- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (NYSE:VST) Secures 20-Year License Extension For Perry Nuclear Power Plant

Reviewed by Simply Wall St

Vistra (NYSE:VST) experienced a significant price increase of 90% in the last quarter, aligning with pivotal developments such as the Nuclear Regulatory Commission's approval to extend the Perry Nuclear Power Plant's operation to 2046. This regulatory win strengthens Vistra’s position in sustainable energy production. While the markets mostly remained steady, the company's extensive buyback activities and announced dividends may have further supported investor sentiment. Against a backdrop of flat market movement over the last seven days, these events provided a positive impetus to Vistra’s overall market performance, countering potential concerns like global trade uncertainties influencing broader markets.

We've discovered 2 possible red flags for Vistra that you should be aware of before investing here.

The recent approval to extend the Perry Nuclear Power Plant's operation likely enhances Vistra's prospects in sustainable energy, directly supporting their focus on zero-carbon projects. This regulatory development could positively impact their revenue and earnings forecasts by bolstering energy capacity and reducing costs, potentially boosting net margins. Over a longer-term perspective, Vistra's total return of very large over five years showcases its growth trajectory, further solidified by the recent share price surge. In contrast, over the past year, Vistra's returns exceeded the broader U.S. market, signaling strong performance.

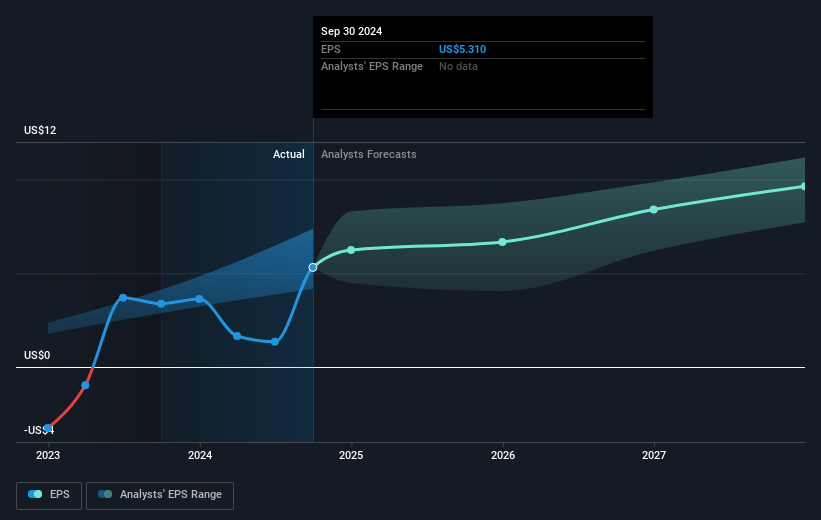

The company's extensive capital return plans, including share repurchases and dividends, convey an intention to enhance earnings per share growth. Despite its high share price, Vistra's market activities contributed to an 11.5% discount to the consensus analyst price target of $163.61. The recent developments position Vistra to potentially capitalize on growing electricity demand, which could bolster the forecasts of its earnings reaching $2.8 billion by May 2028. However, ongoing regulatory and economic uncertainties present potential challenges to these growth assumptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)