Key Takeaways

- Increasing data privacy regulations and AI oversight threaten Upstart's model accuracy, differentiation, and may drive up compliance costs and operational risks.

- Intensifying competition and reliance on limited partners expose Upstart to margin pressure, market share loss, and greater revenue volatility.

- AI-driven model enhancements, diversified lending products, stronger partner funding, and digital-first automation are boosting revenue growth, improving efficiency, and reducing financial risk.

Catalysts

About Upstart Holdings- Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

- Dependence on ongoing access to alternative borrower data for AI model accuracy exposes Upstart to the risk that increasing consumer privacy awareness and tightening data privacy regulations will restrict access to these data sources, reducing model efficacy and potentially lowering approval rates and future transaction volumes, negatively impacting long-term revenue growth.

- Intensifying regulatory scrutiny of artificial intelligence and machine learning in credit decisioning could result in materially higher compliance expenses, model retraining requirements, and the erosion of Upstart's proprietary differentiation, compressing net margins and increasing operational risk over the next several years.

- Competitive threats from both legacy financial institutions and aggressive newer entrants, including large technology firms integrating similar AI-driven lending solutions, are likely to escalate, causing pricing pressure and potential loss of market share, resulting in declining take rates and eventual margin contraction.

- The prolonged elevated interest rate environment, coupled with the risk of further rates volatility, may lead to higher consumer credit losses and increased funding costs for Upstart's loan buyers, which could drive lenders away from the platform, decrease origination volumes, and depress both revenue and earnings growth.

- Ongoing reliance on a limited set of banking partners amplifies customer concentration risk, leaving Upstart vulnerable to abrupt funding withdrawals or the loss of key distribution relationships, resulting in unpredictable revenue volatility and diminished future earnings stability.

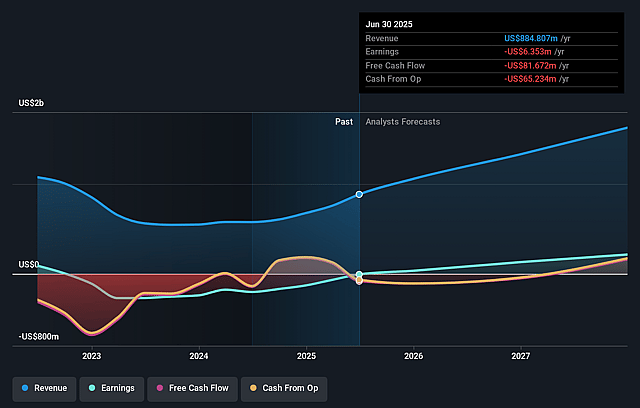

Upstart Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Upstart Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Upstart Holdings's revenue will grow by 22.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.7% today to 14.7% in 3 years time.

- The bearish analysts expect earnings to reach $241.8 million (and earnings per share of $1.96) by about August 2028, up from $-6.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 24.8x on those 2028 earnings, up from -1041.4x today. This future PE is greater than the current PE for the US Consumer Finance industry at 9.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.23%, as per the Simply Wall St company report.

Upstart Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapid improvements in AI model performance, exemplified by the launch of Model 22 and advances in automation and servicing, are directly increasing approval and conversion rates, as well as driving down loan losses, which may sustain stronger revenue growth and support net margins over the long term.

- Expansion into new lending verticals such as Home, Auto, and small dollar loans is accelerating, diversifying revenue streams, and growing Upstart's total addressable market, which could lead to higher aggregate revenues and improved long-run operating leverage.

- Strengthening funding partnerships, including significant bank and credit union relationships, as well as increasing access to third-party funding and the ABS market, may enhance Upstart's ability to scale loan originations without undue balance sheet risk, supporting more predictable earnings.

- Improvements in customer acquisition efficiency, increasing cross-sell opportunities, and a rising percentage of repeat borrowers are progressively lowering customer acquisition costs and may improve long-term contribution margins and profitability.

- The persistent trend toward digital and mobile-first borrowing, combined with Upstart's advancements in automation and instant loan processing across new product lines, positions the company to capture market share from slower-moving incumbents, potentially resulting in sustained revenue growth and enhanced margins over several years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Upstart Holdings is $40.5, which represents two standard deviations below the consensus price target of $81.62. This valuation is based on what can be assumed as the expectations of Upstart Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $241.8 million, and it would be trading on a PE ratio of 24.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of $68.76, the bearish analyst price target of $40.5 is 69.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.