- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (NYSE:VST) Drops 11% Last Month Amid Economic Uncertainty

Reviewed by Simply Wall St

Vistra (NYSE:VST) experienced a notable price move of 11% down over the last month. This performance occurred amid broader market volatility, marked by a sharp decline across major indexes like the S&P 500 and Nasdaq due to looming tariffs and economic uncertainty. As markets reeled from inflation concerns and weak consumer sentiment affecting investor confidence, Vistra's stock was not immune to these pressures. The overall descent in market conditions, evidenced by the 3.5% decrease over the last seven days, alongside sector-specific influences, contributed to Vistra’s underperformance in the turbulent trading landscape.

We've discovered 3 weaknesses for Vistra that you should be aware of before investing here.

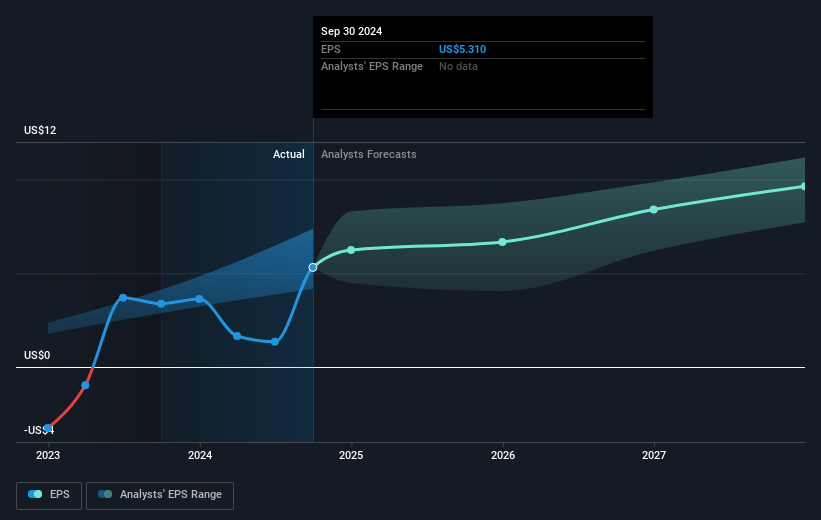

Vistra has delivered very large total returns of 741% over the past five years, reflecting its substantial growth and strategic initiatives. Key developments such as the substantial acquisition of three nuclear sites and 1 million retail customers have likely bolstered revenue streams, positioning the company advantageously within its industry. Additionally, the completion of utility-scale solar projects in Illinois has enhanced Vistra's sustainability profile and diversified its energy portfolio, further contributing to its performance. Over the past year, Vistra's performance also outpaced both the US market and the renewable energy industry, highlighting its relative strength in a competitive sector.

Further underpinning its strong returns, Vistra's robust earnings growth has been complemented by consistent share buyback programs, reducing shares outstanding by 38.67% since October 2021. Despite facing challenges such as regulatory uncertainties and lawsuits related to the Moss Landing Battery Plant fire, the company has maintained momentum. In addition to its operational advancements, Vistra's dividend increases over recent years have also played a role in enhancing shareholder value, reinforcing its commitment to returning capital to investors.

Assess Vistra's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Vistra, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives