- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (NYSE:VST) Increases Dividends Despite 12% Price Drop

Reviewed by Simply Wall St

In the past quarter, Vistra (NYSE:VST) announced significant dividend increases for both preferred and common stocks, which may seem positive on the surface. However, these announcements coincided with a 12% decline in its share price, highlighting investor concerns. The general market sentiment has been weak during this period, with major indices like the S&P 500 and Nasdaq experiencing sharp declines due to falling tech stocks and economic uncertainty. Despite Vistra's efforts to expand its renewable energy footprint with solar projects in Illinois and advisory leadership changes, which aimed to bolster its sustainability outlook, these moves did not appear to offset broader market pressures. As a result, Vistra's performance lagged behind the overall market which, although recently down 3%, has seen a notable increase over the past year. The combination of market volatility and economic anxiety seemingly overshadowed the company's efforts to promote stability and growth through dividends and renewable investments.

See the full analysis report here for a deeper understanding of Vistra.

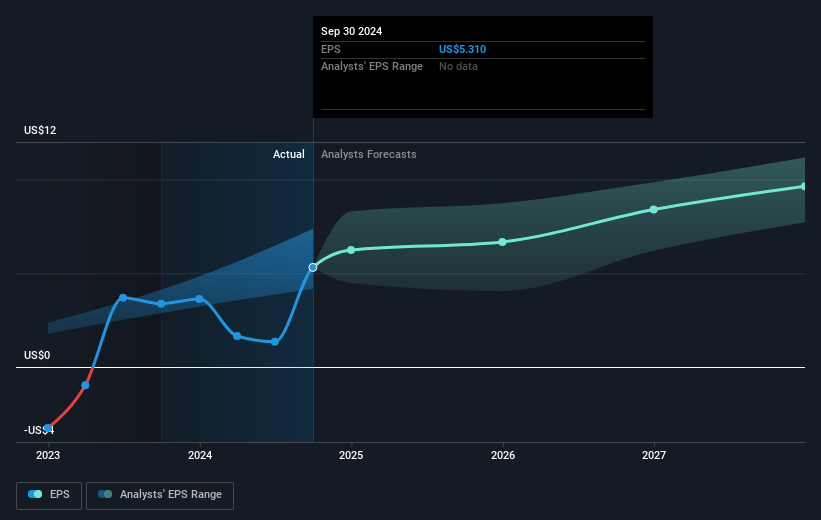

Over the last five years, Vistra (NYSE:VST) has achieved an extraordinary total return of 707.84%, underscoring its significant growth trajectory. This robust performance can be attributed to several critical developments. In particular, profitability saw notable improvement, with earnings growing significantly over the period, reflected in the impressive 44.6% earnings growth in the most recent year. Coupled with a substantial share buyback program, culminating in the repurchase of over 157 million shares, Vistra has actively managed its capital to boost shareholder value. Furthermore, substantial financial milestones, such as the full-year earnings report in 2023 revealing net income of US$1.49 billion, underscore the company's solid foundation.

Despite current market pressures, Vistra outperformed industry peers, with its recent one-year return exceeding the US Renewable Energy sector's gains of 70.5%. The company's aggressive pursuit of renewable energy investments, such as the completion of major solar projects in Illinois, further solidifies its position for sustained growth. These efforts, combined with regulatory approvals, like the extension of the Comanche Peak Nuclear Power Plant's operation, highlight Vistra’s resilient and forward-looking approach to its energy portfolio. In sum, these elements have collectively driven Vistra’s remarkable long-term performance.

- Understand the fair market value of Vistra with insights from our valuation analysis—click here to learn more.

- Assess the potential risks impacting Vistra's growth trajectory—explore our risk evaluation report.

- Invested in Vistra? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives