- United States

- /

- Other Utilities

- /

- NYSE:CNP

CenterPoint Energy (CNP): Reassessing Valuation After Analyst Upgrade, AI Partnership Buzz and Solid Dividend Performance

Reviewed by Simply Wall St

CenterPoint Energy (CNP) is back on investors radar after a fresh analyst upgrade, strong quarterly numbers, and a steady dividend track record converged with buzz around its role in Palantir Chain Reaction.

See our latest analysis for CenterPoint Energy.

Those catalysts are arriving after a solid run, with the share price at $37.84 and a strong year to date share price return of around 20 percent. Multi year total shareholder returns suggest steady, compounding momentum rather than a sudden spike.

If you like the mix of infrastructure demand and defensiveness here, it is worth scanning for other regulated utilities and grid players using our dedicated healthcare stocks as a starting point for ideas.

With analysts leaning bullish, a dividend that keeps edging higher, and AI infrastructure buzz adding a growth twist to a regulated utility, is CenterPoint still cheap, or is the market already pricing in the next leg of expansion?

Most Popular Narrative Narrative: 10.7% Undervalued

With the narrative fair value near $42.38 versus the $37.84 last close, the story leans toward upside, anchored in long dated capital plans and demand.

The analysts have a consensus price target of $40.357 for CenterPoint Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $44.0, and the most bearish reporting a price target of just $34.0.

Curious how steady utility cash flows can support that kind of upside gap? The narrative leans on surprisingly strong revenue, margin, and earnings compounding. Want the full blueprint?

Result: Fair Value of $42.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could stumble if regulatory approvals lag, or if higher interest costs from new debt squeeze margins more than analysts currently assume.

Find out about the key risks to this CenterPoint Energy narrative.

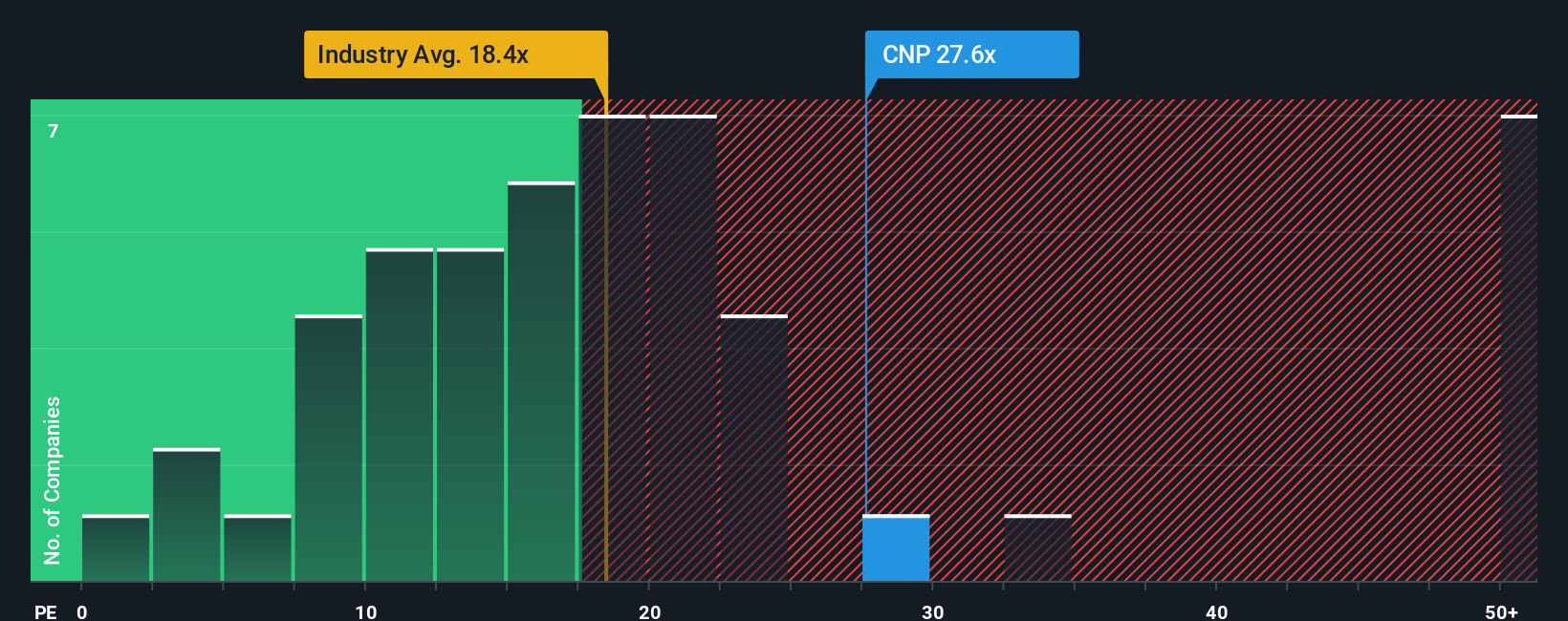

Another Lens On Value

Analyst narratives see upside, but the earnings multiple paints a tighter picture. CenterPoint trades at about 23.8 times earnings, richer than both the global integrated utilities average of 17.9 times and peers at 20.3 times, and almost exactly in line with its 23.9 times fair ratio. This hints more at balance than an obvious bargain and raises the question of where room for surprise remains, whether to the upside or downside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CenterPoint Energy Narrative

If this perspective does not quite fit your view, or you simply prefer hands on research, you can shape your own story in minutes: Do it your way.

A great starting point for your CenterPoint Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity when a whole universe of data backed ideas is a click away. Let the Simply Wall St Screener work for you.

- Capitalize on market mispricings by using these 903 undervalued stocks based on cash flows to spot companies where cash flows point to hidden upside potential.

- Position yourself early in transformative innovation with these 26 AI penny stocks, focusing on businesses harnessing artificial intelligence to reshape entire industries.

- Strengthen your income stream through these 13 dividend stocks with yields > 3%, highlighting reliable payers with attractive yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Solid track record unattractive dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)