- United States

- /

- Electric Utilities

- /

- NYSE:IDA

Analyst Estimates: Here's What Brokers Think Of IDACORP, Inc. (NYSE:IDA) After Its Full-Year Report

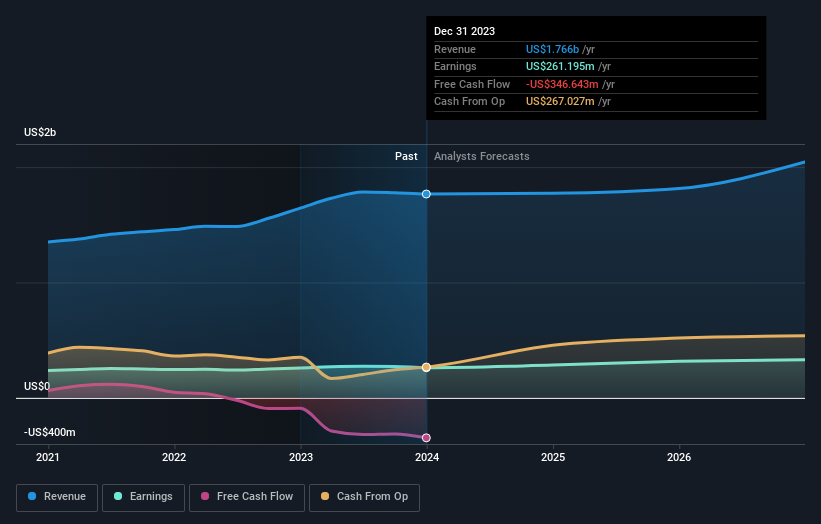

IDACORP, Inc. (NYSE:IDA) last week reported its latest annual results, which makes it a good time for investors to dive in and see if the business is performing in line with expectations. Results overall were respectable, with statutory earnings of US$5.14 per share roughly in line with what the analysts had forecast. Revenues of US$1.8b came in 4.8% ahead of analyst predictions. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for IDACORP

Taking into account the latest results, IDACORP's five analysts currently expect revenues in 2024 to be US$1.77b, approximately in line with the last 12 months. Statutory earnings per share are predicted to rise 5.7% to US$5.45. Before this earnings report, the analysts had been forecasting revenues of US$1.78b and earnings per share (EPS) of US$5.45 in 2024. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at US$102. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic IDACORP analyst has a price target of US$120 per share, while the most pessimistic values it at US$93.00. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting IDACORP is an easy business to forecast or the the analysts are all using similar assumptions.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that IDACORP's revenue growth is expected to slow, with the forecast 0.3% annualised growth rate until the end of 2024 being well below the historical 6.2% p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 3.5% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than IDACORP.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target held steady at US$102, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for IDACORP going out to 2026, and you can see them free on our platform here..

Plus, you should also learn about the 2 warning signs we've spotted with IDACORP (including 1 which is significant) .

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)