- United States

- /

- Consumer Finance

- /

- NYSE:YRD

3 Reliable Dividend Stocks Offering Up To 7.5% Yield

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indices like the Dow Jones and S&P 500 facing setbacks amid economic uncertainties, investors are increasingly turning their attention to dividend stocks for steady income. In such volatile times, reliable dividend stocks offering yields up to 7.5% can provide a cushion against market swings while contributing to a diversified investment strategy.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 6.14% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.80% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.81% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.42% | ★★★★★★ |

| Ennis (EBF) | 5.59% | ★★★★★★ |

| Employers Holdings (EIG) | 3.23% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 4.17% | ★★★★★☆ |

| Dillard's (DDS) | 5.55% | ★★★★★★ |

| CompX International (CIX) | 5.27% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.03% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

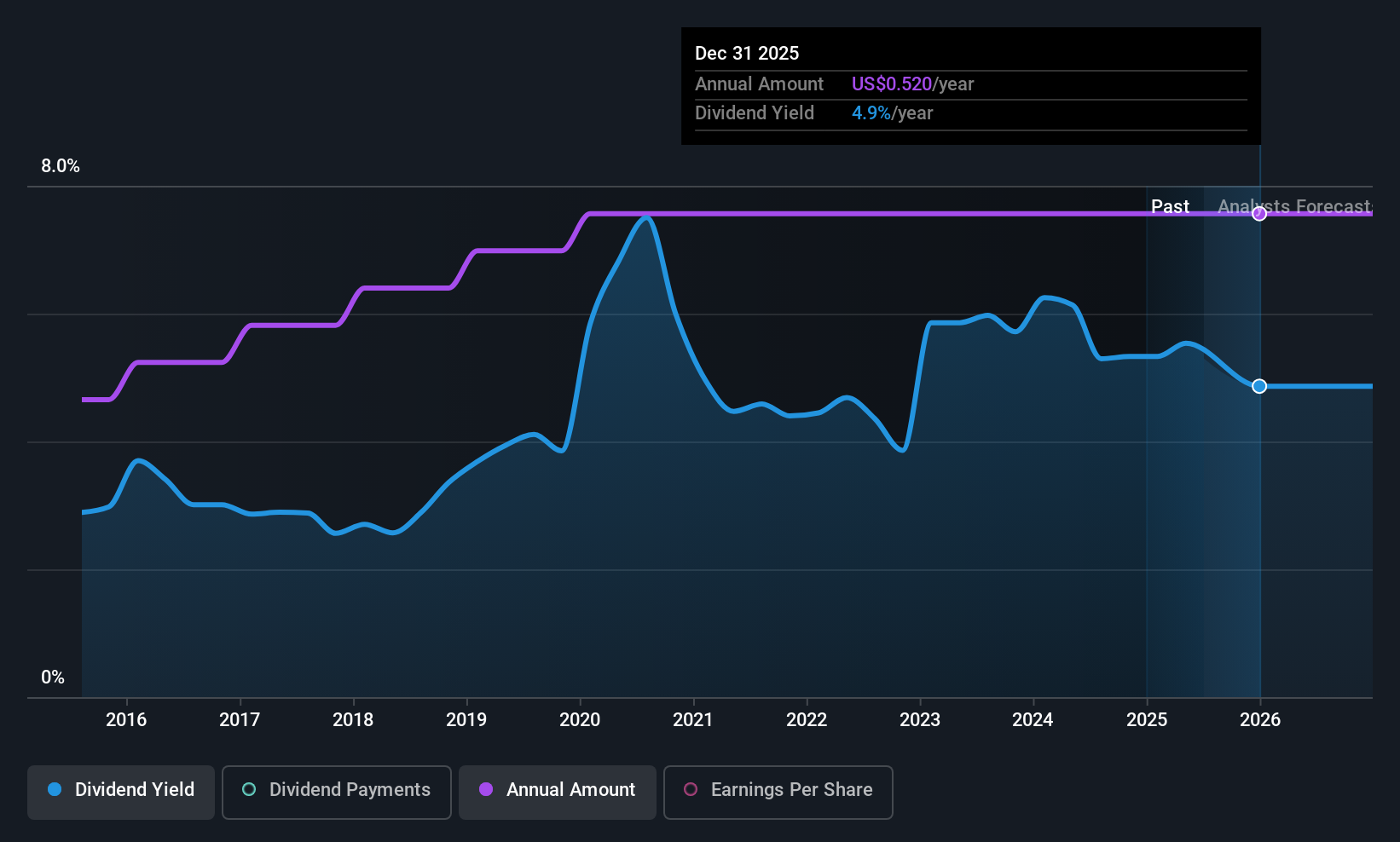

Heritage Commerce (HTBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Heritage Commerce Corp is a bank holding company for Heritage Bank of Commerce, offering commercial and personal banking services in California, with a market cap of $569.76 million.

Operations: Heritage Commerce Corp generates its revenue primarily through providing a range of commercial and personal banking services to individuals and businesses in California.

Dividend Yield: 5.5%

Heritage Commerce recently affirmed a quarterly dividend of US$0.13 per share, maintaining its reputation for stable and reliable payouts over the past decade. The company's dividend yield is among the top 25% in the U.S., although recent earnings showed a decline in net income to US$6.39 million from US$9.23 million year-over-year, affecting overall profitability. Leadership changes with Seth Fonti as CFO may influence future strategic direction and financial performance positively.

- Take a closer look at Heritage Commerce's potential here in our dividend report.

- The analysis detailed in our Heritage Commerce valuation report hints at an inflated share price compared to its estimated value.

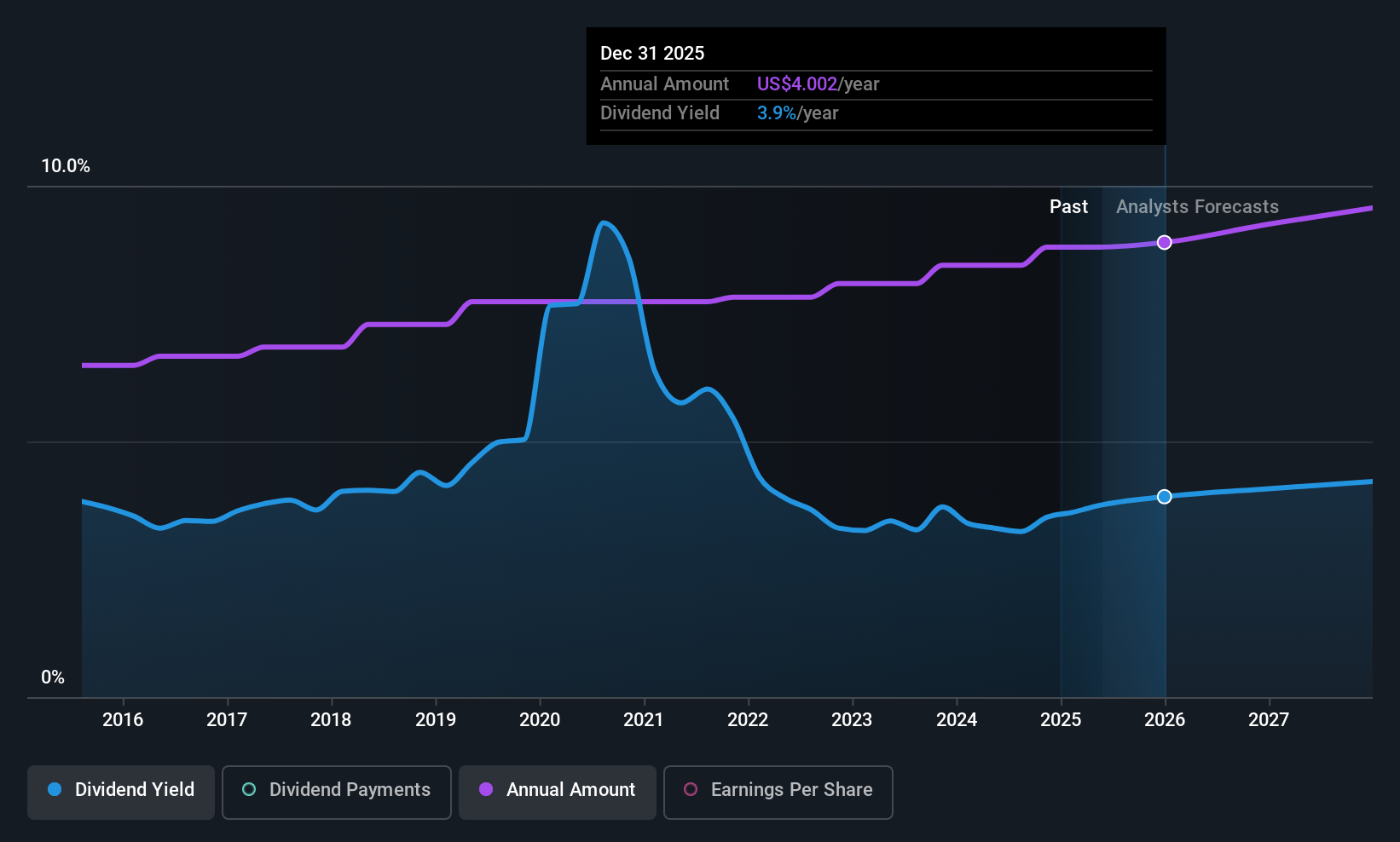

Exxon Mobil (XOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exxon Mobil Corporation is involved in the exploration and production of crude oil and natural gas across various regions including the United States, Canada, the United Kingdom, Singapore, France, and internationally, with a market cap of $467.40 billion.

Operations: Exxon Mobil Corporation's revenue is primarily generated through its operations in the exploration and production of crude oil and natural gas across multiple regions worldwide.

Dividend Yield: 3.7%

Exxon Mobil maintains a stable and reliable dividend history, with payments growing steadily over the past decade. Despite recent declines in earnings—US$7.08 billion in Q2 2025 compared to US$9.24 billion a year ago—the dividend remains covered by both earnings and cash flows, with payout ratios of 55.5% and 58%, respectively. While its current yield of 3.69% is below top-tier U.S. payers, strategic acquisitions may bolster long-term value creation for shareholders.

- Click here to discover the nuances of Exxon Mobil with our detailed analytical dividend report.

- Our valuation report here indicates Exxon Mobil may be undervalued.

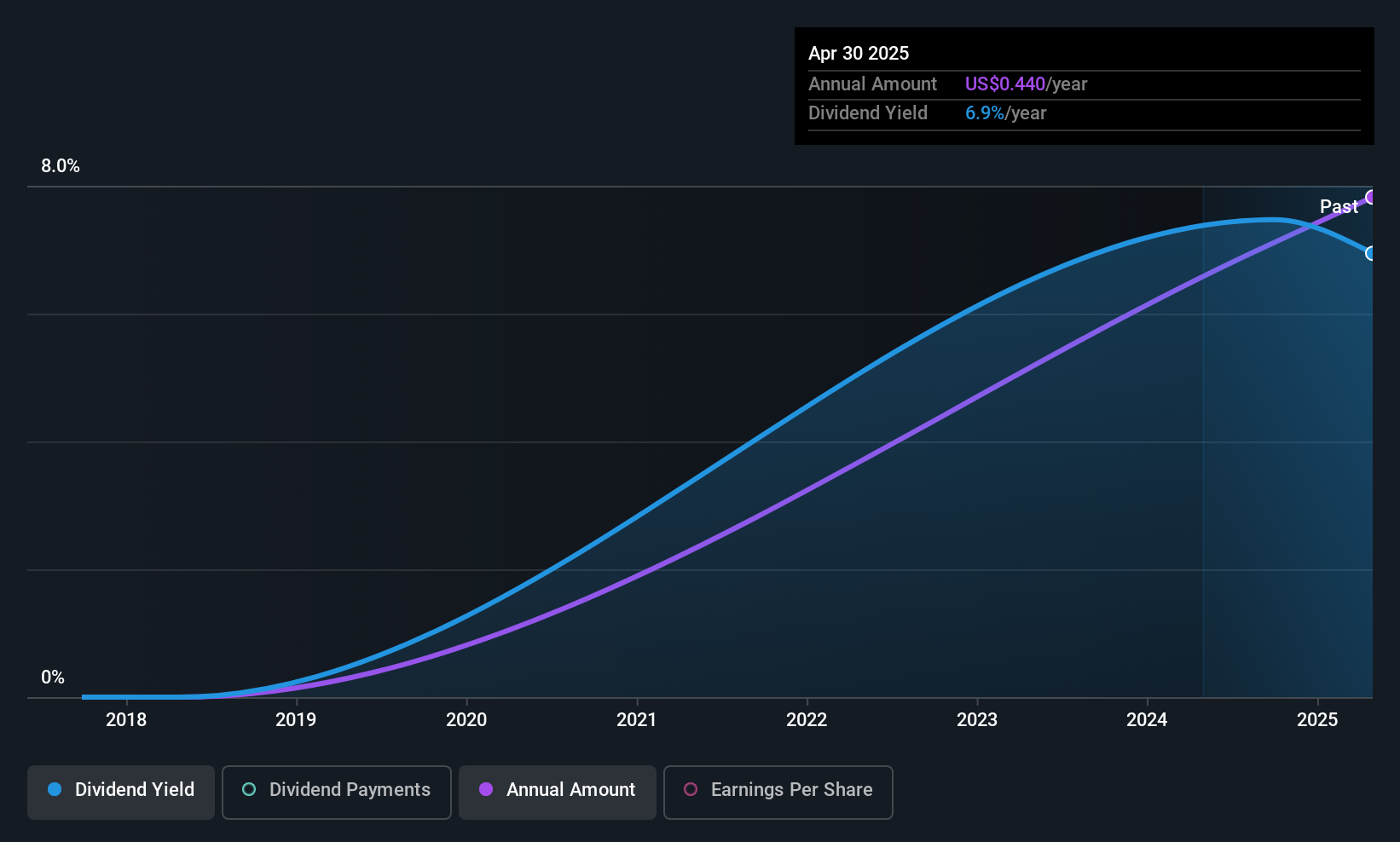

Yiren Digital (YRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yiren Digital Ltd. operates an AI-powered financial services platform in China with a market cap of $490.79 million.

Operations: Yiren Digital Ltd. generates revenue through its Financial Services Business (CN¥3.91 billion) and Insurance Brokerage Business (CN¥354.90 million).

Dividend Yield: 7.6%

Yiren Digital's dividends are well-covered by earnings and cash flows, with payout ratios of 19.7% and 21.6%, respectively. Although the dividend yield of 7.56% ranks in the top quartile among U.S. payers, its reliability remains uncertain due to its recent initiation. The company's Q1 revenue increased to CNY 1,554.53 million, but net income declined year-over-year amid executive changes and strategic market expansion efforts aimed at boosting future growth.

- Unlock comprehensive insights into our analysis of Yiren Digital stock in this dividend report.

- The valuation report we've compiled suggests that Yiren Digital's current price could be quite moderate.

Turning Ideas Into Actions

- Delve into our full catalog of 143 Top US Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YRD

Yiren Digital

Provides financial services through an AI-powered platform in China.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives