- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (NYSE:VST) Dips 8% Despite Dividend Increase

Reviewed by Simply Wall St

Vistra (NYSE:VST) experienced a 7.51% decline in its share price over the last quarter, set against a backdrop of recent announcements, including a quarterly dividend increase and a substantial preferred dividend declaration. The company's strategic moves in its utility-scale solar projects appear consistent with its operational goals, yet the broader market context may have weighed on investor sentiment. During the period, major U.S. stock indexes struggled, with declines partly attributed to recent market volatility and last week's sell-off, which particularly impacted the tech-heavy Nasdaq. The energy sector, while not singled out in broad market news, often correlates with general economic confidence and other market movements. Additionally, governance changes, such as the appointment of Rob Walters as an independent director, may provide long-term benefits but are unlikely immediate influencers of share price. Hence, Vistra's mixed performance reflects both its corporate activities and overarching market trends.

See the full analysis report here for a deeper understanding of Vistra.

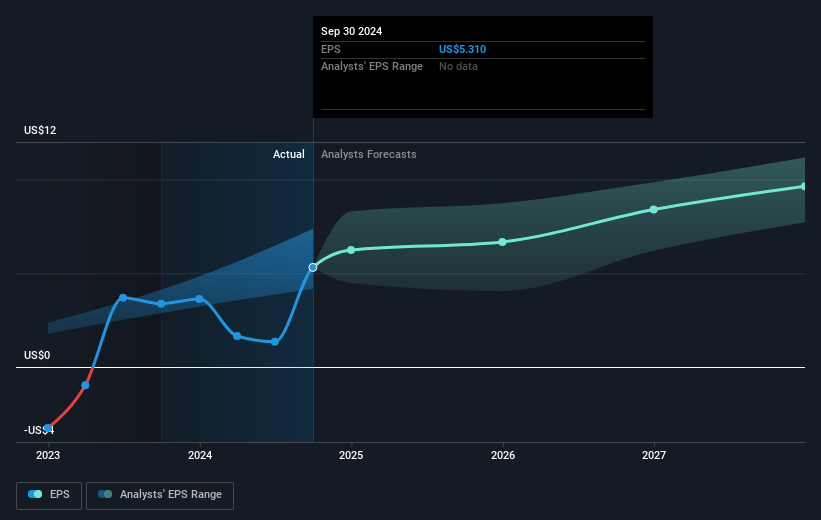

Vistra's shares have delivered a very large total return over the past five years, reflecting the company's strategic moves and market positioning. During this period, the company's earnings growth of 14.5% annually, transforming it to profitability, played a significant role in boosting investor confidence. A series of substantial buyback programs, including a recent increase by US$1.5 billion, further underscored Vistra's commitment to enhancing shareholder value and contributed positively to its performance. Significant earnings growth of 44.6% in recent years, which surpassed the Renewable Energy industry, also supported its long-term share price appreciation.

The extension of operational timelines for Comanche Peak Nuclear Power Plant through 2053 provided a stable foundation for future revenues, enhancing Vistra's attractiveness to investors. Dividends have been consistently increased, offering additional returns to shareholders and fostering loyalty amongst its investor base. These cumulative actions fueled Vistra’s exceptional total shareholder return, while helping it outperform both the US Market and the Renewable Energy industry in the last year.

- Unlock the insights behind Vistra's valuation and discover its true investment potential

- Uncover the uncertainties that could impact Vistra's future growth—read our risk evaluation here.

- Already own Vistra? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives