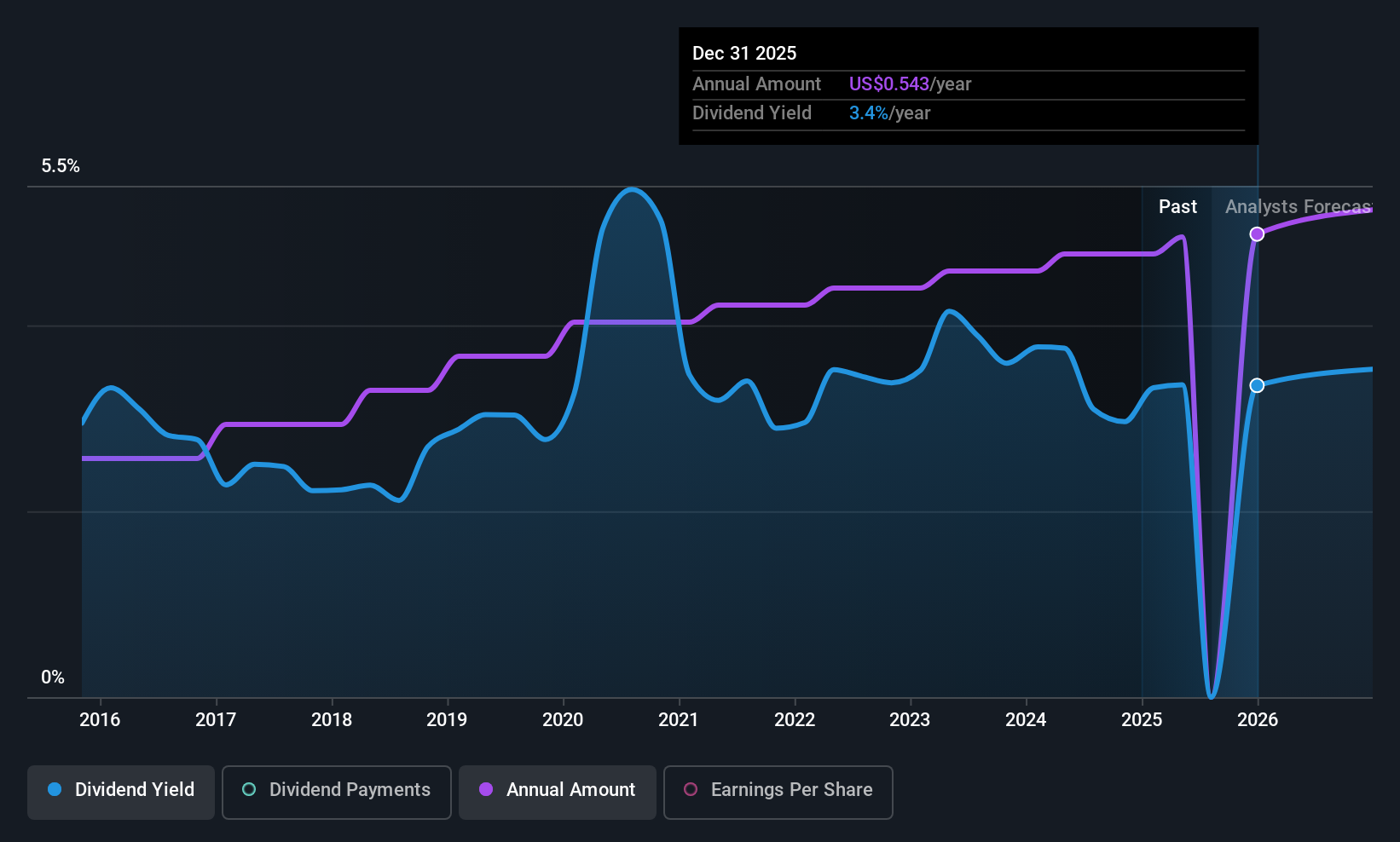

Dividend Yield: 3.3%

First Commonwealth Financial's dividend, yielding 3.31%, is reliable and has grown over the past decade, though it remains below top-tier payers in the US market. The payout ratio of 38.8% suggests dividends are well covered by earnings. Recent results showed net interest income growth to US$95.52 million, despite a decline in net income to US$32.7 million year-over-year, while a recent dividend increase reflects ongoing commitment to shareholders.

- Navigate through the intricacies of First Commonwealth Financial with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of First Commonwealth Financial shares in the market.

SunCoke Energy (SXC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SunCoke Energy, Inc. is an independent producer of coke operating in the Americas and Brazil, with a market cap of approximately $716.15 million.

