- United States

- /

- Software

- /

- NasdaqGS:DDOG

3 Stocks That May Be Undervalued By Up To 49%

Reviewed by Simply Wall St

As U.S. stock indexes, including the Dow, S&P 500, and Nasdaq, continue to reach new all-time highs amid significant partnerships like Nvidia's with OpenAI, investors are keenly observing market dynamics for potential opportunities. In such a robust environment where major indices are soaring, identifying undervalued stocks can be particularly rewarding as these may offer substantial growth potential relative to their current price levels.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TransMedics Group (TMDX) | $125.15 | $245.49 | 49% |

| Pinnacle Financial Partners (PNFP) | $95.18 | $186.59 | 49% |

| Peapack-Gladstone Financial (PGC) | $29.07 | $56.54 | 48.6% |

| Northwest Bancshares (NWBI) | $12.38 | $24.41 | 49.3% |

| Metropolitan Bank Holding (MCB) | $77.50 | $150.26 | 48.4% |

| Investar Holding (ISTR) | $23.14 | $44.73 | 48.3% |

| Horizon Bancorp (HBNC) | $16.27 | $31.77 | 48.8% |

| Alnylam Pharmaceuticals (ALNY) | $458.92 | $902.17 | 49.1% |

| AGNC Investment (AGNC) | $9.72 | $18.82 | 48.4% |

| AbbVie (ABBV) | $222.59 | $441.60 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Rhythm Pharmaceuticals (RYTM)

Overview: Rhythm Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company specializing in treatments for rare neuroendocrine diseases, with a market cap of $6.38 billion.

Operations: The company's revenue segment consists of Pharmaceuticals, generating $156.29 million.

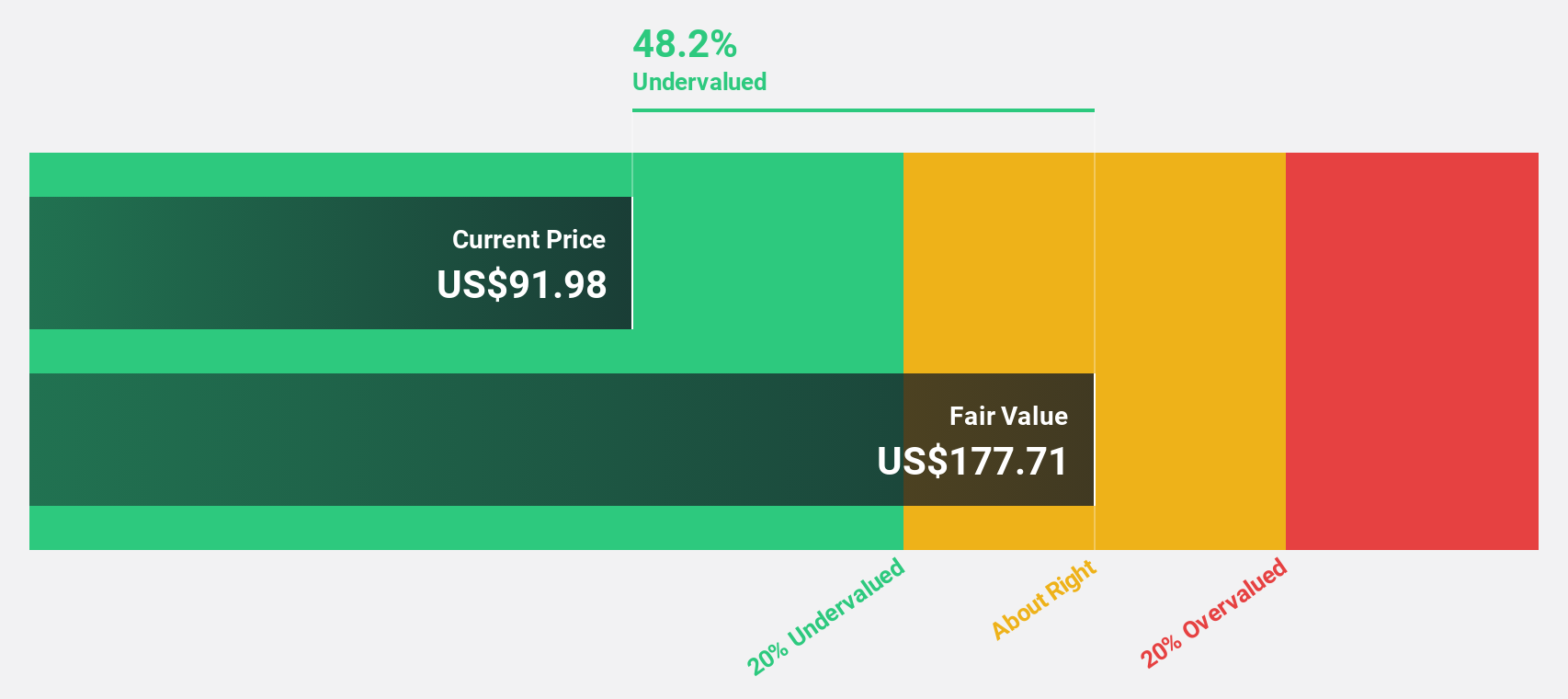

Estimated Discount To Fair Value: 44.3%

Rhythm Pharmaceuticals is trading at US$99, significantly below its estimated fair value of US$177.71, indicating potential undervaluation based on cash flows. The company's revenue is forecast to grow 44% annually, outpacing the broader U.S. market's growth rate of 9.7%. Despite recent net losses, Rhythm expects to achieve profitability within three years. Recent FDA priority review for setmelanotide could enhance future cash flows, although share price volatility remains a concern.

- The analysis detailed in our Rhythm Pharmaceuticals growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Rhythm Pharmaceuticals.

TransMedics Group (TMDX)

Overview: TransMedics Group, Inc. is a commercial-stage medical technology company focused on transforming organ transplant therapy for end-stage organ failure patients both in the United States and internationally, with a market cap of $4.17 billion.

Operations: The company generates revenue of $531.29 million from its Surgical & Medical Equipment segment, focusing on advancing organ transplant therapy.

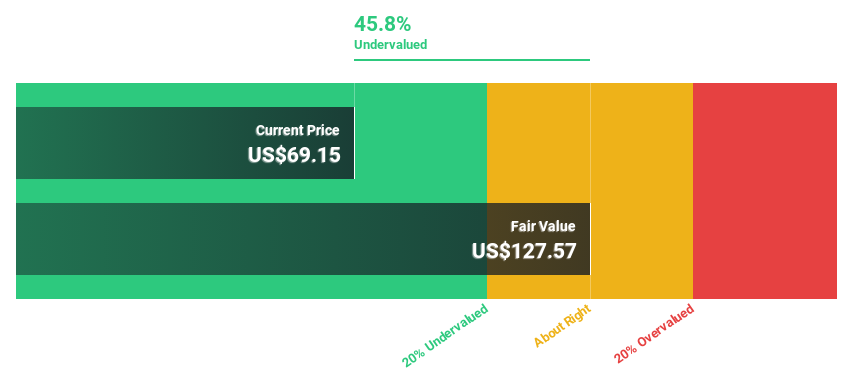

Estimated Discount To Fair Value: 49%

TransMedics Group, trading at US$125.15, is significantly undervalued compared to its estimated fair value of US$245.49. The company has shown robust earnings growth of over 2000% in the past year and expects annual profit growth above 20% for the next three years, surpassing market averages. Recent FDA approval for a major heart trial could bolster future cash flows, while revised revenue guidance indicates strong financial momentum despite potential risks associated with clinical trials.

- Our comprehensive growth report raises the possibility that TransMedics Group is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of TransMedics Group.

Datadog (DDOG)

Overview: Datadog, Inc. operates an observability and security platform for cloud applications worldwide, with a market cap of approximately $48.23 billion.

Operations: The company's revenue primarily comes from its IT Infrastructure segment, which generated $3.02 billion.

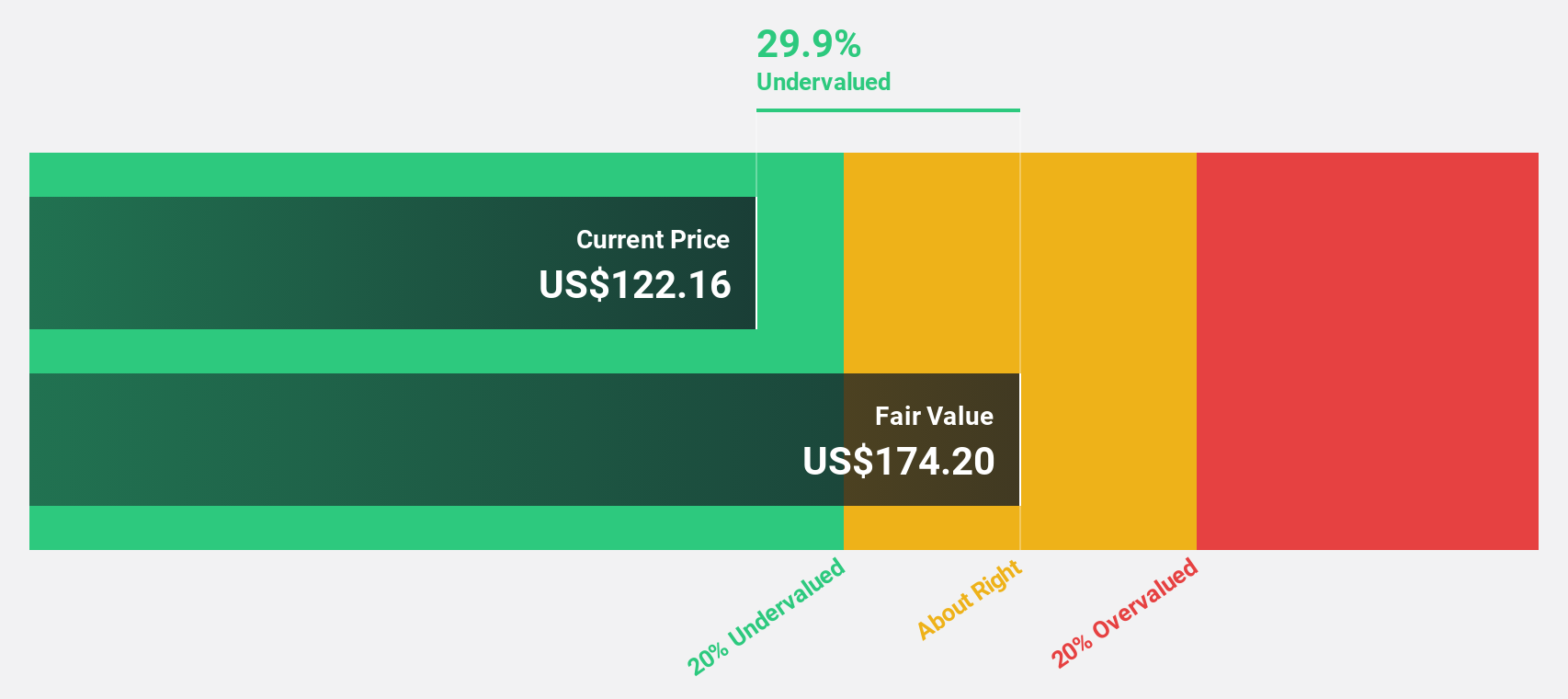

Estimated Discount To Fair Value: 19.9%

Datadog, trading at US$138.35, is undervalued relative to its fair value estimate of US$172.68. Although profit margins have declined from 6.8% to 4.1% over the past year, earnings are forecasted to grow significantly at 33.5% annually, outpacing the broader market's growth rate of 15.5%. Recent developments include a potential acquisition of Upwind Security for up to $1 billion and an expanded board with the appointment of Ami Vora as a director.

- Our expertly prepared growth report on Datadog implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Datadog stock in this financial health report.

Next Steps

- Delve into our full catalog of 194 Undervalued US Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives