- New Zealand

- /

- Banks

- /

- NZSE:HGH

3 Global Penny Stocks With US$600M Market Cap

Reviewed by Simply Wall St

Global markets have been experiencing a mix of optimism and caution, with major U.S. stock indexes advancing amid hopes for an interest rate cut from the Federal Reserve. As investors navigate these changing conditions, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities despite their somewhat outdated designation. With strong financial health, these stocks can defy expectations and present growth potential at lower price points, making them worth exploring for those seeking underappreciated investment avenues.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.67 | MYR356.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.105 | £470.93M | ✅ 5 ⚠️ 0 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.95M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.39 | SGD13.34B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6675 | $388.04M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.205 | MYR315.87M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,588 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Heartland Group Holdings (NZSE:HGH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Heartland Group Holdings Limited, with a market cap of NZ$1.04 billion, operates in New Zealand and Australia offering a range of financial services through its subsidiaries.

Operations: Heartland Group Holdings generates revenue from various segments, including Motor (NZ$56.31 million), Rural (NZ$30.58 million), Business (NZ$9.01 million), Personal Lending (NZ$4.37 million), Reverse Mortgages (NZ$58.33 million), and the Australian Banking Group (NZ$94.80 million).

Market Cap: NZ$1.04B

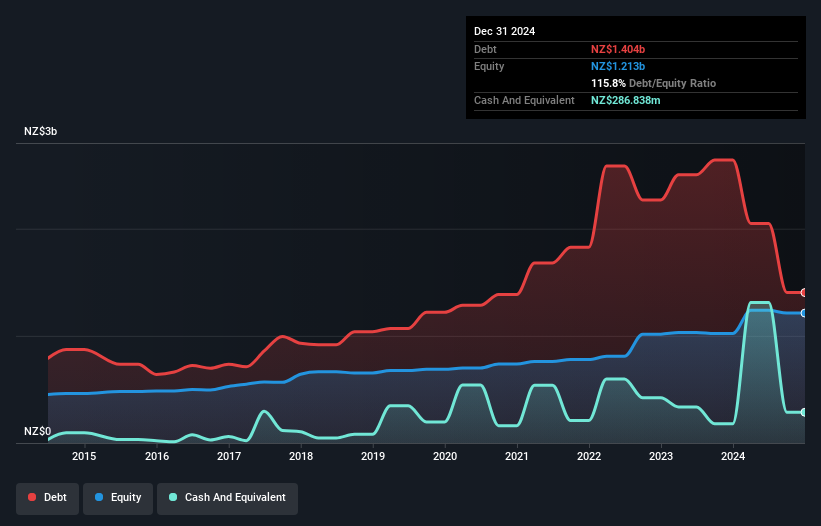

Heartland Group Holdings, with a market cap of NZ$1.04 billion, operates in the financial services sector across New Zealand and Australia. The company maintains an appropriate Loans to Deposits ratio of 108% and has a low Assets to Equity ratio of 7.1x, indicating sound financial management. However, its profit margins have declined to 15.5% from last year's 30.6%, and earnings growth has been negative recently at -47.9%. Despite trading below fair value estimates by 14%, it faces challenges such as high bad loans (2.3%) and low Return on Equity (3.2%). Management's limited experience could impact strategic decisions moving forward.

- Dive into the specifics of Heartland Group Holdings here with our thorough balance sheet health report.

- Examine Heartland Group Holdings' earnings growth report to understand how analysts expect it to perform.

Linmon Media (SEHK:9857)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Linmon Media Limited is an investment holding company involved in the production, distribution, and licensing of drama series broadcasting rights in Mainland China and internationally, with a market cap of HK$1.37 billion.

Operations: The company's revenue primarily comes from Mainland China, with additional contributions from other countries and regions totaling CN¥59.05 million.

Market Cap: HK$1.37B

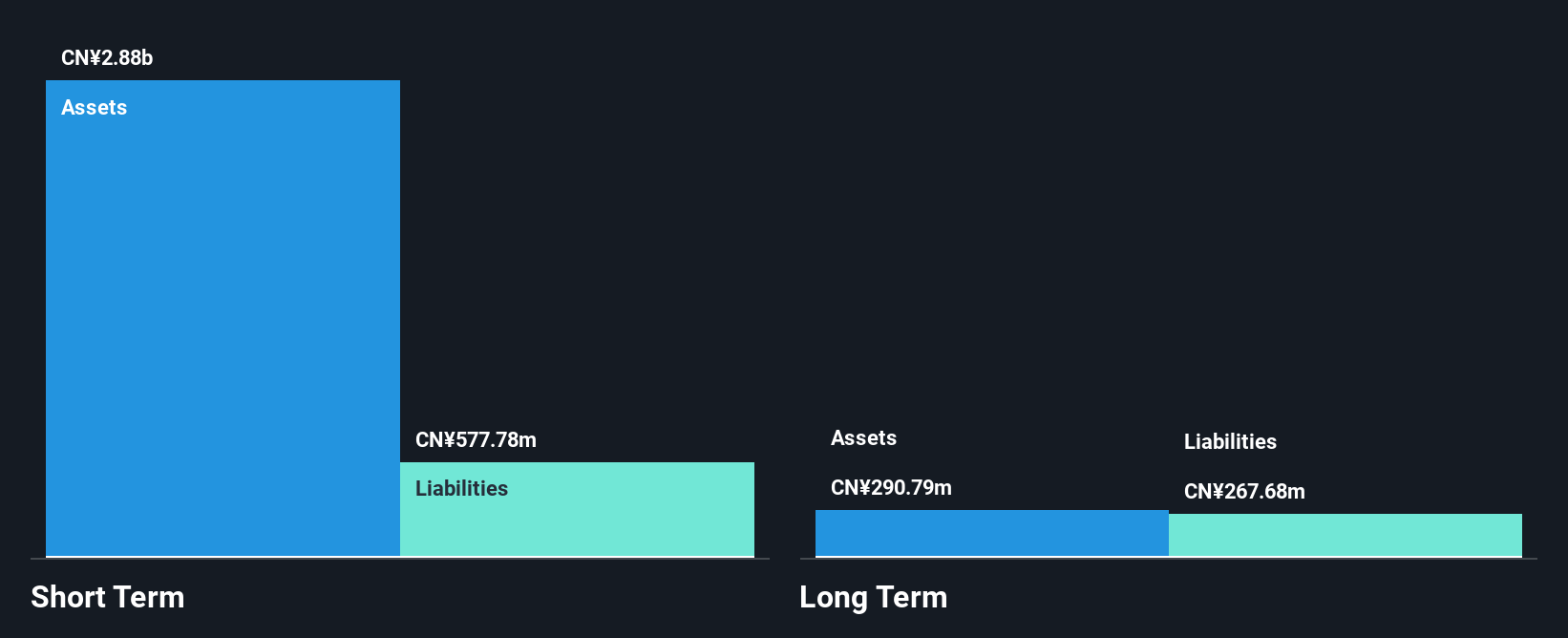

Linmon Media, with a market cap of HK$1.37 billion, is engaged in producing and distributing drama series primarily in Mainland China. The company recently commenced production of "The Showdown," a significant national security-themed project, potentially enhancing its content portfolio. Linmon's financial health appears robust, with short-term assets (CN¥2.9 billion) exceeding both short and long-term liabilities significantly. Although currently unprofitable, the company has more cash than debt and has improved its equity position over five years. Despite negative return on equity (-5.41%), earnings are forecasted to grow substantially at 168.39% annually according to consensus estimates.

- Click to explore a detailed breakdown of our findings in Linmon Media's financial health report.

- Explore Linmon Media's analyst forecasts in our growth report.

Plan B Media (SET:PLANB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Plan B Media Public Company Limited, along with its subsidiaries, offers advertising media production services in Thailand and has a market cap of THB18.86 billion.

Operations: The company generates revenue from two main segments: Advertising Media, contributing THB2.40 billion, and Engagement Marketing, which accounts for THB9.42 billion.

Market Cap: THB18.86B

Plan B Media, with a market cap of THB18.86 billion, has demonstrated stable financial performance despite recent revenue declines. The company reported third-quarter revenue of THB2.35 billion and net income of THB290.38 million, reflecting slight growth in profit margins to 11.5%. With no debt and strong asset coverage for liabilities, Plan B's financial health is solid. Its earnings have grown significantly over five years at 39.8% annually, outperforming the media industry average last year despite slower recent growth (5.7%). Analysts anticipate future earnings growth and potential stock price appreciation by 64%, while dividends remain inconsistent yet recently affirmed at THB0.1674 per share for 2025.

- Get an in-depth perspective on Plan B Media's performance by reading our balance sheet health report here.

- Evaluate Plan B Media's prospects by accessing our earnings growth report.

Make It Happen

- Investigate our full lineup of 3,588 Global Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Heartland Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:HGH

Heartland Group Holdings

Provides various financial services in New Zealand and Australia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026