- United States

- /

- Metals and Mining

- /

- NasdaqGS:METC

Discover 3 Stocks Including ConnectOne Bancorp Priced Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, with the Nasdaq and S&P 500 setting fresh closing records, investors are keenly observing opportunities amidst this bullish trend. In such an environment, identifying stocks priced below their estimated value can be a prudent strategy for those looking to potentially capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.865 | $13.43 | 48.9% |

| SLM (SLM) | $27.12 | $53.65 | 49.4% |

| Metropolitan Bank Holding (MCB) | $76.68 | $150.26 | 49% |

| Investar Holding (ISTR) | $22.92 | $45.29 | 49.4% |

| HCI Group (HCI) | $194.55 | $376.13 | 48.3% |

| First Commonwealth Financial (FCF) | $17.00 | $32.97 | 48.4% |

| First Busey (BUSE) | $23.37 | $45.30 | 48.4% |

| Customers Bancorp (CUBI) | $65.85 | $131.62 | 50% |

| Alnylam Pharmaceuticals (ALNY) | $452.00 | $884.80 | 48.9% |

| AGNC Investment (AGNC) | $9.88 | $19.36 | 49% |

Here's a peek at a few of the choices from the screener.

ConnectOne Bancorp (CNOB)

Overview: ConnectOne Bancorp, Inc. is the bank holding company for ConnectOne Bank, offering commercial banking products and services to small and mid-sized businesses, local professionals, and individuals in the United States, with a market cap of $1.28 billion.

Operations: ConnectOne Bancorp generates revenue primarily through its community banking segment, which accounted for $241.85 million.

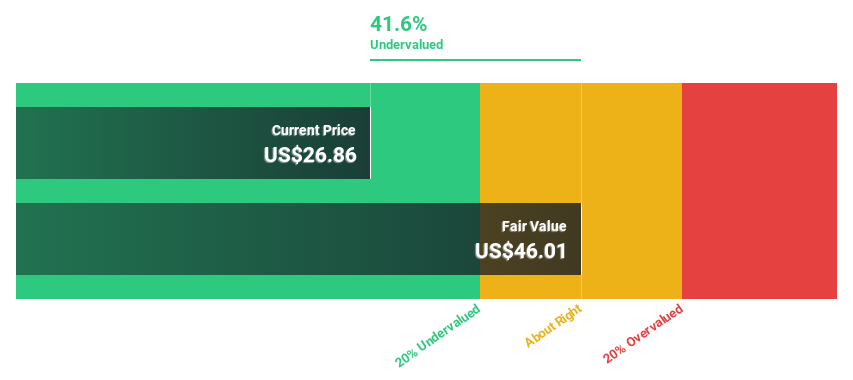

Estimated Discount To Fair Value: 38.6%

ConnectOne Bancorp appears undervalued, trading at US$26.28, below its estimated fair value of US$42.81. Despite a recent net loss and lower profit margins due to significant one-off items, revenue is projected to grow 41.6% annually, outpacing the market's 9.8%. Earnings are expected to increase significantly by 103.5% per year over the next three years, suggesting potential for recovery and growth amid current financial challenges.

- Insights from our recent growth report point to a promising forecast for ConnectOne Bancorp's business outlook.

- Navigate through the intricacies of ConnectOne Bancorp with our comprehensive financial health report here.

Ramaco Resources (METC)

Overview: Ramaco Resources, Inc. is involved in the development, operation, and sale of metallurgical coal with a market cap of $2.27 billion.

Operations: The company's revenue is derived entirely from its Metals & Mining - Coal segment, totaling $625.92 million.

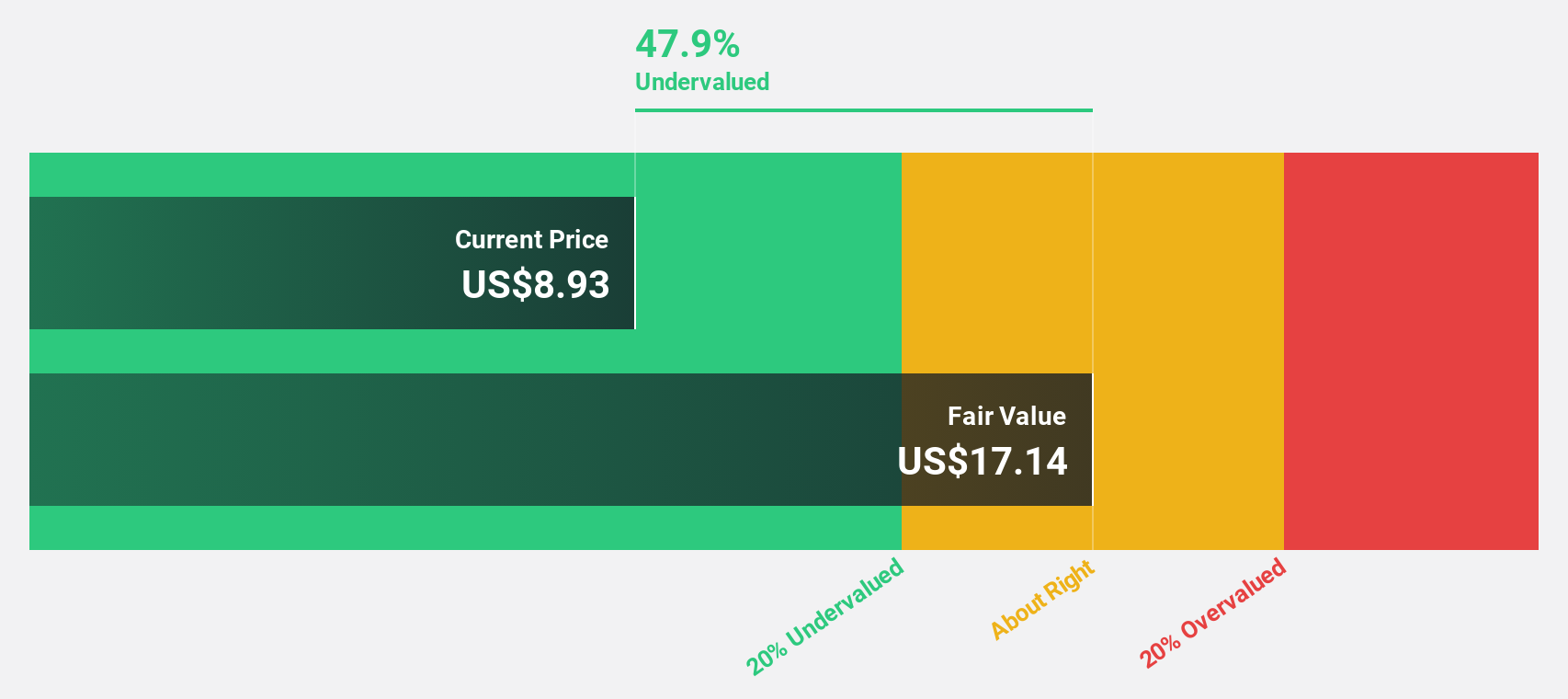

Estimated Discount To Fair Value: 16.8%

Ramaco Resources, trading at US$38.93, is undervalued by 16.8% compared to its fair value estimate of US$46.76. Although currently experiencing net losses and shareholder dilution, it is forecasted to achieve profitability within three years with above-average market growth. Recent executive appointments aim to bolster its critical minerals processing capabilities at the Brook Mine Project, potentially enhancing cash flow prospects despite current volatility in share price and production challenges.

- The analysis detailed in our Ramaco Resources growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Ramaco Resources stock in this financial health report.

Valley National Bancorp (VLY)

Overview: Valley National Bancorp, with a market cap of $5.96 billion, operates as the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management financial services products.

Operations: Valley National Bank's revenue is primarily derived from its Commercial Banking segment at $1.17 billion, followed by Consumer Banking at $344.61 million, and Treasury and Corporate Other contributing $118.11 million.

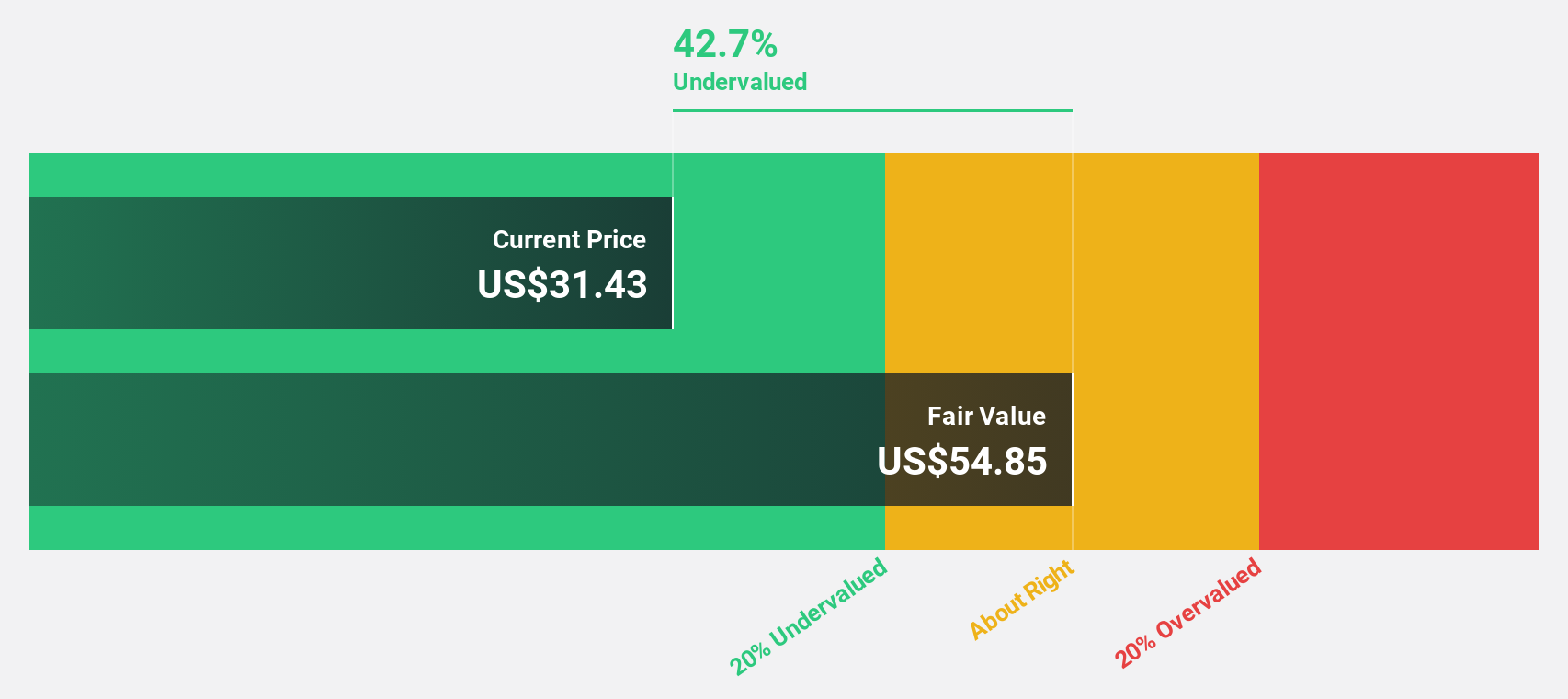

Estimated Discount To Fair Value: 37.6%

Valley National Bancorp, trading at US$10.91, is undervalued by over 20% compared to its fair value estimate of US$17.50. It offers a reliable dividend yield of 4.03% and has shown strong earnings growth of 17.2% over the past year, with future earnings expected to grow significantly at 22.1% annually, outpacing the market average. Recent leadership changes aim to enhance consumer banking strategies which could further support cash flow improvements despite modest revenue growth forecasts.

- According our earnings growth report, there's an indication that Valley National Bancorp might be ready to expand.

- Click here to discover the nuances of Valley National Bancorp with our detailed financial health report.

Summing It All Up

- Dive into all 193 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:METC

Ramaco Resources

Engages in the development, operation, and sale of metallurgical coal.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives