- United States

- /

- Gas Utilities

- /

- NYSE:UGI

UGI Corporation's (NYSE:UGI) Share Price Boosted 26% But Its Business Prospects Need A Lift Too

UGI Corporation (NYSE:UGI) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 35%.

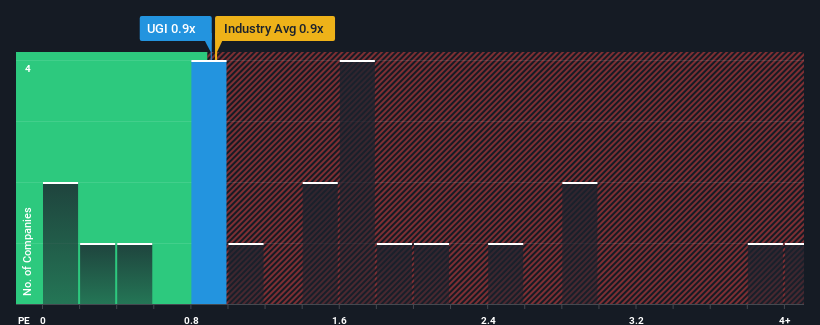

In spite of the firm bounce in price, when close to half the companies operating in the United States' Gas Utilities industry have price-to-sales ratios (or "P/S") above 1.7x, you may still consider UGI as an enticing stock to check out with its 0.9x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for UGI

What Does UGI's Recent Performance Look Like?

While the industry has experienced revenue growth lately, UGI's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think UGI's future stacks up against the industry? In that case, our free report is a great place to start.How Is UGI's Revenue Growth Trending?

In order to justify its P/S ratio, UGI would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 19%. As a result, revenue from three years ago have also fallen 3.2% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 8.1% per annum during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 21% per annum growth forecast for the broader industry.

In light of this, it's understandable that UGI's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From UGI's P/S?

Despite UGI's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of UGI's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for UGI (1 can't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UGI

UGI

Engages in the distribution, storage, transportation, and marketing of energy products and related services in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives