- United States

- /

- Software

- /

- NasdaqGM:RPD

Three Stocks That May Be Undervalued In July 2025

Reviewed by Simply Wall St

As the U.S. stock market flirts with record highs, driven by robust performances from sectors like airlines and technology, investor sentiment remains cautious amid ongoing tariff uncertainties. In this environment, identifying undervalued stocks can be a prudent strategy for investors seeking opportunities that may offer potential value relative to their current price levels.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SharkNinja (SN) | $108.75 | $210.66 | 48.4% |

| Roku (ROKU) | $88.63 | $173.44 | 48.9% |

| Robert Half (RHI) | $42.90 | $83.14 | 48.4% |

| Lyft (LYFT) | $15.66 | $31.20 | 49.8% |

| Ligand Pharmaceuticals (LGND) | $122.40 | $240.64 | 49.1% |

| Insteel Industries (IIIN) | $38.89 | $77.46 | 49.8% |

| Hess Midstream (HESM) | $37.91 | $73.22 | 48.2% |

| e.l.f. Beauty (ELF) | $117.66 | $230.73 | 49% |

| Carter Bankshares (CARE) | $18.11 | $35.50 | 49% |

| Atlantic Union Bankshares (AUB) | $33.24 | $65.54 | 49.3% |

Underneath we present a selection of stocks filtered out by our screen.

Rapid7 (RPD)

Overview: Rapid7, Inc. is a cybersecurity company offering software and services under the Rapid7, Nexpose, and Metasploit brands with a market cap of approximately $1.57 billion.

Operations: The company's revenue is primarily generated from its Security Software & Services segment, which accounts for $849.16 million.

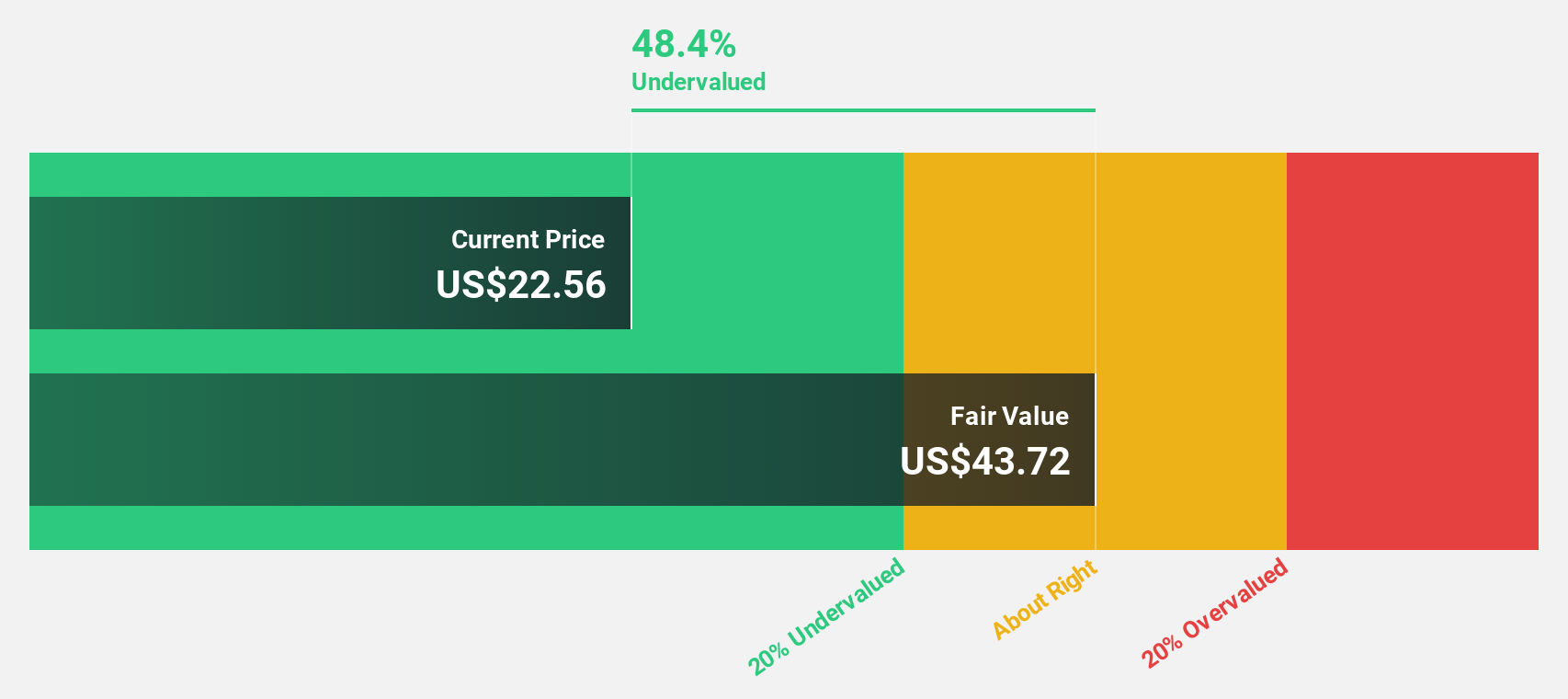

Estimated Discount To Fair Value: 43.1%

Rapid7 is trading at US$25.59, significantly below its estimated fair value of US$45.01, indicating potential undervaluation based on discounted cash flow analysis. Despite slower projected revenue growth compared to the market, Rapid7's earnings are expected to grow significantly over the next three years. Recent developments include a new credit agreement for up to $200 million and enhancements in AI-driven security solutions, which may support future operational efficiency and profitability improvements.

- Insights from our recent growth report point to a promising forecast for Rapid7's business outlook.

- Click to explore a detailed breakdown of our findings in Rapid7's balance sheet health report.

LPL Financial Holdings (LPLA)

Overview: LPL Financial Holdings Inc. offers a comprehensive platform of brokerage and investment advisory services to independent financial advisors and institutional financial advisors in the United States, with a market capitalization of approximately $30.68 billion.

Operations: The company generates revenue primarily through its brokerage segment, which accounted for $12.92 billion.

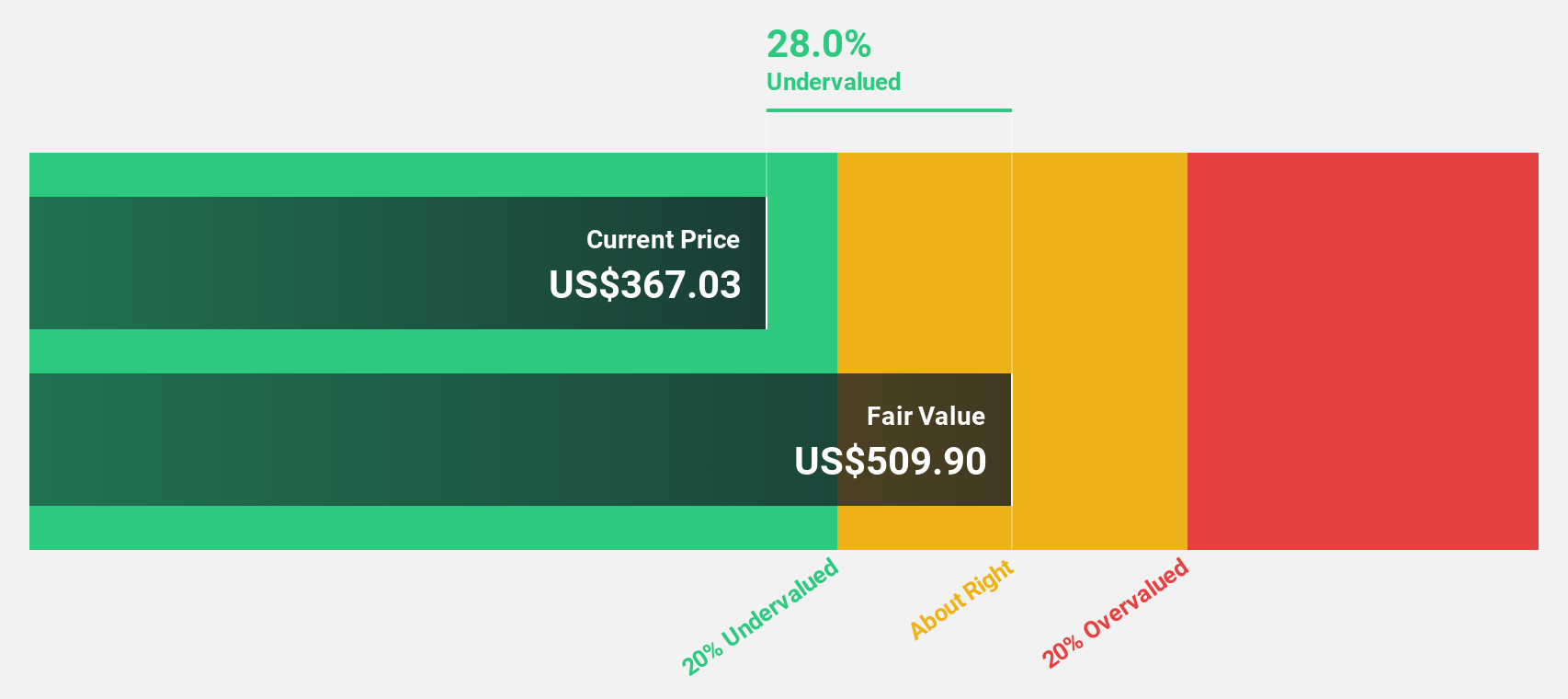

Estimated Discount To Fair Value: 23.9%

LPL Financial Holdings is trading at US$380.9, considerably below its estimated fair value of US$500.34, suggesting it may be undervalued based on cash flows. While revenue growth is forecasted to outpace the U.S. market, earnings growth remains moderate compared to significant levels. Recent strategic initiatives include appointing Mike Holtschlag as Executive Vice President to enhance banking and lending solutions, potentially bolstering comprehensive wealth management services and supporting future cash flow improvements despite recent index exclusions.

- Upon reviewing our latest growth report, LPL Financial Holdings' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of LPL Financial Holdings.

Warner Music Group (WMG)

Overview: Warner Music Group Corp. is a music entertainment company operating in the United States, the United Kingdom, Germany, and internationally with a market cap of approximately $15.37 billion.

Operations: The company generates revenue through its Recorded Music segment, which accounts for $5.11 billion, and its Music Publishing segment, contributing $1.23 billion.

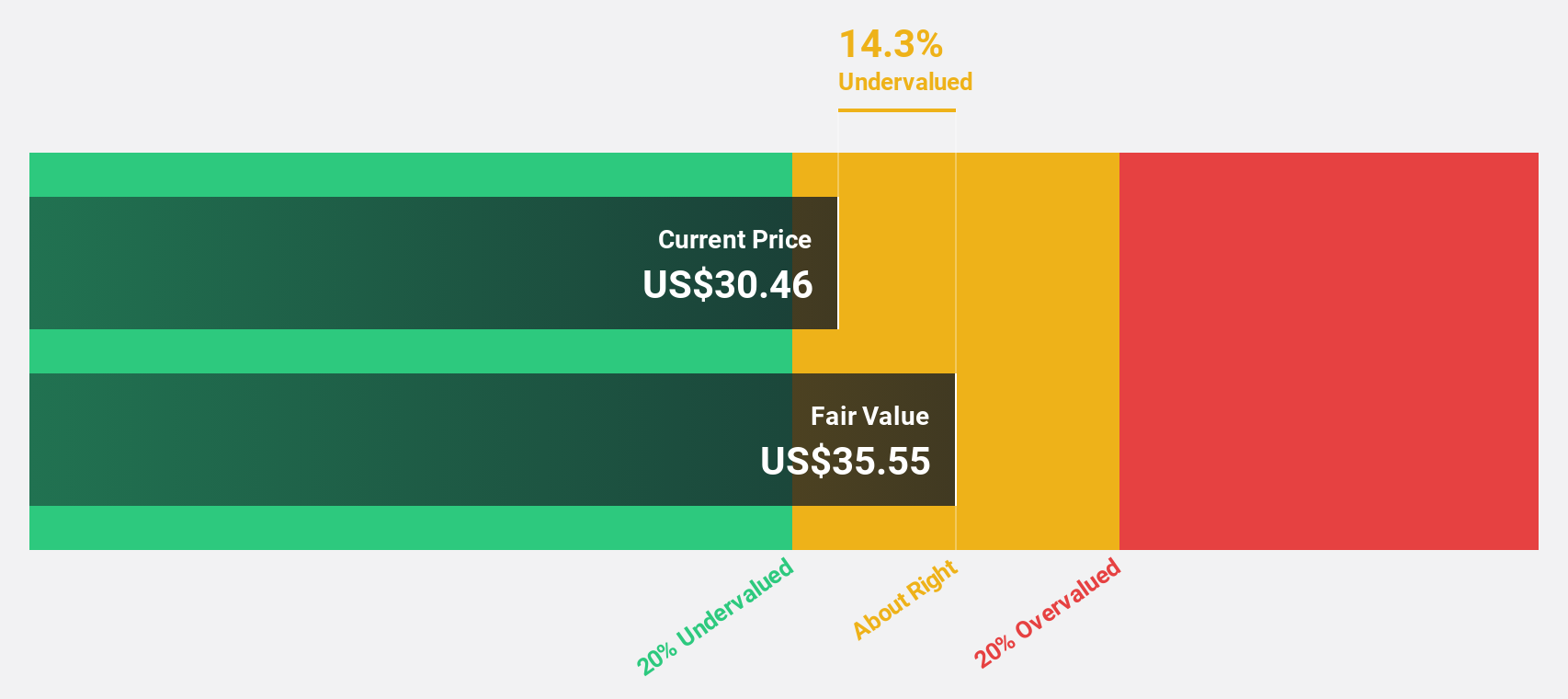

Estimated Discount To Fair Value: 15.4%

Warner Music Group, priced at US$29.99, is trading 15.4% below its fair value estimate of US$35.46, indicating potential undervaluation based on cash flows. Despite high debt levels and slower revenue growth than the market, earnings are projected to grow significantly faster than the U.S. market over three years. A strategic alliance with Bain Capital for a US$1.2 billion music catalog venture could enhance long-term cash flow prospects amid evolving industry dynamics.

- The analysis detailed in our Warner Music Group growth report hints at robust future financial performance.

- Dive into the specifics of Warner Music Group here with our thorough financial health report.

Make It Happen

- Investigate our full lineup of 177 Undervalued US Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives