- United States

- /

- Other Utilities

- /

- NYSE:ED

Consolidated Edison (ED): Reassessing Valuation After Cautious Analyst Calls and a Notable Insider Sale

Reviewed by Simply Wall St

Consolidated Edison (ED) is back in focus after a cluster of cautious analyst calls and a rare insider sale from director John Killian, a combination that has investors rechecking their assumptions on the utility.

See our latest analysis for Consolidated Edison.

Even with that cautious backdrop, Consolidated Edison’s share price has held up reasonably well. It is trading at about $97.53 after a modest recent pullback, leaving its year to date share price return in positive territory, while its five year total shareholder return signals that long term momentum is still very much intact.

If this has you reassessing your income and defensive plays, it could also be a good moment to explore other regulated names and broader healthcare stocks for more resilient ideas.

With analysts trimming targets and insiders taking some chips off the table, yet the stock still hovering just below consensus value, are investors staring at a steady utility bargain or a market already pricing in all the growth ahead?

Price-to-Earnings of 17.3x: Is it justified?

At a last close of $97.53, Consolidated Edison screens as modestly undervalued on earnings, with its 17.3x price-to-earnings ratio sitting below several benchmarks.

The price-to-earnings ratio compares what investors pay today for each dollar of a company’s earnings, a core yardstick for regulated utilities with relatively stable profit profiles. For ED, that 17.3x multiple reflects a market that is willing to pay a reasonable premium for steady earnings growth without assigning a stretch valuation usually reserved for high growth sectors.

Relative comparisons add weight to that view. ED’s 17.3x price-to-earnings ratio is cheaper than the peer average of 19.2x and even undercuts the global Integrated Utilities industry at 17.9x, suggesting the market is not overpaying for its earnings stream. Versus an estimated fair price-to-earnings ratio of 23.5x, the current multiple also sits well below a level the market could plausibly move toward if sentiment or growth expectations improved.

Explore the SWS fair ratio for Consolidated Edison

Result: Price-to-Earnings of 17.3x (UNDERVALUED)

However, investors still face risks from potential regulatory shifts in New York, as well as slower than expected demand growth that could compress earnings and valuations.

Find out about the key risks to this Consolidated Edison narrative.

Another View on Value

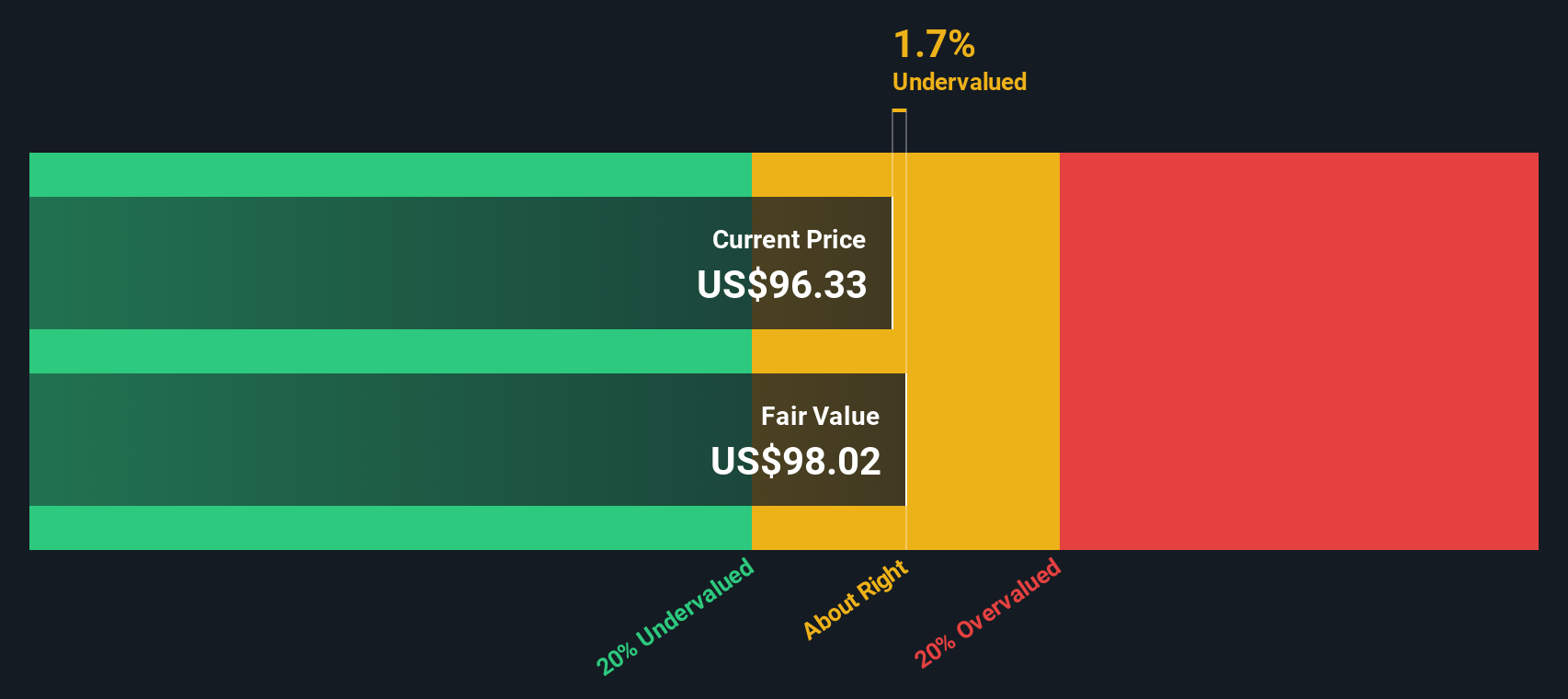

Our DCF model paints a quieter picture. With ED trading almost exactly at our fair value estimate of $97.6, it looks more fairly priced than its earnings multiple alone suggests. If cash flows are already fully reflected, how much upside is really left for new buyers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Consolidated Edison for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Consolidated Edison Narrative

If you see the story differently or want to stress test our assumptions against your own research, you can build a custom view in minutes: Do it your way.

A great starting point for your Consolidated Edison research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas you do not want to miss?

Before you move on, lock in your next smart move with targeted stock ideas from the Simply Wall St Screener that match where you want your portfolio to go.

- Capture potential mispricings by scanning these 903 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Ride structural tailwinds in healthcare and technology by focusing on these 30 healthcare AI stocks reshaping patient care and diagnostics.

- Supercharge your income strategy by targeting these 13 dividend stocks with yields > 3% that combine meaningful yields with robust business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ED

Consolidated Edison

Through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)