- Australia

- /

- Consumer Durables

- /

- ASX:FWD

3 ASX Penny Stocks With Market Caps Under A$1B To Watch

Reviewed by Simply Wall St

As Australian shares continue their upward trend, buoyed by positive movements in U.S. markets and speculation of a potential Fed rate cut, investors are keeping a keen eye on emerging opportunities. Penny stocks, often representing smaller or newer companies, may seem like a throwback to earlier market days but remain relevant for those seeking affordable entry points with growth potential. In this article, we explore three penny stocks that stand out for their financial strength and potential to thrive in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Dusk Group (ASX:DSK) | A$0.83 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.99 | A$459.53M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.62 | A$267.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.046 | A$53.81M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.066 | A$34.76M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| SKS Technologies Group (ASX:SKS) | A$3.80 | A$435.89M | ✅ 3 ⚠️ 1 View Analysis > |

| Service Stream (ASX:SSM) | A$2.19 | A$1.34B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.73 | A$252.75M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.5M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 412 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Fleetwood (ASX:FWD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fleetwood Limited, with a market cap of A$252.75 million, operates in Australia and New Zealand where it designs, manufactures, sells, and installs modular accommodation and buildings.

Operations: Fleetwood generates revenue from three primary segments: Building Solutions (A$356.21 million), Community Solutions (A$76.87 million), and RV Solutions (A$70.61 million).

Market Cap: A$252.75M

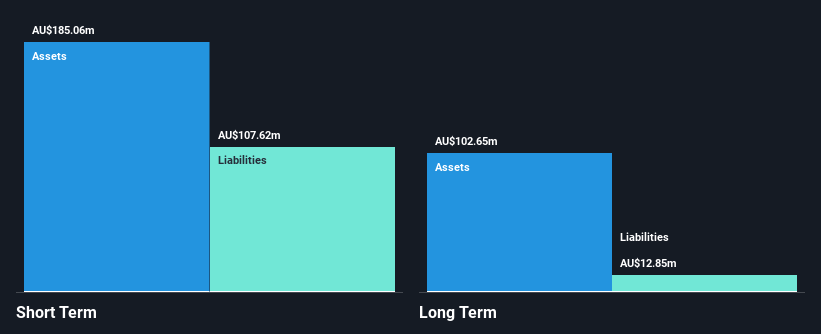

Fleetwood Limited, with a market cap of A$252.75 million, has shown significant earnings growth, reporting net income of A$14.56 million for the year ending June 30, 2025, up from A$3.79 million the previous year. Despite a large one-off loss impacting its recent financials and a low return on equity at 8.8%, Fleetwood remains debt-free and has not diluted shareholders recently. The company’s short-term assets comfortably cover both short-term and long-term liabilities. Additionally, Fleetwood was added to the S&P Global BMI Index in September 2025, highlighting its growing market recognition.

- Take a closer look at Fleetwood's potential here in our financial health report.

- Gain insights into Fleetwood's future direction by reviewing our growth report.

IVE Group (ASX:IGL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IVE Group Limited, along with its subsidiaries, operates in the marketing sector in Australia and has a market capitalization of A$459.53 million.

Operations: The company generates revenue of A$959.25 million from its advertising segment.

Market Cap: A$459.53M

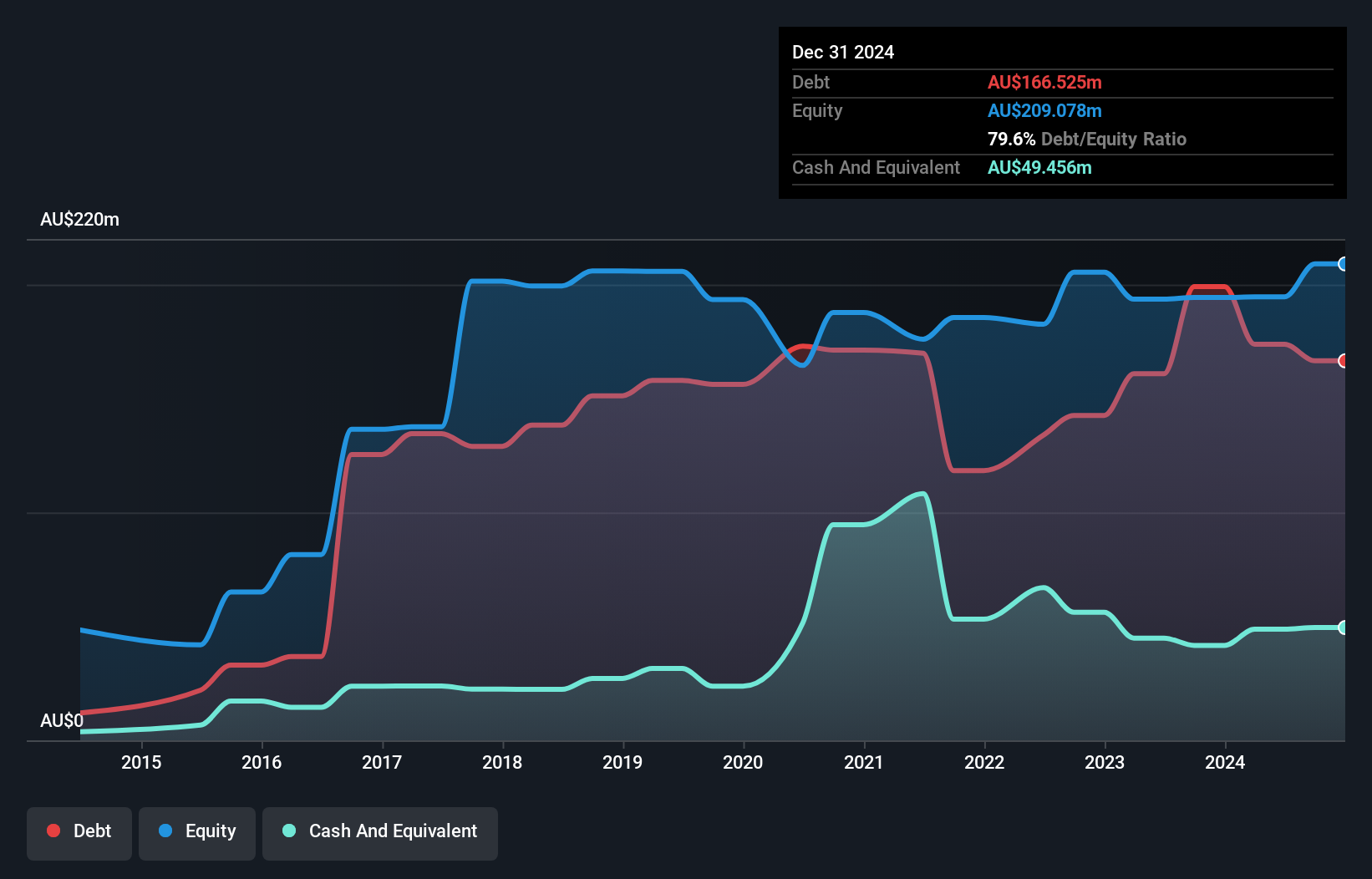

IVE Group Limited, with a market cap of A$459.53 million, demonstrates robust financial health and growth potential despite being a penny stock. The company reported notable earnings growth of 69.2% over the past year, with net income rising to A$46.71 million from A$27.61 million previously. Its return on equity is high at 22%, and it maintains well-covered interest payments by EBIT at 5.1x coverage, though its net debt to equity ratio remains elevated at 51.7%. Recent strategic moves include share buybacks and exploring acquisitions in sectors like merchandise and creative content to bolster future expansion.

- Click to explore a detailed breakdown of our findings in IVE Group's financial health report.

- Learn about IVE Group's future growth trajectory here.

Peet (ASX:PPC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Peet Limited acquires, develops, and markets residential land in Australia with a market cap of A$941 million.

Operations: The company's revenue is primarily derived from Company Owned Projects (A$313.24 million), Funds Management (A$56.39 million), and Joint Arrangements (A$51.88 million).

Market Cap: A$941M

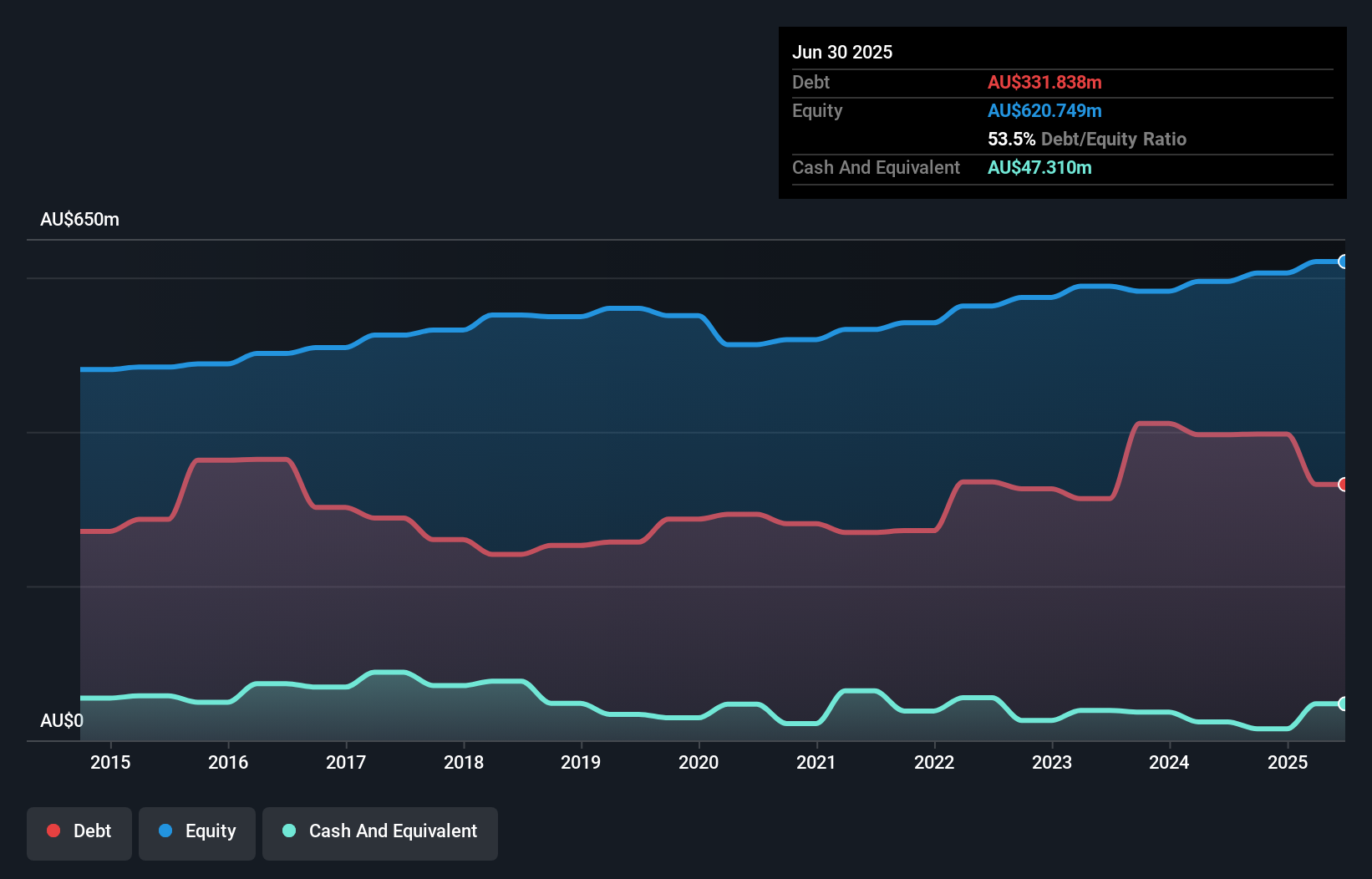

Peet Limited, with a market cap of A$941 million, presents a mixed picture as a penny stock. The company has shown impressive earnings growth of 60% over the past year, outperforming the real estate industry average. Its net profit margins have improved to 14.1%, and its debt is well covered by operating cash flow at 32.3%. However, Peet carries a high net debt to equity ratio of 45.8% and faces challenges with long-term liabilities exceeding short-term assets. Recent organizational changes include the departure of COO Tony Gallagher after an internal restructure, highlighting potential shifts in management strategy.

- Click here and access our complete financial health analysis report to understand the dynamics of Peet.

- Examine Peet's past performance report to understand how it has performed in prior years.

Summing It All Up

- Get an in-depth perspective on all 412 ASX Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FWD

Fleetwood

Designs, manufactures, sells, and installs modular accommodation and buildings in Australia and New Zealand.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)