- United States

- /

- Leisure

- /

- NasdaqGS:JAKK

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As major U.S. indexes hover near record highs, investors are keenly watching economic indicators and Federal Reserve signals for insights into future market directions. In this environment, dividend stocks can offer a stable income stream, making them an attractive option for those looking to balance potential volatility with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Huntington Bancshares (HBAN) | 3.72% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.20% | ★★★★★★ |

| Ennis (EBF) | 5.55% | ★★★★★★ |

| Employers Holdings (EIG) | 3.05% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.63% | ★★★★★☆ |

| Dillard's (DDS) | 4.97% | ★★★★★★ |

| DHT Holdings (DHT) | 8.64% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.59% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.55% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.42% | ★★★★★☆ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Civista Bancshares (CIVB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Civista Bancshares, Inc. is the financial holding company for Civista Bank, offering community banking services in the United States with a market cap of $386.45 million.

Operations: Civista Bancshares, Inc. generates revenue primarily through its banking segment, which accounts for $157.43 million.

Dividend Yield: 3.4%

Civista Bancshares offers a stable and reliable dividend, consistently paying out over the past decade with little volatility. The recent quarterly dividend of $0.17 per share yields an annualized 2.89% based on a stock price of $23.20 as of June 30, 2025. Despite recent shareholder dilution from a follow-on equity offering raising $70 million, the company's earnings growth and low payout ratio suggest dividends are well-covered by earnings, though not among the highest yields in the U.S. market.

- Dive into the specifics of Civista Bancshares here with our thorough dividend report.

- Our expertly prepared valuation report Civista Bancshares implies its share price may be lower than expected.

JAKKS Pacific (JAKK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JAKKS Pacific, Inc. is a company that designs, produces, markets, sells, and distributes toys and related products as well as consumer goods like kids' furniture and costumes worldwide, with a market cap of $191.17 million.

Operations: JAKKS Pacific's revenue is primarily derived from two segments: Toys/Consumer Products, which generated $706.62 million, and Costumes, which reported -$21.93 million.

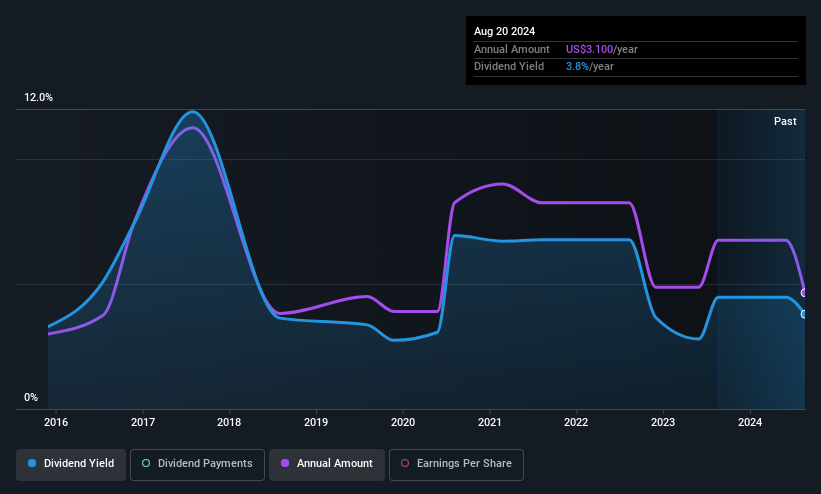

Dividend Yield: 5.8%

JAKKS Pacific's dividend yield of 5.83% places it in the top 25% of U.S. dividend payers, supported by a low payout ratio of 14.4%. Despite recent earnings challenges, including a net loss for Q2 2025 and declining sales, dividends remain well-covered by cash flows with a cash payout ratio of 28.2%. The company has just initiated its dividend payments, making long-term reliability uncertain while trading at an attractive price-to-earnings ratio of 5x compared to the market average.

- Click here to discover the nuances of JAKKS Pacific with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of JAKKS Pacific shares in the market.

John B. Sanfilippo & Son (JBSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: John B. Sanfilippo & Son, Inc., operating through its subsidiary JBSS Ventures, LLC, processes and distributes tree nuts and peanuts in the United States with a market cap of approximately $734.81 million.

Operations: John B. Sanfilippo & Son, Inc. generates revenue of approximately $1.11 billion from selling various nut and nut-related products in the United States.

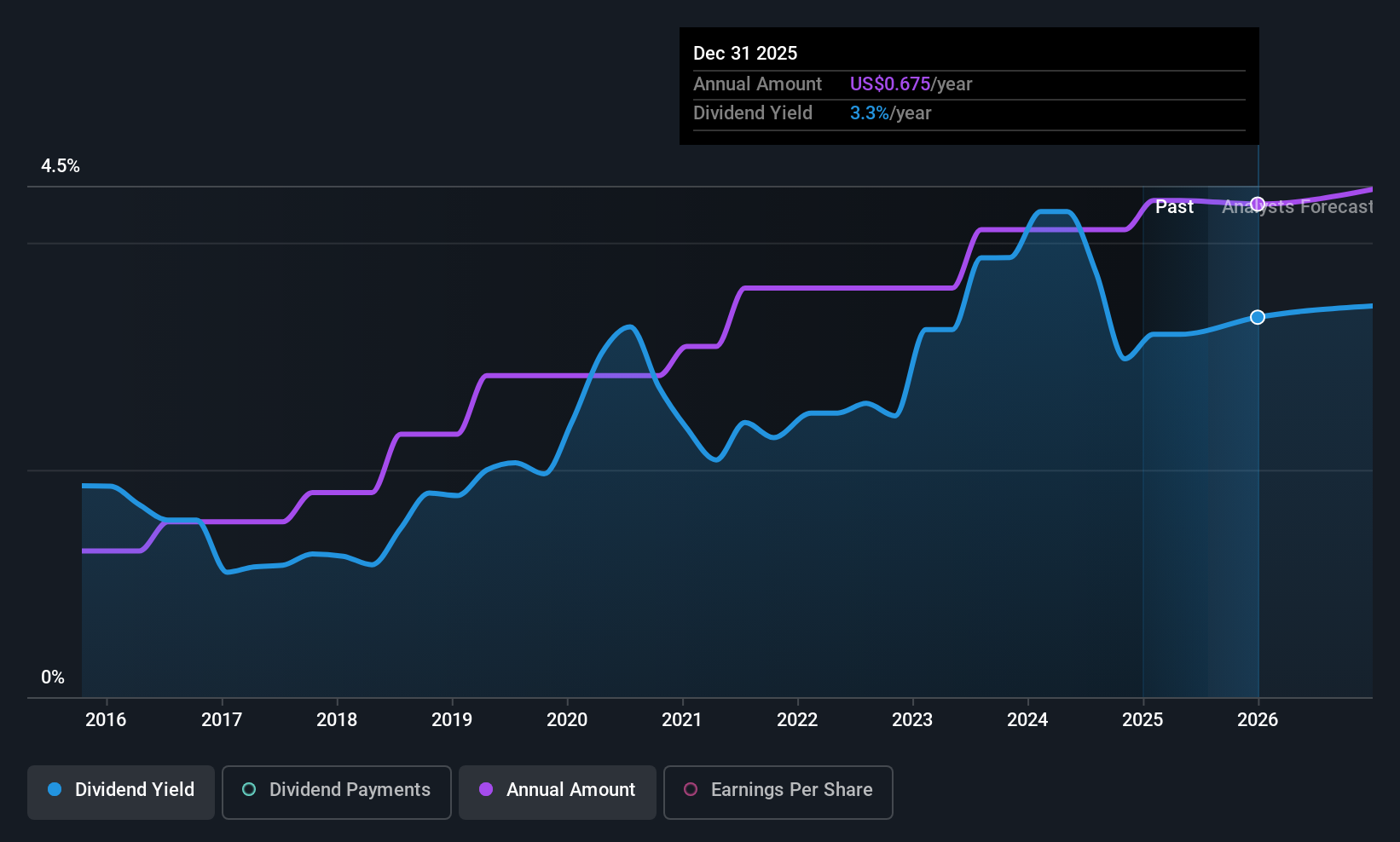

Dividend Yield: 4.9%

John B. Sanfilippo & Son's dividend yield of 4.88% ranks it among the top 25% of U.S. dividend payers, with a low payout ratio of 17.9%, suggesting dividends are well covered by earnings despite lacking free cash flow coverage. Recent announcements include a special dividend and an annual increase, though past payments have been volatile and unreliable over ten years. The company was recently added to several Russell Value Indexes, potentially enhancing its market visibility.

- Click to explore a detailed breakdown of our findings in John B. Sanfilippo & Son's dividend report.

- The analysis detailed in our John B. Sanfilippo & Son valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Click this link to deep-dive into the 135 companies within our Top US Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JAKK

JAKKS Pacific

Designs, produces, markets, sells, and distributes toys and related products, consumer products, kids indoor and outdoor furniture, costumes, and sporting goods and home furnishings space products worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives