- United States

- /

- Banks

- /

- NasdaqCM:ISBA

Isabella Bank And 2 Other Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market faces renewed volatility due to escalating trade tensions with China, investors are increasingly drawn to dividend stocks for their potential stability and income generation amidst uncertainty. In this environment, a good dividend stock is often characterized by a strong track record of consistent payouts and resilience in challenging economic conditions, making them appealing options for those seeking reliable returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 11.36% | ★★★★★☆ |

| PACCAR (PCAR) | 4.65% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.97% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.49% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.19% | ★★★★★★ |

| Ennis (EBF) | 5.88% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.97% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.78% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.66% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.35% | ★★★★★☆ |

Click here to see the full list of 139 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

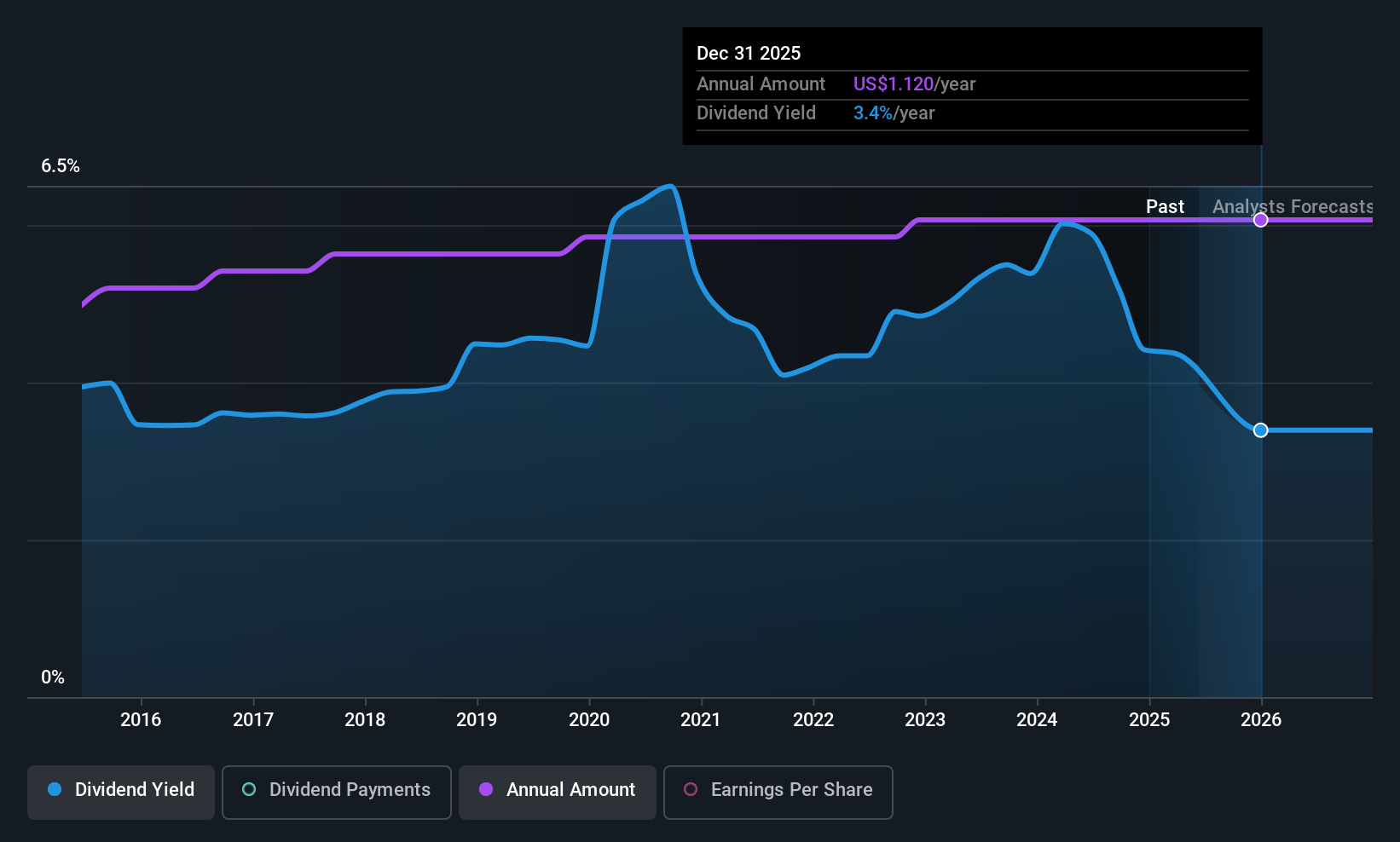

Isabella Bank (ISBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Isabella Bank Corporation, with a market cap of $265.62 million, operates as the bank holding company for Isabella Bank, offering banking and wealth management services to businesses, institutions, and individuals in Michigan, United States.

Operations: Isabella Bank Corporation generates revenue primarily from its Retail Banking Operations, which amounted to $73.30 million.

Dividend Yield: 3.1%

Isabella Bank's dividend has been stable and growing over the past decade, supported by a reasonable payout ratio of 51.1%, though its yield of 3.1% is below the top quartile in the US market. Recent executive changes include Brian Tessin joining the board, potentially enhancing financial oversight. The bank's earnings have shown consistent growth, with recent net income rising to US$5.03 million for Q2 2025, indicating robust financial health supporting its dividend strategy.

- Delve into the full analysis dividend report here for a deeper understanding of Isabella Bank.

- According our valuation report, there's an indication that Isabella Bank's share price might be on the expensive side.

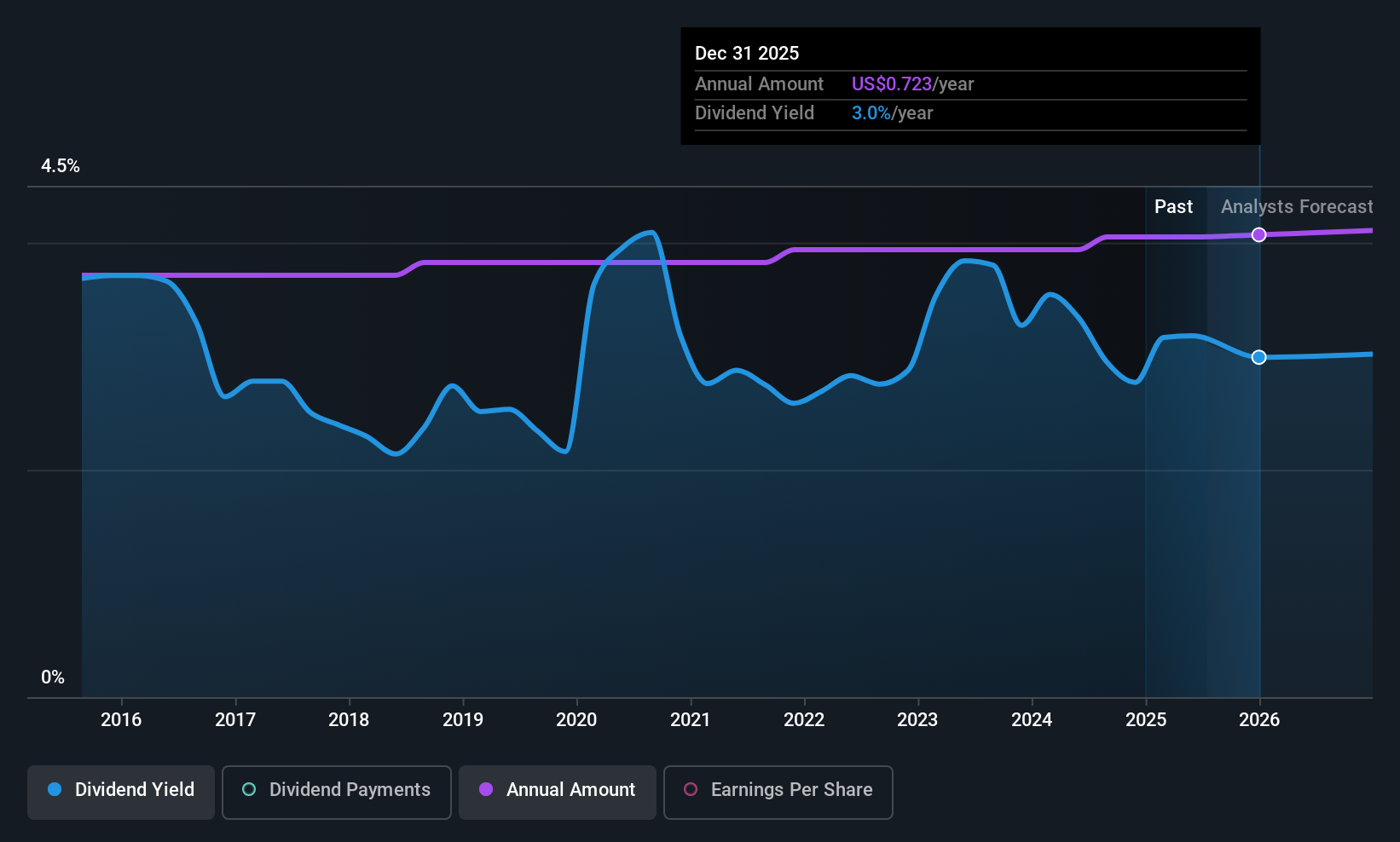

CNB Financial (CCNE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNB Financial Corporation, with a market cap of $689.61 million, operates as the bank holding company for CNB Bank, offering a range of banking products and services to individual, business, governmental, and institutional customers.

Operations: CNB Financial Corporation generates revenue primarily through its banking segment, which amounts to $224.76 million.

Dividend Yield: 3.1%

CNB Financial's dividend of US$0.18 per share remains reliable, with a stable history over the past decade and a low payout ratio of 30.2%, ensuring coverage by earnings. However, its yield of 3.05% is below the top quartile in the US market. Despite recent shareholder dilution, earnings have been growing at 5.9% annually over five years, supporting future dividends amid recent board changes and steady financial performance with Q2 net income at US$13.96 million.

- Take a closer look at CNB Financial's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that CNB Financial is priced lower than what may be justified by its financials.

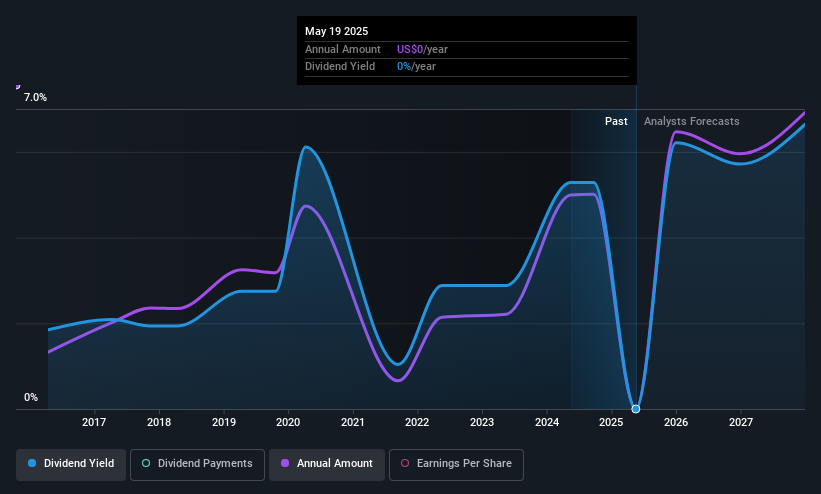

Credicorp (BAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Credicorp Ltd. operates in the financial, insurance, and health sectors both in Peru and internationally, with a market capitalization of approximately $20.24 billion.

Operations: Credicorp Ltd.'s revenue is primarily derived from Universal Banking through Banco De Crédito Del Perú at PEN 13.97 billion, followed by Insurance and Pension Funds through Pacífico Seguros and Subsidiaries at PEN 1.71 billion, Microfinance via Mibanco at PEN 1.69 billion, Investment Management and Advisory services at PEN 971 million, Insurance and Pension Funds through Prima AFP at PEN 469 million, Universal Banking via Banco De Crédito De Bolivia at PEN 339 million, and Microfinance operations in Colombia including Edyficar S.A.S. at PEN 329 million.

Dividend Yield: 4.3%

Credicorp's dividend track record is unstable, with past volatility and unreliability. However, dividends are currently covered by earnings with a 50.8% payout ratio and forecasted to remain sustainable at 53.7% in three years. Despite a high level of bad loans at 5%, Credicorp offers good value compared to peers, trading below estimated fair value by 43.3%. Recent net income growth and favorable earnings guidance support potential dividend improvements amid regulatory challenges resolved without financial provisions.

- Dive into the specifics of Credicorp here with our thorough dividend report.

- Our valuation report here indicates Credicorp may be undervalued.

Where To Now?

- Click through to start exploring the rest of the 136 Top US Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ISBA

Isabella Bank

Operates as the bank holding company for Isabella Bank that provides banking and wealth management services to businesses, institutions, and individuals and their families in Michigan, the United States.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives