- United States

- /

- Software

- /

- NasdaqGS:WDAY

August 2025's Stock Selections With Estimated Undervaluations

Reviewed by Simply Wall St

As the U.S. stock market faces a period of volatility with major indices like the S&P 500 experiencing consecutive declines, investors are closely monitoring Federal Reserve Chair Jerome Powell's upcoming speech for insights on future interest rate policies. Amidst these uncertain conditions, identifying undervalued stocks can be a strategic approach for investors looking to capitalize on potential opportunities; such stocks often offer strong fundamentals at prices that may not fully reflect their intrinsic value in the current market environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $115.19 | $225.65 | 49% |

| Udemy (UDMY) | $6.78 | $13.22 | 48.7% |

| StoneCo (STNE) | $14.83 | $28.88 | 48.6% |

| Niagen Bioscience (NAGE) | $9.77 | $18.91 | 48.3% |

| Lyft (LYFT) | $15.81 | $30.93 | 48.9% |

| Fiverr International (FVRR) | $23.04 | $45.18 | 49% |

| First Commonwealth Financial (FCF) | $16.86 | $32.97 | 48.9% |

| First Busey (BUSE) | $23.19 | $45.40 | 48.9% |

| e.l.f. Beauty (ELF) | $116.31 | $224.85 | 48.3% |

| Dime Community Bancshares (DCOM) | $28.37 | $56.37 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

Datadog (DDOG)

Overview: Datadog, Inc. provides an observability and security platform for cloud applications globally, with a market cap of approximately $45.05 billion.

Operations: The company's revenue primarily comes from its IT Infrastructure segment, which generated $3.02 billion.

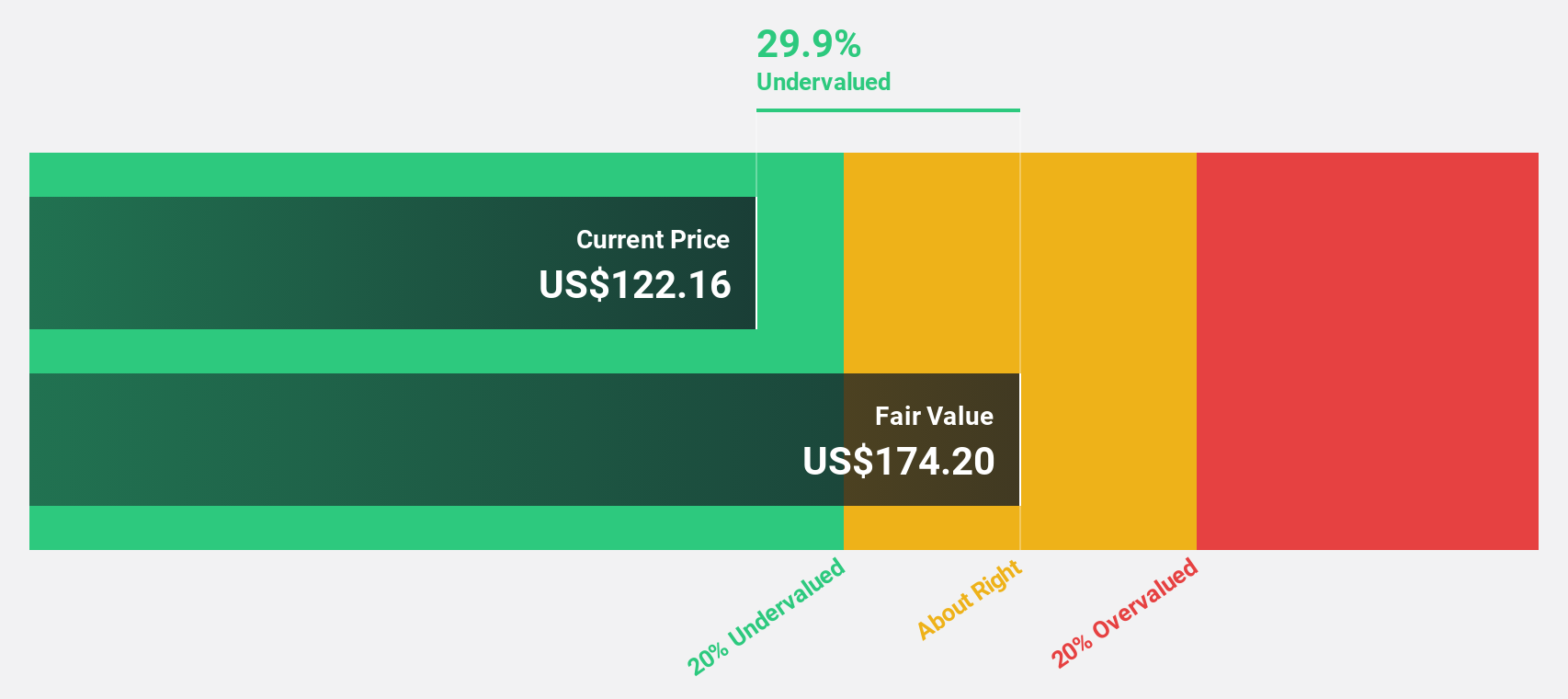

Estimated Discount To Fair Value: 26.1%

Datadog's current trading price of US$129.15 is significantly below its estimated fair value of US$174.86, suggesting potential undervaluation based on discounted cash flows. Despite lower profit margins compared to the previous year, earnings are forecast to grow substantially at 34.2% annually, outpacing the broader US market's growth expectations. Recent insider selling and a drop in net income from US$43.82 million to US$2.65 million raise caution; however, revenue growth remains robust with forecasts exceeding market averages.

- Our growth report here indicates Datadog may be poised for an improving outlook.

- Navigate through the intricacies of Datadog with our comprehensive financial health report here.

Workday (WDAY)

Overview: Workday, Inc. offers enterprise cloud applications globally and has a market cap of approximately $60.71 billion.

Operations: The company's revenue primarily comes from its cloud applications segment, which generated $8.70 billion.

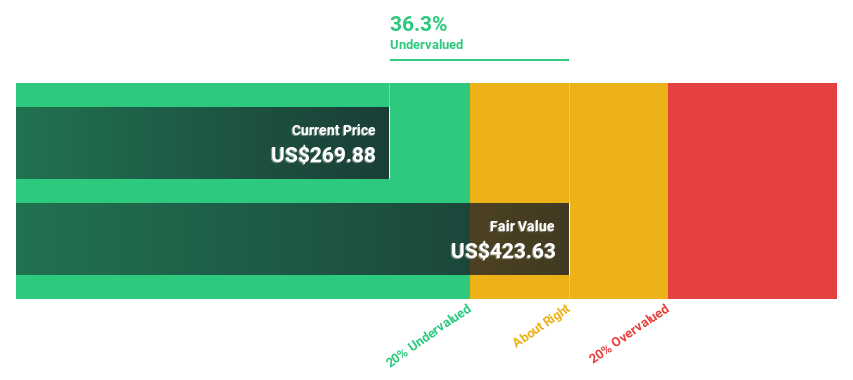

Estimated Discount To Fair Value: 31.3%

Workday's trading price of US$227.58 is notably under its fair value estimate of US$331.12, indicating potential undervaluation based on discounted cash flows. The company's earnings are expected to grow significantly at 29.9% per year, surpassing the US market average growth rate. Recent earnings reports show strong revenue growth from US$2.09 billion to US$2.35 billion year-over-year, though profit margins have declined from 19.7% to 5.6%.

- The growth report we've compiled suggests that Workday's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Workday.

Tapestry (TPR)

Overview: Tapestry, Inc. is a company that offers accessories and lifestyle brand products across North America, Greater China, the rest of Asia, and internationally, with a market cap of approximately $20.58 billion.

Operations: The company's revenue is derived from its Coach segment at $5.60 billion, Kate Spade at $1.20 billion, and Stuart Weitzman at $215.10 million.

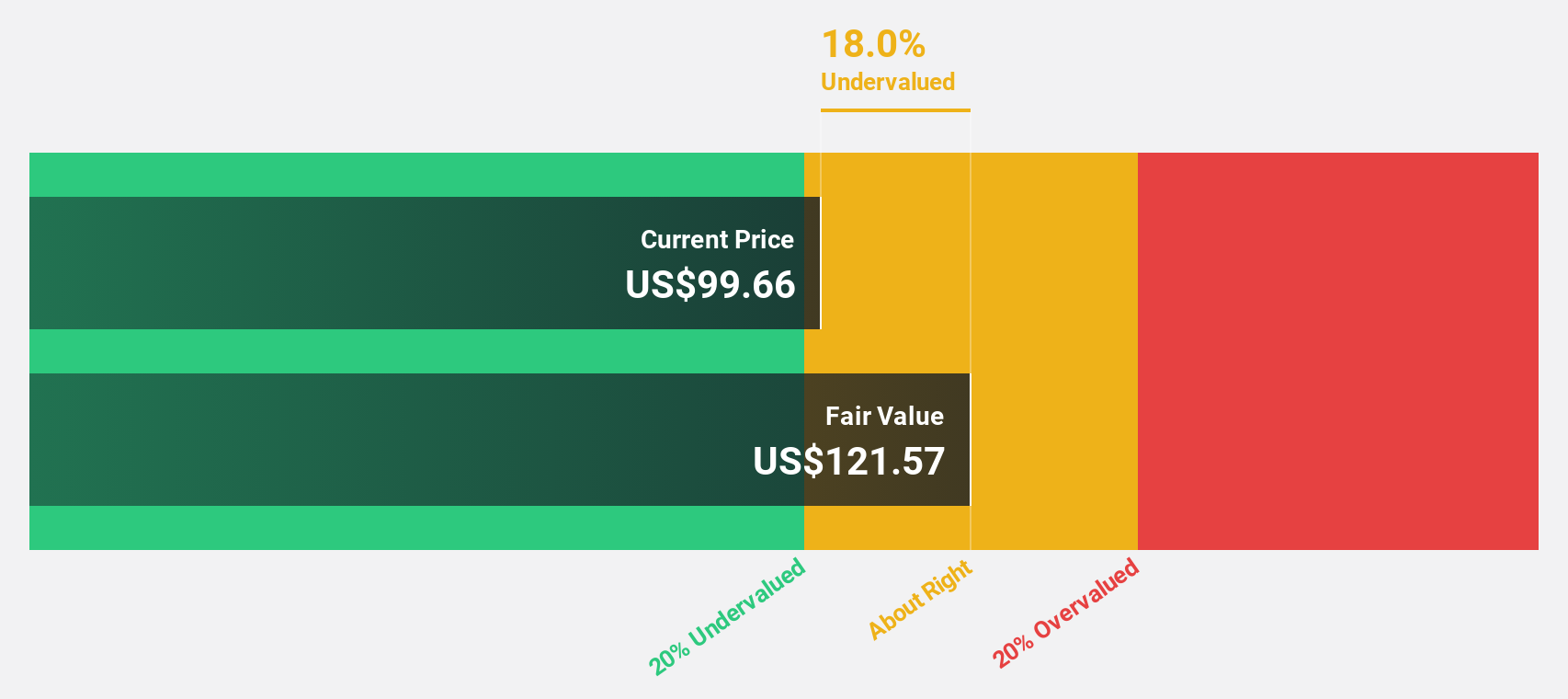

Estimated Discount To Fair Value: 19.1%

Tapestry's current trading price of US$98.39 is below its estimated fair value of US$121.65, suggesting it may be undervalued based on cash flows. Despite reporting a net loss for the recent quarter, Tapestry's earnings are forecast to grow significantly at 25.3% per year, outpacing the broader US market growth rate. The company recently increased its dividend by 14%, reflecting confidence in future cash flow generation despite lower profit margins compared to last year.

- The analysis detailed in our Tapestry growth report hints at robust future financial performance.

- Take a closer look at Tapestry's balance sheet health here in our report.

Turning Ideas Into Actions

- Delve into our full catalog of 199 Undervalued US Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives