Last Update07 Aug 25Fair value Increased 17%

Despite a reduction in consensus revenue growth forecasts, a notable improvement in net profit margin has driven the consensus analyst price target for Upstart Holdings up from $67.36 to $76.86.

What's in the News

- Upstart provided Q3 2025 guidance of $280 million revenue with a GAAP net loss of $9 million; full-year 2025 guidance is $1.055 billion revenue and $35 million GAAP net income.

- Cabrillo Credit Union partnered with Upstart to offer personal loans via the Upstart Referral Network, integrating Cabrillo's credit policies for tailored applicant offers.

- Cobalt Credit Union partnered with Upstart to offer personal loans, HELOCs, and auto refinance loans; also purchasing HELOC portfolios from Upstart Mortgage to expand lending offerings.

- All In Credit Union partnered with Upstart to offer personal loans through the Upstart Referral Network, tailoring offers based on All In Credit Union credit policies.

Valuation Changes

Summary of Valuation Changes for Upstart Holdings

- The Consensus Analyst Price Target has significantly risen from $67.36 to $76.86.

- The Consensus Revenue Growth forecasts for Upstart Holdings has significantly fallen from 28.7% per annum to 25.2% per annum.

- The Net Profit Margin for Upstart Holdings has significantly risen from 16.31% to 17.98%.

Key Takeaways

- AI-driven lending advancements and automation are boosting approval rates, reducing operating costs, and supporting higher margins and market share growth.

- Diversification into new loan products and growing fintech partnerships are reducing risk concentration and expanding revenue streams.

- Mounting competition, dependence on external funding, and unproven new products threaten Upstart's profitability, growth, and technology edge amid a volatile macroeconomic and lending environment.

Catalysts

About Upstart Holdings- Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

- Rapid model advancements leveraging neural networks and increasingly comprehensive AI architectures-such as Model 22-are driving significant improvements in borrower approval and conversion rates, directly increasing origination volumes and fee-based revenue while also supporting higher contribution margins and net income.

- Upstart's swift expansion into new loan verticals (Home, Auto, and small dollar products) is accelerating, with these new businesses now contributing an increasing share of originations and offering a path to diversify revenue streams, reduce risk concentration, and meaningfully increase long-term total revenues as third-party funding comes online.

- The accelerated automation and digitization of traditionally manual lending processes-exemplified by instant property verification for HELOCs and full automation of remote notarization for Auto refinance-reduces operating costs, improves user experience, and positions Upstart to capture share from legacy incumbents, supporting higher margins and market share growth.

- As the underlying trend of banks and credit unions increasing partnership penetration with fintech platforms continues, Upstart expects to surpass previous records for available partnership funding, which will enable greater origination scale without heavy reliance on its balance sheet, resulting in increased revenues and higher return on equity.

- Continuous gains in AI-driven servicing and individualized risk modeling have led to notable reductions in delinquency rates and improved loss performance, which is likely to both reduce loss provisions and enable more aggressive, profitable loan origination-positively impacting net margins and bottom-line earnings over time.

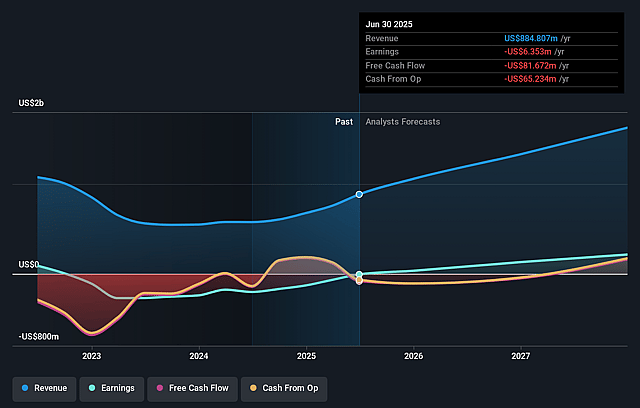

Upstart Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Upstart Holdings's revenue will grow by 27.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.7% today to 18.2% in 3 years time.

- Analysts expect earnings to reach $332.9 million (and earnings per share of $1.69) by about August 2028, up from $-6.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.3x on those 2028 earnings, up from -1053.0x today. This future PE is greater than the current PE for the US Consumer Finance industry at 9.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.26%, as per the Simply Wall St company report.

Upstart Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in the personal and near-prime loan markets, including new entrants like SoFi and increased capital availability, may compress take rates and margins, making it harder for Upstart to maintain growth and profitability in its core business over the long term. (Margins, revenue, earnings)

- The company's rapid expansion into Home and Auto lending exposes it to untested unit economics and operational risk; immature products still depend heavily on Upstart's own balance sheet funding, posing a risk to revenue stability and net income if external funding partners are slower to materialize or macro conditions worsen. (Revenue, net income)

- Ongoing macroeconomic risks such as high default rates, elevated inflation, and potential shocks to consumer credit quality (as measured by the UMI index) could increase loss provisions or depress origination volumes, directly impacting earnings and profitability. (Revenue, net income, loss provisions)

- Competitive pressure from incumbent banks and new fintechs adopting similar or more advanced AI/automation, as well as the commoditization of automated underwriting, could erode Upstart's technology-driven competitive advantage, resulting in margin compression and reduced market share. (Net margins, revenue)

- Upstart's reliance on partnerships with banks, credit unions, and volatile institutional capital (including ABS market fluctuations) means that shifts in partner appetite or funding market disruptions could rapidly constrain origination capacity and fee income, threatening top-line growth and long-term earnings predictability. (Revenue, earnings)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $79.143 for Upstart Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $332.9 million, and it would be trading on a PE ratio of 35.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $69.53, the analyst price target of $79.14 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.