- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (NYSE:VST) Announces US$40 Dividend Per Preferred Share US$75 Million Payout for Common Shares

Reviewed by Simply Wall St

Recent developments at Vistra (NYSE:VST) include the board's announcement of increased dividends for both common and preferred stocks, coinciding with executive and board changes, and new solar projects reinforcing its renewable energy transition strategy. Despite these advancements, Vistra’s share price fell 7.1% over the last quarter. This decline took place amid broader market volatility, where the Dow Jones and S&P 500 also posted declines due to a broad sell-off influenced by negative economic data and significant drops in key stocks like UnitedHealth and Tesla. The dividend announcements and board changes might initially indicate positive investor sentiment, but broader market trends, including a notable 2.2% decrease across markets over seven days, likely overshadowed these company-specific developments. Vistra continues to focus on strategic transitions and community economic contributions, yet these highlights faced pressure from prevailing market conditions affecting investor sentiment and total shareholder returns.

Take a closer look at Vistra's potential here.

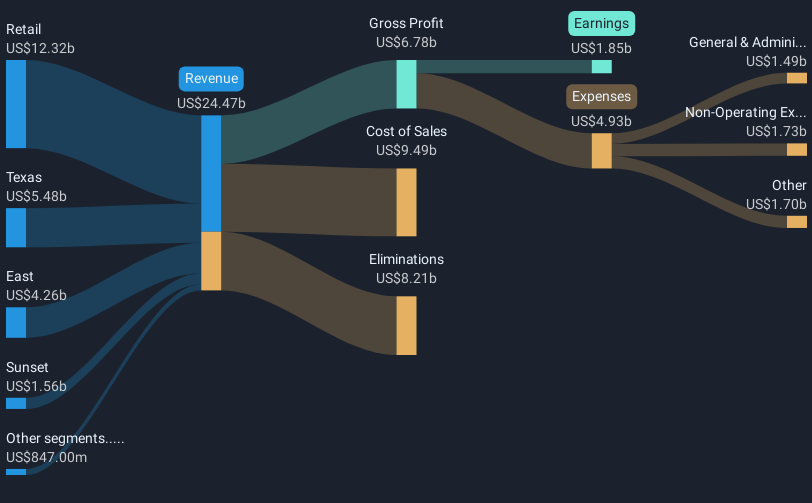

Vistra's shares have experienced substantial growth over the past five years, with total returns well above the percentage point threshold. Despite recent headwinds in broader markets, these returns reflect significant underlying strengths. The company's financial performance improvement, as evidenced by earnings growth exceeding 44.6% last year, underscores robust operational achievements. Furthermore, share repurchase activities with US$4.51 billion spent and a US$1 billion increase in buyback authorization align with efforts to enhance shareholder value. Vistra’s earnings growth has far outpaced the renewable energy industry's 26.9% gain, showcasing its competitive advantage.

Key events include the company's extension of the Comanche Peak Nuclear Power Plant's operation through 2053 and the initiation of large-scale solar projects. These developments contribute to its future resilience and support for sustainable energy initiatives. The company has also improved its net profit margins, up to 11.4% from 8.2% the previous year, indicating efficient cost management and strategic revenue improvements, reinforcing shareholders' confidence in Vistra's transformative growth trajectory.

- Analyze Vistra's fair value against its market price in our detailed valuation report—access it here.

- Assess the downside scenarios for Vistra with our risk evaluation.

- Already own Vistra? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives