Update shared on 31 Jul 2025

Fair value Increased 8.80%Execution risks show up, but subscriber growth and long-term FCF trajectory remain on track.

📄 Q2 2025 Earnings Release 📊 Shareholder Deck 🗣️ Prepared Remarks

To read all the details of the company's performance, please check out the links above. My update below will focus purely on how my narrative is tracking, and what I’ve changed.

As mentioned in most of my other narratives, I’d prefer to be conservative and wrong to the upside than overly optimistic and wrong to the downside. This mindset protects me from overpaying and builds in room for upside if things go better than expected — which has generally been the case with Spotify.

Q2 2025 was a good reminder that execution isn’t always smooth. A strong quarter in user growth and cash generation was somewhat offset by FX headwinds and unexpected social charges, which somewhat masked Spotify’s improving operating leverage. Additionally, the elephant in the room was the ads business.

Daniel Ek noted that: "The one area that hasn’t yet met our expectations is our ads business. We’ve simply been moving too slowly, and it’s taken longer than expected to see the improvements we initiated to take hold. It’s really an execution challenge, not a problem with the strategy". I like that kind of candid commentary from a CEO.

That said, the long-term free cash flow thesis is still very much intact, and most of the company’s key metrics continue to exceed my original assumptions.

Below is how each part of the narrative is tracking.

Retain Dominant Market Share Position In Paid Music Streaming

This assumption continues to track ahead of my expectations.

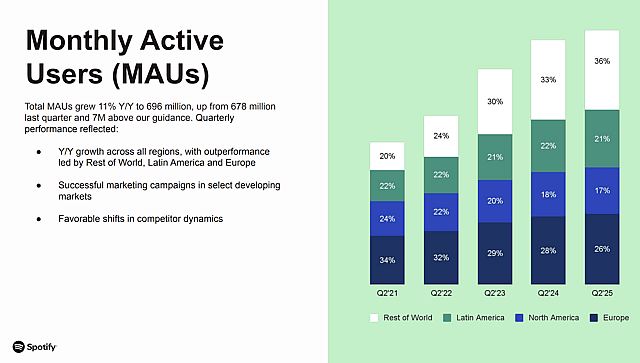

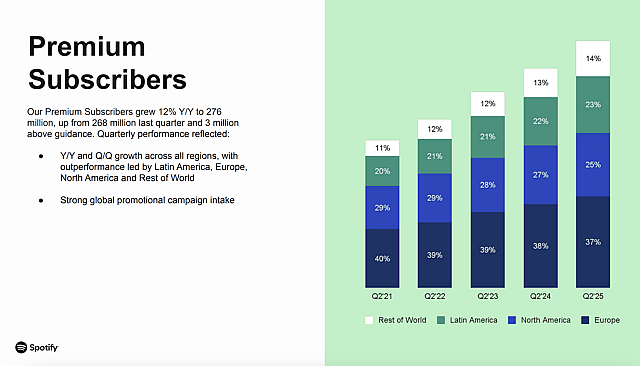

I originally forecast 8% growth per year in MAUs and Premium subscribers. Spotify reported:

- MAUs of 696m, up 11% YoY

- Premium subscribers of 276m, up 12% YoY

This growth continues to outpace my modelled rate (8% p.a.) and validates Spotify’s pricing power and user retention, even after multiple price hikes.

If Spotify grows MAUs at just 8% annually from here, it would reach 1.1 billion MAUs by June 2030, which is ahead of my previous forecast of 991m. Similarly, Premium subscribers growing at 8% from here would reach 432m, versus my previous estimate of 386m.

I’m now lifting my June 2030 assumptions slightly to 1.05 billion MAUs and 420 million Premium subscribers, reflecting this momentum. That change directly increases the company’s long-term revenue potential.

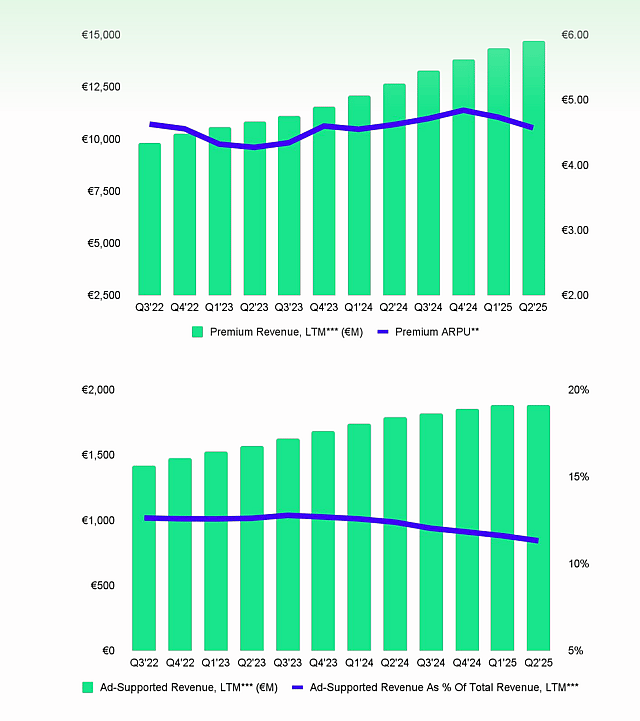

ARPU to Climb From Price Increases And New Revenue Streams

Premium ARPU for Q2 was reported at €4.57, down just 1% YoY (impacted by FX headwinds). But importantly, excluding FX headwinds, ARPU was up 3% Y/Y on a constant currency basis. While it isn't super close, it's more supportive of my expectation of 7.5% annual ARPU growth over the long term. There might need to be some catchup later on, so I'll keep an eye out here. It's brought down by the fact that most of the user growth is coming from lower ARPU regions (Latin America + Rest of world).

Given that, I’m retaining my forecast of €7/month (€84/year) for Premium ARPU by 2030. With 420m Premium subscribers, that equates to €35.3bn in Premium revenue.

On the Ad-supported side, ARPU is currently around €0.41/month (€4.92/year), relatively flat YoY. While ad monetization remains a slower part of the thesis, I still believe there is long-term upside as audio becomes a more efficient and differentiated ad channel. That said, I’ll slightly temper my prior estimate of €8/year ARPU down to €7/year for 2030.

Assuming ~630m Ad-supported MAUs (MAUs minus Premium), that translates to €4.4bn in Ad-supported revenue (640m x €7/year).

Total projected revenue for June 2030: €39.7bn (up from prior January 2030 estimate of €37.2bn)

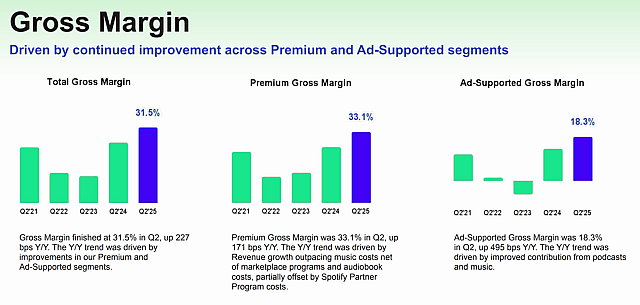

Gross Margins to Rise From New Deals And Revenue Sources

Spotify reported a gross margin of 31.5% in Q2, up from 27% a year ago and in line with the 32.2% reported in Q4. This suggests Spotify is steadily executing on gross margin expansion, despite currency volatility and content mix shifts.

Management noted multiple tailwinds:

- Audiobook contribution to Premium

- Strength in music and podcast monetization in Ad-Supported

- Cost efficiencies across the board

Given the direction of travel, I’m retaining my 2030 gross margin target of 35%, which feels increasingly achievable. On €39.7bn in projected revenue, that equates to €13.9bn in gross profit.

Net Cash Flow Margins To Improve Dramatically

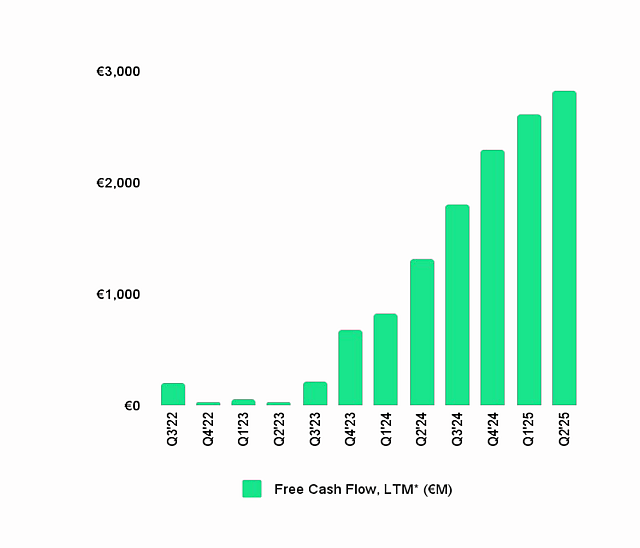

Spotify generated €700 million in free cash flow in Q2 2025, up 43% YoY from €490m in Q2 2024. This brings LTM free cash flow to €2.8bn, far ahead of my previous expectations and a clear signal of improving capital efficiency.

While some volatility in expenses (social charges) and FX will continue to impact net income, free cash flow is the more important long-term driver — and Spotify continues to shine here.

Given these trends, I’m holding my 2030 FCF margin target at 20%, which would deliver €7.94bn in free cash flow.

For this Simply Wall St Valuator, I need an earnings figure, so, assuming a net profit margin of 15%, that implies €5.96bn in net income.

Updated Valuation Forecast for June 30 2030

- Revenue: €39.7bn

- Gross Margin: 35%

- Gross Profit: €13.9bn

- FCF Margin: 20%

- Free Cash Flow: €7.94bn

- Net Profit: €5.96bn (15% net margin)

- PE Multiple: 40x

- 2030 Market Capitalization: €238bn

- Shares Outstanding: 235m (assumes 3% annual dilution)

- 2030 Value Per Share: €1,012

- Discount Rate: 8%

- 2025 Value Per Share: €667

- USD Equivalent (2025): $692

If Spotify continues to repurchase shares, as suggested by the expanded $2bn buyback authorization (up from $1bn, and only $100m has been bought so far), the share count could decline rather than grow, pushing the per-share valuation even higher. But as always, I’m not baking that into the base case.

‼️ Valuation note: You'll note my Fair value on the right says $703. That's because at the time of posting this update, the valuator isn't using the latest Q2 figures, so I increased the revenue growth rate from 14% to 19% so it shows the 39.6bn in revenue, and I decreased the future PE ratio from 40x to 35x to try and more accurately reflect the FV I intended from my above calcs. When the valuator updates to allow a rebasing from Q2 2025 figures (soon), I'll do that and adjust those figures back to 40x and 14% revenue growth. Additionally, there is a discrepancy because the exchange rate has changed considerably since my last update (it was 1.03x USD/EUR, but now it's 1.14). My calcs above estimate 1.03x, and I find it hard to predict a future EUR/USD exchange rate 5 years out given the monetary policies of both regions are likely to be similarly expansionary between now and then I'll leave it at around 1.03x for now until I have more conviction either way.

Final Thoughts

Despite some execution hiccups in this quarter, mainly FX headwinds, higher social charges and ad business execution challenges, Spotify’s long-term free cash flow narrative remains well on track. The company continues to grow its user base faster than expected, expand margins, and generate significant cash, all while monetization initiatives (like audiobooks and ads) still have room to run.

My long-term thesis stands: Spotify is transitioning from a high-growth platform to a highly cash-generative business with meaningful operating leverage.

Disclaimer

Simply Wall St analyst MichaelP has a position in NYSE:SPOT. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.