Last Update 31 Jul 25

Fair value Increased 8.80%Execution risks show up, but subscriber growth and long-term FCF trajectory remain on track.

📄 Q2 2025 Earnings Release 📊 Shareholder Deck 🗣️ Prepared Remarks

To read all the details of the company's performance, please check out the links above. My update below will focus purely on how my narrative is tracking, and what I’ve changed.

As mentioned in most of my other narratives, I’d prefer to be conservative and wrong to the upside than overly optimistic and wrong to the downside. This mindset protects me from overpaying and builds in room for upside if things go better than expected — which has generally been the case with Spotify.

Q2 2025 was a good reminder that execution isn’t always smooth. A strong quarter in user growth and cash generation was somewhat offset by FX headwinds and unexpected social charges, which somewhat masked Spotify’s improving operating leverage. Additionally, the elephant in the room was the ads business.

Daniel Ek noted that: "The one area that hasn’t yet met our expectations is our ads business. We’ve simply been moving too slowly, and it’s taken longer than expected to see the improvements we initiated to take hold. It’s really an execution challenge, not a problem with the strategy". I like that kind of candid commentary from a CEO.

That said, the long-term free cash flow thesis is still very much intact, and most of the company’s key metrics continue to exceed my original assumptions.

Below is how each part of the narrative is tracking.

Retain Dominant Market Share Position In Paid Music Streaming

This assumption continues to track ahead of my expectations.

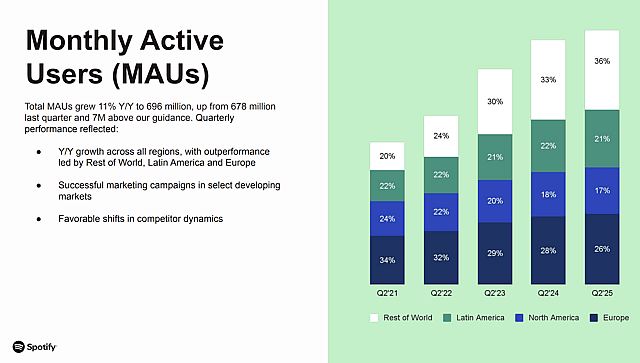

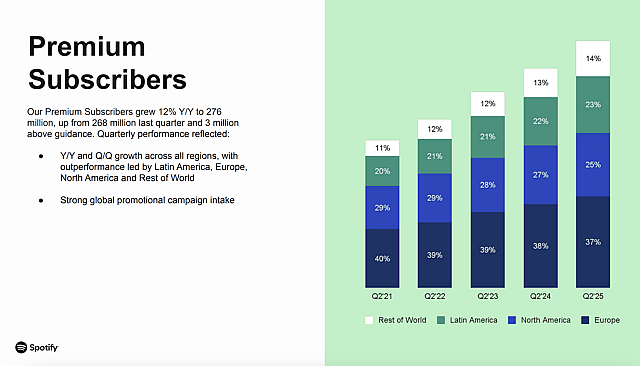

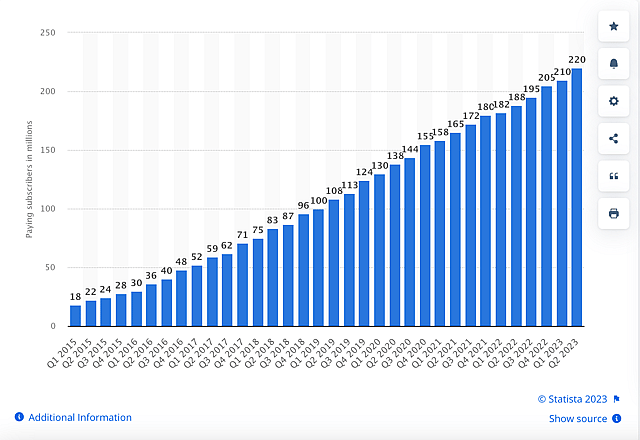

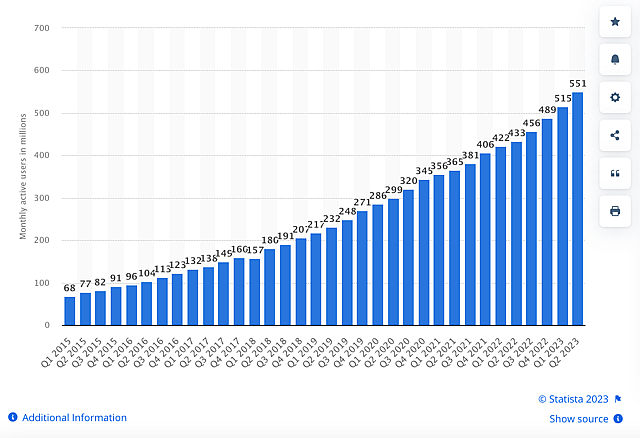

I originally forecast 8% growth per year in MAUs and Premium subscribers. Spotify reported:

- MAUs of 696m, up 11% YoY

- Premium subscribers of 276m, up 12% YoY

This growth continues to outpace my modelled rate (8% p.a.) and validates Spotify’s pricing power and user retention, even after multiple price hikes.

If Spotify grows MAUs at just 8% annually from here, it would reach 1.1 billion MAUs by June 2030, which is ahead of my previous forecast of 991m. Similarly, Premium subscribers growing at 8% from here would reach 432m, versus my previous estimate of 386m.

I’m now lifting my June 2030 assumptions slightly to 1.05 billion MAUs and 420 million Premium subscribers, reflecting this momentum. That change directly increases the company’s long-term revenue potential.

ARPU to Climb From Price Increases And New Revenue Streams

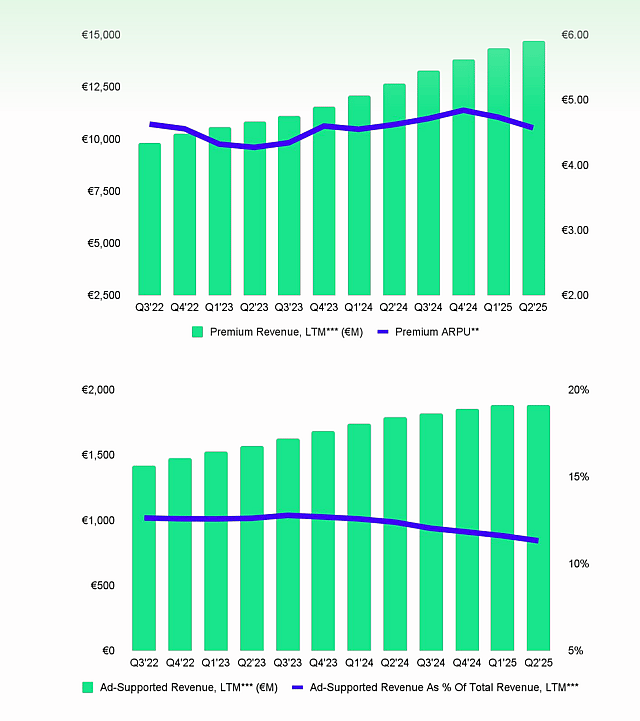

Premium ARPU for Q2 was reported at €4.57, down just 1% YoY (impacted by FX headwinds). But importantly, excluding FX headwinds, ARPU was up 3% Y/Y on a constant currency basis. While it isn't super close, it's more supportive of my expectation of 7.5% annual ARPU growth over the long term. There might need to be some catchup later on, so I'll keep an eye out here. It's brought down by the fact that most of the user growth is coming from lower ARPU regions (Latin America + Rest of world).

Given that, I’m retaining my forecast of €7/month (€84/year) for Premium ARPU by 2030. With 420m Premium subscribers, that equates to €35.3bn in Premium revenue.

On the Ad-supported side, ARPU is currently around €0.41/month (€4.92/year), relatively flat YoY. While ad monetization remains a slower part of the thesis, I still believe there is long-term upside as audio becomes a more efficient and differentiated ad channel. That said, I’ll slightly temper my prior estimate of €8/year ARPU down to €7/year for 2030.

Assuming ~630m Ad-supported MAUs (MAUs minus Premium), that translates to €4.4bn in Ad-supported revenue (640m x €7/year).

Total projected revenue for June 2030: €39.7bn (up from prior January 2030 estimate of €37.2bn)

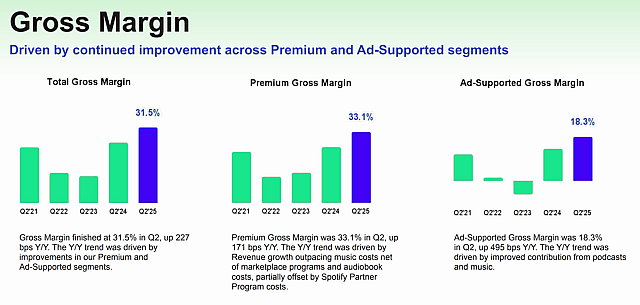

Gross Margins to Rise From New Deals And Revenue Sources

Spotify reported a gross margin of 31.5% in Q2, up from 27% a year ago and in line with the 32.2% reported in Q4. This suggests Spotify is steadily executing on gross margin expansion, despite currency volatility and content mix shifts.

Management noted multiple tailwinds:

- Audiobook contribution to Premium

- Strength in music and podcast monetization in Ad-Supported

- Cost efficiencies across the board

Given the direction of travel, I’m retaining my 2030 gross margin target of 35%, which feels increasingly achievable. On €39.7bn in projected revenue, that equates to €13.9bn in gross profit.

Net Cash Flow Margins To Improve Dramatically

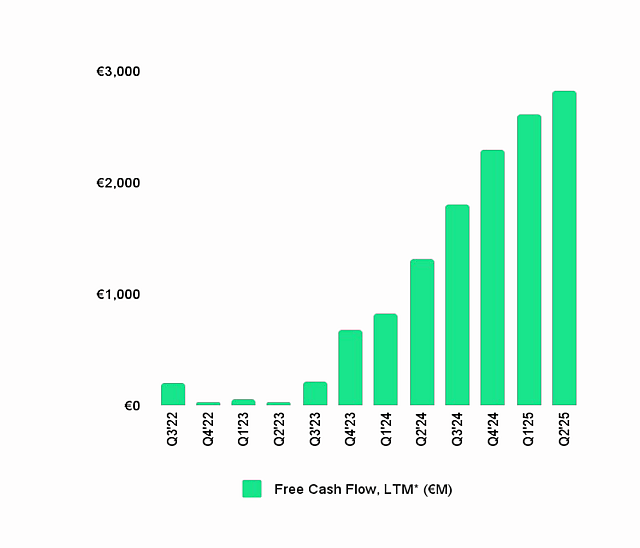

Spotify generated €700 million in free cash flow in Q2 2025, up 43% YoY from €490m in Q2 2024. This brings LTM free cash flow to €2.8bn, far ahead of my previous expectations and a clear signal of improving capital efficiency.

While some volatility in expenses (social charges) and FX will continue to impact net income, free cash flow is the more important long-term driver — and Spotify continues to shine here.

Given these trends, I’m holding my 2030 FCF margin target at 20%, which would deliver €7.94bn in free cash flow.

For this Simply Wall St Valuator, I need an earnings figure, so, assuming a net profit margin of 15%, that implies €5.96bn in net income.

Updated Valuation Forecast for June 30 2030

- Revenue: €39.7bn

- Gross Margin: 35%

- Gross Profit: €13.9bn

- FCF Margin: 20%

- Free Cash Flow: €7.94bn

- Net Profit: €5.96bn (15% net margin)

- PE Multiple: 40x

- 2030 Market Capitalization: €238bn

- Shares Outstanding: 235m (assumes 3% annual dilution)

- 2030 Value Per Share: €1,012

- Discount Rate: 8%

- 2025 Value Per Share: €667

- USD Equivalent (2025): $692

If Spotify continues to repurchase shares, as suggested by the expanded $2bn buyback authorization (up from $1bn, and only $100m has been bought so far), the share count could decline rather than grow, pushing the per-share valuation even higher. But as always, I’m not baking that into the base case.

‼️ Valuation note: You'll note my Fair value on the right says $703. That's because at the time of posting this update, the valuator isn't using the latest Q2 figures, so I increased the revenue growth rate from 14% to 19% so it shows the 39.6bn in revenue, and I decreased the future PE ratio from 40x to 35x to try and more accurately reflect the FV I intended from my above calcs. When the valuator updates to allow a rebasing from Q2 2025 figures (soon), I'll do that and adjust those figures back to 40x and 14% revenue growth. Additionally, there is a discrepancy because the exchange rate has changed considerably since my last update (it was 1.03x USD/EUR, but now it's 1.14). My calcs above estimate 1.03x, and I find it hard to predict a future EUR/USD exchange rate 5 years out given the monetary policies of both regions are likely to be similarly expansionary between now and then I'll leave it at around 1.03x for now until I have more conviction either way.

Final Thoughts

Despite some execution hiccups in this quarter, mainly FX headwinds, higher social charges and ad business execution challenges, Spotify’s long-term free cash flow narrative remains well on track. The company continues to grow its user base faster than expected, expand margins, and generate significant cash, all while monetization initiatives (like audiobooks and ads) still have room to run.

My long-term thesis stands: Spotify is transitioning from a high-growth platform to a highly cash-generative business with meaningful operating leverage.

Key Takeaways

- Spotify is wisely focusing on long-term objectives over short-term profitability.

- Leverage will shift from labels (suppliers) to Spotify (the aggregator) as scale continues to grow.

- Being an audio platform will reduce reliance on music, diversify revenue streams and improve cost structure.

- The market will come to appreciate Spotify’s current and future profitability metrics.

- Continued global user growth, higher ARPU and margin expansion will drive future cash flows.

Catalysts

User Growth and Engagement Will Remain The Focus Over Profitability

Spotify recognises the huge long-term opportunity ahead of it in the audio space, and it is therefore focusing on long-term objectives over short-term profitability.

The long-term objectives have been to become the #1 Audio platform, by helping creators (artists, podcasters, etc) to share and monetize their work effectively.

Spotify’s strategy around ubiquity, personalisation and freemium has been the driving force behind its strong user growth and retention to date and will continue to be long into the future.

Everything from the new agreements with the labels to cheaper prices in emerging markets, to being able to listen on over 2,000 devices from 200 brands (up from 300 devices from 80 brands in 2020), to original content investments, every decision has been approached with user growth and engagement first because profitability can be addressed later (at least on a net income basis since it’s already free cash flow positive).

Spotify Premium users - Statista

Spotify Monthly Active Users (MAUs) - Statista

Since 2015, its Premium subscribers and Monthly active users have grown by 36% and 29% per annum, respectively. In order to reach its ambitious goal of 1bn MAUs by 2030, that means the growth rate would need to only continue at 9% per annum, which is very doable in my opinion since in the last 5 years alone, it has expanded from 65 markets to 184 markets and is still in the early days in most markets.

Since Spotify’s base of users and creators grows, and engagement remains high, the monetization lever can be pulled at a later date as long as the value from the service continues to exceed user cost.

Spotify wants to create a win-win-win platform business. Where creators win (artists, labels, podcasters, authors), users win and therefore Spotify wins. While the first two are definitely winning more than Spotify right now (in terms of value like reach, engagement, finances etc), Spotify knows it will eventually win as well when the time is right, but for now, it's currently still building.

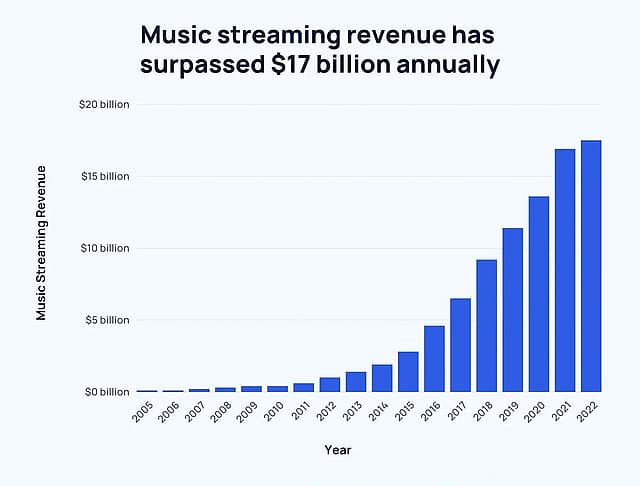

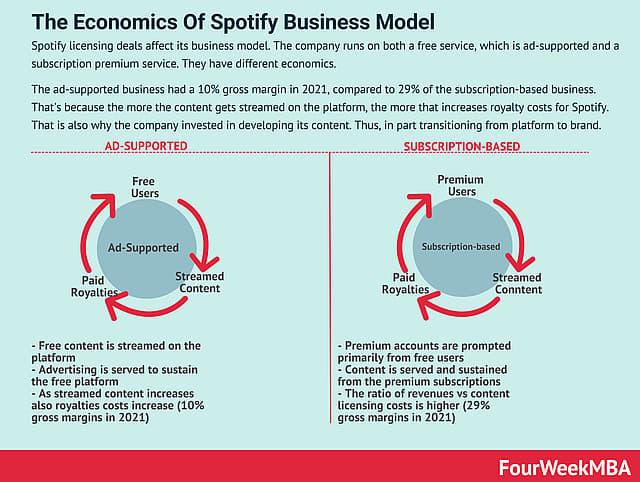

Streaming Economics Will Favour The Suppliers, Users AND The Aggregators.

In the early days of streaming, Spotify needed the labels more than the labels needed Spotify (granted pirating was a big issue for them). But the labels at least had options for music steamers to pick and choose from after a few more emerged, whereas Spotify couldn’t survive without them.

Its relationship with the music labels (UMG, Sony, Warner, and others) has been one that so far has advantaged the labels more than Spotify. But I believe over time, those dynamics will change. Why? Well, Ben Thompson put it this way: “Aggregators consolidate demand to gain power of supply”.

Meaning, that as Spotify continues to build a global market of engaged users, well above its competitors, it will start to gain more leverage over its suppliers, i.e. the labels.

Just like Netflix in the early days, in order to provide value to customers, it was reliant on suppliers for content, and those suppliers had the leverage in negotiations since they had what Netflix needed - content.

Now that Netflix has reached scale and has its own content, other streamers are struggling and it has more leverage in the negotiations for better deals. Netflix now has what content owners need - a large base of engaged paying viewers.

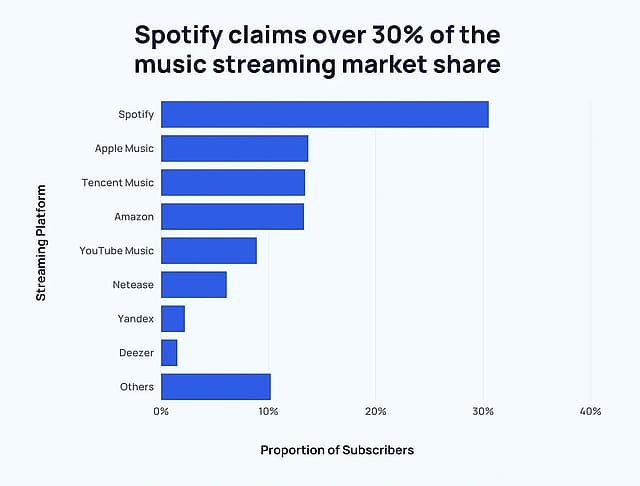

And I believe the same will happen with Spotify. As an aggregator (with a 30.5% market share, more than double its closest competitor), it is responsible for a large portion of the music labels streaming revenues.

As it consolidates demand, it will gain more “power” over the suppliers.

Music Streaming Revenue - Exploding topics

Music Streaming Market Share - Exploding Stats

If you’re a music label, and you want to monetize your music library, you currently have the leverage over the music streaming platforms who need your catalogue to entice users to stay, because no one aggregator (music streaming platform) has untouchable market leadership just yet.

This works for a long time. But eventually, when you’ve got one streaming platform that controls the lion's share of the market, it makes little sense to play hardball with that entity that is responsible for a large portion of your revenue. Instead, to me, the win-win scenario makes sense.

As a label, it makes sense to give up a few points of margin to support a thriving music industry where everybody wins their fair share.

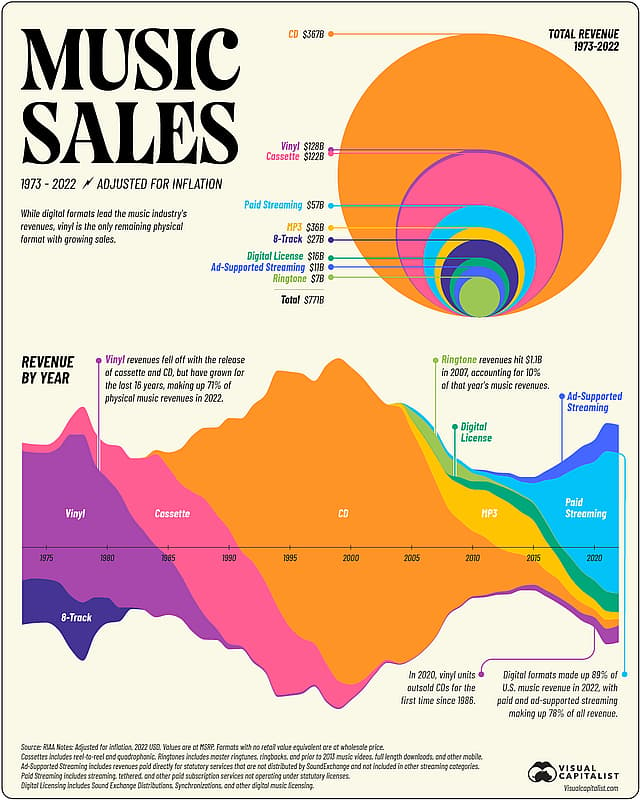

Back in the day, it made sense for labels to receive the lion's share of the profits because, as Jake Rosser put it: “they funded the retail network, oversaw the capital-intensive business of producing and distributing physical media and discovered and promoted stars. Many of those tasks have been rendered obsolete by music streaming.”

With its best-in-class UX, industry-leading discovery, curation and ubiquity, Spotify’s role as an aggregator is adding significantly more value to the music industry than others, and arguably adding more value to the entire ecosystem than the labels, and so I believe it will eventually receive its fair share i.e. more margin.

Charted: 50 Years of Music Industry Revenues, by Format - Visual Capitalist

While this hasn’t occurred yet, I believe it is only a matter of time, and when it does occur, it will have a huge impact on Spotify’s profitability. I agree with Jake Rosser, in the sense that “over time, I expect Spotify to capture the economics of the music industry value chain commensurate with its importance to the eco-system”.

Another long-term development that will give Spotify more leverage in the negotiations with labels will be its reduction in reliance on them because other forms of audio will start to contribute more to revenues and overall listening time from users.

Being An Audio Platform Will Lead To Less Reliance on Variable-Cost Music

As podcasts continue to increase as a percentage of total listening time by users (and I expect audiobooks to contribute to this eventually too), time spent listening to music as a percentage of total listening time will decrease, making Spotify’s cost structure more favourable.

By owning the supply chain in podcasts through platforms like Anchor and Megaphone, it is positioning itself to receive a portion of all advertising dollars spent on podcasts, not just those on its own platform. Spotify has gone from 700k podcasts on its platform in Q4 2019 to more than 6 million today. A huge increase and a sign that users are more likely than not to find a podcast that suits their interests and keeps them listening on the platform.

Podcasting now reportedly accounts for 31% of listening time in the US. In 2018, only 7% of users listened to podcasts, and that now surpasses 30% of MAU. Edison Research did a report titled “The Podcast Consumer 2023”, which found that podcasts have more listeners than ever, spending more time than ever (the report didn’t even include Spotify listeners as far as I can tell). And I expect podcast listeners and their time spent listening as a % of total listening to continue climbing as podcast adoption and podcast content continue to grow.

As more users start to adopt this more fixed-cost structured content as a percentage of their listening time (its AI translation pilot will help podcasters grow audiences globally across different languages), Spotify’s economics will start to become more favourable as it relies less on its current variable cost structure (pay per stream).

Not only that, but the Edison Research Report found that podcast listeners are “an advertiser's dream”, being “more affluent, more employed and more educated” compared to the U.S. Population.

So I’d expect advertising dollars to transition from less accurate and effective mediums like radio to more accurate and effective mediums like Spotify's Ad Studio. And if these ads continue to be more efficient than other mediums, I expect the trend of advertising dollars to shift towards Spotify’s ad business.

Another shift is occurring. The music labels are becoming more reliant on Spotify for audience reach (including marketplace) and their revenues (music streaming accounts for 84% of the music industry’s revenue), while at the same time, Spotify is becoming less reliant on the labels (albeit very slowly).

While I expect music streaming will no doubt remain the largest portion of users listening time on average, as podcasts and audiobooks increase in adoption (both of which are expected to become higher gross margin offerings than music currently is when investment reduces and scale increases), it seems the music industry will become more reliant on Spotify than Spotify is reliant on them.

Then, Spotify will have more leverage in negotiations. Two main benefits from this will occur:

- This increases its chances of better and more equitable music rights deals and payments, and

- More non-music audio consumption results in better overall cost structure from the more fixed-cost structure audio versus variable cost structure audio. (Spotify pays royalties to labels on a per stream basis, the more a song is streamed, the more they pay).

Spotify Business Model - FourWeekMBA

The Market Will Come To Understand Spotify’s Current and Future Profitability.

The market’s obsession with short-term results over long-term results is what led many investors to misunderstand Amazon, Netflix and many others in their early days, and the same is true with Spotify.

You’d hear investors say: “Yeah, but you aren’t profitable?”. Well, those companies were playing the long game while those investors who only looked a few quarters out missed the boat of companies that had great qualitative metrics that weren’t yet evident in traditional quantitative financial metrics.

As for Spotify, the market has been focusing on a few things that led it to misunderstand the company:

- Its obsession with gross margins in the short term (which have hovered around 25% for a few years now), and

- Accounting profit/losses vs Free cash flows

Both of these lead investors to misunderstand the bigger picture, which means there’s opportunity for those with patience.

For starters, there are a few reasons for gross margin growth stagnating, and they are:

- New negotiations with labels focus on long-term objectives, like global licences for new markets, and marketing tools for artists (and usage of the two-sided marketplace), rather than lower royalty payments.

- With the new agreements focusing on long-term goals, and Spotify needing to pay upfront royalties in some new markets during its international expansion, it is still not in a position to negotiate better terms with the labels, and these have kept premium gross margins the same. I don’t expect us to see lower payments to the labels within the next 3 years.

- However, 3+ years from now, as mentioned above, I can see a world where labels are more reliant on Spotify than other music streamers for their revenue, and Spotify is less reliant on music as a portion of its total revenue. In this scenario, it is likely some downward pressure on gross margins will be lifted thanks to the lapsing of upfront royalty payments for new markets, better uptake of the two-sided marketplace tool (where labels pay Spotify), and overall labels accepting a slightly smaller share (say 60% take instead of 70%) of a much bigger pie (the music streaming industry) that Spotify has created for them.

- The aggressive podcast investment over the past 2 years has been a drag on overall gross margins (podcast investments are reported against ad-supported revenues), which have been negative for a few quarters now. But these will moderate as podcast investment reduces and podcast revenues increase.

- Aggressive use of discounted premium subscriptions as a customer acquisition tool (for example, $1 for three months), has been a headwind to gross margins during the promotional period in new markets.

- Lastly, premium subscriber penetration has levelled off at roughly 45% of total MAUs due to growth in developing markets opting for free plans and the impact of multi-user plans.

All in, these variables have been a short-term headwind to Spotify's gross margins. In the next few years, I believe Spotify’s efforts in other areas (podcasts, etc) will outweigh these headwinds experienced above (and those that will remain for the foreseeable future, like cheaper ARPU from certain geographic regions), and that we’ll see gross margins rise past 30%.

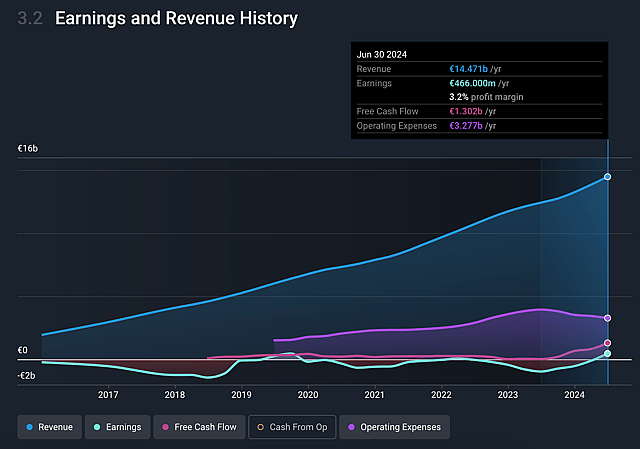

Accounting Profits vs FCF

Spotify was running at around breakeven in terms of cashflows on purpose, as mentioned by Paul Vogel on past earnings calls, and it has been running like this for the last 6 years (pink line) until recently.

You can see that Earnings and FCF have ticked up in the last 12 months, thanks to reduced expenditure and continually increased revenues.

Spotify’s Earnings, Revenue and Free Cash Flow History - Simply Wall St

Its negative GAAP earnings are largely driven by a lot of non-cash expenses. Additionally, Deferred revenue, Share-based compensation and higher accounts payable all contribute to the reason earnings differ significantly from free cash flows.

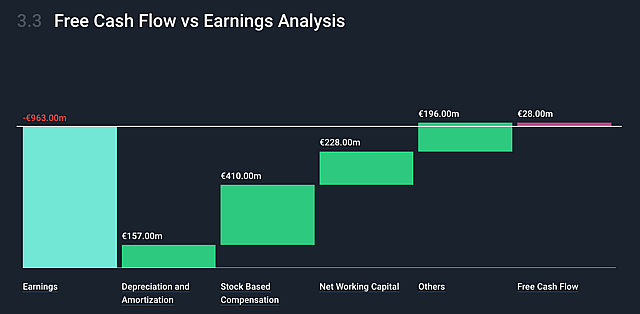

Spotify Free Cash Flow vs Earnings Analysis 30 June 2023 - Simply Wall St

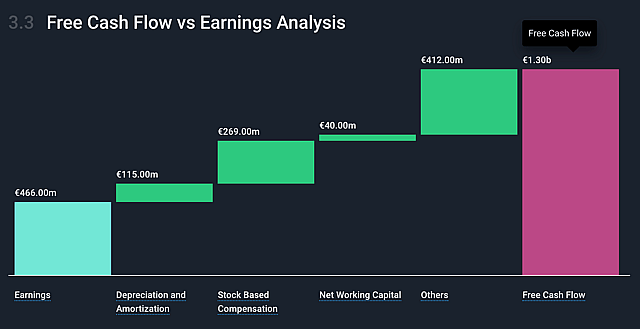

Spotify Free Cash Flow vs Earnings Analysis 30 June 2024 - Simply Wall St

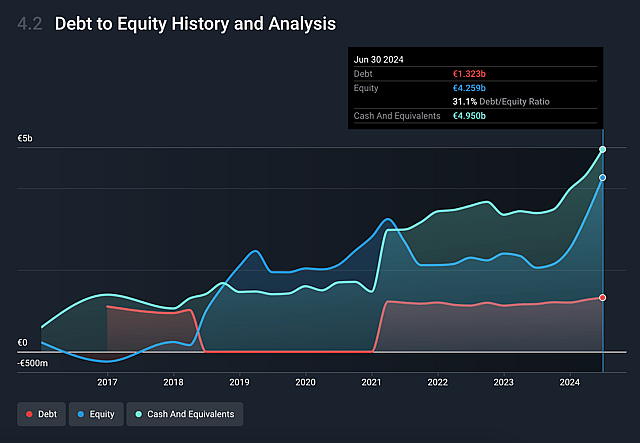

If Spotify wasn’t profitable in those last 6 years, you’d see its cash balance decreasing not increasing (even excluding the capital raise in early 2021).

Spotify’s Debt to Equity History and Analysis - Simply Wall St

I believe Generally Accepted Accounting Principles (GAAP) aren’t very suitable for many tech companies, and Spotify is a prime example. As investors continue to focus on GAAP metrics, a company like Spotify will be misunderstood while it builds its moat over the long term.

As of 2022, Spotify only monetised 14% of podcast listening time while it focused on user growth, engagement, and podcast investment. As the business ramps up monetization of content, achieves better deals with the labels, reduces growth expenditure and relies less on music, I expect its gross and net margins will improve considerably, which will also change the way investors value the stock.

Assumptions

Retain Dominant Market Share Position In Paid Music Streaming

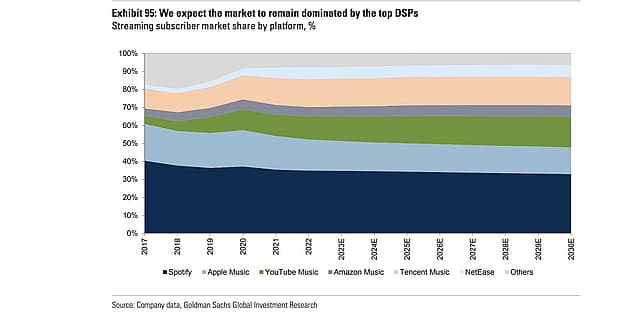

I expect Spotify to remain the dominant player in the paid music streaming industry, much in agreement with Goldman Sachs' expectations of 31% market share by 2030.

Music Streaming Subscriber Market Share - Goldman Sachs Investment Research

They believe that by the year 2030, there will be 1.2 billion paid music streaming users, up from 612m as at the end of 2022, growth of about 8% per year.

By end of Q2 2029 (5 years from now), I expect Spotify to have 35% market share of the 1.05 billion paid music streaming users (about 8% annual growth from 612m), which equates to 362 million paid subscribers, up from 246 million at Q2 2024 - an 8% CAGR matching industry growth expectations. At this point, I also expect it to have around 860m monthly active users (8% CAGR as well). While Spotify said it could hit 1bn MAU by 2030, I estimate it’ll fall just shy at 933m MAU.

ARPU to Climb From Price Increases And New Revenue Streams

Currently, ARPU is €4.62 Euros (per month, €55.44 Euros per year) as of Q2 2024.

In 5 years' time, thanks to subsequent price increases, better monetization of content and new revenue streams, I expect this number to reach €7 Euros per month (€84 Euros per year) by end of Q2 of 2029. This would result in Q2 2029 TTM revenues of €31.7bn Euro, a 17% CAGR (revenues have grown at 22% annually over the last 5 years, so I expect a slight slowdown).

Gross Margins to Rise From New Deals And Revenue Sources

Gross margins were 29.2% in Q2 of 2024. Based on the cost structure of non-music content listened to, new negotiations with the labels, and new revenue streams from the marketplace and ads, I expect overall gross margins to slightly improve from 29.1% to 30% by end of Q2 2029.

Net Cash Flow Margins To Improve Dramatically

The business currently generates cash flow margins of about 1.5%. It’s generated, on average, around €200m Euros in Free Cash Flow per year over the last 3 years (page 12). Since the start of 2016, it has generated a cumulative €1.4bn Euro in FCF, which has helped grow its cash balance.

More recently though, we've seen this occurring incredibly quickly as the chart above illustrated.

I expect this to improve dramatically thanks to favourable cost structure changes, better operating expense control, less aggressive capex, and operating leverage achieved from scale. By mid 2029, I expect free cash flow margins to reach 9%, meaning €2.85bn Euros in mid 2029 FCF.

While this is cash flow margins, to work within the valuator, I expect net profit margins to reach 6.7% by mid 2029, they're currently at 3.2%. This would make net income $2.1bn

Risks

Competition in Music Streaming Could Deteriorate Market Dominance and Gross Margins

There is a chance that if other streaming platforms are hugely successful, they will reduce Spotify user growth and its chances of becoming a dominant aggregator in the industry and thus getting better terms with the labels. As such, this would lower my forecasts for user growth, revenue, and my gross margins.

Additionally, in emerging markets, there are existing players that may reduce the size of Spotify’s Serviceable Obtainable Market (SOM - a subset of the total addressable market) in these regions which are being relied upon for growth expectations.

While I’m sure Apple, Amazon and others will probably do well (and smaller local players in emerging markets may persist), I'm not convinced that they will be a huge issue to Spotify’s long-term trajectory.

For these other platforms, they have to somehow uno existing consumer listening habits on Spotify, plus do better in terms of ubiquity, personalisation, freemium, curation, podcasts, audiobooks, etc. Something which I don't believe is highly likely.

As for the smaller players, existing trends of emerging market growth are proving that adoption is not a huge issue, at least for now.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst MichaelP has a position in NYSE:SPOT. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives