- United States

- /

- Mortgage REITs

- /

- NYSE:RC

Byrna Technologies And 2 Other Stocks That May Be Undervalued By The Market

Reviewed by Simply Wall St

In recent trading, the U.S. stock market has shown mixed performance with the S&P 500 and Nasdaq rising, driven by tech stocks like Alphabet reaching record highs, while the Dow Jones Industrial Average faced slight declines. As Treasury yields slide amid soft jobs data and economic uncertainties persist, investors are increasingly on the lookout for undervalued stocks that may offer potential opportunities despite current market fluctuations. Identifying such stocks involves assessing their intrinsic value compared to current market prices, especially in an environment where economic indicators and monetary policy decisions could influence future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $137.33 | $263.29 | 47.8% |

| Udemy (UDMY) | $6.76 | $13.24 | 49% |

| Phibro Animal Health (PAHC) | $36.685 | $70.71 | 48.1% |

| Peapack-Gladstone Financial (PGC) | $28.96 | $56.54 | 48.8% |

| Northwest Bancshares (NWBI) | $12.625 | $24.41 | 48.3% |

| Niagen Bioscience (NAGE) | $9.88 | $18.87 | 47.6% |

| McGraw Hill (MH) | $14.19 | $27.12 | 47.7% |

| Investar Holding (ISTR) | $23.18 | $45.84 | 49.4% |

| Fiverr International (FVRR) | $23.11 | $45.46 | 49.2% |

| Excelerate Energy (EE) | $23.82 | $46.64 | 48.9% |

We'll examine a selection from our screener results.

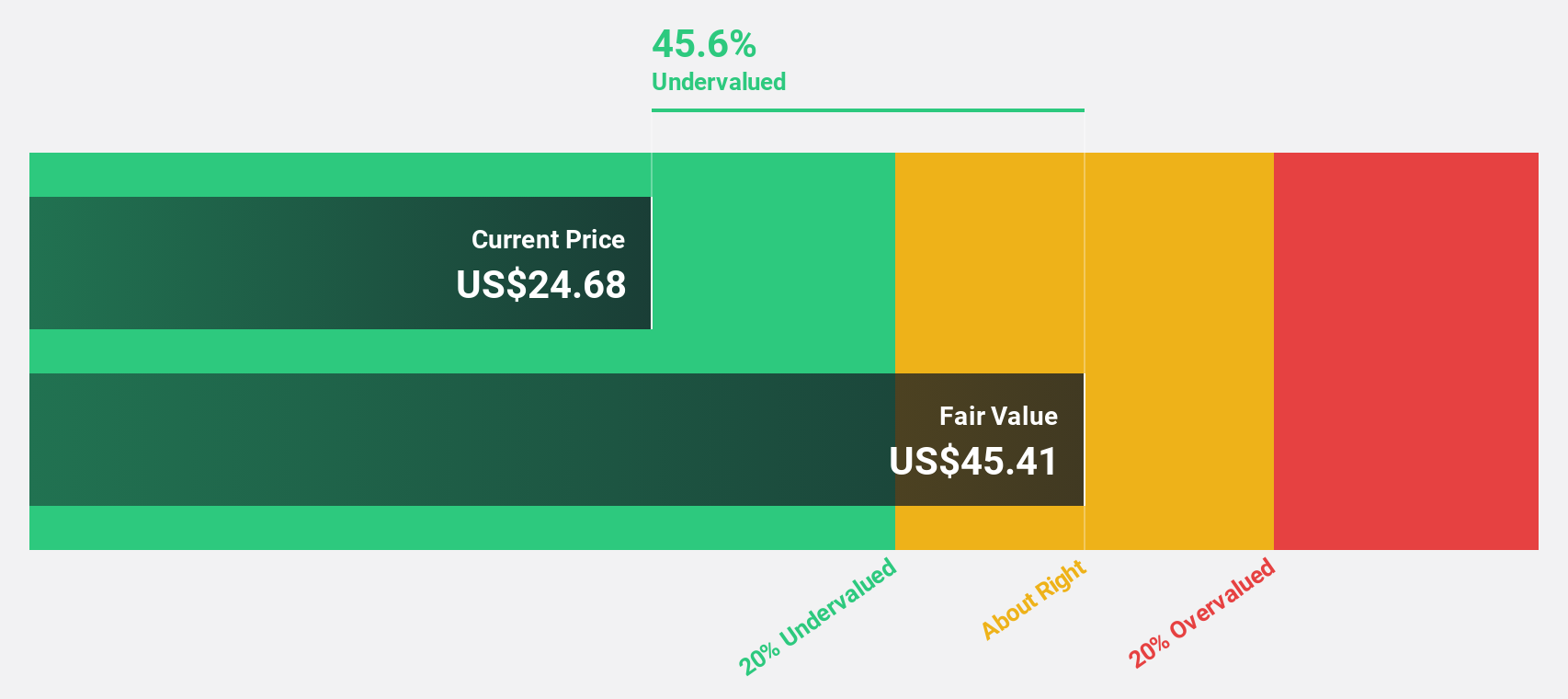

Byrna Technologies (BYRN)

Overview: Byrna Technologies Inc. is a company that develops, manufactures, and sells less-lethal personal security solutions across multiple continents, with a market cap of $463.16 million.

Operations: Byrna Technologies generates revenue from its Aerospace & Defense segment, amounting to $103.53 million.

Estimated Discount To Fair Value: 29.6%

Byrna Technologies is trading at a significant discount, valued 29.6% below its estimated fair value of US$29.55 per share, based on discounted cash flow analysis. The company reported strong second-quarter earnings with sales of US$28.51 million and net income of US$2.43 million, reflecting robust growth driven by the successful launch of its new Byrna Compact Launcher and expanded distribution channels. Analysts expect earnings to grow significantly over the next three years, outpacing the broader market's growth rate.

- The growth report we've compiled suggests that Byrna Technologies' future prospects could be on the up.

- Click here to discover the nuances of Byrna Technologies with our detailed financial health report.

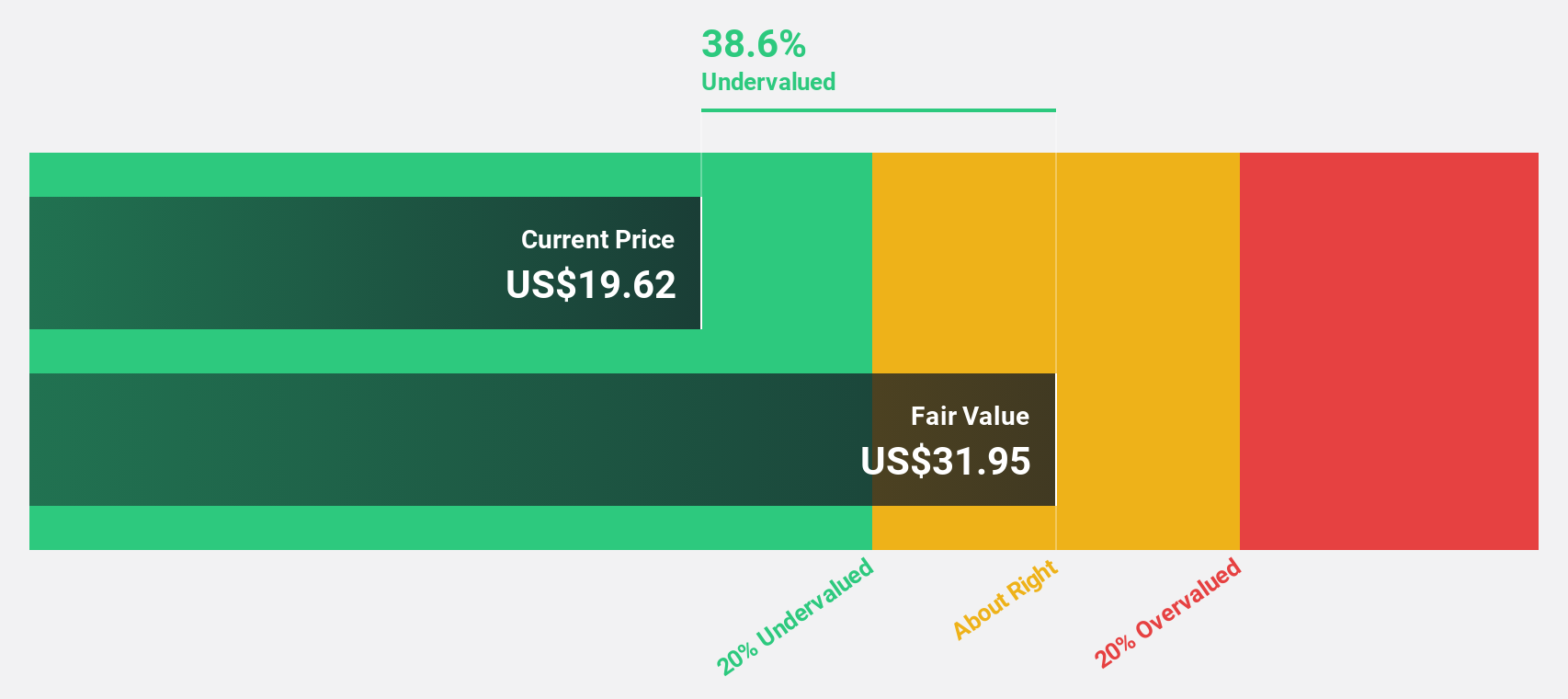

First Busey (BUSE)

Overview: First Busey Corporation, with a market cap of $2.20 billion, operates as the bank holding company for Busey Bank, providing retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Operations: The company's revenue segments consist of $435.30 million from banking, $21.76 million from Firs Tech, and $67.69 million from wealth management.

Estimated Discount To Fair Value: 45.9%

First Busey is trading at a significant discount, 45.9% below its estimated fair value of US$45.41 per share, based on discounted cash flow analysis. Recent earnings reports show net interest income of US$153.18 million for Q2 2025, a substantial increase from the previous year. However, profit margins have decreased to 15.5% from 25.8%. Despite past shareholder dilution and large one-off items affecting results, revenue and earnings are expected to grow significantly above market rates.

- In light of our recent growth report, it seems possible that First Busey's financial performance will exceed current levels.

- Get an in-depth perspective on First Busey's balance sheet by reading our health report here.

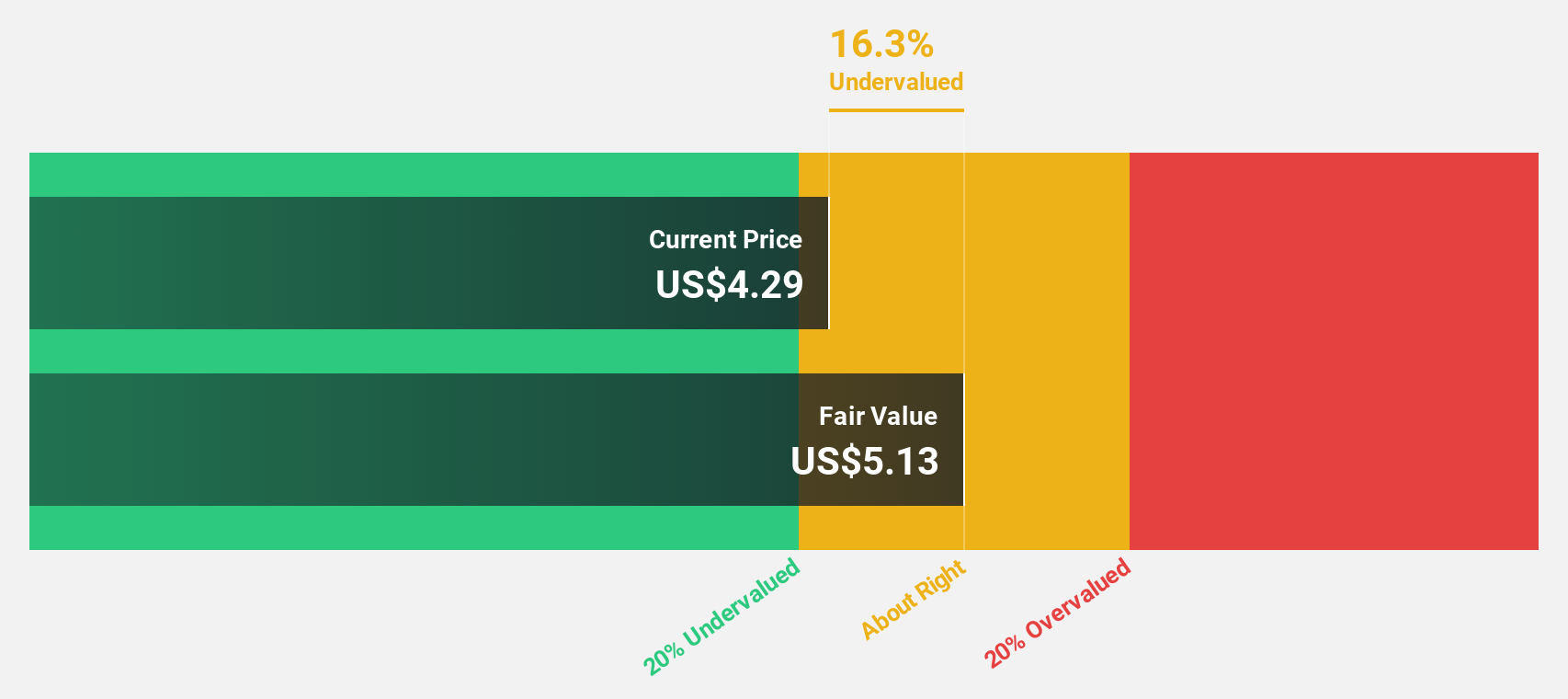

Ready Capital (RC)

Overview: Ready Capital Corporation is a real estate finance company in the United States with a market cap of approximately $702.60 million.

Operations: The company generates revenue through its Small Business Lending segment, which earned $146.78 million, while its LMM Commercial Real Estate segment reported a loss of $310.88 million.

Estimated Discount To Fair Value: 15.6%

Ready Capital's stock is trading at 15.6% below its estimated fair value of US$5.06, suggesting potential undervaluation based on cash flows. Despite a challenging financial position with debt not well covered by operating cash flow and a net loss of US$55.49 million for Q2 2025, the company is expected to achieve profitability within three years, outpacing market growth rates. Recent strategic moves include share buybacks and acquiring Block 216 Tower in Portland, enhancing asset management capabilities.

- The analysis detailed in our Ready Capital growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Ready Capital's balance sheet health report.

Next Steps

- Unlock our comprehensive list of 200 Undervalued US Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RC

Ready Capital

Operates as a real estate finance company in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives