- United States

- /

- Auto

- /

- NYSE:NIO

NIO (NYSE:NIO) Reports 17% Increase In Vehicle Deliveries For June 2025

Reviewed by Simply Wall St

NIO (NYSE:NIO) recently reported impressive growth in vehicle deliveries for June and the second quarter of 2025, with total deliveries up by 17.5% compared to the previous year. Despite this positive performance, NIO's stock price remained flat over the past week. This modest movement aligns with broader market trends as the S&P 500 and Nasdaq Composite recorded similar results. The delivery figures, though promising, did not appear to significantly impact NIO's share price against the broader backdrop of mixed market sentiment and cautious anticipation of economic developments.

Be aware that NIO is showing 1 possible red flag in our investment analysis.

NIO's recent vehicle delivery growth did not immediately translate into stock price movement, suggesting a nuanced reaction from investors who may be weighing positive operational metrics against broader market uncertainties. Over the last year, NIO's total shareholder return, including both share price and dividends, declined by 22.52%. This underperformance contrasts significantly with the broader US Auto industry's 41.6% return and the US market's 13.9% gain over the same period.

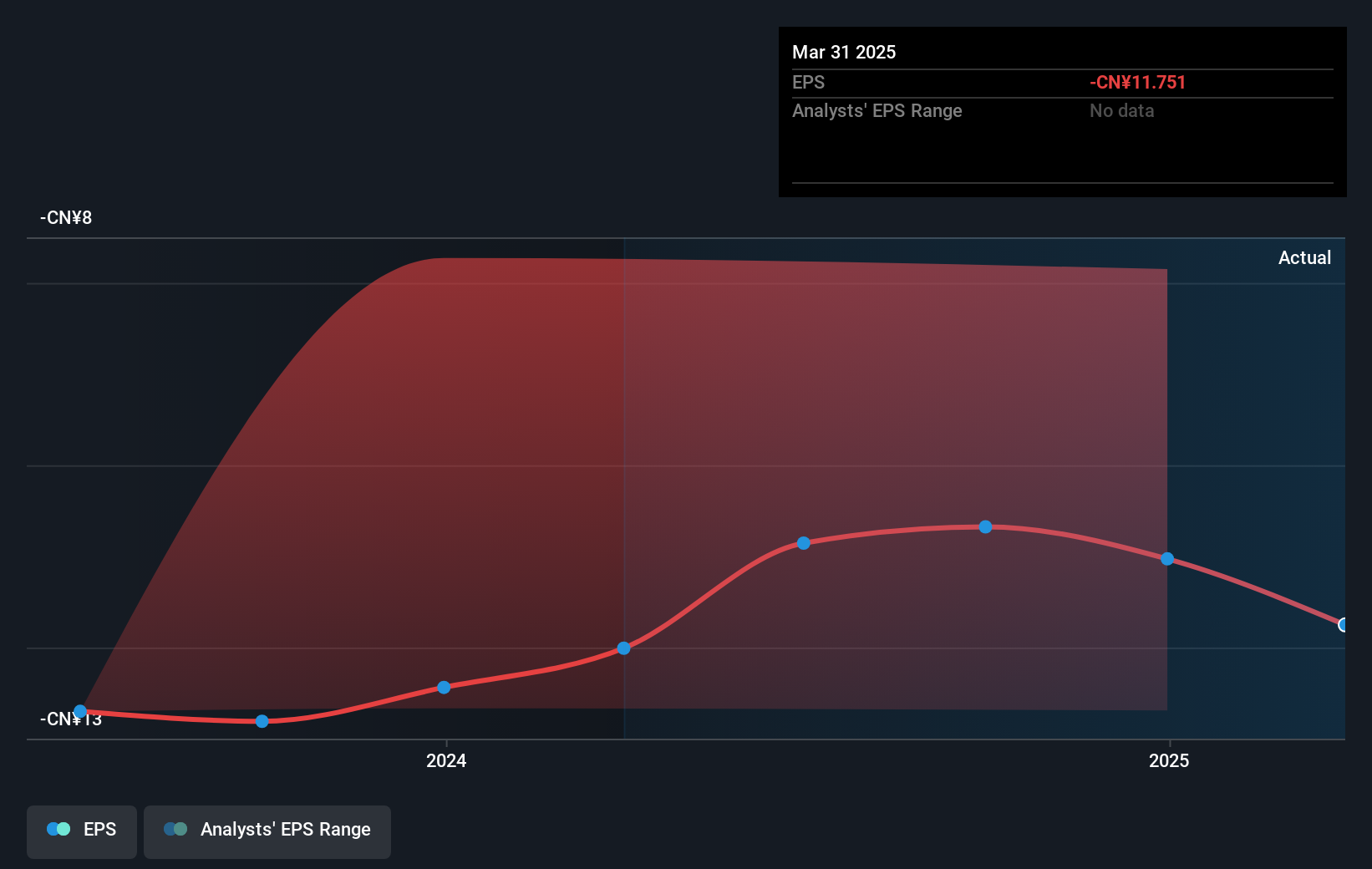

The company's strategic focus on expanding its smart EV models and optimizing cost structures may influence future revenue and earnings forecasts positively, though current projections suggest unprofitability continues over the next three years. While revenue is expected to grow at 18.3% annually, analysts remain conservative regarding profitability, envisioning a gradual improvement aligning with industry averages in the longer term. This forward-looking scenario underscores potential revenue growth driven by NIO's product cycle expansion and AI investments. However, challenges such as rising costs and heightened competition remain critical factors impacting future profit margins.

The consensus analyst price target for NIO stands at US$5.08, depicting a potential 16.5% upside from the current US$4.24 share price. Despite a flat recent price trend, this target anticipates future improvements in financial performance, which investors would need to carefully consider in the context of existing risk factors and market conditions. As new data and insights emerge, shareholders should continually evaluate the alignment of analyst projections with the evolving market dynamics and NIO's operational execution.

Our valuation report unveils the possibility NIO's shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives