Key Takeaways

- Upstart's AI-powered credit models and automation create accelerating network effects, enabling higher conversion, faster growth, and stronger margins, surpassing consensus expectations.

- Disruptive automation and digital-first positioning unlock scalable, inclusive originations and recurring revenues, uniquely benefiting Upstart as lenders move beyond legacy credit systems.

- Regulatory challenges, rising defaults, reliance on immature new segments, and intensifying competition threaten Upstart's growth, profitability, and margin stability.

Catalysts

About Upstart Holdings- Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

- While analyst consensus highlights improved underwriting accuracy and model enhancements like Model 22 as catalysts for higher approval rates and lower defaults, these assessments may understate the compounding power of Upstart's AI; the company is now expanding neural network-based credit models across every product line, enabling a network effect where cumulative cross-vertical data can further accelerate conversion rates, loan originations, and net margins well beyond consensus expectations.

- Analyst consensus notes rapid Home and Auto loan growth and cross-selling as revenue drivers, but the full disruptive impact is likely underestimated; Upstart's instant property verification and full automation of home equity processes could redefine the customer experience for massive, underserved loan markets, driving explosive growth in origination, recurring fee revenue, and significant operating leverage due to unmatched automation.

- Upstart is uniquely positioned to capitalize on the global shift toward digital-first financial services, as its "always-on everything store for credit" vision and AI-powered automation open a path to persistent, frictionless underwriting and onboarding of new borrowers, increasing market share, customer lifetime value, and lowering acquisition costs substantially over the long term.

- The breadth and depth of Upstart's diversified funding channels-including accelerated adoption among banks and credit unions for both balance sheet and third-party capital-will enable rapid origination scalability without capital constraints, ensuring revenue growth is not bottlenecked by liquidity cycles and directly supporting sustainable, asset-light margin expansion.

- With AI-driven credit assessment and servicing models continually reducing bias and increasing inclusion for underbanked populations, Upstart stands to benefit disproportionately as regulatory and social trends push lenders away from legacy FICO systems, resulting in a step-change in total addressable market, originations, and long-term earnings growth.

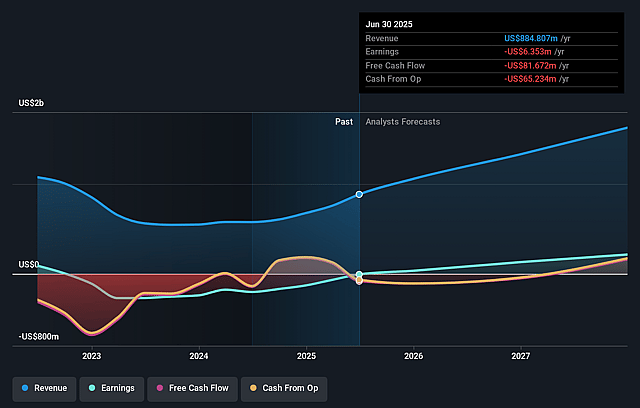

Upstart Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Upstart Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Upstart Holdings's revenue will grow by 31.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.7% today to 19.5% in 3 years time.

- The bullish analysts expect earnings to reach $390.2 million (and earnings per share of $3.29) by about August 2028, up from $-6.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.9x on those 2028 earnings, up from -1053.0x today. This future PE is greater than the current PE for the US Consumer Finance industry at 9.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.26%, as per the Simply Wall St company report.

Upstart Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny of algorithmic lending platforms and heightened requirements around data privacy may limit Upstart's ability to leverage AI models, which could restrict product differentiation and slow user growth, ultimately impacting long-term revenue and margin expansion.

- The persistent high-default environment and potential for worsening macroeconomic conditions, such as elevated interest rates or labor market weakness, could undermine borrower credit quality and increase loan losses, resulting in higher credit costs that would erode net margins and GAAP profitability.

- Upstart's rapid expansion into new verticals like Home and Auto carries a risk that immature unit economics and a dependence on balance-sheet funding-prior to sufficient third-party funding-could create periods of low or negative margin, leading to earnings volatility and potential capital constraints.

- Intensifying competition from both incumbent banks with their own AI underwriting tools and fintech peers entering near-prime and prime segments could drive take-rate compression, reducing fee revenue and squeezing contribution margins over time.

- Commodity-like pricing pressures across consumer lending, as automated underwriting becomes more accessible industry-wide, may threaten Upstart's ability to maintain its competitive moat and could result in top-line growth deceleration and long-term margin pressure.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Upstart Holdings is $105.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Upstart Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $390.2 million, and it would be trading on a PE ratio of 39.9x, assuming you use a discount rate of 8.3%.

- Given the current share price of $69.53, the bullish analyst price target of $105.0 is 33.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.