Operations: SunCoke Energy generates revenue through its segments, with Domestic Coke contributing $1.76 billion, Logistics providing $107.40 million, and Brazil Coke adding $34.60 million.

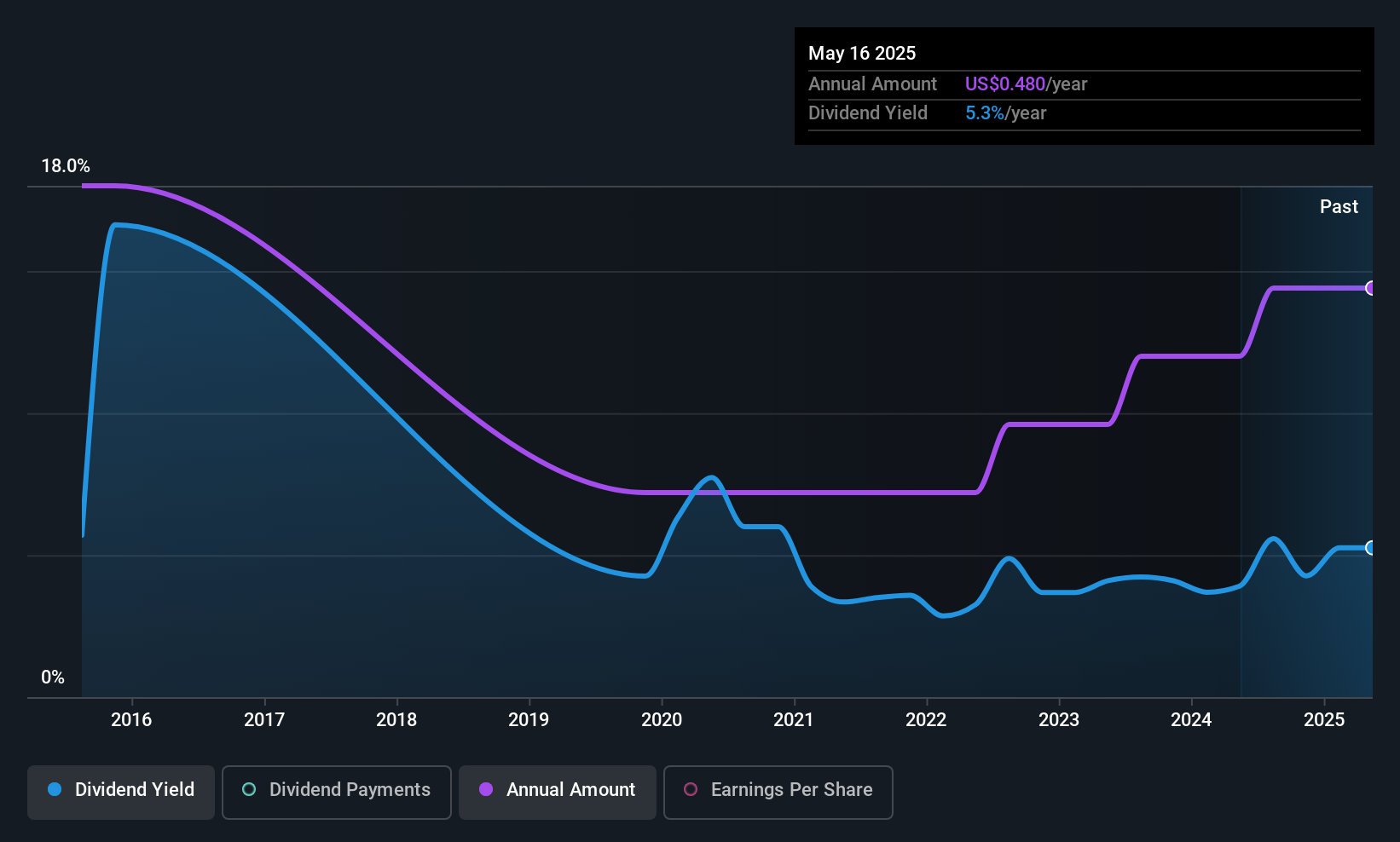

Dividend Yield: 5.8%

SunCoke Energy's dividend yield of 5.76% places it in the top 25% of US dividend payers, with a payout ratio of 42.1%, indicating dividends are well covered by earnings and cash flows. However, the company's dividend history is unstable, marked by volatility over the past decade. Recent earnings showed a decrease to US$17.3 million from US$20 million year-over-year, while a definitive agreement to acquire Phoenix Global may impact future financials and dividends.

- Click to explore a detailed breakdown of our findings in SunCoke Energy's dividend report.

- In light of our recent valuation report, it seems possible that SunCoke Energy is trading behind its estimated value.

Next Steps

- Delve into our full catalog of 138 Top US Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives