- United States

- /

- Other Utilities

- /

- NYSE:ED

Assessing Consolidated Edison (ED) Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Consolidated Edison.

Consolidated Edison’s share price momentum has been fairly muted lately. However, if you zoom out, its three-year total shareholder return of about 29% shows that steady long-term growth is still in play, even as short-term price moves remain subdued.

If you’re interested in discovery opportunities beyond utilities, now could be an ideal time to broaden your investing outlook and uncover fast growing stocks with high insider ownership.

With a modest discount to analyst targets and long-term returns still outpacing recent gains, the key question emerges: is Consolidated Edison currently an undervalued play, or has the market already factored in its future potential?

Price-to-Earnings of 18.2x: Is it justified?

Consolidated Edison trades at a price-to-earnings (P/E) ratio of 18.2x, noticeably lower than both its peers and the industry average. With the last close at $97.64, this marks the stock as attractively valued relative to similar utility companies.

The price-to-earnings ratio compares a company’s share price to its earnings per share, helping investors assess whether the current price reflects growth prospects. For a utility like Consolidated Edison, P/E is especially relevant because earnings stability is key to the sector.

ED’s P/E sits below the peer average of 22.9x and the global integrated utilities industry average of 18.4x. This signals value appeal within its group. Compared to its estimated Fair Price-to-Earnings Ratio of 21.6x, the current valuation suggests the market could adjust higher if earnings performance continues.

Explore the SWS fair ratio for Consolidated Edison

Result: Price-to-Earnings of 18.2x (UNDERVALUED)

However, continued revenue growth depends on consistent earnings improvements and regulatory stability, and both factors could shift if market or policy dynamics change.

Find out about the key risks to this Consolidated Edison narrative.

Another View: What Does the SWS DCF Model Say?

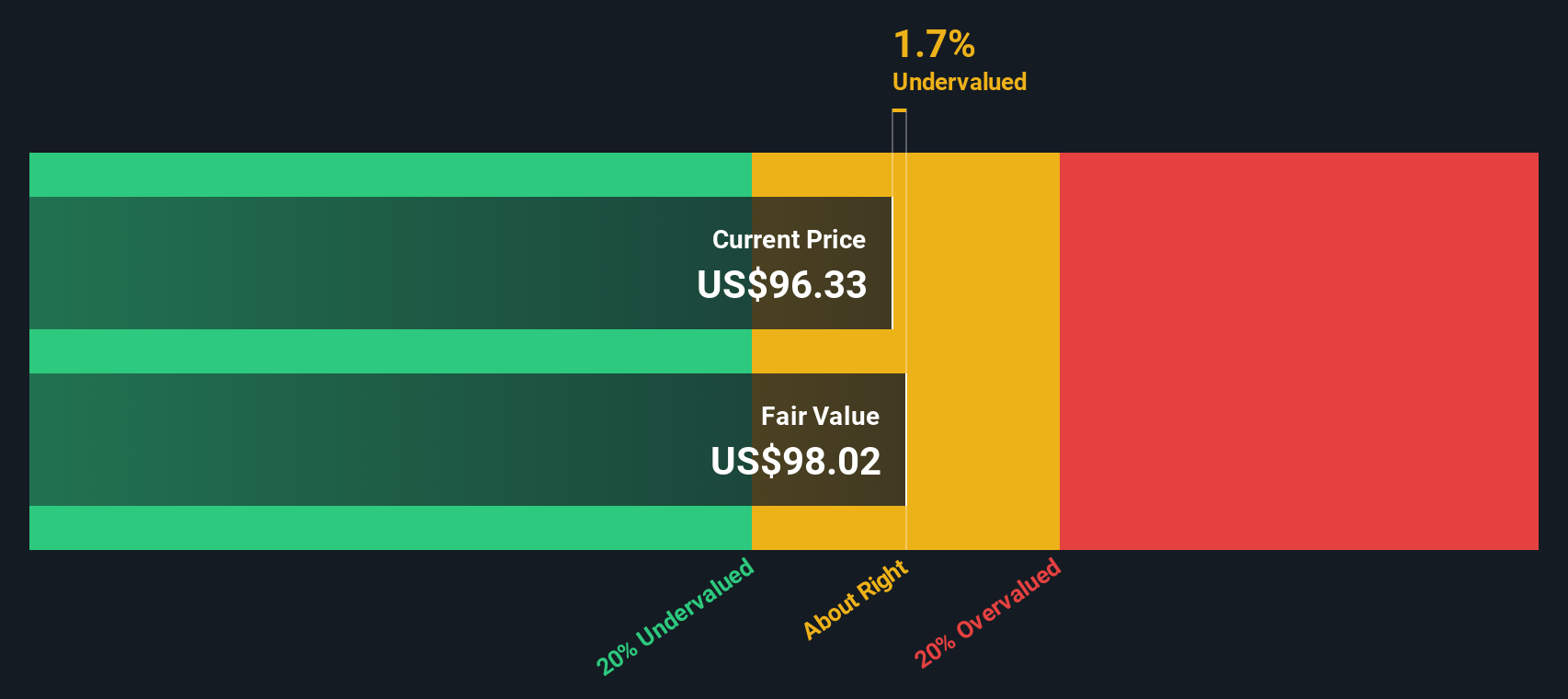

While the price-to-earnings approach suggests Consolidated Edison is undervalued compared to its peers and fair ratio, our DCF model offers another lens. It currently shows ED trading nearly at its estimated fair value, with shares priced at $97.64 versus a DCF-calculated fair value of $98.02. This suggests there is little room for immediate upside or downside based on forecast cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Consolidated Edison for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Consolidated Edison Narrative

If you have a different perspective, or prefer to dig into the details yourself, you can easily build your own analysis in just a few minutes. Do it your way.

A great starting point for your Consolidated Edison research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to uncover new opportunities. Using the right screener could be the move that sets your portfolio apart this year.

- Capitalize on fast-growing healthcare innovation and check out these 31 healthcare AI stocks that are reshaping the medical landscape with breakthroughs in patient care and diagnostics.

- Collect strong, steady income by turning your attention to these 19 dividend stocks with yields > 3% boasting yields over 3% and the financial stability to support consistent payouts.

- Catch the next wave of technological change by acting early with these 26 quantum computing stocks at the forefront of quantum computing and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ED

Consolidated Edison

Through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026