- United States

- /

- Electric Utilities

- /

- NYSE:PCG

PG&E (PCG): Assessing Valuation After This Year’s Share Price Reset

Reviewed by Simply Wall St

PG&E (PCG) has quietly slipped about 9% over the past month, even though earnings and cash flow have been relatively stable. This may present an interesting entry point for patient utility investors.

See our latest analysis for PG&E.

Zooming out, PG&E’s share price has fallen sharply this year, with a weak year to date share price return and a negative one year total shareholder return. This suggests momentum has cooled as investors reassess regulatory and execution risks despite improving earnings.

If PG&E’s reset has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates for your portfolio.

With shares down this year despite solid profit growth and a large gap to analyst price targets, investors face a key question: is PG&E mispriced after its pullback or are markets already discounting its future growth?

Most Popular Narrative Narrative: 29.4% Undervalued

With PG&E shares at $14.99 versus a narrative fair value around $21.23, the story implies a sizable gap to be closed if projections hold.

Expanding opportunities for capital investment in grid modernization, wildfire mitigation, and resilience, fueled by both regulatory mandates and the need to serve new electrification and decarbonization requirements, position PG&E to grow its rate base and regulated earnings steadily over the next decade. Strong alignment of capital strategy and balance sheet flexibility, including no further equity issuance through at least 2028 and a pathway toward investment-grade credit ratings, may lower borrowing costs and support consistent long-term EPS and dividend growth, differentiating PG&E within the sector.

Want to see how steady grid spending, rising demand and margin expansion are stitched together into this valuation story? The forecast quietly assumes an earnings ramp, richer profitability and a future multiple more often seen in higher growth names. Curious which specific financial levers have to fire in sequence for that price to make sense? Drill into the narrative to uncover the numbers behind this call.

Result: Fair Value of $21.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could be derailed if wildfire liabilities flare up again or if regulators clamp down harder on returns and cost recovery.

Find out about the key risks to this PG&E narrative.

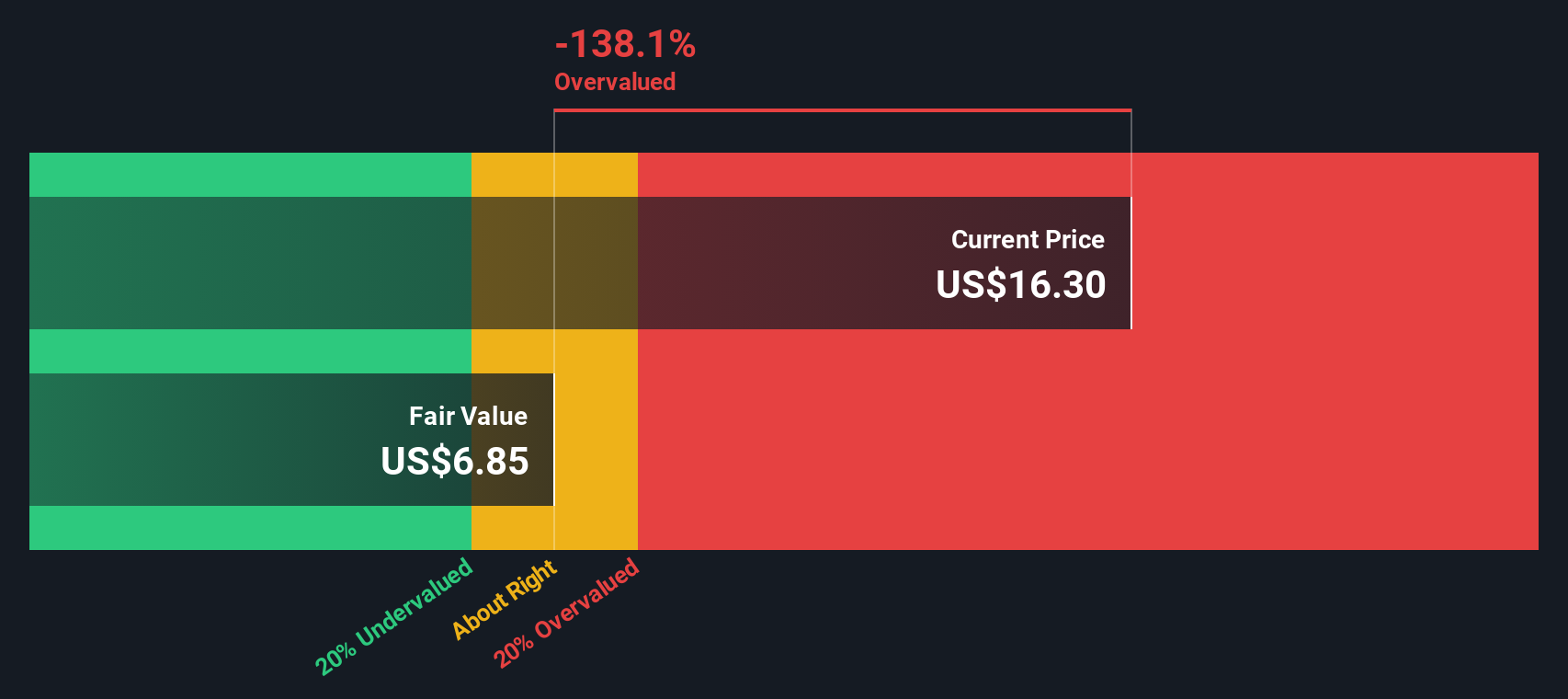

Another View: What Our DCF Says

Our DCF model paints a very different picture. Through this lens, PG&E’s stock looks overvalued, with the current $14.99 price sitting well above an estimated fair value of about $6.85. This suggests that cash flow risks may be higher than earnings based narratives imply.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PG&E for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PG&E Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just minutes: Do it your way.

A great starting point for your PG&E research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single stock. Use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy before other investors get there.

- Capture potential mispricings early by scanning these 900 undervalued stocks based on cash flows, built on rigorous cash flow analysis instead of short term market noise.

- Position yourself at the frontier of innovation by targeting these 26 AI penny stocks that could reshape entire industries with intelligent automation.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that balance reliable payouts with solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026