- United States

- /

- Banks

- /

- NasdaqGS:VLY

Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a boost from big tech stocks, with the S&P 500 and Nasdaq climbing higher, investors are keeping a close eye on economic indicators such as job data and potential interest rate cuts by the Federal Reserve. In this environment of fluctuating indices and economic uncertainty, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance growth with stability in their investment portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.34% | ★★★★★☆ |

| PACCAR (PCAR) | 4.49% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.52% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.79% | ★★★★★★ |

| Ennis (EBF) | 5.50% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.60% | ★★★★★☆ |

| Dillard's (DDS) | 4.64% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.41% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.59% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.40% | ★★★★★☆ |

Click here to see the full list of 128 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CVB Financial (CVBF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CVB Financial Corp. is a bank holding company for Citizens Business Bank, offering banking and financial services to small to mid-sized businesses and individuals, with a market cap of $2.74 billion.

Operations: CVB Financial Corp.'s revenue segment is primarily derived from its banking operations, totaling $508 million.

Dividend Yield: 4%

CVB Financial offers a stable dividend history with consistent growth over the past decade, maintaining reliability despite recent challenges such as a drop from the Russell 2000 Dynamic Index. The company declared a $0.20 per share dividend for Q2 2025, supported by earnings with a payout ratio of 54.6%. Recent buybacks totaling $37.47 million may enhance shareholder value, although its current yield of 4.01% is slightly below top-tier US dividend payers.

- Take a closer look at CVB Financial's potential here in our dividend report.

- According our valuation report, there's an indication that CVB Financial's share price might be on the cheaper side.

Independent Bank (INDB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Independent Bank Corp., the holding company for Rockland Trust Company, offers commercial banking products and services to individuals and small-to-medium sized businesses in the United States, with a market cap of approximately $3.55 billion.

Operations: Independent Bank Corp. generates revenue primarily through its Community Banking segment, which accounted for $662.75 million.

Dividend Yield: 3.3%

Independent Bank offers a reliable dividend history with stable growth over the past decade, currently yielding 3.35%. Despite recent shareholder dilution and significant insider selling, the bank's dividends are covered by earnings with a payout ratio of 52.4%. The company is trading below its estimated fair value and has announced a $150 million share repurchase program, potentially enhancing shareholder value amidst consistent dividend payments. Recent earnings showed steady net interest income but slight declines in net income year-over-year.

- Unlock comprehensive insights into our analysis of Independent Bank stock in this dividend report.

- The valuation report we've compiled suggests that Independent Bank's current price could be inflated.

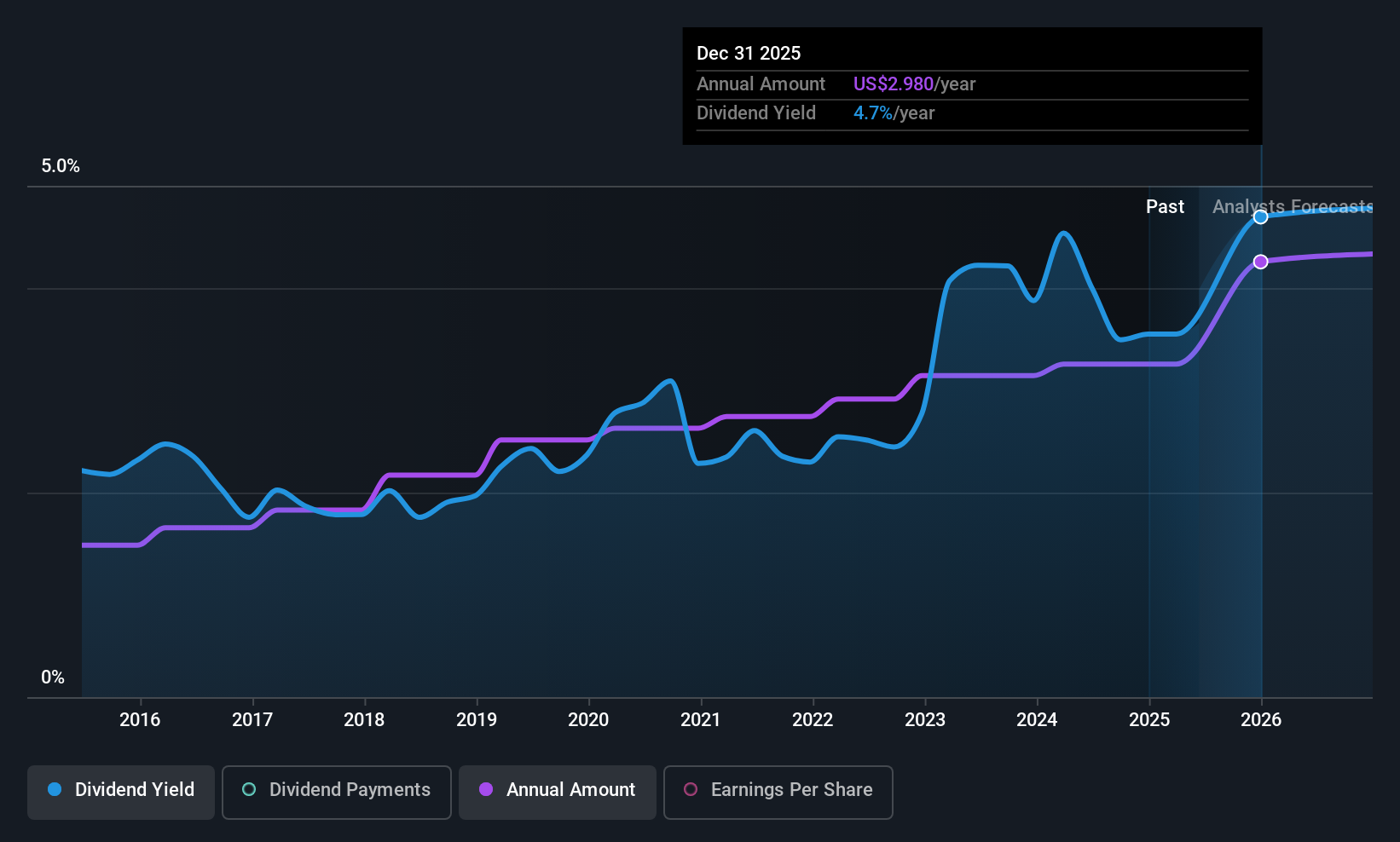

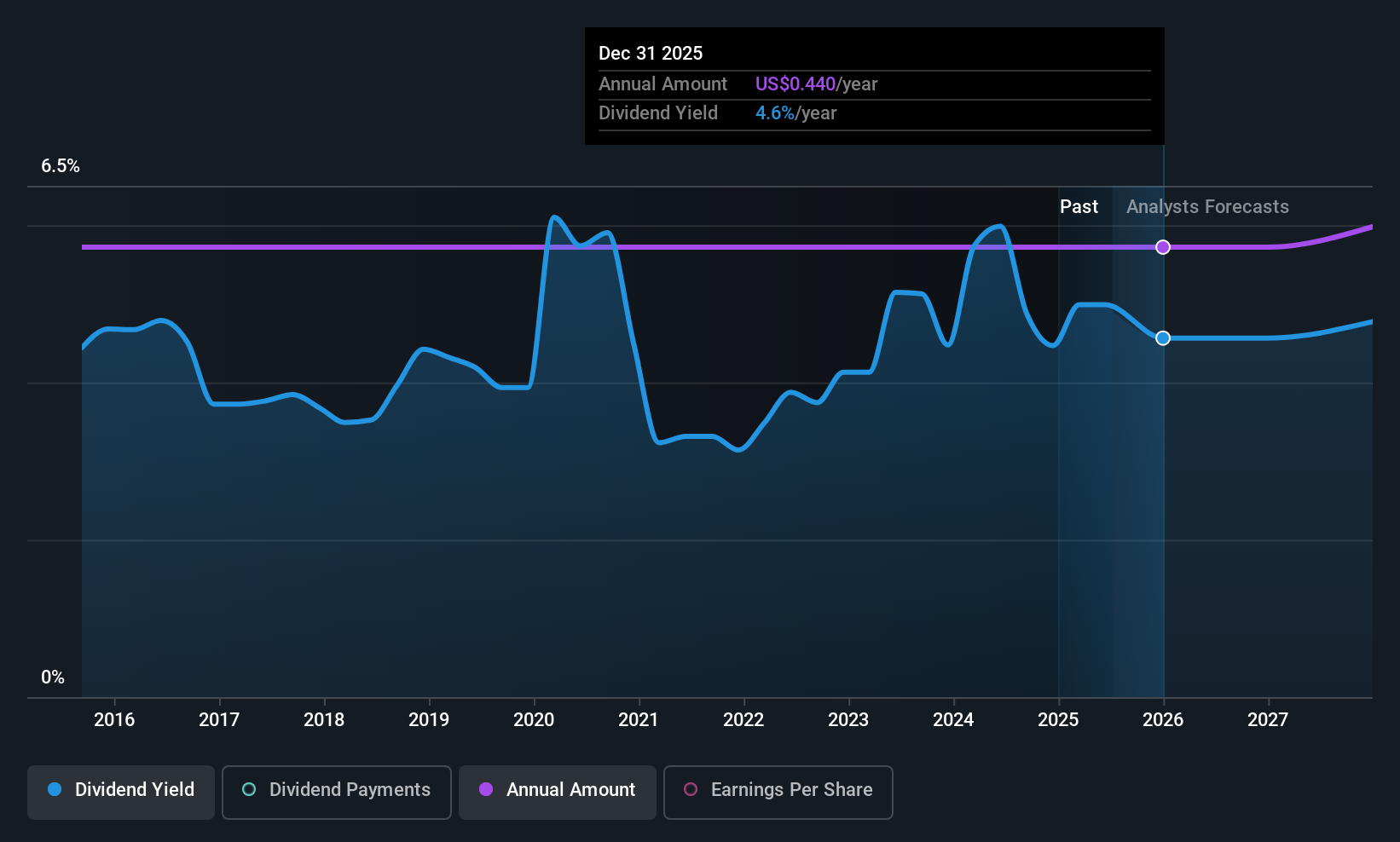

Valley National Bancorp (VLY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valley National Bancorp, with a market cap of $5.83 billion, operates as the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management financial services.

Operations: Valley National Bancorp's revenue is primarily derived from its Consumer Banking segment, contributing $344.61 million, and its Commercial Banking segment, which generates $1.17 billion.

Dividend Yield: 4.2%

Valley National Bancorp pays a consistent dividend of US$0.11 per share, but its yield of 4.19% is below the top quartile in the U.S. market. While dividends are covered by earnings with a 55.9% payout ratio, they have not grown over the past decade and have been somewhat unreliable. The company recently completed a share buyback worth US$4.33 million and reported solid earnings growth, with net income rising to US$133.17 million for Q2 2025 from US$70.42 million a year ago, indicating financial stability despite recent charge-offs of US$37.83 million.

- Navigate through the intricacies of Valley National Bancorp with our comprehensive dividend report here.

- Our valuation report here indicates Valley National Bancorp may be undervalued.

Make It Happen

- Click through to start exploring the rest of the 125 Top US Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)