- United States

- /

- Chemicals

- /

- NasdaqCM:ASPI

3 Companies That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed performance amid significant economic events, such as trade discussions between President Trump and China's Xi Jinping and earnings reports from major tech companies, investors are keenly observing how these factors influence market indices like the Dow Jones, Nasdaq, and S&P 500. In this environment of fluctuating indices and evolving monetary policies, identifying stocks that may be trading below their estimated value becomes crucial for those looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $32.58 | $64.47 | 49.5% |

| Tenable Holdings (TENB) | $28.64 | $56.63 | 49.4% |

| NeuroPace (NPCE) | $10.13 | $19.72 | 48.6% |

| NBT Bancorp (NBTB) | $39.905 | $78.43 | 49.1% |

| Enovix (ENVX) | $11.77 | $22.82 | 48.4% |

| e.l.f. Beauty (ELF) | $126.99 | $251.46 | 49.5% |

| Eagle Bancorp (EGBN) | $16.66 | $33.24 | 49.9% |

| Compass (COMP) | $7.61 | $15.20 | 49.9% |

| Beacon Financial (BBT) | $23.12 | $44.76 | 48.3% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.24 | $38.00 | 49.4% |

We'll examine a selection from our screener results.

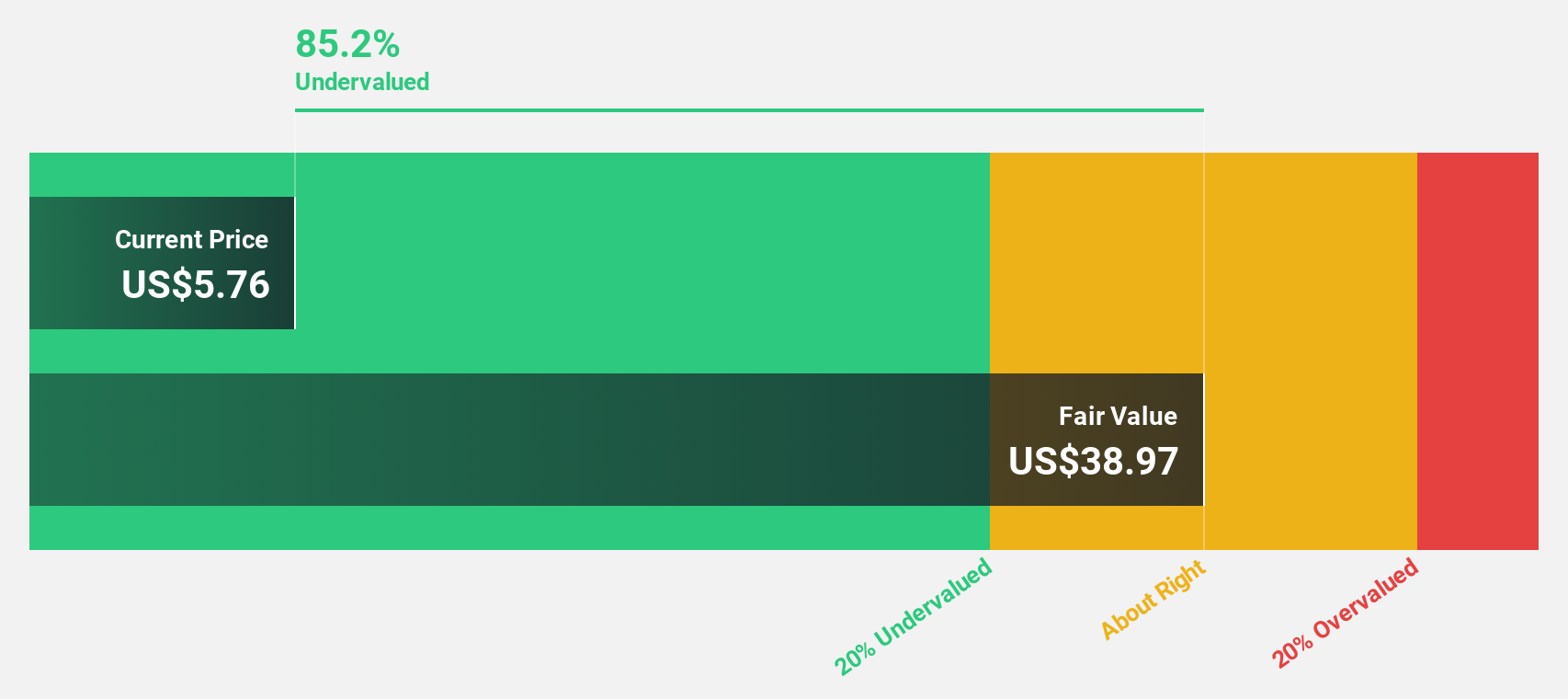

ASP Isotopes (ASPI)

Overview: ASP Isotopes Inc. is a development stage advanced materials company focused on the production, distribution, marketing, and sale of isotopes, with a market cap of $1.15 billion.

Operations: The company's revenue primarily comes from its Specialist Isotopes and Related Services segment, which generated $4.38 million.

Estimated Discount To Fair Value: 47.2%

ASP Isotopes appears undervalued with its stock trading significantly below estimated fair value, despite high expected revenue growth of 62.1% annually. Recent strategic moves, including a $210.3 million equity offering and a major supply agreement for enriched silicon-28, could bolster cash flows. However, the company faces challenges such as substantial insider selling and shareholder dilution over the past year, alongside volatility in share price and significant net losses reported recently.

- The growth report we've compiled suggests that ASP Isotopes' future prospects could be on the up.

- Take a closer look at ASP Isotopes' balance sheet health here in our report.

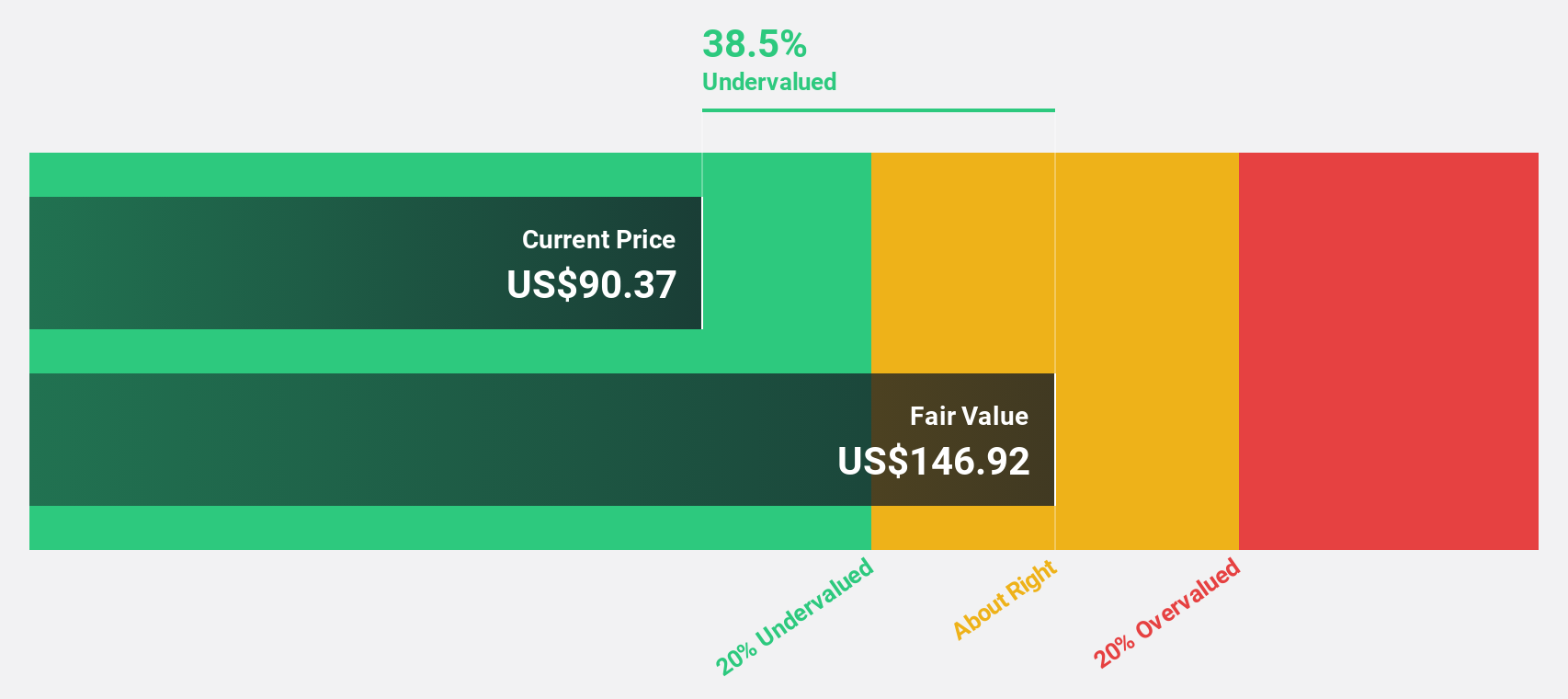

Crocs (CROX)

Overview: Crocs, Inc., along with its subsidiaries, is involved in the design, development, manufacturing, marketing, distribution, and sale of casual lifestyle footwear and accessories under the Crocs and HEYDUDE brands for men, women, and children globally; it has a market cap of approximately $4.74 billion.

Operations: The company's revenue is primarily derived from the Crocs Brand, contributing $3.34 billion, and the Heydude Brand, which adds $797.32 million.

Estimated Discount To Fair Value: 40.5%

Crocs is trading at US$84.69, significantly below its estimated fair value of US$142.28, suggesting it may be undervalued based on cash flows. Despite a forecasted revenue decline of 0.9% annually over the next three years, earnings are expected to grow significantly at 64.7% per year, outpacing the broader US market's growth rate of 15.7%. However, recent corporate guidance indicates an anticipated revenue decrease in Q4 2025 and high debt levels remain a concern.

- Insights from our recent growth report point to a promising forecast for Crocs' business outlook.

- Click to explore a detailed breakdown of our findings in Crocs' balance sheet health report.

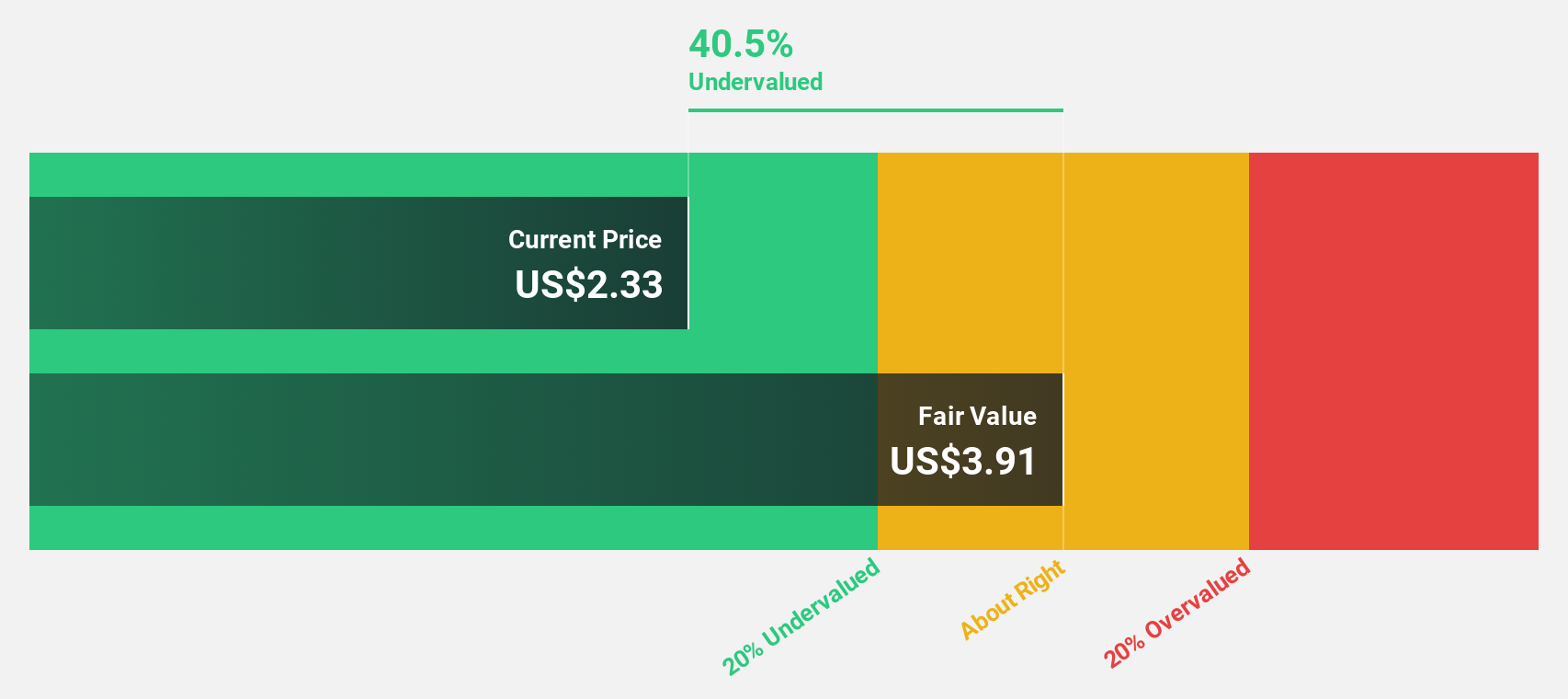

RLX Technology (RLX)

Overview: RLX Technology Inc. develops, manufactures, and sells e-vapor products in China and internationally, with a market cap of approximately $2.95 billion.

Operations: The company generates revenue from its Personal Products segment, amounting to CN¥2.92 billion.

Estimated Discount To Fair Value: 38.9%

RLX Technology, trading at US$2.39, is valued below its estimated fair value of US$3.91, indicating potential undervaluation based on cash flows. Recent earnings show significant growth with net income increasing to CNY 217.12 million for Q2 2025 from CNY 132.31 million a year ago. Forecasts suggest revenue will grow at 24% annually, surpassing the broader market's growth rate of 10.2%, although return on equity remains low at an anticipated 7.6%.

- Our earnings growth report unveils the potential for significant increases in RLX Technology's future results.

- Click here to discover the nuances of RLX Technology with our detailed financial health report.

Next Steps

- Investigate our full lineup of 179 Undervalued US Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASPI

ASP Isotopes

A development stage advanced materials company, engages in the production, distribution, marketing, and sale of isotopes.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)