- United States

- /

- Banks

- /

- NasdaqCM:CZNC

3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

The United States market has been flat over the last week, but it is up 9.9% over the past year with earnings forecast to grow by 15% annually. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for investors seeking stability and returns in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.56% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.13% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.94% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 7.17% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Dillard's (DDS) | 6.52% | ★★★★★★ |

| Credicorp (BAP) | 5.11% | ★★★★★☆ |

| CompX International (CIX) | 5.04% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.46% | ★★★★★★ |

| Citizens & Northern (CZNC) | 6.03% | ★★★★★☆ |

Click here to see the full list of 153 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

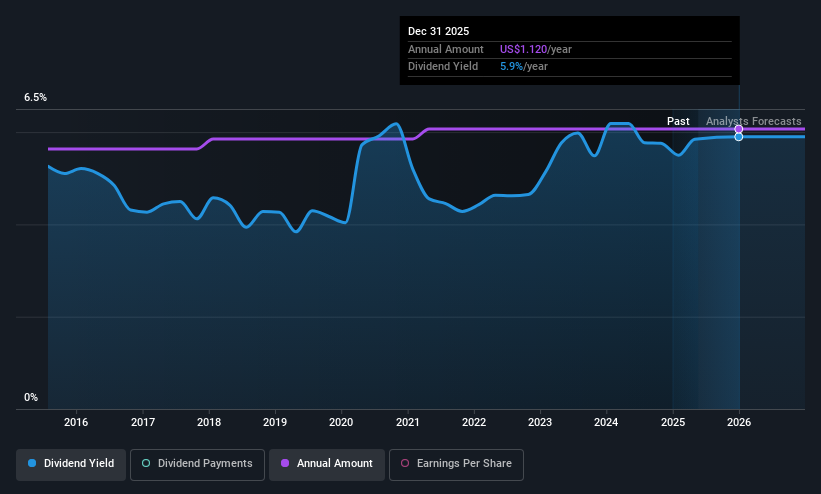

Citizens & Northern (CZNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens & Northern Corporation is the bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate customers, with a market cap of $283.09 million.

Operations: Citizens & Northern Corporation generates revenue primarily from its Community Banking segment, which accounts for $108.11 million.

Dividend Yield: 6%

Citizens & Northern offers a stable dividend profile with a payout ratio of 64.1%, ensuring coverage by earnings. Its dividend yield of 6.03% ranks in the top quartile among U.S. dividend payers, and payments have been consistent over the past decade, growing steadily without volatility. Recent earnings growth supports this reliability, with net income rising to US$6.29 million in Q1 2025 from US$5.31 million a year prior, reinforcing its appeal for income-focused investors amidst its recent merger developments.

- Get an in-depth perspective on Citizens & Northern's performance by reading our dividend report here.

- Our valuation report unveils the possibility Citizens & Northern's shares may be trading at a discount.

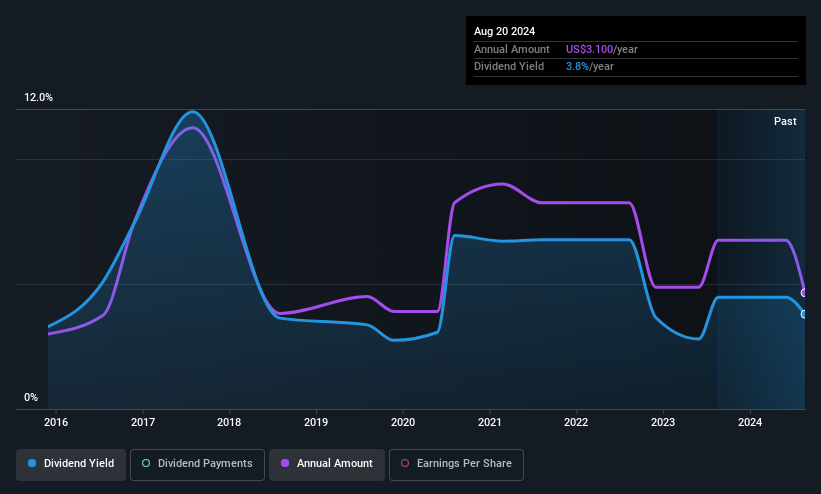

John B. Sanfilippo & Son (JBSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: John B. Sanfilippo & Son, Inc., with a market cap of $731.63 million, operates through its subsidiary JBSS Ventures, LLC to process and distribute tree nuts and peanuts in the United States.

Operations: John B. Sanfilippo & Son, Inc. generates its revenue primarily from selling various nut and nut-related products, amounting to $1.11 billion.

Dividend Yield: 4.9%

John B. Sanfilippo & Son's dividend yield of 4.94% is among the top 25% in the U.S., but its sustainability is questionable due to lack of free cash flow coverage, despite a low payout ratio of 17.9%. Dividend payments have been volatile over the past decade, though they have increased overall. Recent earnings showed improved net income for Q3 2025 at US$20.15 million, highlighting potential for dividend growth amidst fluctuating sales figures.

- Dive into the specifics of John B. Sanfilippo & Son here with our thorough dividend report.

- The analysis detailed in our John B. Sanfilippo & Son valuation report hints at an deflated share price compared to its estimated value.

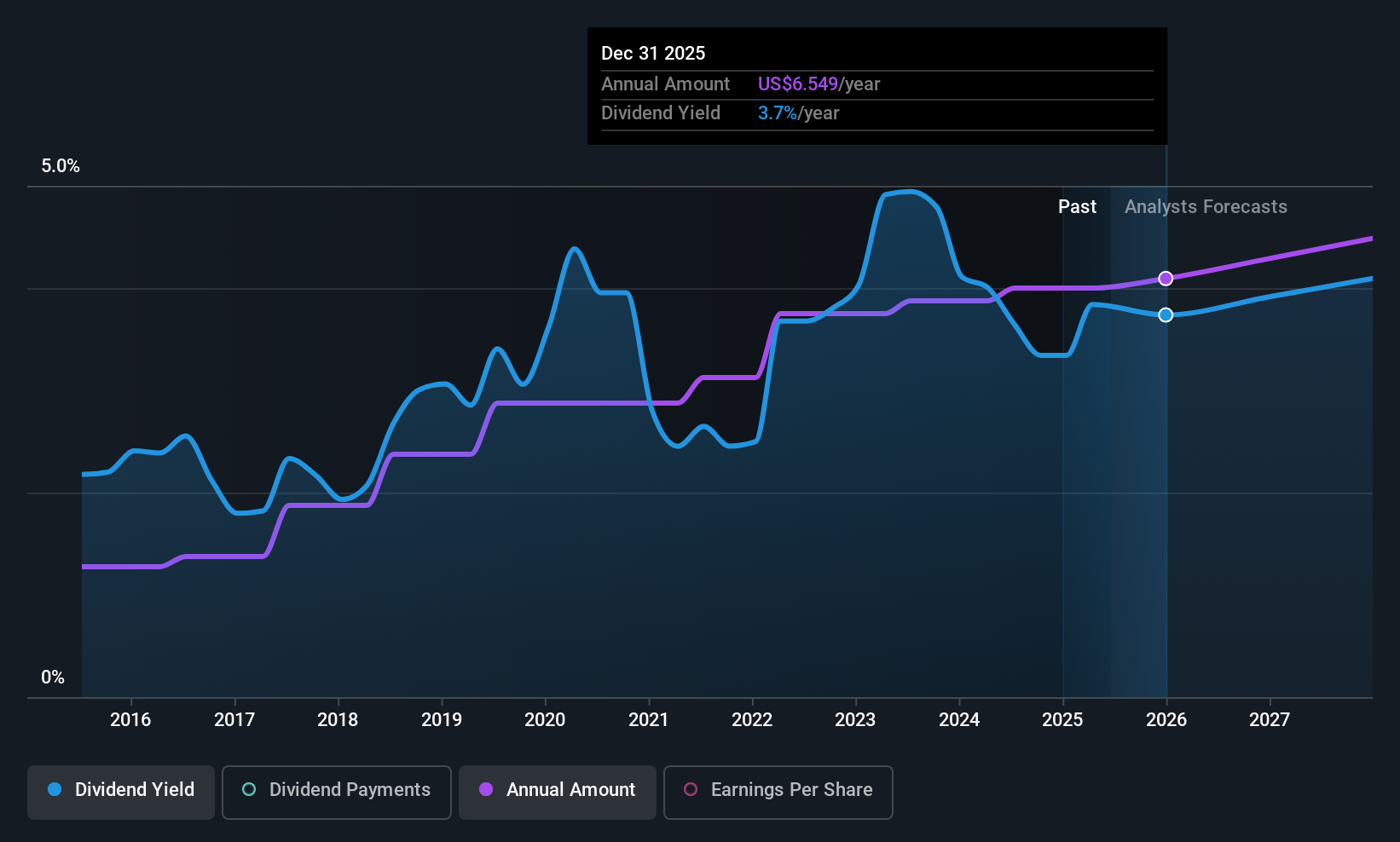

PNC Financial Services Group (PNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The PNC Financial Services Group, Inc. is a diversified financial services company operating in the United States with a market cap of approximately $68.51 billion.

Operations: PNC Financial Services Group generates revenue through its Asset Management Group ($1.64 billion), Corporate & Institutional Banking ($9.97 billion), and Retail Banking including Residential Mortgage ($14.25 billion) segments.

Dividend Yield: 3.7%

PNC Financial Services Group offers a stable dividend yield of 3.65%, supported by a low payout ratio of 44.7%, ensuring sustainability. Dividends have grown consistently over the past decade, and are forecast to remain well-covered in three years at a 41.2% payout ratio. PNC trades at 47.1% below its estimated fair value, enhancing its appeal as an investment option despite recent insider selling and debt financing activities amounting to US$1 billion redemption in June 2025.

- Take a closer look at PNC Financial Services Group's potential here in our dividend report.

- The valuation report we've compiled suggests that PNC Financial Services Group's current price could be quite moderate.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 150 Top US Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZNC

Citizens & Northern

Operates as the bank holding company for Citizens & Northern Bank that provides various banking and related services to individual and corporate customers.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)