- Turkey

- /

- Telecom Services and Carriers

- /

- IBSE:TTKOM

Global Market Insights Three Stocks Possibly Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets recently celebrated record highs, driven by easing geopolitical tensions and positive trade developments, investors are keenly observing opportunities amidst fluctuating economic indicators. In such an environment, identifying stocks that might be trading below their estimated value becomes crucial for those seeking potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SIGMAXYZ Holdings (TSE:6088) | ¥1222.00 | ¥2440.81 | 49.9% |

| Prospect Logistics and Industrial Freehold and Leasehold Real Estate Investment Trust (SET:PROSPECT) | THB7.20 | THB14.38 | 49.9% |

| Maxscend Microelectronics (SZSE:300782) | CN¥69.87 | CN¥139.67 | 50% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €55.30 | €110.26 | 49.8% |

| KeePer Technical Laboratory (TSE:6036) | ¥3385.00 | ¥6750.67 | 49.9% |

| Good Will Instrument (TWSE:2423) | NT$43.45 | NT$86.70 | 49.9% |

| Duk San NeoluxLtd (KOSDAQ:A213420) | ₩33600.00 | ₩67079.97 | 49.9% |

| Cavotec (OM:CCC) | SEK17.00 | SEK33.89 | 49.8% |

| América Móvil. de (BMV:AMX B) | MX$16.83 | MX$33.60 | 49.9% |

| Almirall (BME:ALM) | €10.64 | €21.21 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Tofas Türk Otomobil Fabrikasi Anonim Sirketi (IBSE:TOASO)

Overview: Tofas Türk Otomobil Fabrikasi Anonim Sirketi manufactures and sells passenger cars and light commercial vehicles in Turkey, with a market cap of TRY101.95 billion.

Operations: The company's revenue segments include Consumer Financing, generating TRY9.29 billion, and Trading of Spare Parts and Automobile, contributing TRY97.99 billion.

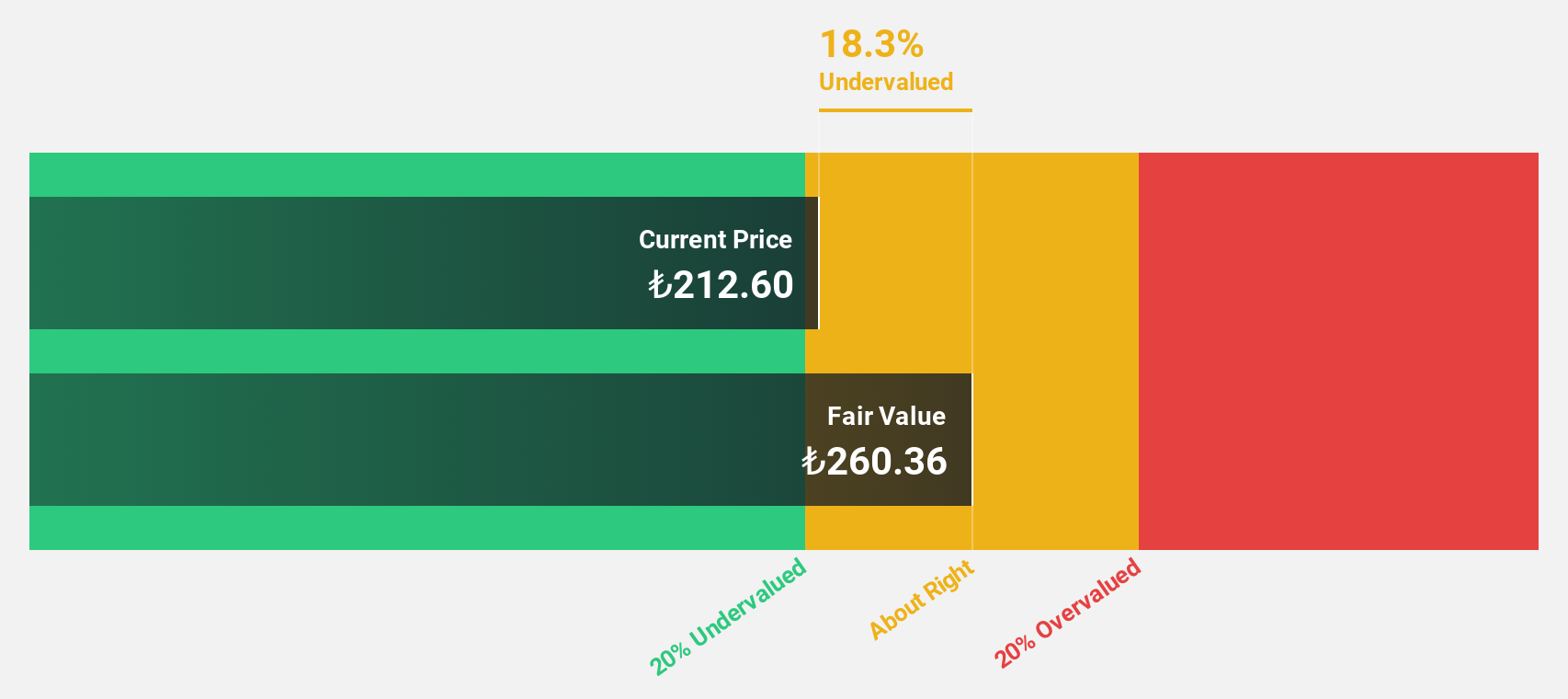

Estimated Discount To Fair Value: 21.7%

Tofas Türk Otomobil Fabrikasi Anonim Sirketi is trading at TRY 203.9, below its estimated fair value of TRY 260.36, indicating it may be undervalued based on cash flows despite recent challenges. While the company reported a net loss in Q1 2025 with sales dropping significantly year-on-year, analysts forecast robust revenue growth of 38.9% annually and earnings growth of over 71%, outpacing the Turkish market's expectations, although dividends remain unsustainable from current cash flows.

- Our earnings growth report unveils the potential for significant increases in Tofas Türk Otomobil Fabrikasi Anonim Sirketi's future results.

- Delve into the full analysis health report here for a deeper understanding of Tofas Türk Otomobil Fabrikasi Anonim Sirketi.

Türk Telekomünikasyon Anonim Sirketi (IBSE:TTKOM)

Overview: Türk Telekomünikasyon Anonim Sirketi, along with its subsidiaries, functions as an integrated telecommunications provider in Turkey with a market capitalization of TRY214.20 billion.

Operations: The company's revenue segments include Mobile at TRY70.02 billion and Fixed-Line at TRY104.54 billion.

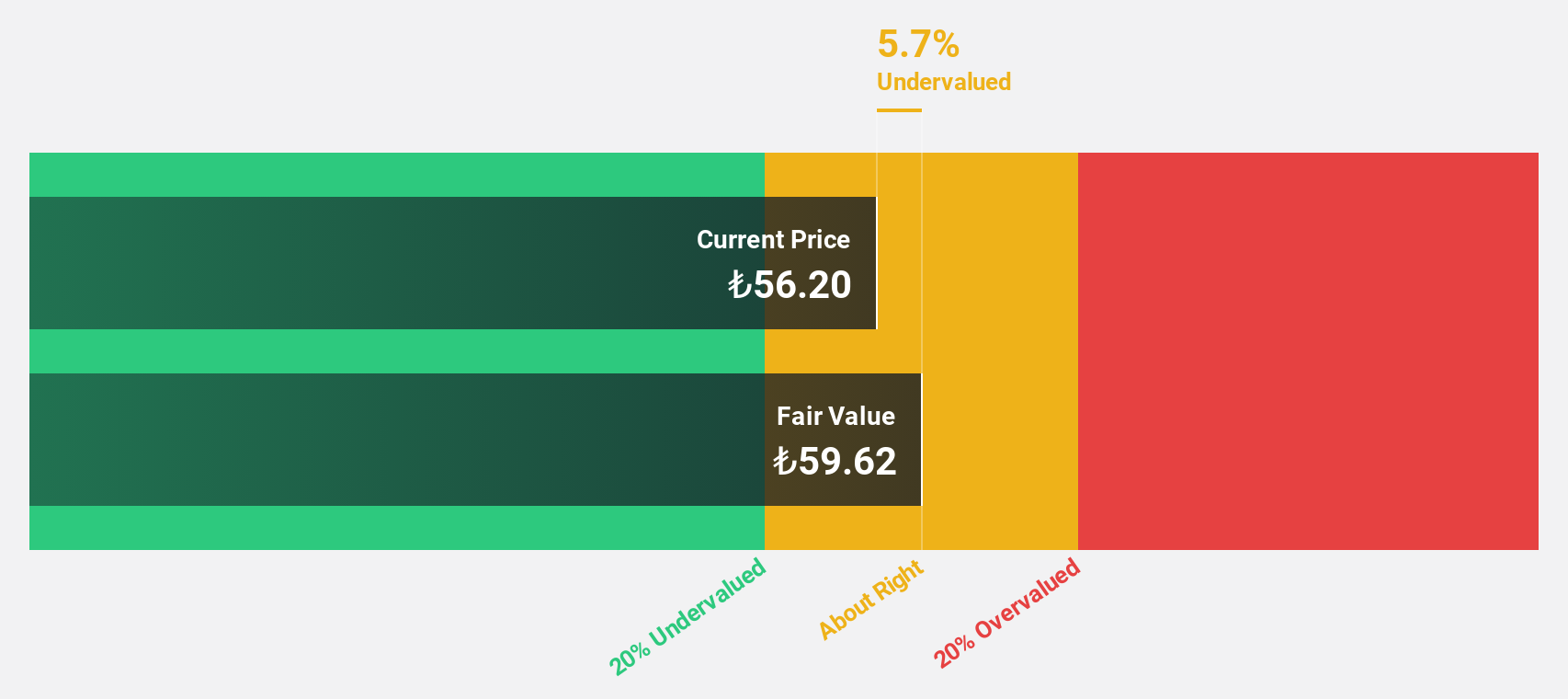

Estimated Discount To Fair Value: 17%

Türk Telekomünikasyon Anonim Sirketi, priced at TRY 61.2, trades below its estimated fair value of TRY 73.73, suggesting potential undervaluation based on cash flows. The company's earnings and revenue are forecast to grow significantly faster than the Turkish market over the next three years. Despite a decline in profit margins compared to last year, Türk Telekom's innovative strides in 6G technology and strong quarterly performance bolster its growth outlook amidst evolving industry standards.

- Upon reviewing our latest growth report, Türk Telekomünikasyon Anonim Sirketi's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Türk Telekomünikasyon Anonim Sirketi stock in this financial health report.

Saudi Basic Industries (SASE:2010)

Overview: Saudi Basic Industries Corporation operates globally in the manufacturing, marketing, and distribution of chemicals, polymers, plastics, and agri-nutrients with a market cap of SAR165 billion.

Operations: The company's revenue segments include Agri-Nutrients at SAR11.32 billion and Petrochemicals & Specialties at SAR130.57 billion.

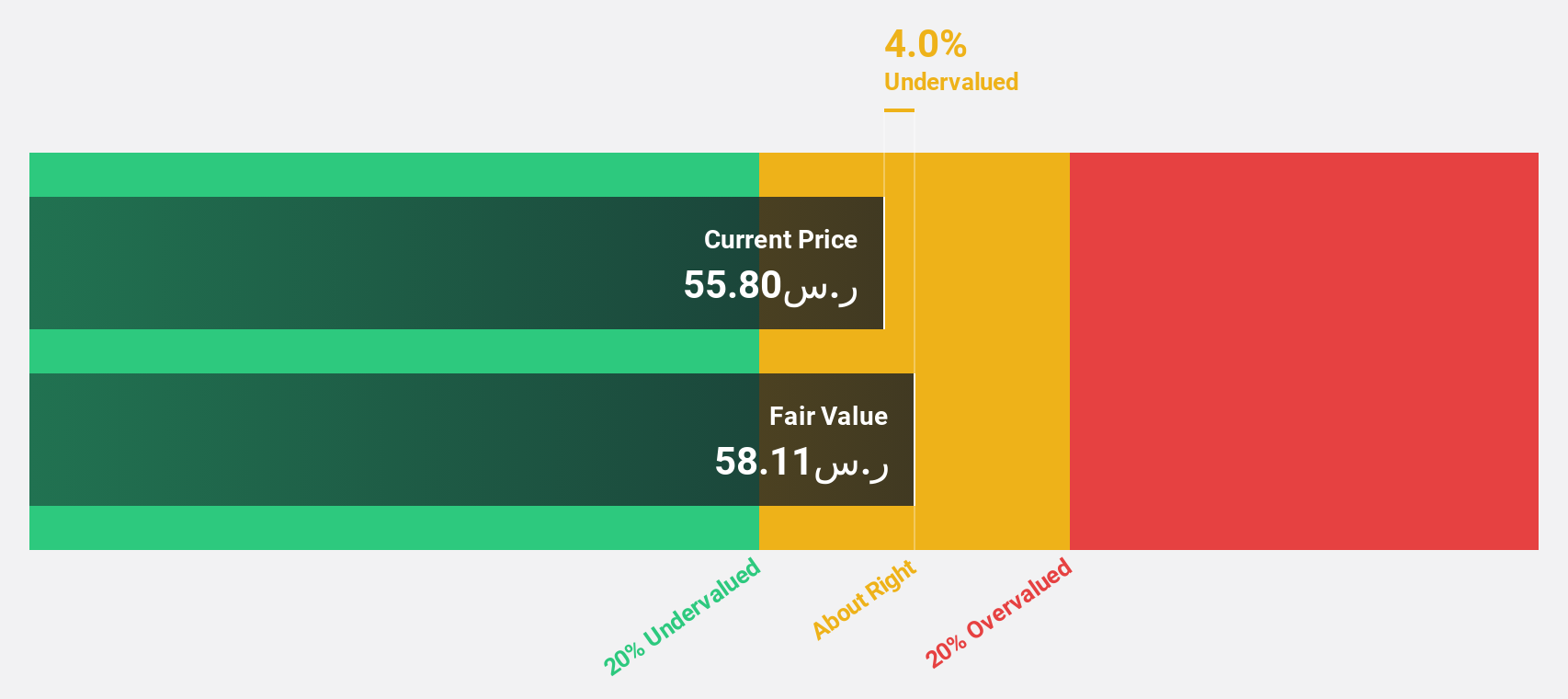

Estimated Discount To Fair Value: 18.4%

Saudi Basic Industries, priced at SAR 55.1, trades below its fair value estimate of SAR 67.56, indicating potential undervaluation based on cash flows. Despite a recent net loss and lower profit margins compared to last year, its earnings are expected to grow significantly faster than the Saudi Arabian market over the next three years. The company is exploring an IPO for its gas business amid broader operational reviews, which may influence future financial flexibility and growth strategies.

- The analysis detailed in our Saudi Basic Industries growth report hints at robust future financial performance.

- Get an in-depth perspective on Saudi Basic Industries' balance sheet by reading our health report here.

Make It Happen

- Discover the full array of 487 Undervalued Global Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Türk Telekomünikasyon Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TTKOM

Türk Telekomünikasyon Anonim Sirketi

Operates as an integrated telecommunication company in Turkey.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives