- United Kingdom

- /

- Oil and Gas

- /

- AIM:CEG

Big Technologies Leads The Charge In UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite these broader market fluctuations, investors often find opportunities in smaller or newer companies known as penny stocks. Although the term might seem outdated, these stocks can offer surprising value and potential growth for those willing to explore beyond traditional investments.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.525 | £13.19M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.105 | £470.93M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.03 | £164M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.895 | £13.51M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.10 | £26.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6675 | $388.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.49 | £183.47M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.435 | £69.31M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.485 | £41.8M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Big Technologies (AIM:BIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Technologies PLC, operating under the Buddi brand, develops and delivers remote monitoring technologies and services for the offender and remote personal monitoring industry, with a market cap of £196.16 million.

Operations: The company generates revenue of £48.62 million from its electronic tracking devices, products, and services segment.

Market Cap: £196.16M

Big Technologies PLC, with a market cap of £196.16 million, is currently unprofitable and has seen its losses increase over the past five years. Despite being debt-free and trading below its estimated fair value, the company faces challenges such as significant insider selling recently and an inexperienced management team. Recent board changes include Sangita Shah taking over as interim Independent Non-Executive Chair amid ongoing litigation issues involving former CEO Sara Murray. The company's half-year results reported a net loss of £28.84 million, highlighting financial difficulties despite generating revenue from its electronic tracking devices segment.

- Get an in-depth perspective on Big Technologies' performance by reading our balance sheet health report here.

- Learn about Big Technologies' future growth trajectory here.

Challenger Energy Group (AIM:CEG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Challenger Energy Group PLC is involved in the exploration, development, appraisal, and production of oil and gas properties with a market cap of £32.91 million.

Operations: Challenger Energy Group PLC does not report any specific revenue segments.

Market Cap: £32.91M

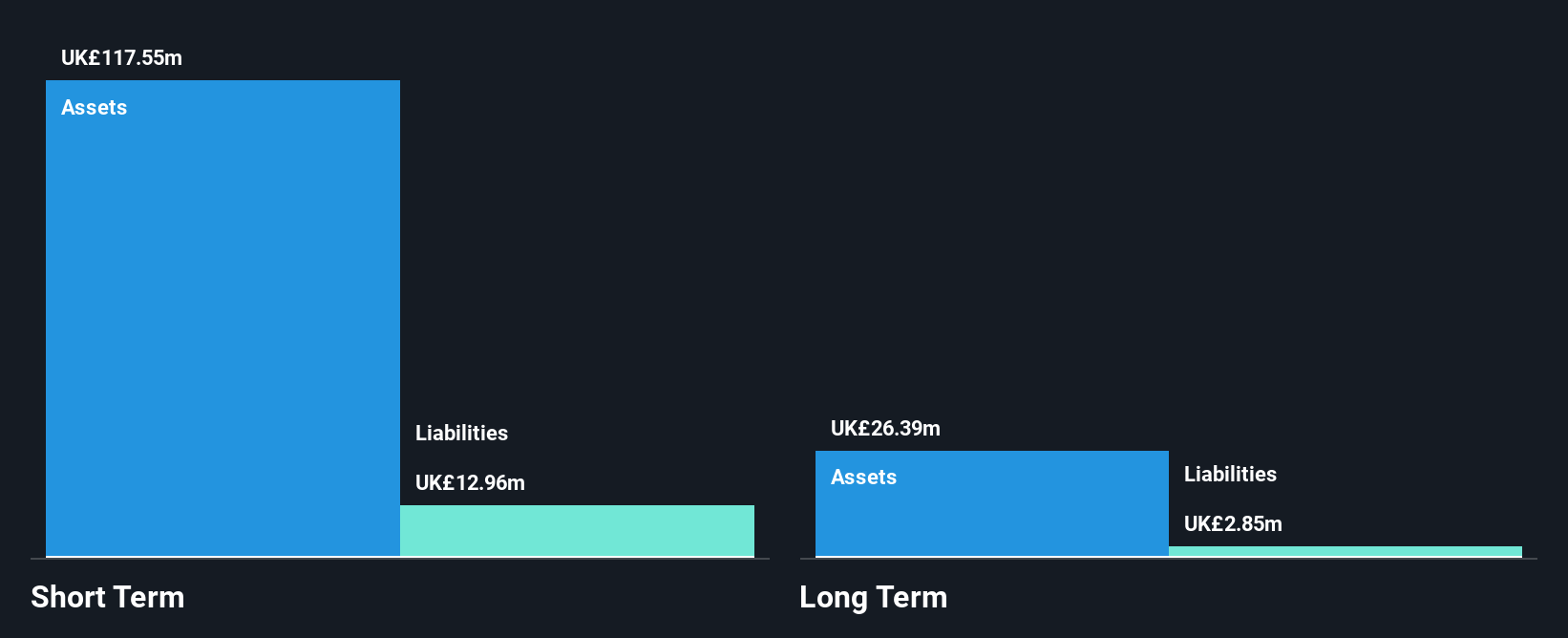

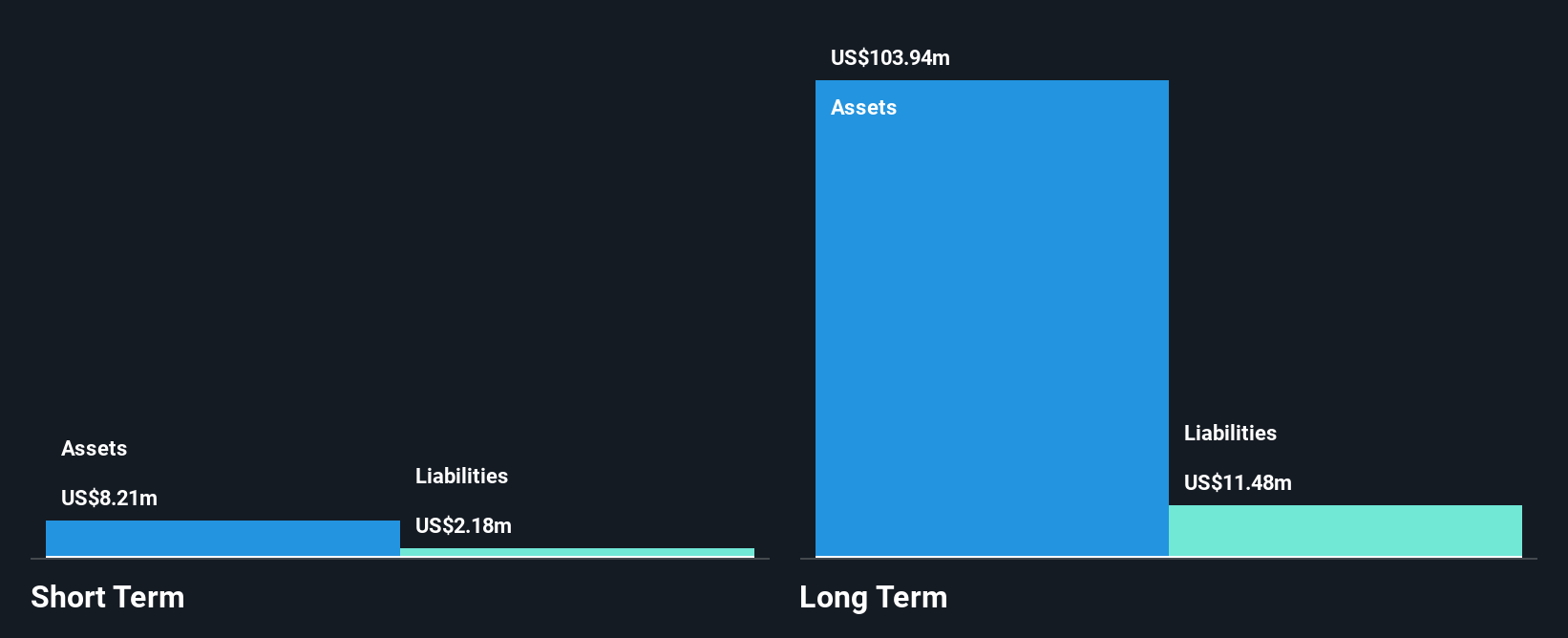

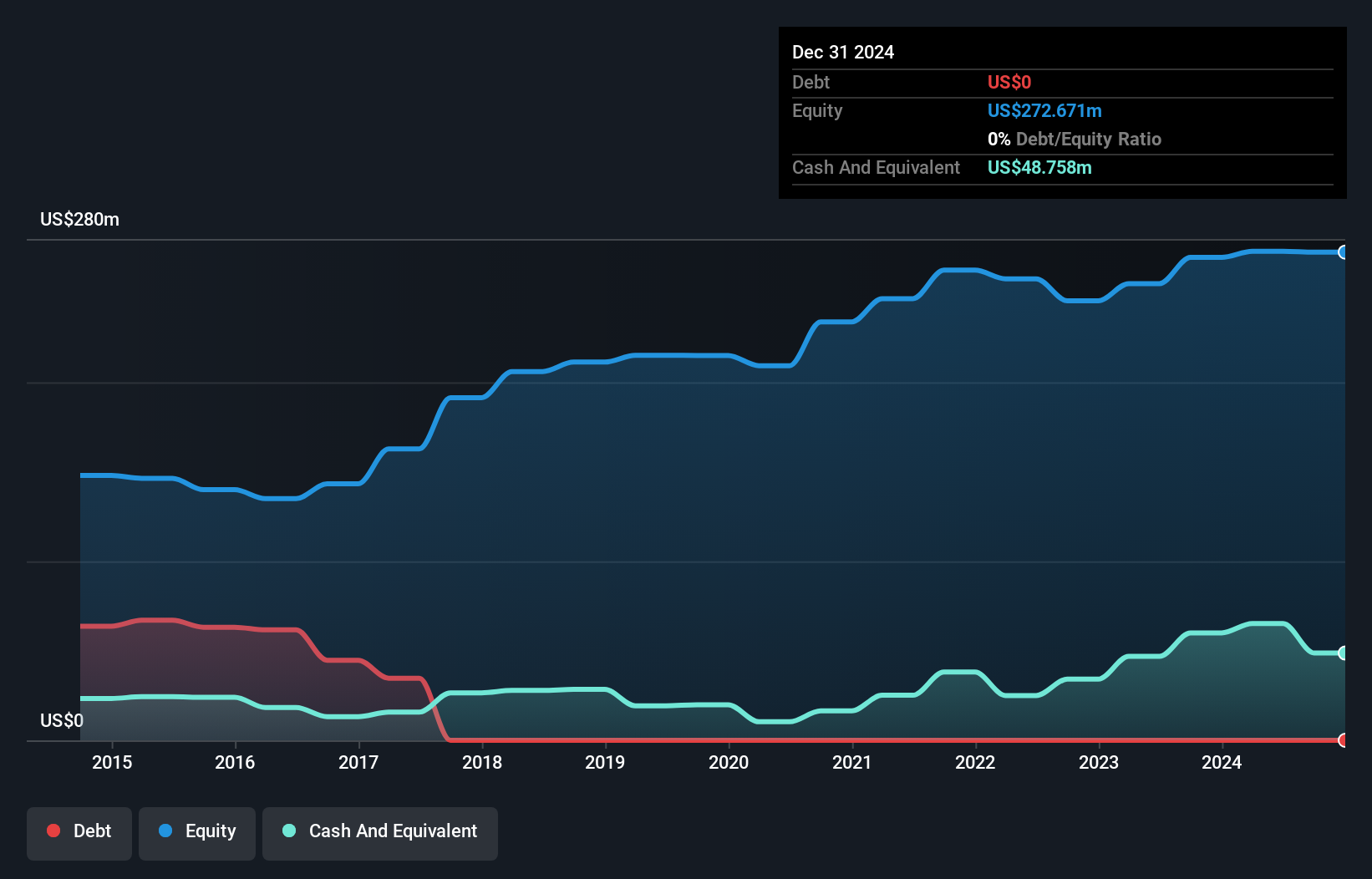

Challenger Energy Group PLC, with a market cap of £32.91 million, is currently pre-revenue and unprofitable but has managed to reduce losses at a rate of 18.2% annually over five years. The company is debt-free, though its short-term assets of $8.2M do not fully cover long-term liabilities of $11.5M, indicating potential financial constraints despite covering short-term obligations. A recent acquisition by Sintana Energy Inc., valued at approximately £44.72 million, offers strategic shifts in leadership and potential synergies post-merger completion expected in December 2025 following shareholder and court approvals.

- Click to explore a detailed breakdown of our findings in Challenger Energy Group's financial health report.

- Review our growth performance report to gain insights into Challenger Energy Group's future.

Griffin Mining (AIM:GFM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and mining of mineral properties, with a market cap of £416.75 million.

Operations: The company's revenue is primarily generated from the Caijiaying Zinc Gold Mine, amounting to $113.09 million.

Market Cap: £416.75M

Griffin Mining Limited, with a market cap of £416.75 million, generates significant revenue from the Caijiaying Zinc Gold Mine, totaling $113.09 million. The company is debt-free, which eliminates concerns about interest coverage and cash flow for debt servicing. Despite stable weekly volatility at 6%, profit margins have declined to 7.8% from last year's 13.2%. Recent buyback activities saw Griffin repurchase shares worth $19.24 million to reduce share capital, reflecting strategic financial management amid regulatory challenges impacting production until year-end 2025 as it prepares for new ore extraction in early 2026.

- Navigate through the intricacies of Griffin Mining with our comprehensive balance sheet health report here.

- Evaluate Griffin Mining's prospects by accessing our earnings growth report.

Seize The Opportunity

- Click here to access our complete index of 306 UK Penny Stocks.

- Ready To Venture Into Other Investment Styles? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CEG

Challenger Energy Group

Engages in the exploration, development, appraisal, and production of oil and gas properties.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)