Key Takeaways

- Premium revenue to be kept in check by competition and market saturation.

- Gross margin will improve, but remain below 30%.

- Lots of room for improvement in ad-supported ARPU.

- Podcasts will drive growth in ad-supported MAU.

- Ad revenue will therefore drive top line growth.

- R&D spend will need to remain high.

Catalysts

Industry Catalysts

Competition Will Keep a lid on Price Points and Growth

Spotify is arguably the premier audio streaming platform. But it has several notable competitors, and these platforms are able to bundle their audio offerings with other services. As an example, YouTube Premium offers music streaming services along with ad free videos.

I think Spotify will remain the platform of choice for those who prioritize music, and possibly podcasts - but users looking for value will choose YouTube premium, Amazon or Apple, and other regional platforms. These competitors will also have more flexibility in the future if they believe they are losing subscribers to Spotify. Furthermore, App Store fees give Apple a significant advantage.

I also think that growth in paid for streaming services will begin to slow, simply because penetration of the addressable market is already high.

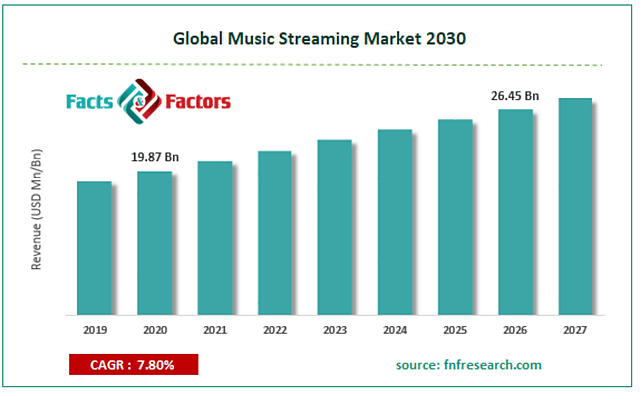

I am therefore expecting premium subscriber growth to be slightly lower than industry forecasts, ie. 6% rather than the 7 to 8% rate forecast by industry analysts. I also think that Spotify will be able to increase the price of premium plans, but competitive forces will keep annual ARPU growth for premium subs at 5%. Note: This 5% includes ad revenue from podcasts on premium plans which include ads.

Global Streaming Market 2019 to 2027 Image Credit: FNF Research

AI gives Spotify a Slight Advantage

Music streaming businesses use AI in various ways, and most importantly to help users find music (and other audio), to increase engagement and to target ads. Spotify has been doing this for a long time, and has a singular focus on audio. I think this does give Spotify an edge, and its discovery algorithms are highly regarded compared to competitors.

However, Alphabet and Amazon also have significant resources in terms of AI capabilities, compute power and cash. So I think Spotify’s edge is quite narrow and there is a risk that they struggle to differentiate themselves.

Gross Margins Will Increase, but Take Longer than Expected to Reach 30%

On the music side, I don’t think Spotify will become dominant enough to reduce the royalty percentage it pays out as much as it would like - at least not in the next five years. Nevertheless, I do think there will be some improvement due to efficiencies in the way royalties are calculated.

For podcasts, I believe Spotify will continue to make investments in original content as a way to attract users from other free podcasting platforms. Spotify has renewed its deal with Joe Rogan, but the deal now differs in that it's partly tied to ad revenue, and the Joe Rogan Experience will no longer be exclusive to Spotify. I believe deals will continue to involve some guaranteed income, and therefore contribute to content costs.

I’m forecasting a gross margin of 28% for FY2029, up from 25.7% in the 12 months to September 2023.

Company Catalysts

Podcasts to Drive Growth In Free Accounts, But Contribute to Opex Remaining High

Podcasts are still a growth opportunity for Spotify, both in terms of subscriber count and ad revenue.

There is still a fair amount of friction involved between podcasts on the platform and those on other platforms. The majority of podcasts have traditionally been hosted on free platforms, where creators have monetized their own content by inserting ads or endorsing sponsors. Premium podcasts on the other hand are exclusive to specific platforms.

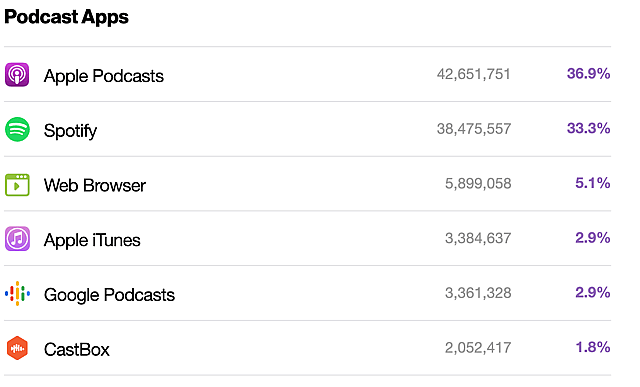

Podcasts Platform Share January 2024 Image Credit: BuzzSprout

Ideally for Spotify, it will eventually become THE podcast platform in the same way that YouTube is THE platform for long form videos. This will allow ads to be targeted to individual listeners, which I think will increase the amount each episode can earn. If it can get there, Spotify will be involved in more of the monetization process for creators, resulting in more shared revenue.

To become the platform of choices for podcasters, Spotify needs to show that it is better at monetizing content than creators are. I believe it will continue to invest heavily in technology to do this, but this means operating expenses will rise with revenue.

Spotify has indicated that podcasts will soon contribute to the bottom line, but I believe that most of the cash flow from this segment will be reinvested to solidify its position in the market.

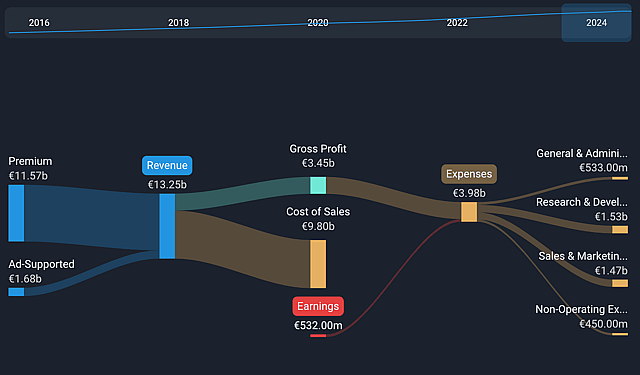

Spotify Segment Analysis Image Credit: Simply Wall St

Lots of Room for Improvement from Ad Revenue

Spotify currently earns approximately € 5.2 per user per year in ad revenue, which is a little over 50% of what YouTube earns. Users can spend more time listening to audio than they can watching videos, so I believe there is lots of room for improvement here.

There are several ways Spotify can improve ARPU from ads:

- Providing better value to advertisers by targeting ads with user behavior data and AI.

- Offering podcasters better monetization tools which will encourage them to do more monetizing within Spotify’s platform.

- Creating more, lower budget original podcast content which can be fully monetized with ads.

These are all initiatives where Spotify has already invested significantly over the last five years, and I believe these investments will pay off over the next five years.

I’m therefore expecting ad revenue to increase to €7 billion by 2028. This represents a CAGR of 32% driven by 15%/year growth in subs and 15%/year growth in ARPU, and is substantially higher than industry forecasts.

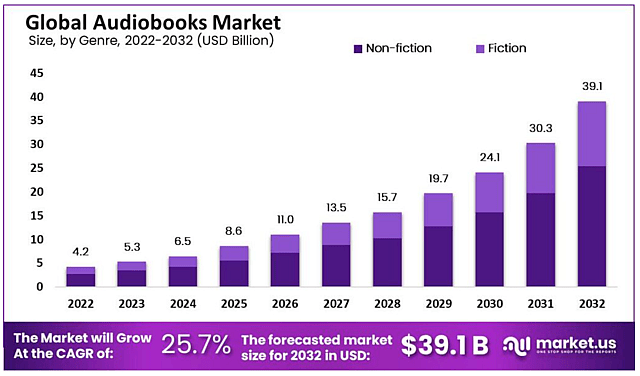

Audiobooks Won’t Move the Needle Before 2028

Audiobooks have a smaller addressable market, but it is growing and it compliments the podcast business and Spotify’s goals of being the market leader across audio media. Spotify also needs to prove the business model as it attempts to make a streaming model work where books are sold by the hour rather than by the book.

Global Audiobook Market Forecast to 2032 Image Credit: Markets.us

I don’t believe audiobooks will contribute to the bottom line until 2028 at the earliest. However, I also believe R&D costs will be manageable as there will be a lot of overlap with the podcast business. I think content costs for audiobooks will align with the rest of the business.

I think that to make the necessary investments to continue to build the podcast and audiobook segment and to optimize adtech across the business, Spotify’s operating expenses will need to continue to increase at 5% annually, reaching approximately € 5,9 billion in 2028. This will still be a substantial improvement in the OpEx margin, down from 28% in 2023 to 20% in 2028.

Assumptions

The Share Count Will Increase Slightly

The share count will increase at 1% annually, reaching 204 million in 2028. This will primarily be due to stock based compensation as Spotify will be cash flow positive. I believe interest expenses will be immaterial.

Spotify will begin to pay tax as Earnings Turn Positive

I’m assuming Spotify will pay an effective 15% tax rate in 2028.

FY2028 Free Cash Flow To Reach € 2.04 Billion

FY2028 Line Revenue and Expenses as Follows

- Premium Revenue: 316 million paid subscribers with ARPU of € 68 = € 21.6 billion

- Ad Revenue: 762 million ad-supported subscribers with ARPU of € 10 = € 8 billion

- Total Revenue: € 29.6 billion

- Gross Profit: € 8.3 billion (28% of revenue)

- Operating Expenses: € 5.9 billion (20% of revenue)

- EBITDA: €2.4 billion

- Tax: €360 million (15% of EBITDA)

- Free Cash Flow: €2.04 billion

The Market will price Spotify at 30x FCF for FY2028

Although I’m expecting free cash flow to increase rapidly over the next five years, I believe growth will slow by 2028, so I’m using a 30x free cash flow multiple.

This implies a market capitalization of €72.6 billion in 2028.

Risks

Downside Risks:

- Spotify’s major competitors are in a position to aggressively compete on price if they choose to do so. I don’t expect this to happen - but it’s not out of the question.

- Legislation to protect music artists or labels could also cap the gross margin below 28%.

Upside Risks:

- The biggest upside risk to my thesis is that Spotify could achieve a more dominant position in the music industry and command a higher gross margin earlier than I expect it to.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Richard_Bowman holds no position in NYSE:SPOT. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.